Airline Financial Model (Aircraft Lease & Capex Option) (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Gain a comprehensive understanding of your airline's financial performance with integrated financial statements and detailed revenue stream analysis.

- Make informed decisions with flexible modeling options for new aircraft acquisitions, including both leased and purchased options.

- Visualize key financial metrics effortlessly with clear and insightful graphs, helping you track KPIs, revenue, profitability, and cash flows effectively.

AIRLINE INDUSTRY EXCEL DESCRIPTION

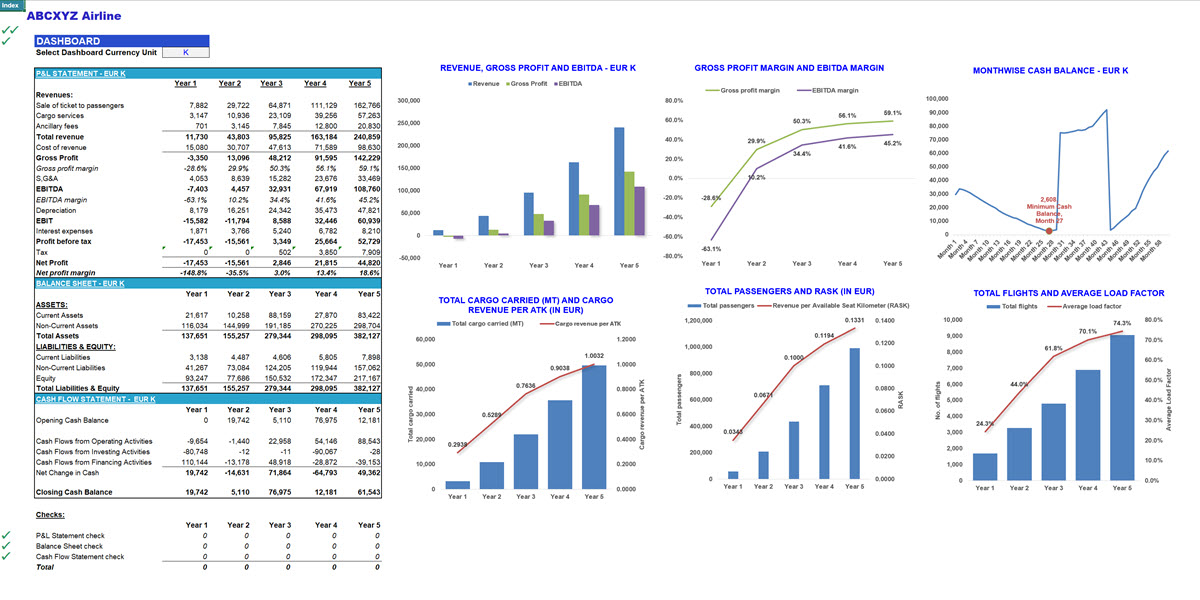

This financial model is meticulously designed to analyze and forecast the financial performance of an airline that operates with both purchased and leased aircraft. The model accommodates different aircraft types, multiple travel classes, and various revenue streams, including passenger ticket sales, cargo services, and ancillary revenue. It provides a dynamic and flexible tool for strategic financial planning, profitability analysis, and decision-making.

The model offers a 5-year forecast horizon (60 months) and includes placeholders for up to 36 months of historical financial data. It enables detailed revenue and cost projections based on fleet composition, route network, load factor, and cost structures. Graphs and dashboards are preconfigured for the forecast period but can be expanded to incorporate historical data for enhanced insights.

This financial model is an invaluable resource for internal planning, investor presentations, loan applications, and strategic decision-making.

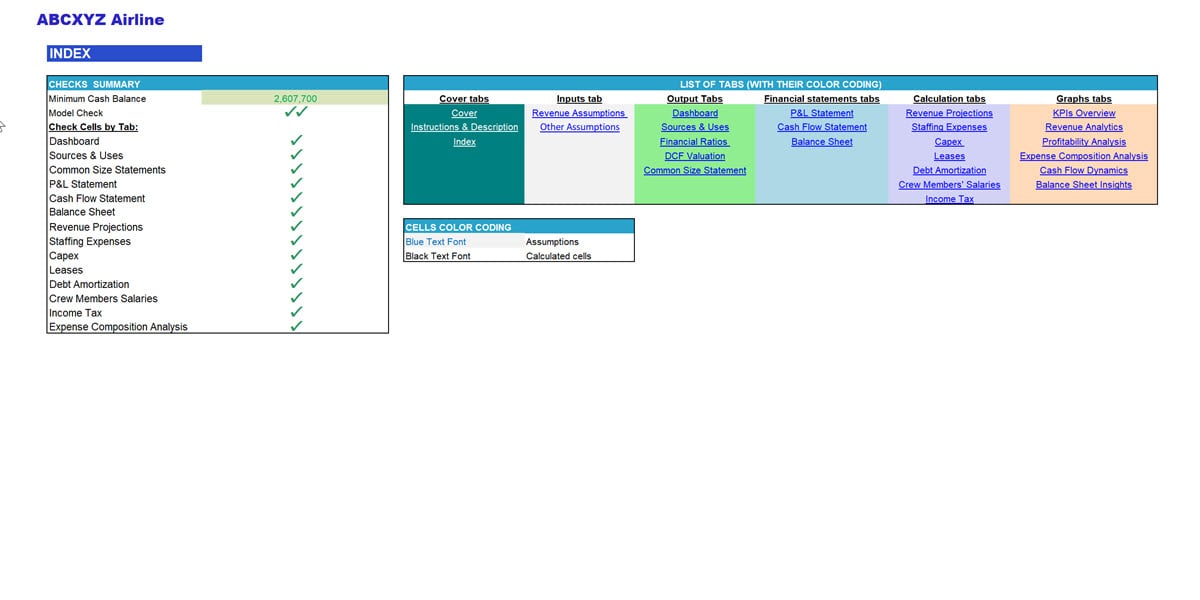

The financial model is structured into six main sections:

I. Cover Tabs:

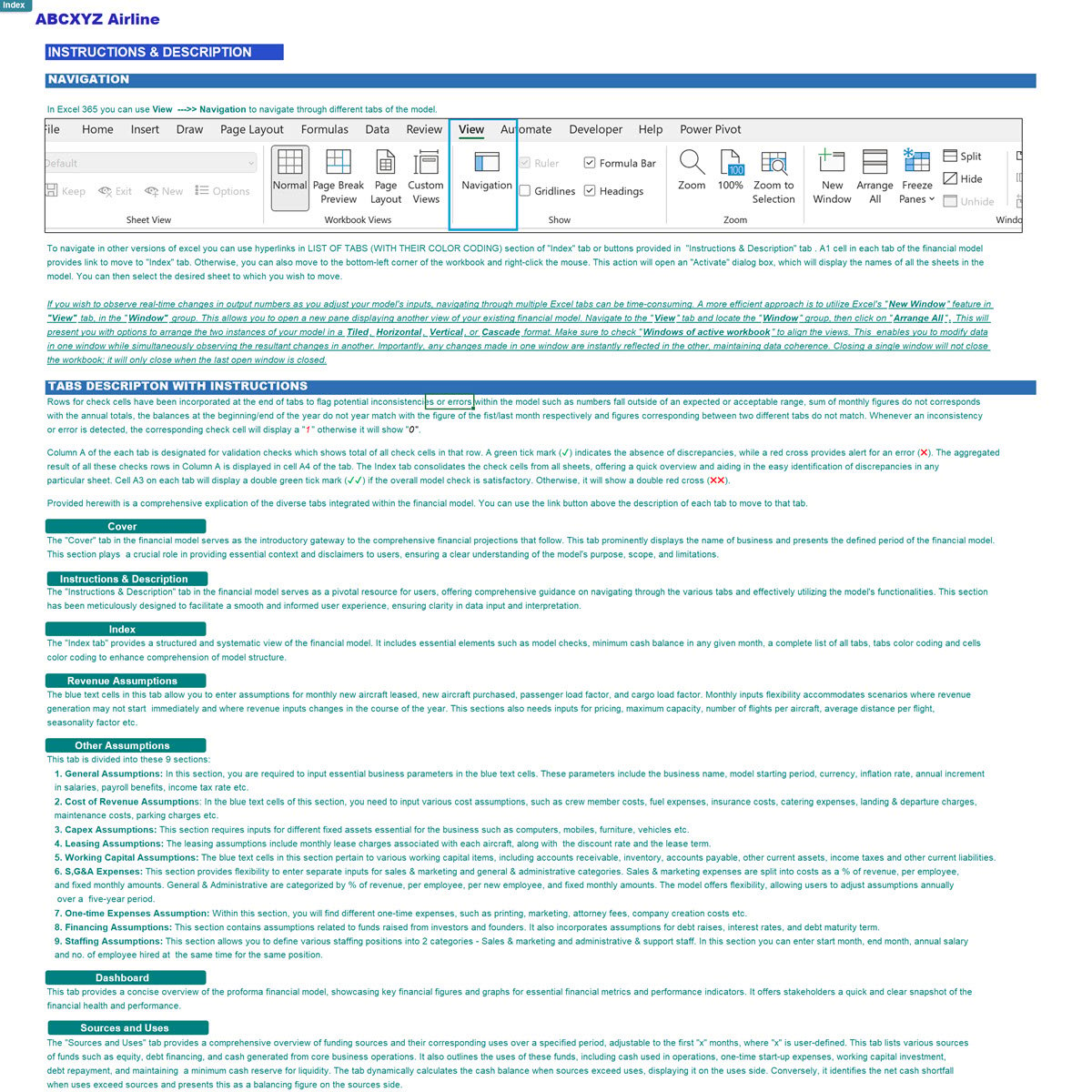

• Navigation and instructions to guide users through the model.

II. Assumptions Tab:

Customizable assumptions, including:

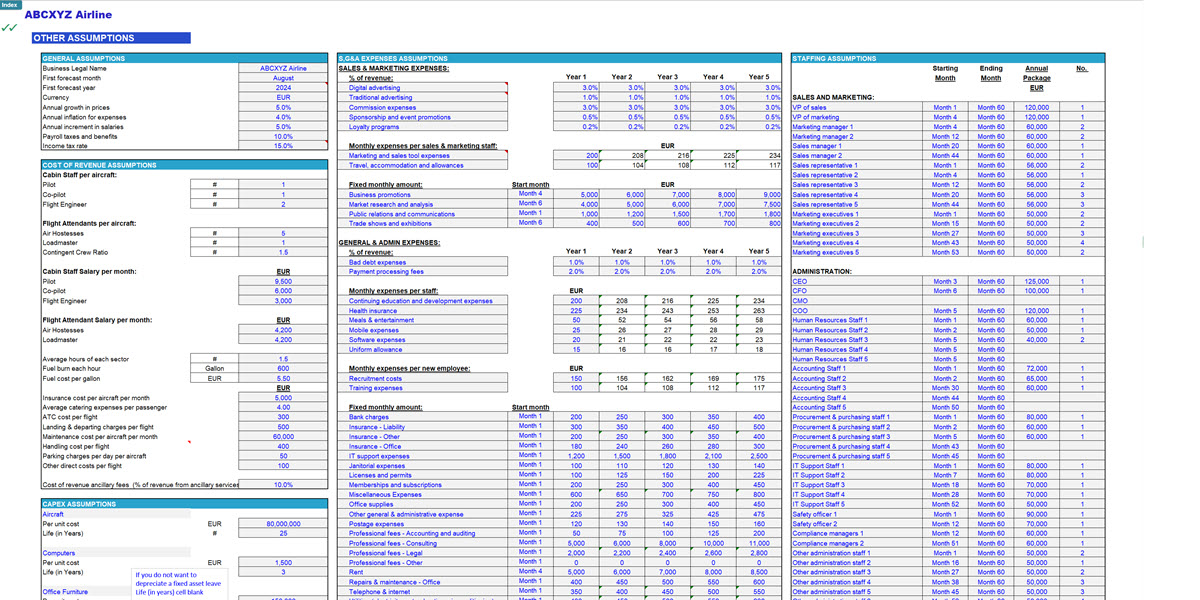

1. General Assumptions – Includes general assumptions such as business name, forecast start month, currency, inflation, growth in salaries, payroll benefits and income

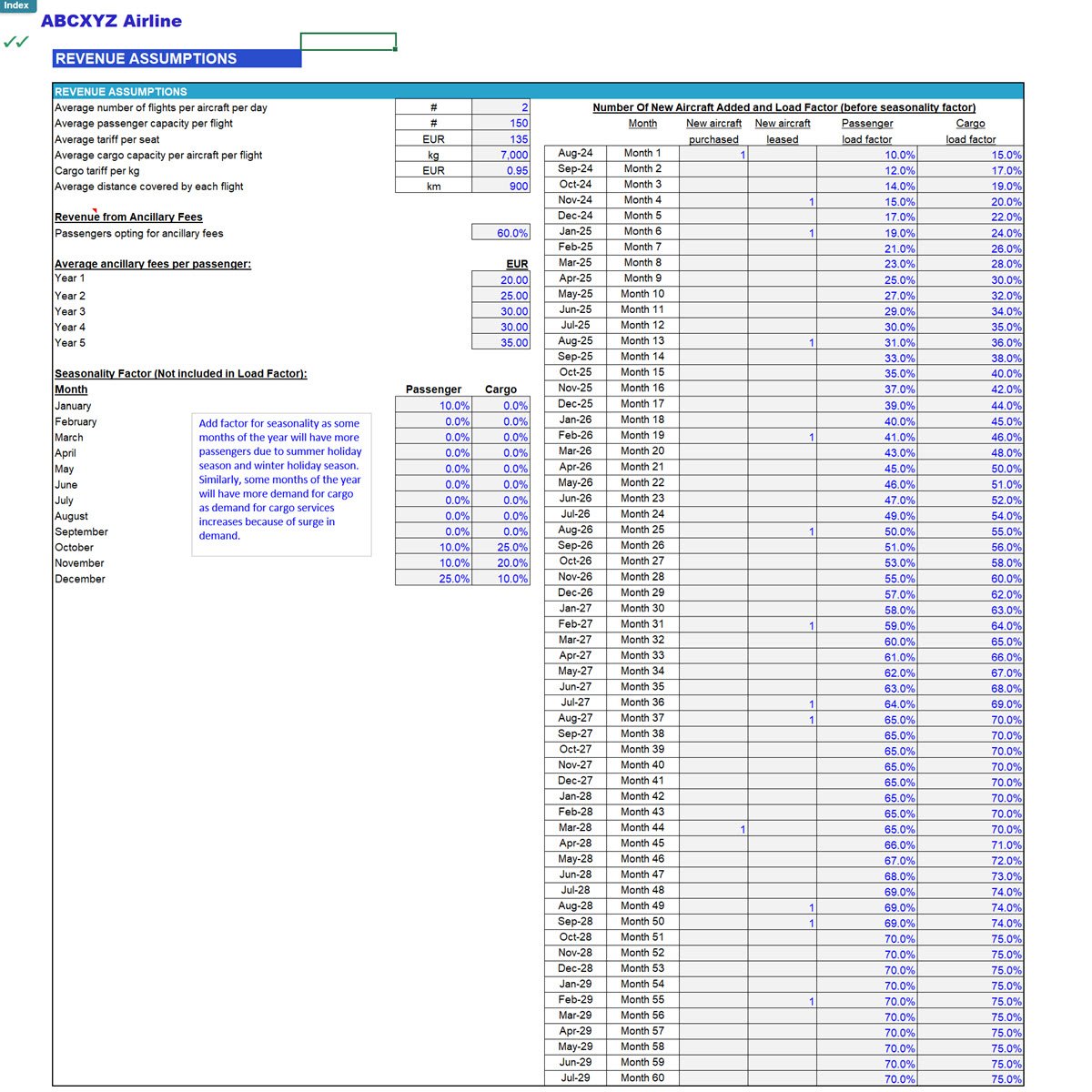

2. Revenue Assumptions – Input aircraft mix, purchase vs. lease structure passenger demand, fare structures, load factors, cargo volume, and ancillary services.

3. Operational Cost Assumptions – Inputs for variable and fixed costs, including:

• Fuel Costs – Based on block hours, fuel consumption, and price per gallon.

• Lease Rentals – Monthly lease expenses for leased aircraft.

• Crew Salaries & Benefits – Pilot and crew compensation structure.

• ATC, Landing & Departure Charges – Sector-wise air traffic control and airport fees.

• Handling Costs – Ground handling and baggage management expenses.

• Catering Expenses – Meal service costs per passenger.

• Aircraft Maintenance & Insurance – Scheduled maintenance and insurance premiums.

4. Capital Expenditure (CapEx) Assumptions – Aircraft purchases, infrastructure investments, and equipment costs.

5. Working Capital Assumptions – Receivable/payable days and cash flow management.

6. Staffing Assumptions – Assumptions for start month, end month and salaries for sales & marketing staff and general & administrative staff.

7. Financing Assumptions – Loan terms, interest rates, and equity funding.

III. Output Tabs:

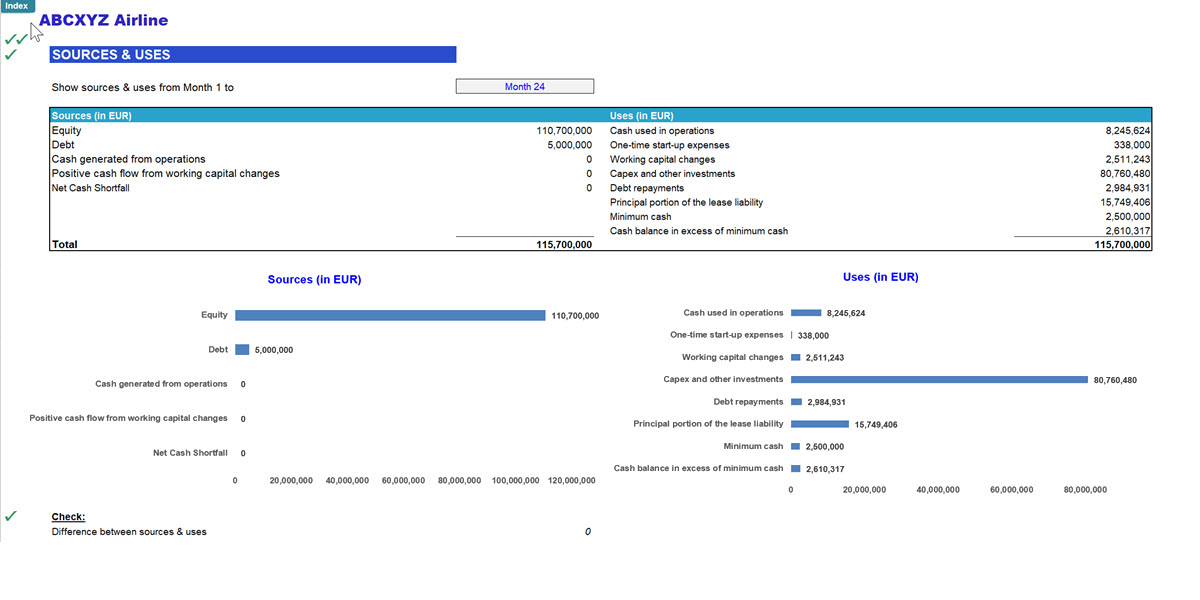

Summarize key financial metrics through:

• Dashboard – Visual representation of key KPIs.

• Profitability Analysis – Revenue, cost breakdown, and margin analysis.

• Sources & Uses of Funds – Capital allocation summary.

• Cash Flow Analysis – Monthly and annual cash flow projections.

• Financial Ratios – Profitability, efficiency, and solvency metrics.

IV. Financial Statements Tabs:

Detailed monthly and annual views of:

• Profit & Loss Statement

• Cash Flow Statement

• Balance Sheet

V. Calculation Tabs:

The backbone of the model, containing detailed projections for:

• Operations – Number of aircraft in operation, sector-wise flights, passenger traffic, and cargo volume..

• Revenue – Passenger, cargo, and ancillary revenue forecasts.

• Cost of Revenue – Fuel, lease, crew, maintenance, ATC, and other direct costs.

• Staffing Expenses – Salaries of sales & marketing staff and general & administrative staff.

• Capex – Capex on aircraft, equipment and other fixed & depreciation calculations. Also includes

• Financing – Loan repayments, interest expenses, and calculations of funds from equity.

VI. Advanced Analysis Tabs:

• Valuation – Calculates the airline's enterprise value using DCF (Discounted Cash Flow)

• KPIs Overview – Summarizes key operational performance indicators

• Revenue Analytics – Breakdown of revenue streams by passenger class, cargo services, and ancillary income,

• Expense Composition Analysis – Details the distribution of operating costs and highlights major cost drivers

• Balance Sheet Insights – Analyzes capital structure, debt-equity mix, asset utilization, and working capital trends over the forecast period.

Technical Specifications

• No VBA or Macros – Ensures compatibility and ease of use.

• Circular Reference-Free – Reliable calculations without iterative dependencies.

• Excel Compatibility – Fully functional in Microsoft Excel 2010 and later versions.

Validation Checks for Accuracy

The model includes built-in validation checks to ensure accuracy. Each tab summarizes its checks with green ticks (✔) for no issues or red crosses (✖) for errors, with an overall summary in the Index tab.

Why Choose This Model?

This model is an all-in-one financial planning tool for airlines, offering detailed financial projections, cost structures, and profitability analysis. Whether you are presenting to investors, applying for loans, or optimizing airline operations, the model equips you with the tools needed for informed decision-making. Its flexibility, depth, and accuracy make it an indispensable resource for airline financial planning.

For any custom solutions or technical support, our team is available to assist in tailoring the model to your airline's specific needs.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Airline Industry, Integrated Financial Model Excel: Airline Financial Model (Aircraft Lease & Capex Option) Excel (XLSX) Spreadsheet, ExcelFinModels