Cash Flow Waterfall: Equity Multiple Hurdle (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

JOINT VENTURE EXCEL DESCRIPTION

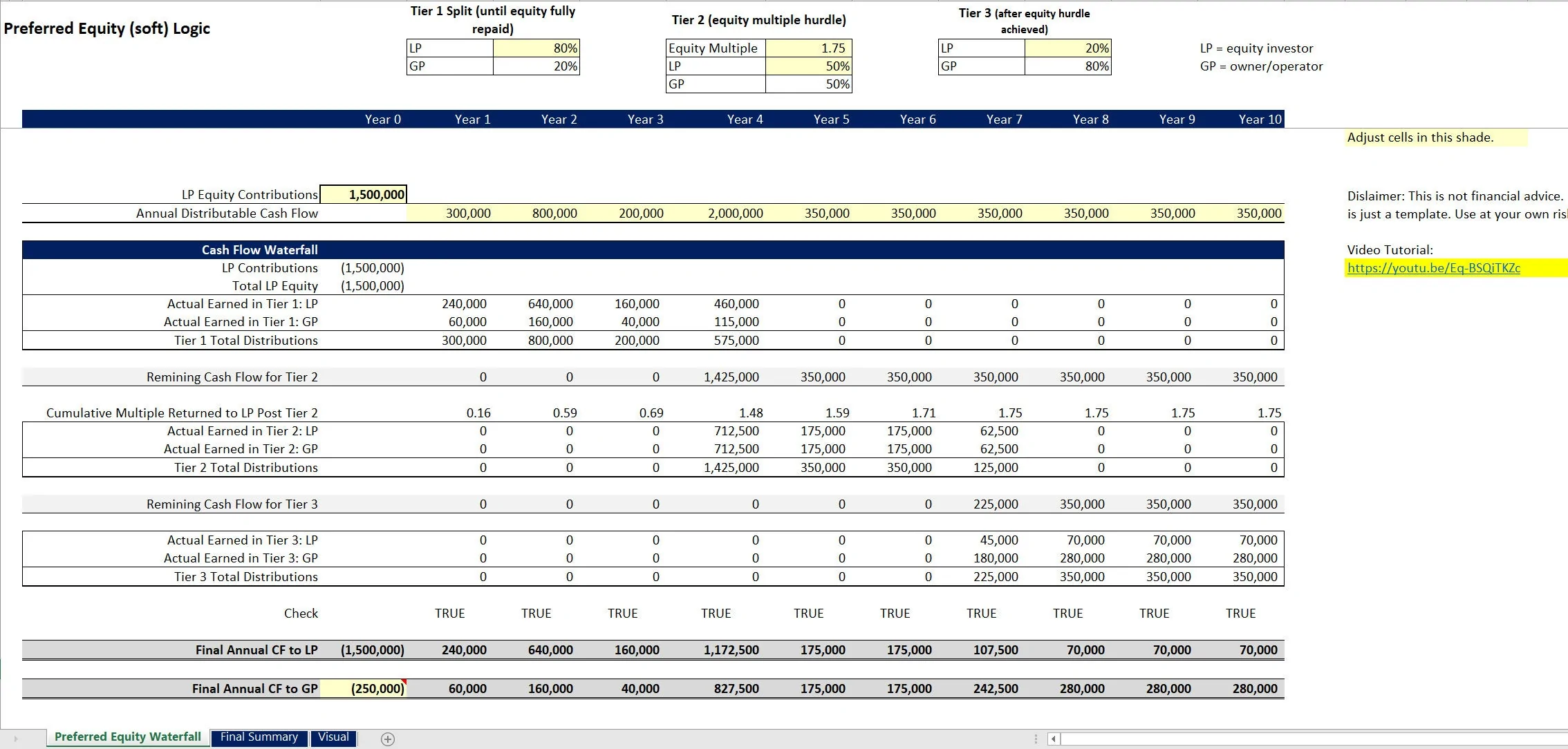

This joint venture waterfall distribution is designed for cash flow entries at the top, and the defined split at each hurdle. All logic flows from that and it is very easy to explain to anyone. The model was built to track up for up to 10 years.

The hurdles are also very simple:

• Hurdle 1: Repay All Equity

• Hurdle 2: Defined Equity Multiple Cash splits can be defined up until each hurdle is met as well as a split thereafter.

I like this model because it is really easy to explain the pros and cons of each aspect of the deal depending on how it is structured in the model. A higher equity multiple may mean a lower share of cash split for the investor after the multiple is achieved, maybe even a 0% share thereafter.

A lower equity multiple may mean a higher share of cash flow for the investor after the multiple has been received. It is very easy to understand the deal components.

Hurdle Specifics:

1) Repay all equity – A defined cash split percentage is entered that defines how much the LP / GP receives up until 100% of the initial investment is repaid to the investor. It could be 100% / 0% or what have you.

2) After equity is fully repaid, the next cash flow split is defined and that will hold until the equity multiple defined for the investor has been reached (equity multiple means a desired total return on investment – anything above 1 means a positive return and anything less than 1 means not all of the investment has been earned back).

For example, an entry of 1.5, means that the full investment has been repaid plus 50% more than the initial investment i.e. $100 invested and $150 has been paid back in total. Thereafter)

Once the equity multiple has been achieved by the investor, any remaining cash flow is split based on a final defined percentage distribution.

The nice thing about this model is the flexibility in the variable inputs. You can choose to make it a hard preferred equity model or soft (based on how cash is split up until the investment is fully repaid)

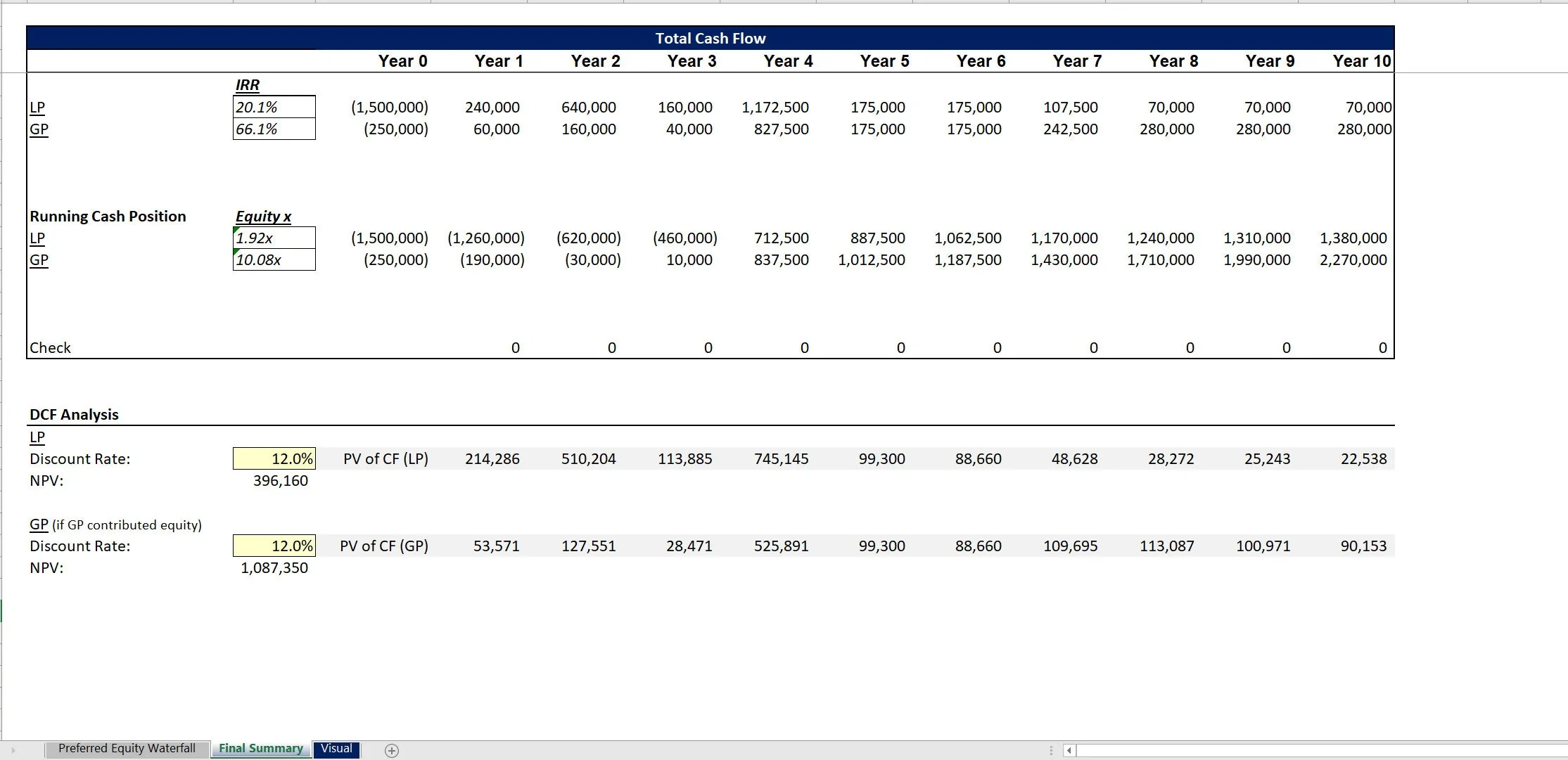

More output reports include a finalized total IRR for the investor and operator as well as a DCF Analysis for each. There is a visual to show the cash flow splits over the entire project. Note, the model has no options for an annual preferred return. Instead, the focus is to base cash distributions on equity repayment and an equity multiple achieved for the investor.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Joint Venture Excel: Cash Flow Waterfall: Equity Multiple Hurdle Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Joint Venture Cash Flow Waterfalls

This bundle contains 11 total documents. See all the documents to the right.