Airline Financial Projection Model (Aircraft Lease Basis) (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

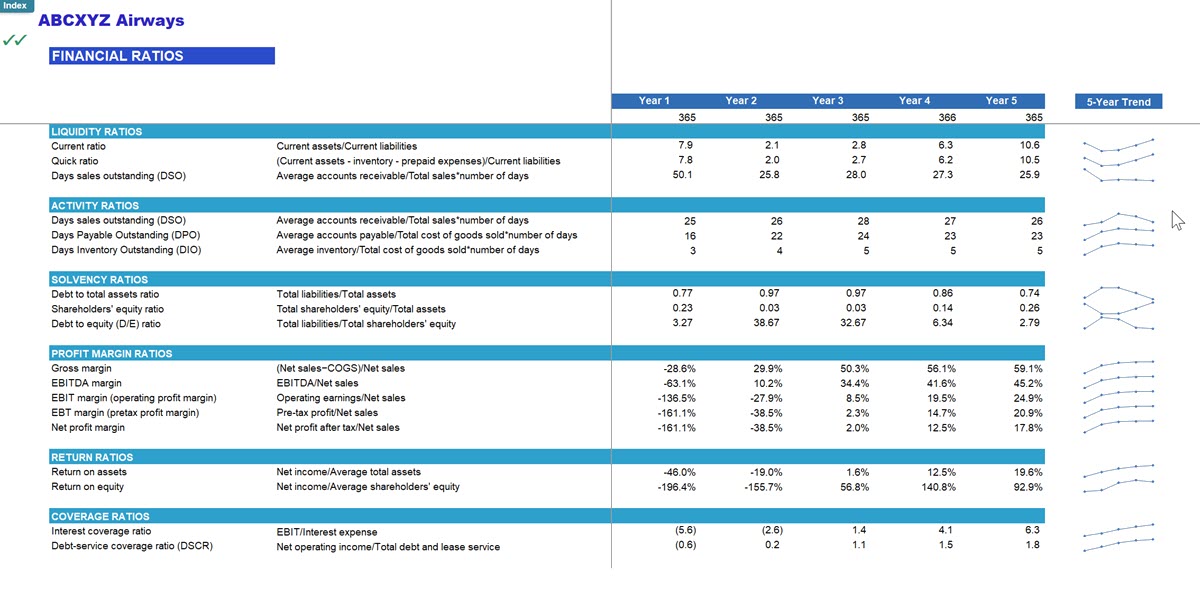

- Provides a ready-to-use framework for forecasting airline revenue, operating costs, and profitability over a 5-year horizon.

- Enables detailed sector-level revenue modeling with integrated aircraft utilization, ASK/ATK metrics, and RASK/CASK analysis.

- Supports budgeting, valuation, and investor presentations with complete monthly financial statements and built-in validation checks.

AIRLINE INDUSTRY EXCEL DESCRIPTION

This financial model is meticulously designed to analyze and forecast the financial performance of a commercial airline, providing detailed forecasts for different aircraft types operating across different sector. It captures the key revenue and cost drivers unique to the aviation sector, including passenger revenue, ancillary income, cargo operations. The model segments performance by aircraft type, route structure, and seasonal demand patterns, ensuring a granular and operationally realistic projection framework.

The model incorporates key operational parameters such as block hours, turnaround times, aircraft utilization, load factors, cargo tonne-kilometer metrics, and monthly fleet additions. Seasonal variations, price indices, ramp-up curves, and route-level distance and block-time structures are fully integrated to ensure realistic, data-driven airline financial forecasts.

Delivering a 5-year forecast horizon (60 months) with detailed monthly and annual outputs, this financial model serves as a comprehensive tool for network planning, route profitability analysis, investor communication, and financing applications for airlines operating leased aircraft only.

Model Structure – 5 Main Sections

1. Cover Section

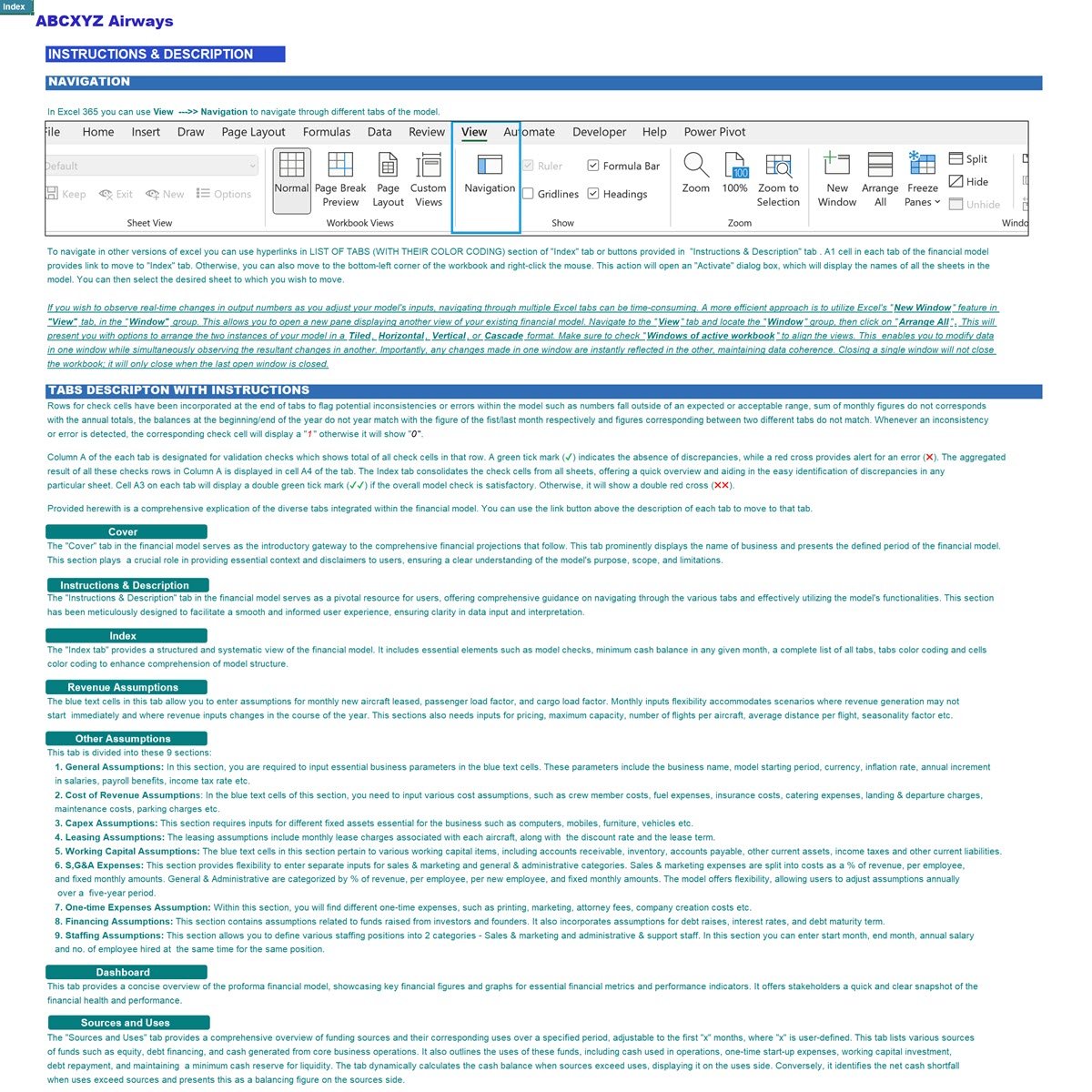

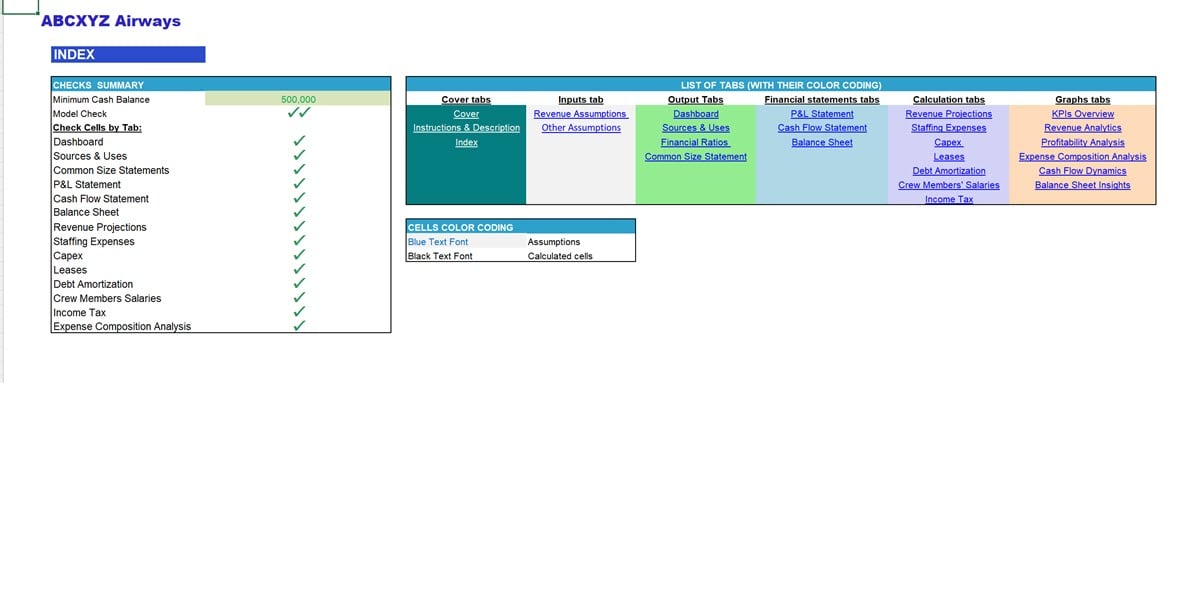

• Index showing all model tabs with tab-color mapping

• Summary of key checks and integrity indicators

• Cell color-coding

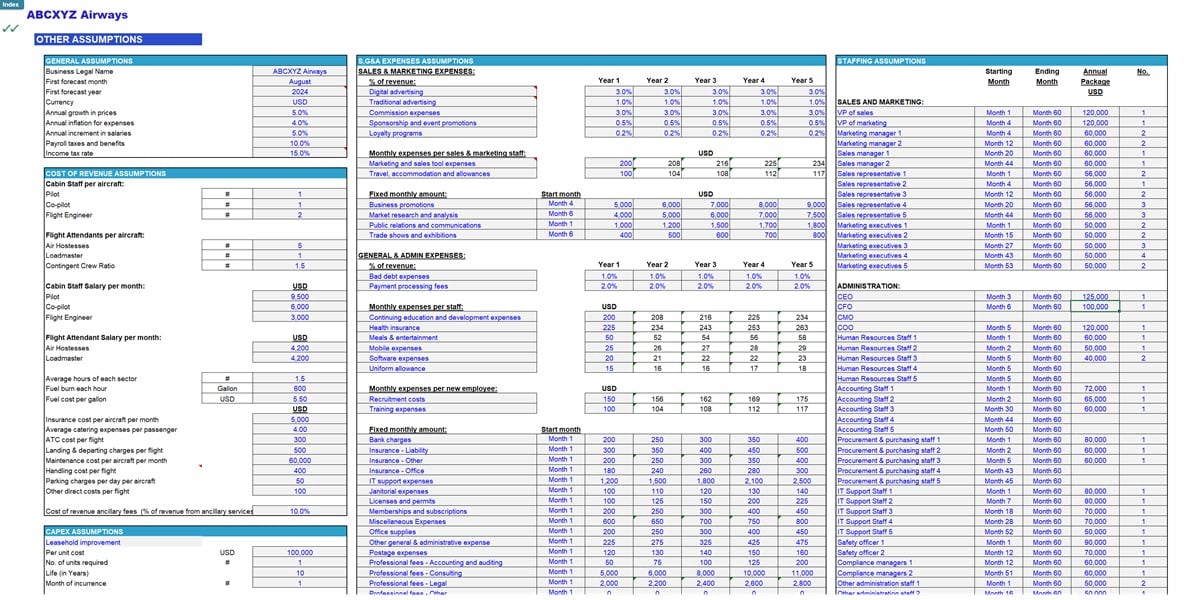

2. Input Section (Assumptions Tab)

All assumptions are consolidated into a structured, user-friendly tab. Inputs appear in Light Gray Cells with Blue Text for intuitive data entry.

Key input areas include:

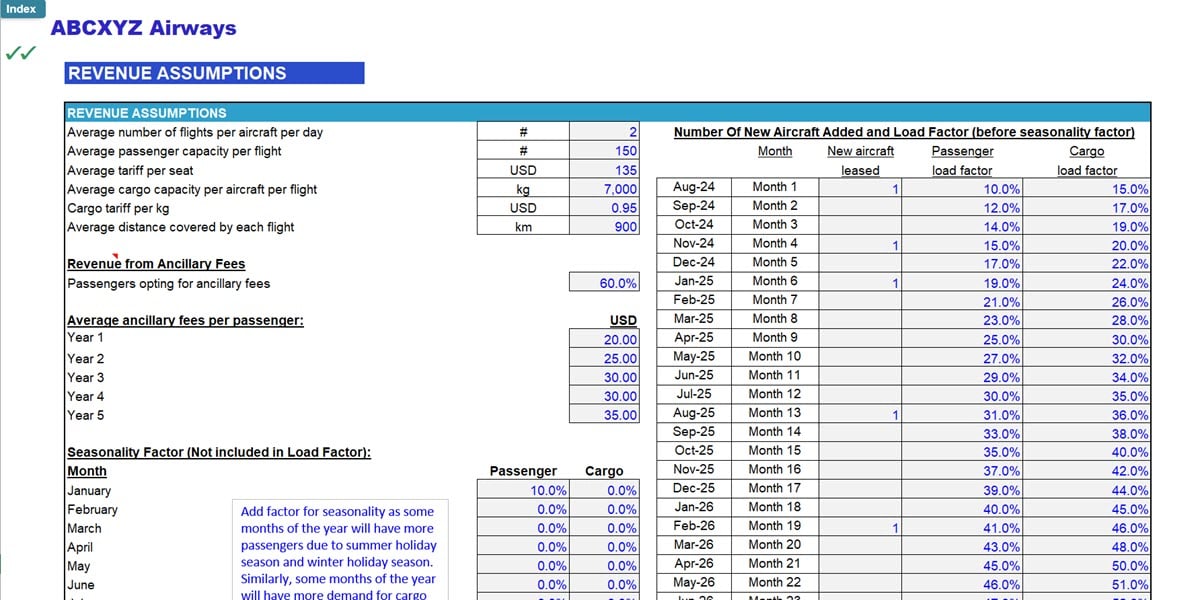

• Revenue Assumptions

• Passenger seat configuration by aircraft type (Economy & Business)

• Sector distances, block times, and turnaround times

• Monthly load factor schedule + ramp-up curve

• Passenger fares by route and class; yield per RPK

• Cargo capacity per aircraft (kg) and cargo tariff per kg

• Cargo yield per kg-km and cargo load factor

• Seasonal Passenger & Cargo Price Indices

• Ancillary revenue

• Operational / Fleet Assumptions

• Number of aircraft by type and monthly induction schedule

• Serviceable hours per aircraft per day

• Allocation of utilized hours by route

• Fuel burn per block hour

• General Assumptions

• Airline name, forecast start date, reporting currency

• Inflation, tax rates, and escalation factors

• Cost of Revenue

• Fuel cost per block hour

• ATC, navigation, landing & departure charges

• Ground handling, dispatch, and station support

• Catering and ancillary cost percentages

• Direct Operating Expenses (DOE)

• Aircraft lease rentals

• Crew salaries and benefits

• Aircraft maintenance

• Aircraft insurance

• Hangar & long-term parking

• S,G&A Expenses

• Overheads: admin, sales & distribution, utilities, tech systems

• Marketing and head office staffing

• Working Capital

• Receivable and payable days

• Fuel credit terms

• Minimum cash reserve balance

• Financing & One-Time Costs

• Loan terms and repayment schedules (if applicable)

• Licensing, certification, branding, and pre-operational expenditures

3. Output Tabs Section

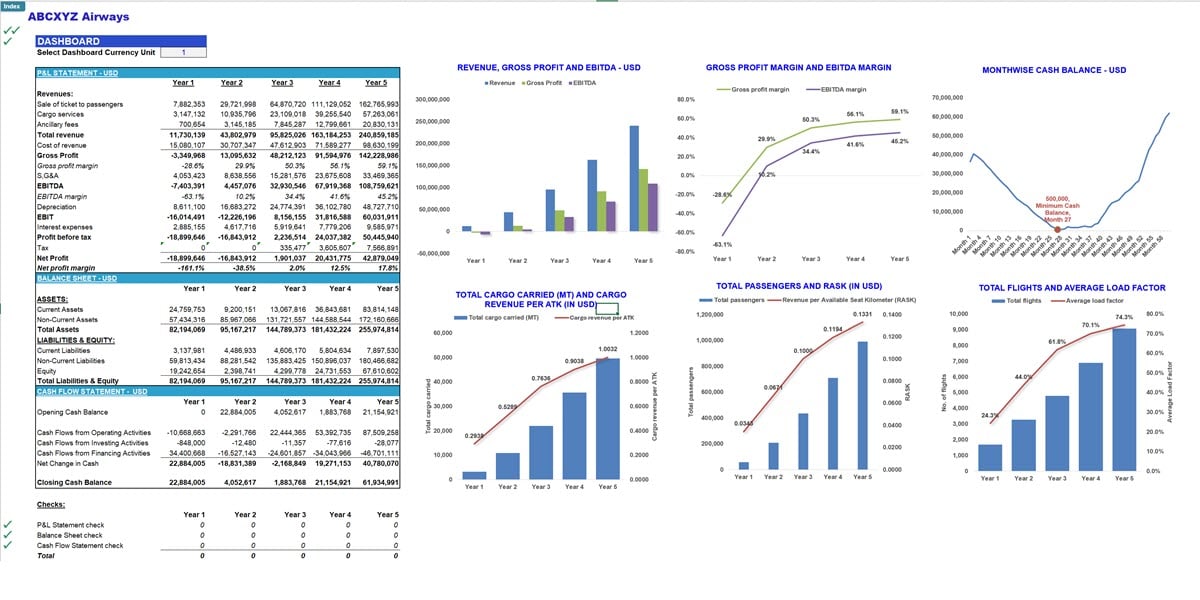

• Dashboard: KPI overview of revenue, utilization, margins, ASK/RPK/ATK/RTK/RASK etc

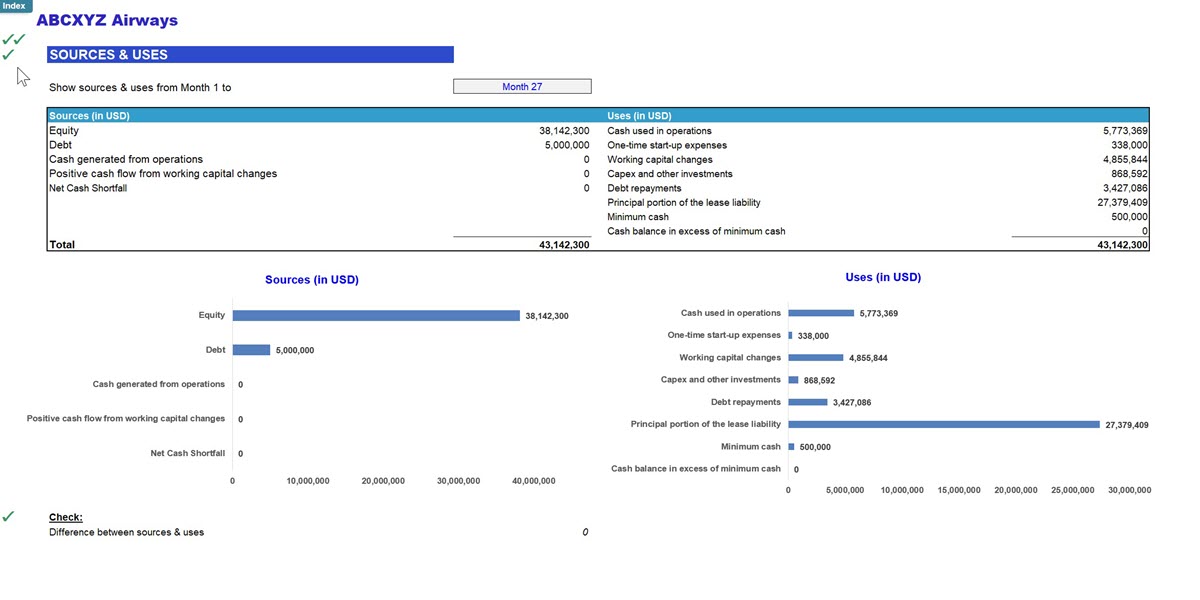

• Sources & Uses: Summary of funding and allocation

• Valuation: DCF valuation with sensitivity analysis

4. Financial Statements Section

• Profit & Loss Statement

• Cash Flow Statement

• Balance Sheet

5. Calculations Section

• Detailed revenue calculations (passenger, cargo, ancillary)

• Aircraft utilization schedule and block-hour calculations

• Cost of revenue build-up (fuel, ATC, handling, catering)

• Direct aircraft operating costs (lease, maintenance, crew, insurance)

• Debt schedule

Technical Specifications

• No VBA / No Macros – full transparency and compatibility

• Circular-reference free

• Compatible with Excel 2010 or later

Validation Checks

Integrated validation ensures consistency and accuracy.

• Automatic error flags in each tab

• Model-wide status summary with green ticks (✓) for OK, red crosses (✗) for issues requiring user attention

Why Choose This Model?

This financial model is specifically designed for commercial airlines operating leased aircraft, providing a robust, flexible, and investor-ready framework for budgeting, strategy, pricing, and fundraising. It supports detailed network planning, aircraft utilization analysis, and long-term financial forecasting—giving your airline clear visibility into revenue potential, cost structure, and profitability.

For enhanced customization, our team can tailor the model to your specific fleet mix, route network, pricing strategy, and operational characteristics.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Airline Industry, Integrated Financial Model Excel: Airline Financial Projection Model (Aircraft Lease Basis) Excel (XLSX) Spreadsheet, ExcelFinModels