BENEFITS OF THIS EXCEL DOCUMENT

- This Accounting Firm Financial Model Template has been built for use by anyone looking to model out their Accounting Firm financials over a 10 year period.

- This model includes all the key variables you would need to consider with operating your Accounting Firm including specific metrics you can track on Revenue by Service

- Users will easily be able to navigate the model with all input fields highlighted in Blue font. These models are designed to be the perfect financial tool for business owners to use to make decisions for their Accounting Firm

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Description

This Accounting Firm Financial Model Template has been built for use by anyone looking to model out their Accounting Firm financials over a 10 year period. This model includes all the key variables you would need to consider with operating your Accounting Firm including specific metrics you can track on Revenue by Service (Tax, Audit and Assurance, Advisory, Outsourced Accounting and Bookkeeping, Forensic Accounting and Litigation Support); as well as key costs in running the Firm (Staff costs, Rent and Office Expenses, Technology and Software Maintenance, Professional Fees and Memberships, Training and Development, Marketing and Business Development, Insurance and Legal Costs).

Users will easily be able to navigate the model with all input fields highlighted in Blue font. These models are designed to be the perfect financial tool for business owners to use to make decisions for their Accounting Firm as well as provide a snapshot of how the business is currently performing and what the forecasts look like to stakeholders (investors, internal stakeholders).

Revenue & Direct Costs Assumptions

Starts with basic model questions on Start date of the model, Corporate tax rate.

Revenue assumptions are the anticipated factors that drive a company's income generation over a specific period. These assumptions form the basis for financial projections and are crucial for planning and decision-making. In our model we have included detailed inputs for different Revenue categories including:

Tax: Individual Tax Returns, Corporate Tax Filings, Tax Advisory, Estate and Trust Tax Services

Audit and Assurance: Financial Statement Audits, Internal Audits, Compliance Audits

Advisory: Business Consulting, M&A Advisory, Business Valuations

Outsourced Accounting and Bookkeeping: Monthly Bookkeeping, Payroll Services, Financial Reporting

Forensic Accounting and Litigation Support: Fraud Investigation, Litigation Support

Each Revenue category has an input driver of # of Customers and Average Service Price for each service offered.

Operating Expenses Assumptions

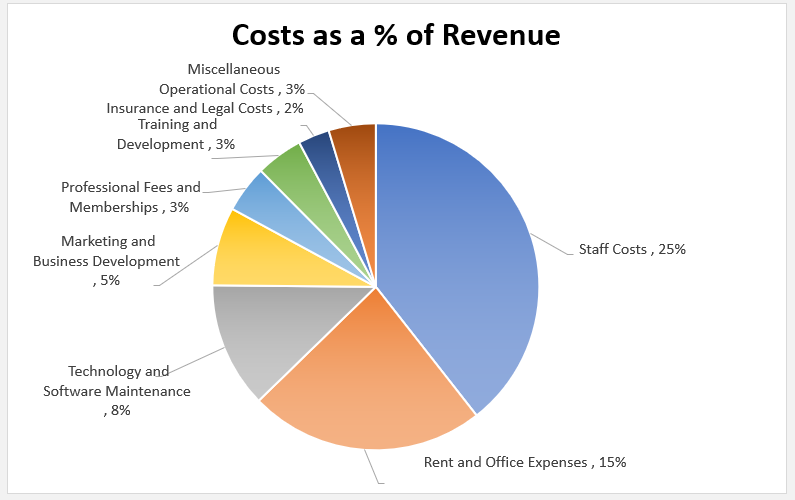

Operating expense assumptions are typically based on historical data, industry benchmarks, market trends, and management's judgment. They are crucial for estimating the total cost of running the business and for determining profitability. Like revenue assumptions, it's important to regularly review and adjust operating expense assumptions to reflect changes in the business environment and ensure the accuracy of financial forecasts. In our model we have included detailed inputs on Operational Staff Costs (Partners (x2), Managers (x2), Senior Accountants (x4), Junior Accountants (x10), Bookkeeper (x3), Administrative Staff (x3), IT Support Staff), Typical Accounting Firm related Operational Expenditure items including Rent and Office Expenses, Technology and Software Maintenance, Marketing and Business Development, Professional Fees and Memberships, Training and Development, Insurance and Legal Costs, Miscellaneous Operational Costs, however, you can add any other expenses you think may be relevant to your business in this sheet.

Capex Assumptions

Capital expenditure (Capex) assumptions refer to the anticipated investments a company plans to make in long-term assets, such as property, equipment, and technology, over a specific period. These assumptions are crucial for financial planning, budgeting, and forecasting, as they impact the company's cash flow, profitability, and growth prospects. We have included a Detailed list of likely Initial Costs for an Accounting Firm founder including Technology (Software, Hardware and IT Infrastructure), Office Equipment and Furniture, Leasehold Improvements and Other Capex costs. We have included a Fixed Asset Register that has the relevant capex items above listed with assumed useful lives for depreciation purposes. We have also given an assumption on Capital Structure (i.e. if Capex Purchases were funded entirely through Equity or Debt).

Monthly Projections (10 year period)

We have broken down projections on a Month by Month basis when projecting Income Statement, Balance Sheet and Cash Flow Statement items. The monthly projections are provided over a 10 year time frame. This is particularly useful for businesses looking at month-on-month trends and insights in the business, which leads to better decision making and also better budgeting should there be a need to either raise more capital, pursue growth opportunities from excess capital or pay down interest bearing debt. Monthly projections also help a business ascertain what performance may be seasonal in nature when looking at growth projections on a month-over-previous-year's-month basis.

Annual Projections (10 year period)

The model has Annualized Financial Projections of Income Statement, Balance Sheet and Cash Flow Statement over a 10 year time frame. Annual projections provide an excellent overview of expected revenues, expenses, profits, cash flow, and other key financial metrics for the upcoming year. Annual projections are essential for strategic planning, budgeting, fundraising, and performance evaluation for any company at any stage of their business cycle.

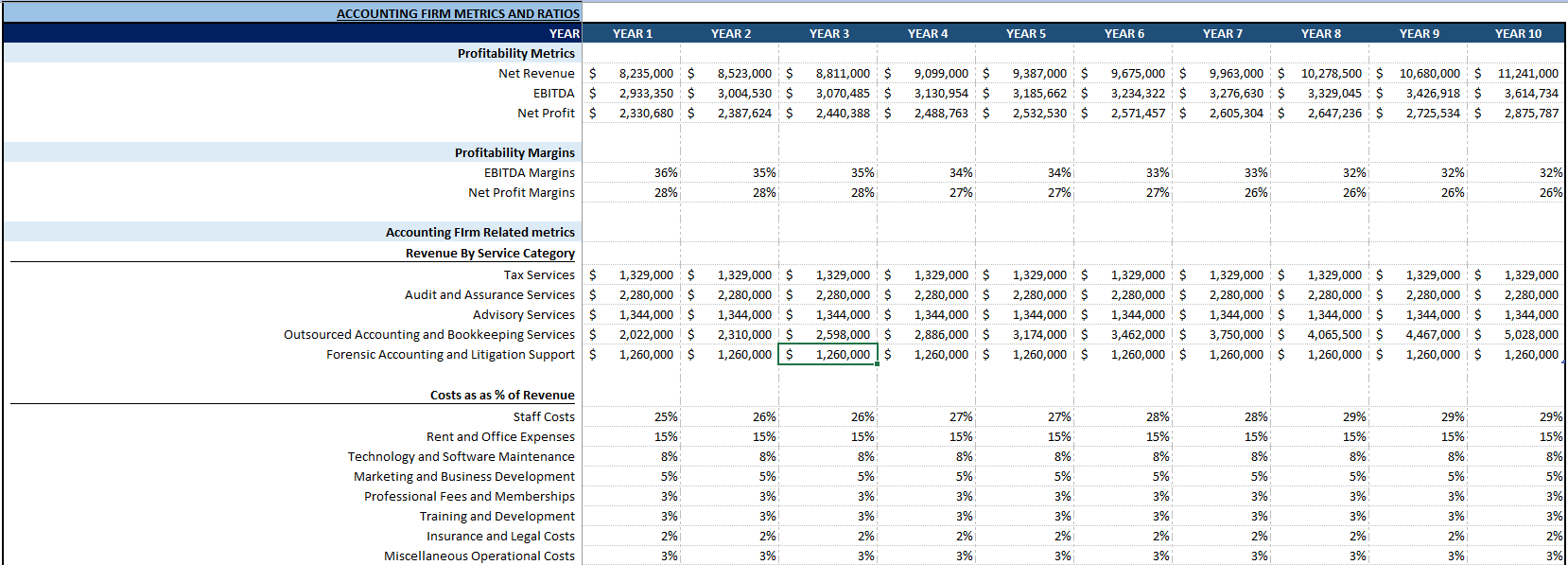

Accounting Firm Metrics & Ratios

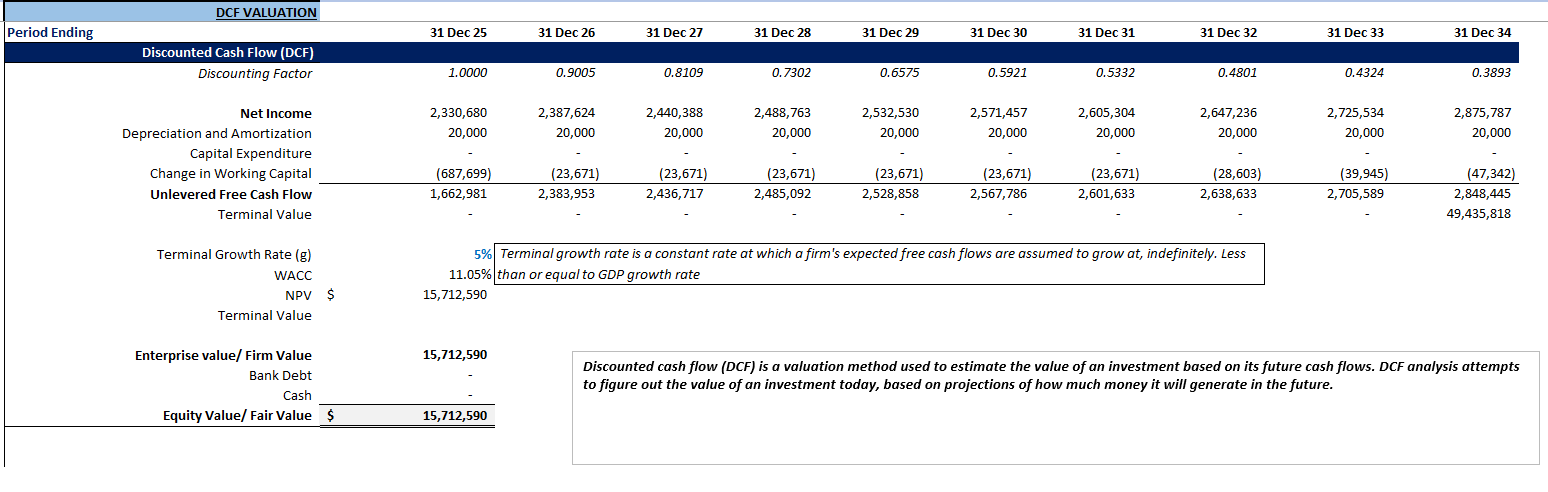

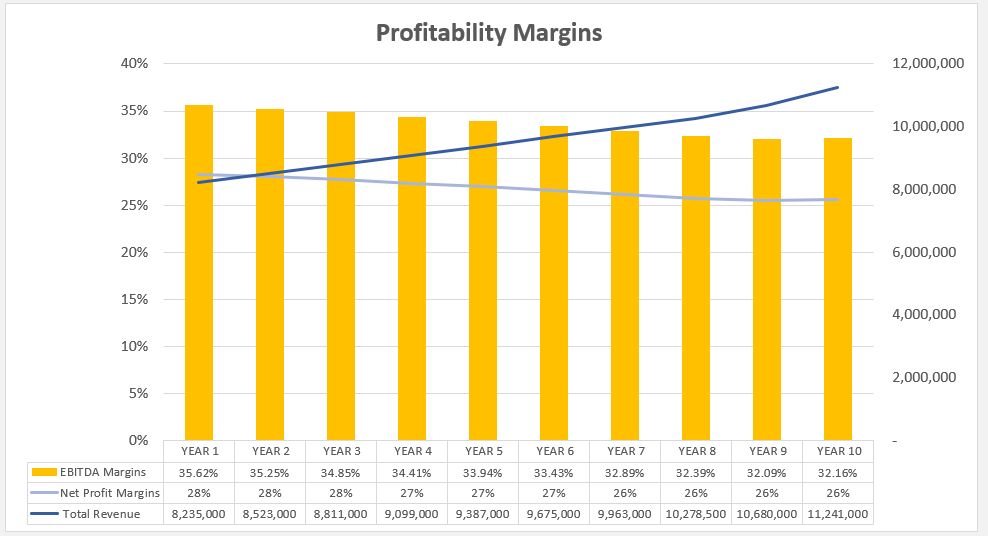

Accounting Firm specific metrics including Revenue by Service Category, Costs as a % of Revenue, Profitability Ratios, Liquidity Ratios, Asset Turnover Ratios provided.

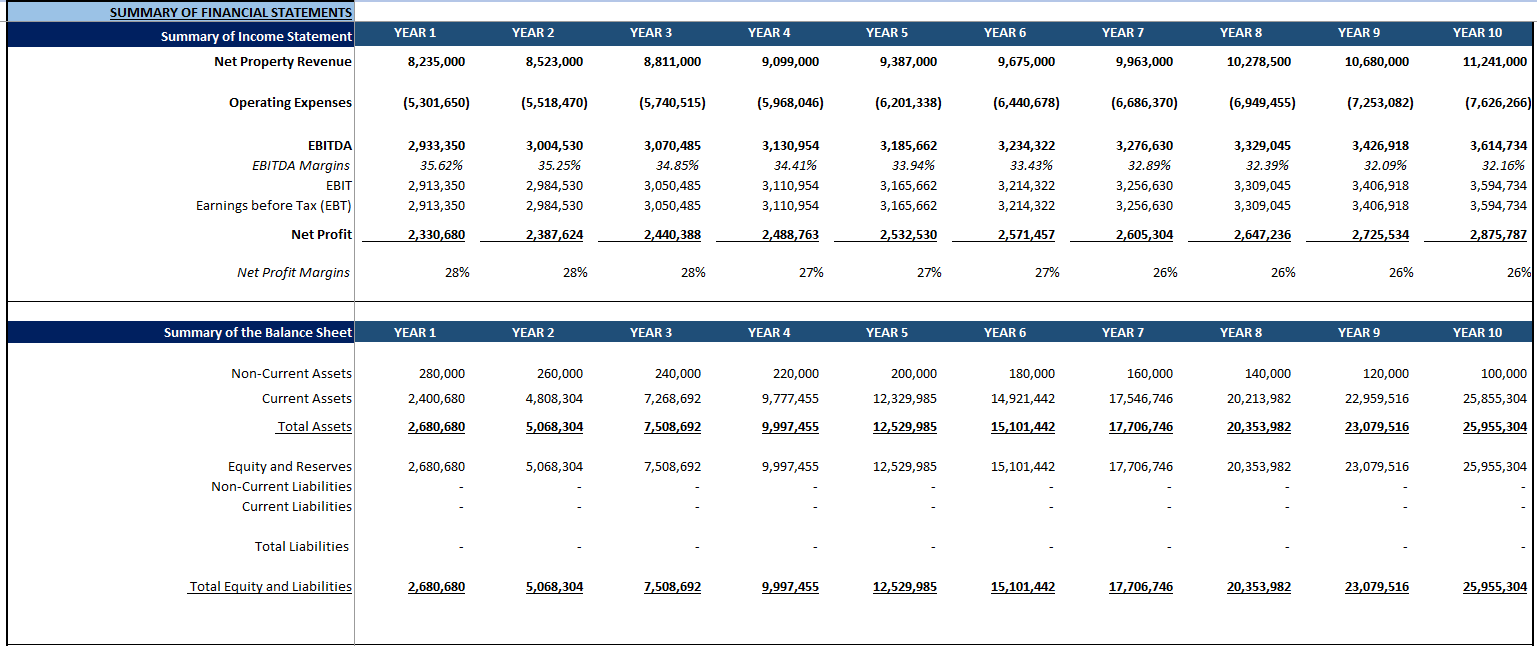

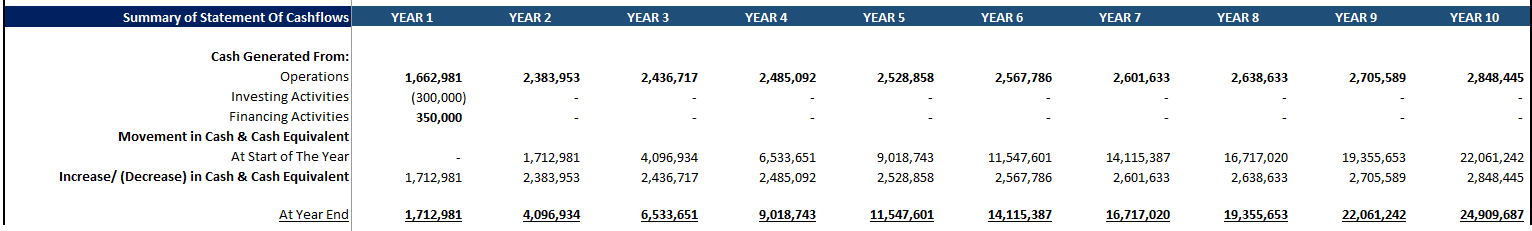

Summary of Financial Statements (10 year period)

Summarized Financial Statements over a 10 year time frame helps for better snapshots of financial performance. Income Statement, Balance Sheet and Cash Flow Statement all provided.

Charts

Charts available including Profitability Analysis, Costs as a % of Revenue and Use of Funds Chart.

Depreciation Schedule

Detailed Depreciation Schedule shows additions / disposals to the Fixed Asset Register of the business. Sections included for Technology (Software, Hardware and IT Infrastructure), Office Equipment and Furniture and Leasehold Improvements.

Debt Schedule

Debt schedule provided with interest rate assumptions and payback period assumptions included.

Equity Schedule

Equity schedule provided with assumptions on all investments into the business by investors or owners.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Accounting Firm Financial Model Excel (XLSX) Spreadsheet, Financial Models Hub