Business Valuation Matrix with Printable Visuals (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- An easy template to generate a range of valuations for your business.

- Printable spreadsheet with visualizations.

VALUATION EXCEL DESCRIPTION

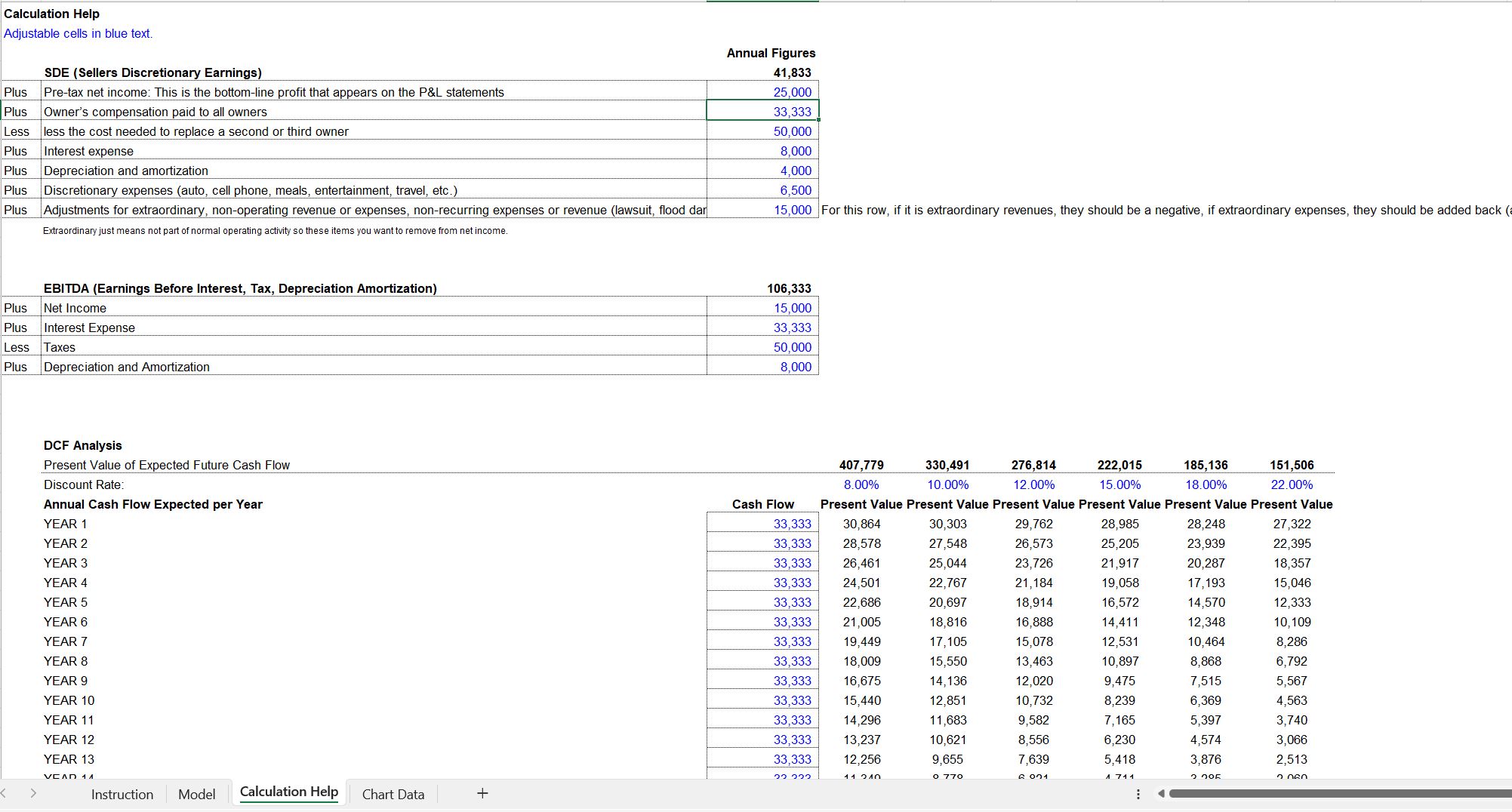

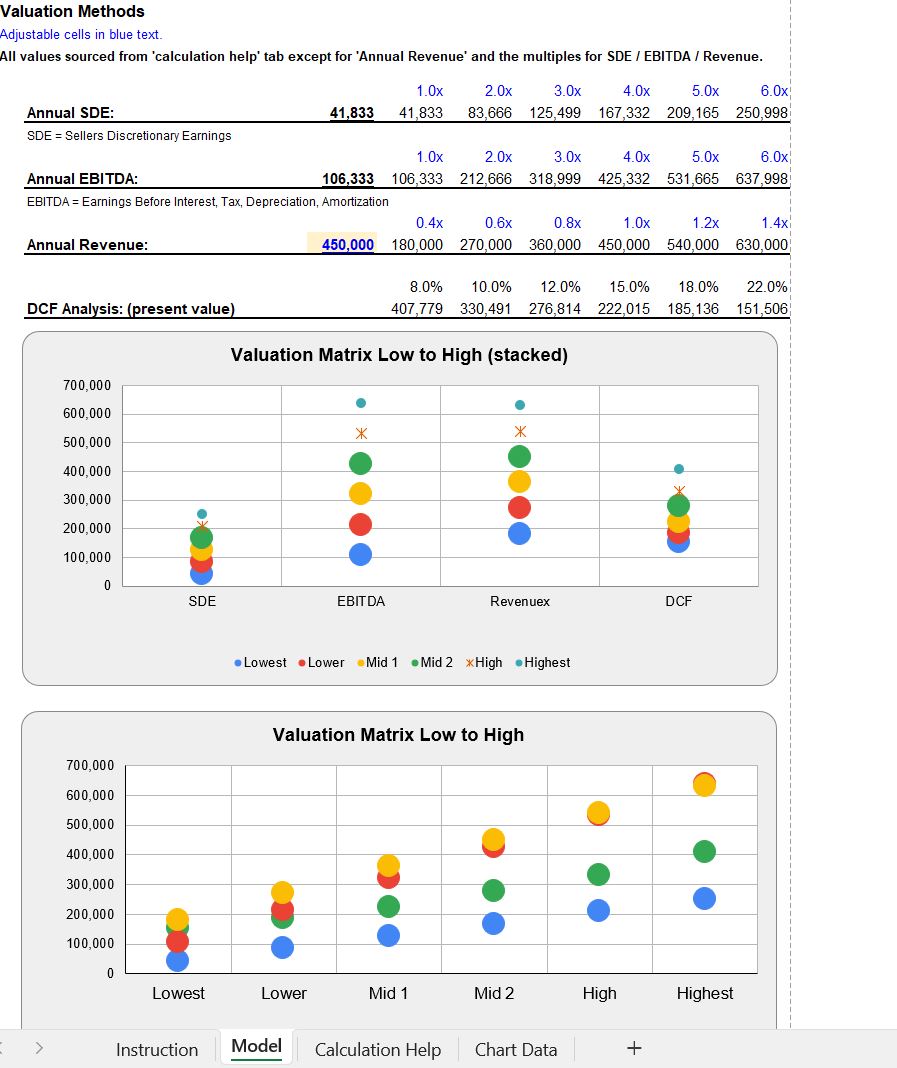

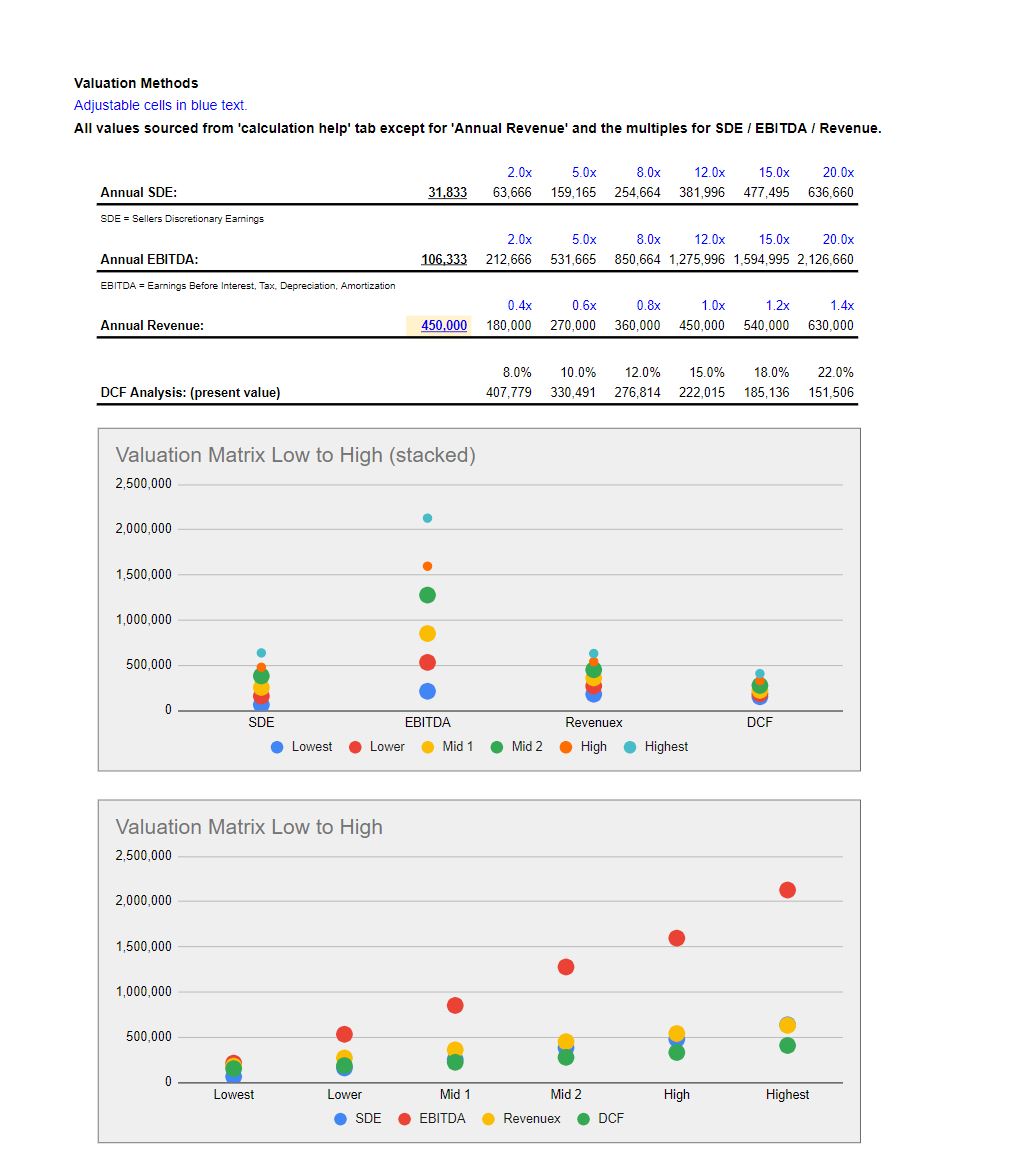

There are four main quantitative ways to value a business. This model has logic for all four. It walks you through how to calculate each as well as shows up to 6 potential valuations in a sensitivity table. Six multiples and discount rates (for the DCF methodology) are used.

Four valuation methods:

• SDE (seller discretionary earnings) multiple.

• EBITDA (earnings before interest, taxes, depreciation, amortization) multiple.

• Revenue multiple.

• Present value of future expected cash flows.

Most of the time that went into this template was in creating a visualization output that was digestible and printable. By digestible, I just mean you can look at it and quickly understand the data that is being represented (multiple types of valuations for a business given certain assumptions). These charts will print out on 8.5 x 11 dimensions.

To help users come up with their businesses SDE, EBITDA, PV of cash flows, I made helper calculations for each one that automatically flows into the sensitivity tables. These helper calculations are a step-by-step guide into each input that is pulled from the financial statements to come up with the proper valuation basis. There was no need to do this for 'Revenue' since that is self-explanatory.

The discounted cash flow section will allow for up to 6 discount rates to be applied to a cash flow stream that goes as far as 50 years. Since those are annual periods, the discount rate should represent an annual rate.

If you want to generate a professional looking summary about what the possible range of valuations are for a small or medium-size business, this sheet is your best reusable resource.

Note, an instructional video is included in the file and a Google Sheet version is also included in the file (link) that has its own visuals that are printable.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Excel: Business Valuation Matrix with Printable Visuals Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping