INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Starting a stationery shop requires careful financial planning to ensure profitability and long-term growth. A well-structured financial model helps business owners make informed decisions about revenue streams, marketing costs, and operational efficiency. This Template breaks down a comprehensive Stationery Shop Excel Financial Model, covering essential components such as financial projections, income statements, and break-even analysis. By understanding these elements, stationery store owners can create a strong community presence, improve customer retention, and maximize profitability.

Key Components

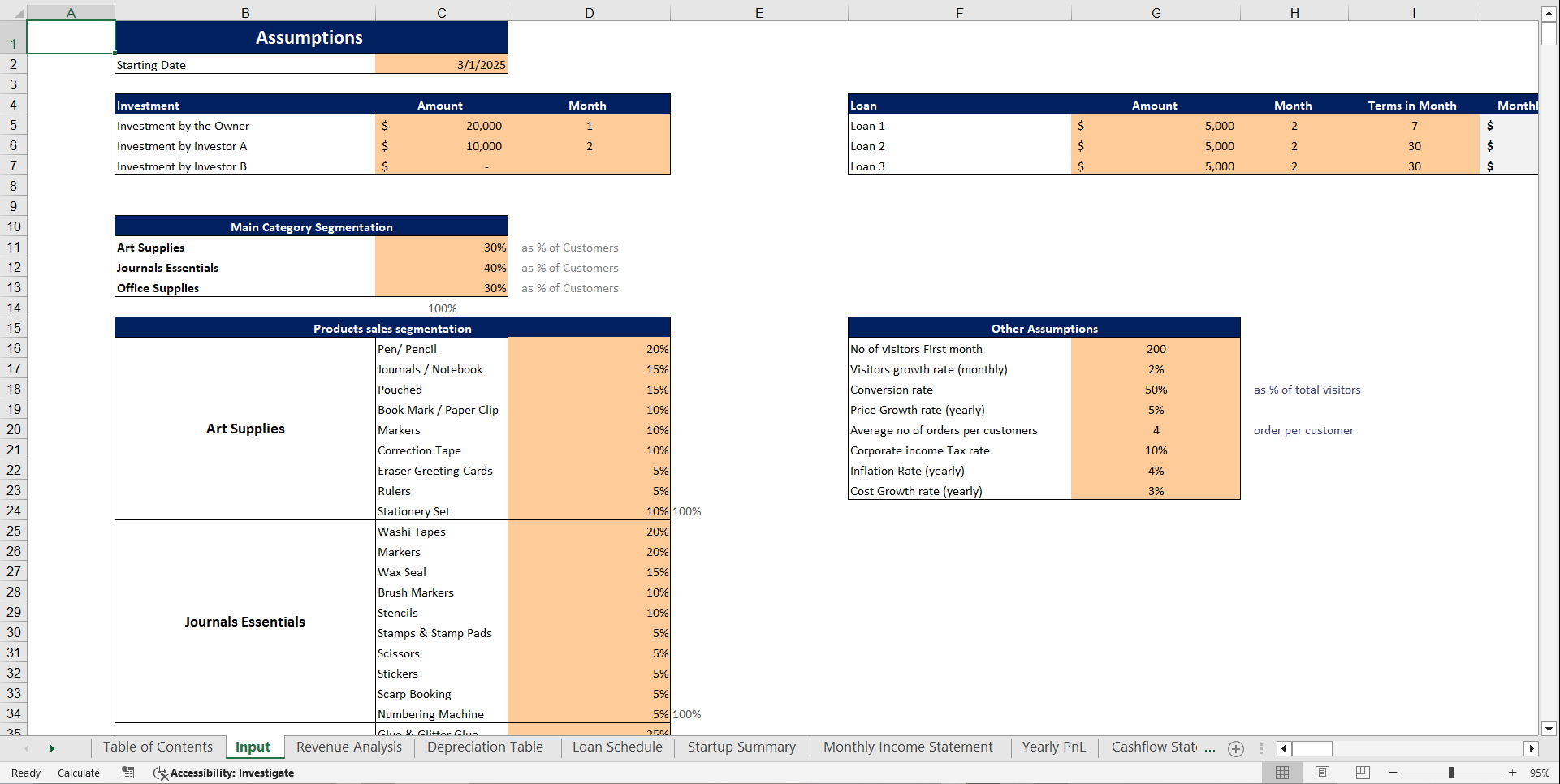

Input Sheet

The Input Sheet forms the foundation of the financial model, allowing users to define key variables such as:

1. Startup costs: Initial investment, equipment, and inventory.

2. Marketing costs: Expenses for advertisements, social media campaigns, and promotional events.

3. Staff costs: Salaries, wages, and benefits for employees.

4. Stock levels: Initial and replenishment inventory requirements.

5. Financial assumptions: Tax rates, inflation, and loan interest rates.

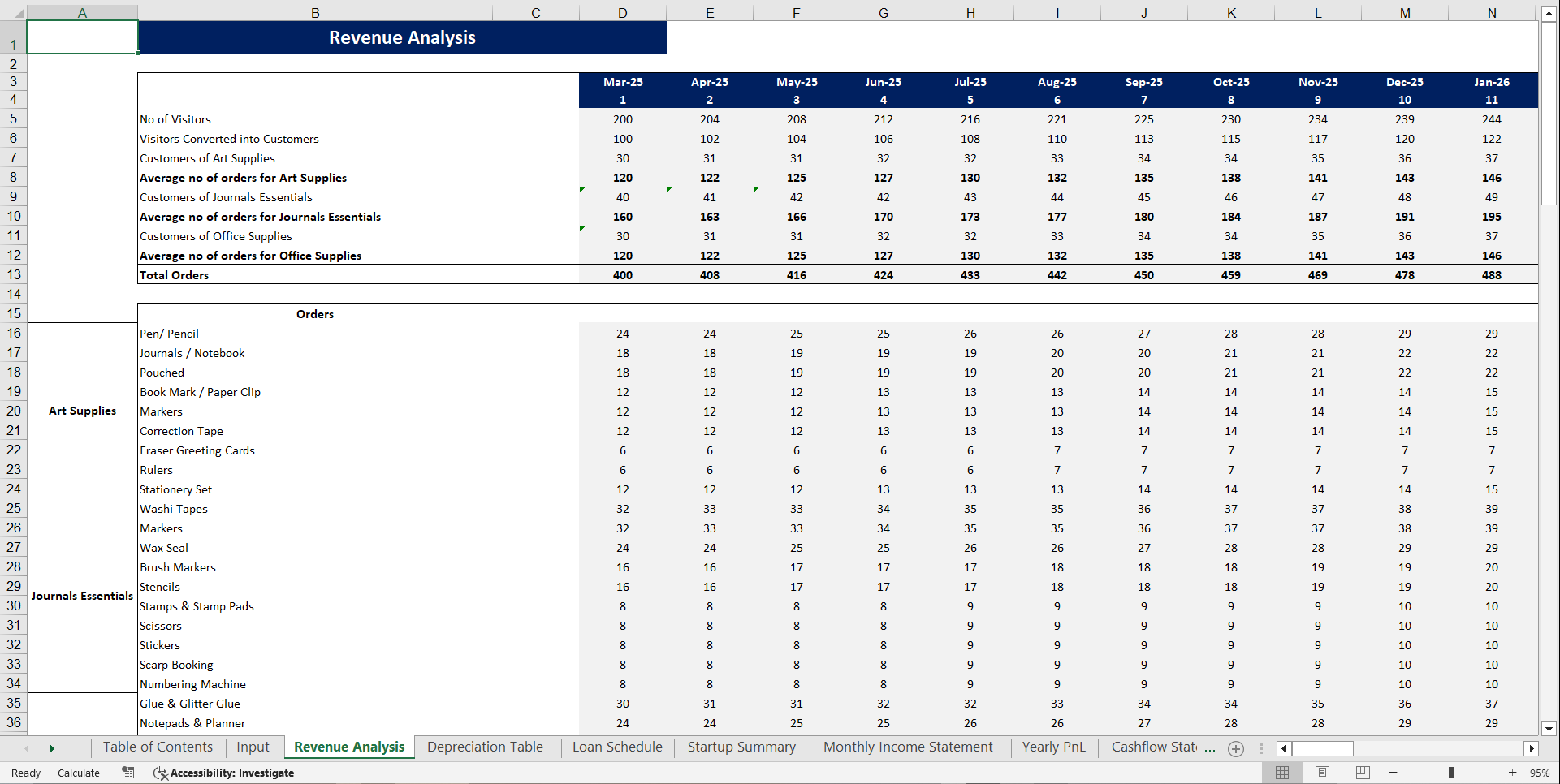

Revenue Analysis

1. Product pricing: Apply Competitive pricing for custom stationery products and school supplies.

2. Potential profitability: Analysis of revenue versus cost structures.

3. Stationery store sales projections: Based on customer demand, previous purchases and trends.

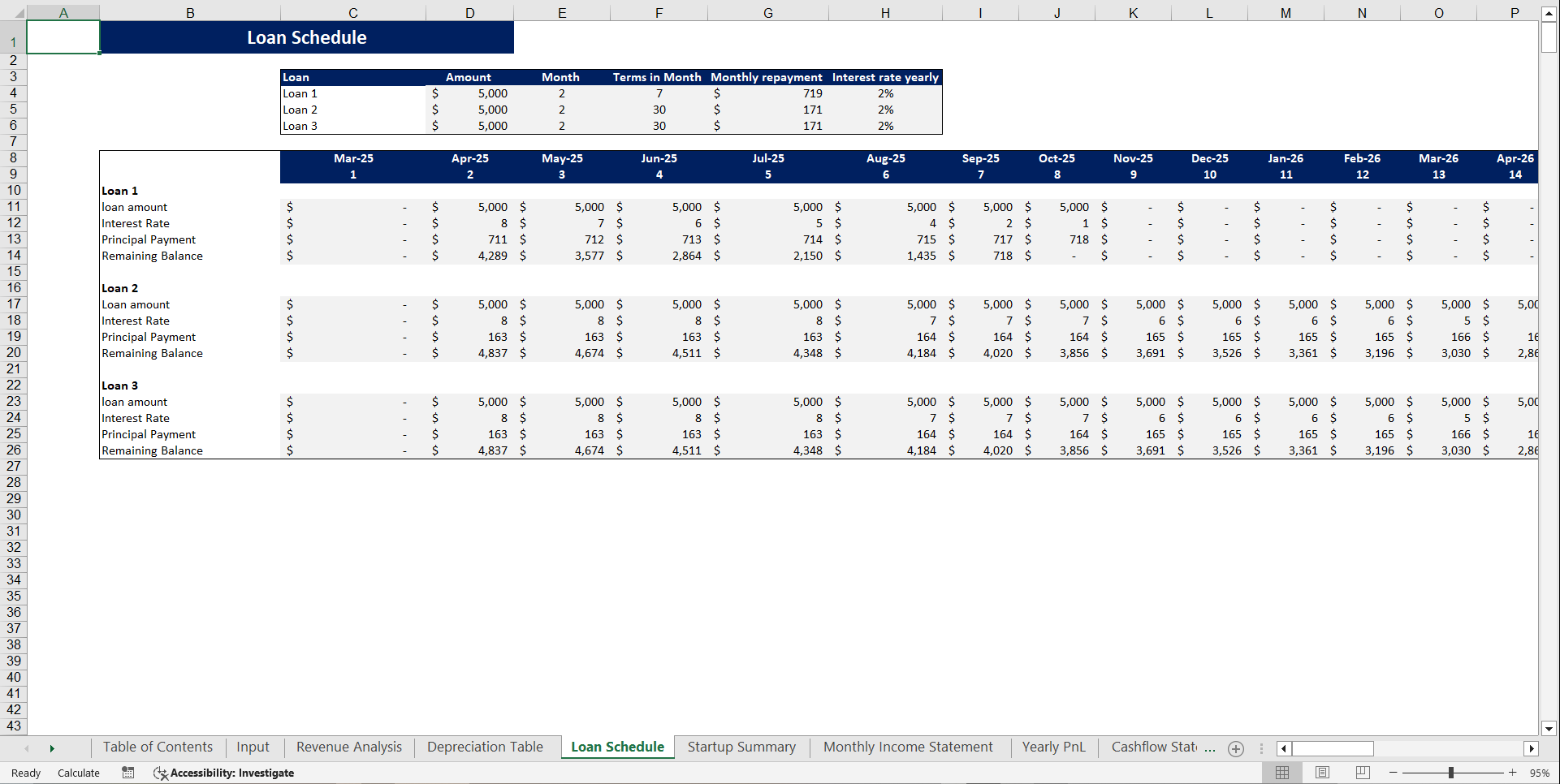

Startup Summary

1. Initial capital requirements: Total investment needed to launch the stationery store.

2. Funding sources: Loans, equity, or personal investments.

3. Breakdown of startup costs: Rental space, fixtures, inventory, licenses, and working capital.

4. Projected return on investment (ROI): Time frame for financial stability and profitability in stationery shops.

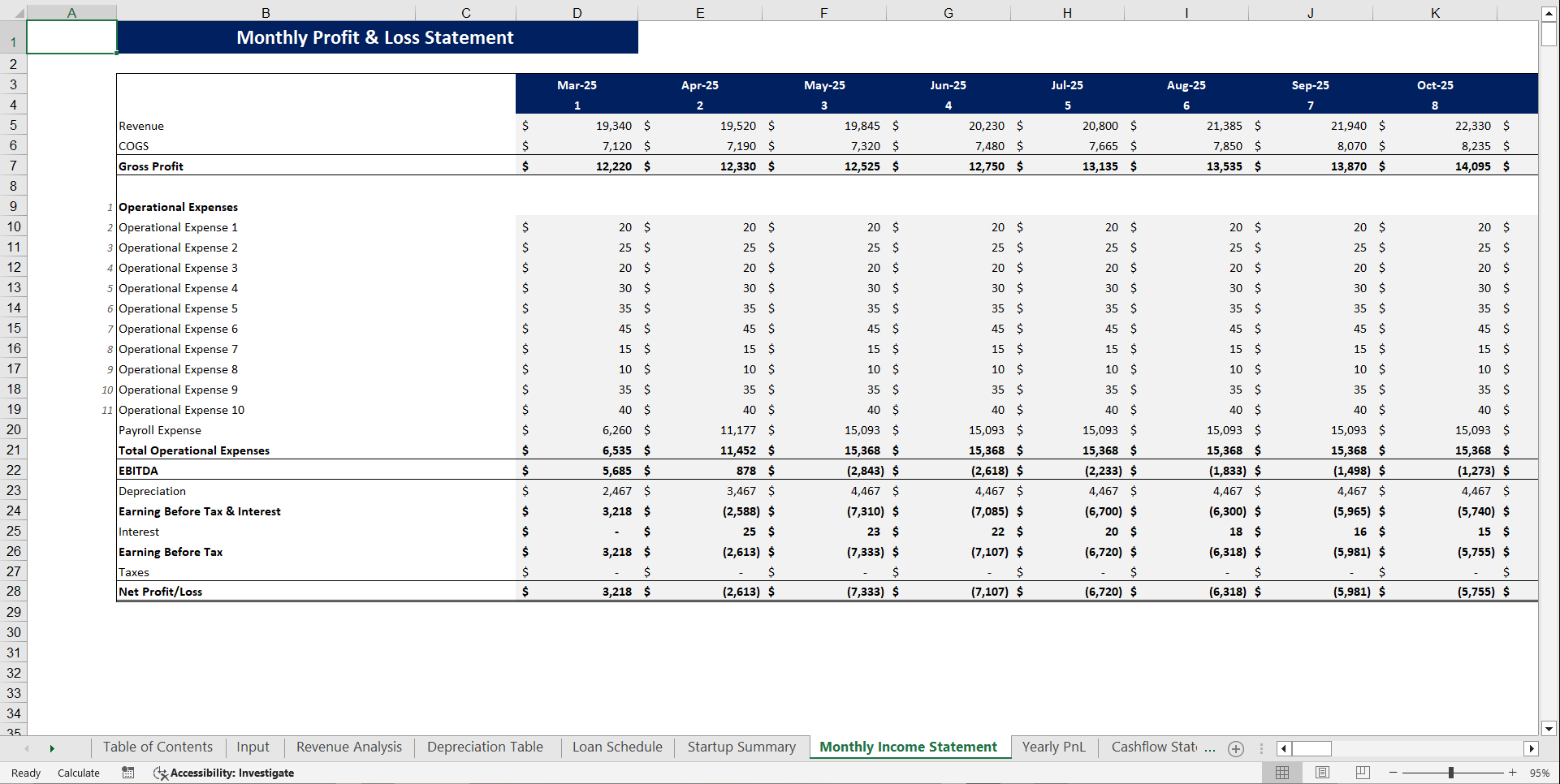

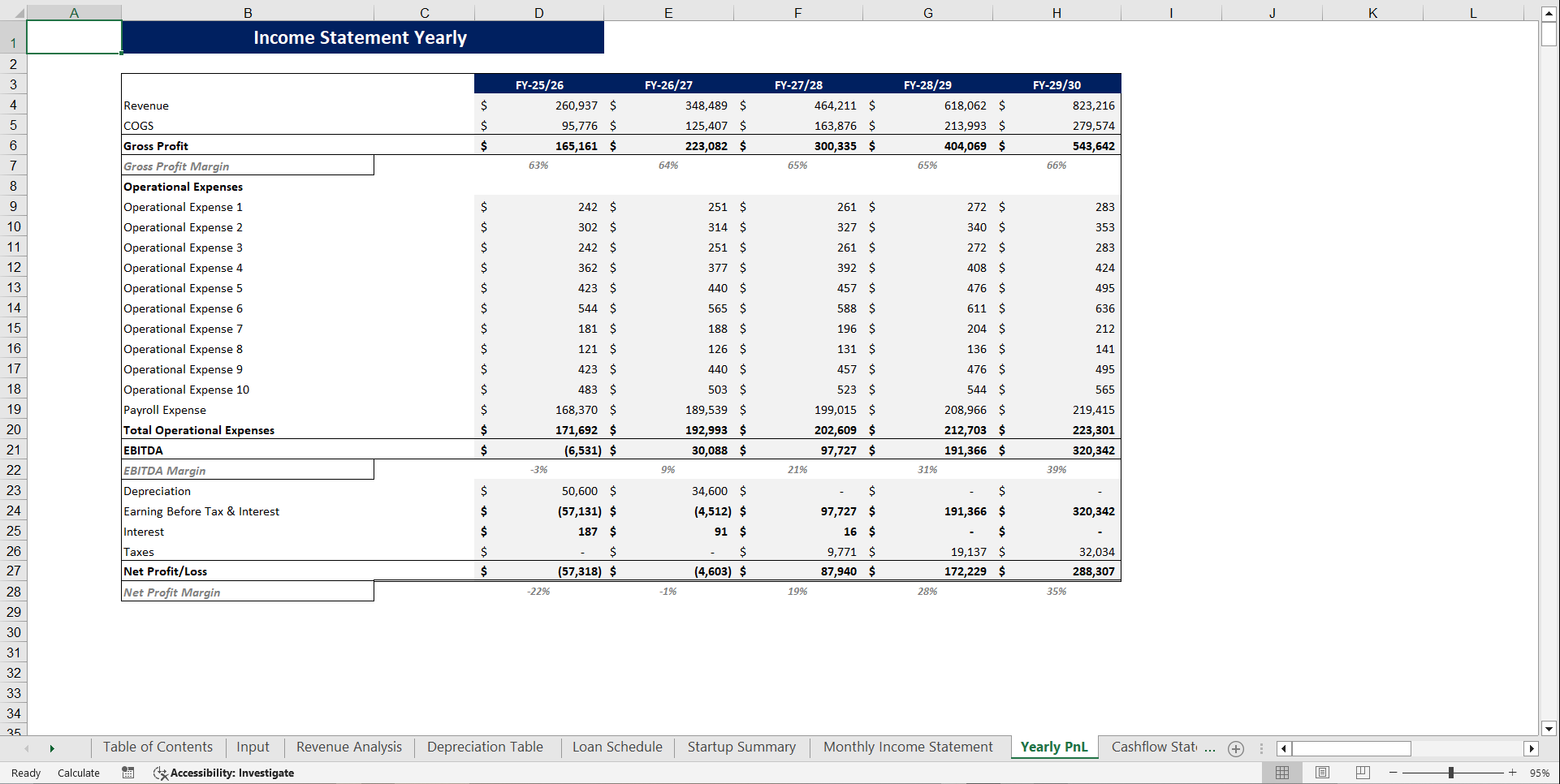

Income Statement

1. Revenue streams: Sales from stationery enthusiasts, schools and businesses.

2. Cost of goods sold (COGS): Direct expenses related to product sales.

3. Operating expenses: Rent, salaries, marketing costs, and utilities.

4. Net profit or loss: Indicator of financial health and long-term growth.

Cashflow Statement

1. Operating cash flow: Income from stationery store operations.

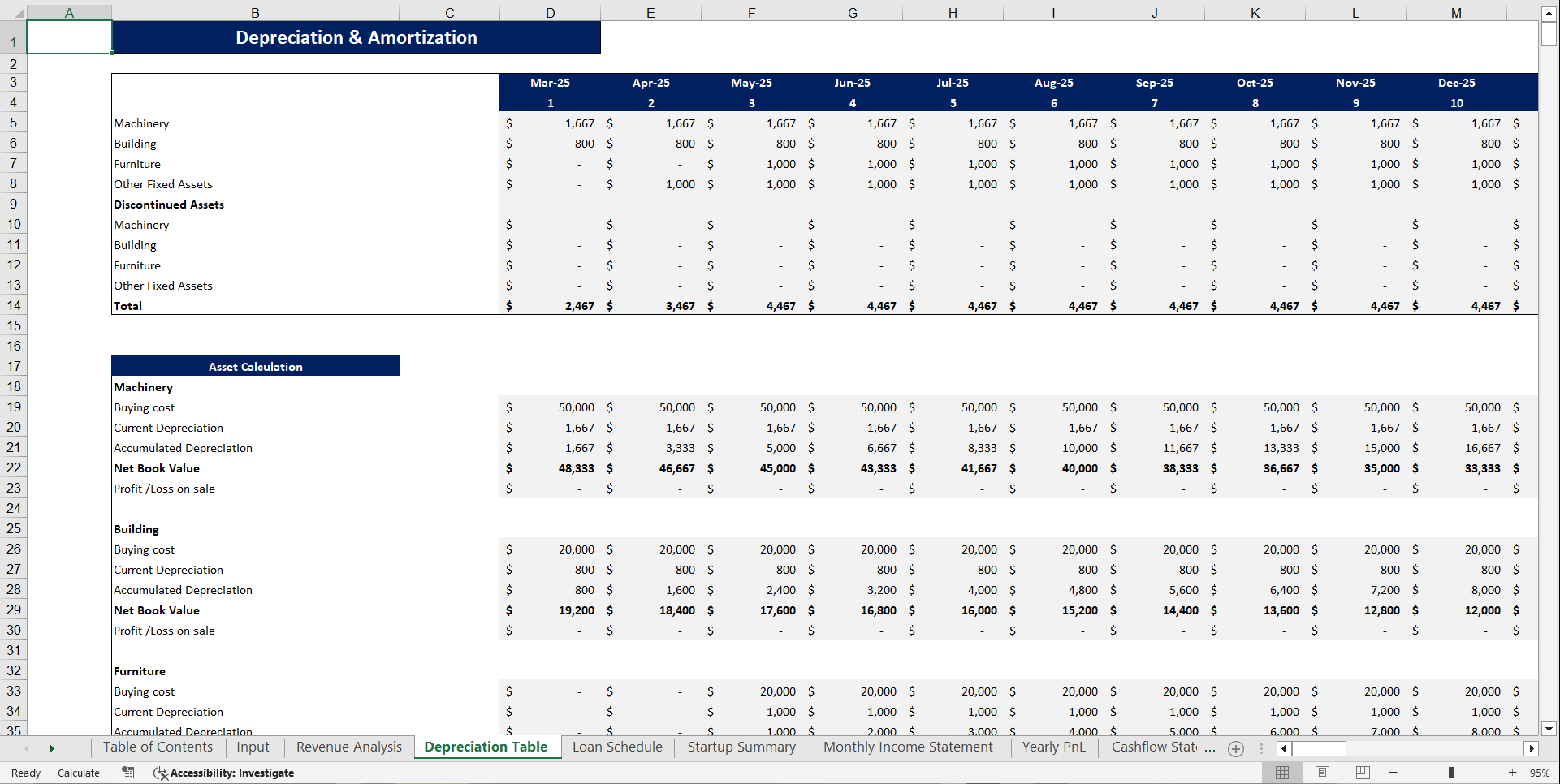

2. Investing cash flow: Asset purchases or sales.

3. Financing cash flow: Loans, repayments, and equity injections.

4. Short-term liquidity assessment: Ensuring sufficient cash for daily operations.

Balance Sheet

1. Assets: Cash, inventory, equipment, and accounts receivable.

2. Liabilities: Loans, supplier payments, and other financial obligations.

3. Owner's equity: Net worth of the business.

4. Financial stability: Determines long-term growth potential.

Project Evaluation

1. Net present value (NPV): Measures future cash flow profitability.

2. Internal rate of return (IRR): Expected return on investment.

3. Payback period: Time required to recover the initial investment.

4. Profitability index: Comparison of investment benefits against costs.

Sensitivity Analysis

1. Revenue fluctuations: School seasons, customer preferences, and market trends.

2. Cost variations: Changes in supplier pricing and marketing costs.

3. Impact on financial planning: Adapting strategies for stationery stores based on market shifts.

KPIs and Financial Ratios

1. Gross profit margin: Profitability in stationery shops after COGS.

2. Net profit margin: Overall profitability after expenses.

3. Return on assets (ROA) & return on equity (ROE): Efficiency in using resources and investor funds.

4. Customer retention rates: Impact of effective loyalty programs and customer engagement.

Dashboard

1. Revenue and expense trends: Helps in making informed decisions.

2. Cash flow movements: Monitoring financial health.

3. Profitability indicators: Assessing long-term business sustainability.

4. Social media presence impact: Evaluating the effectiveness of online promotions.

FAQs

Why is financial projection important for a stationery shop?

Financial projections help in planning for stationery stores by estimating future revenue, expenses, and profits. It assists in making informed decisions regarding investments, stock levels, and marketing strategies.

How does an effective loyalty program increase customer retention?

A well-structured loyalty program enhances customer retention rates by encouraging repeat purchases, rewarding previous purchases, and strengthening community relationships. This results in long-term customer relationships and an increase in customer engagement.

How can social media marketing boost stationery store sales?

Utilizing social media marketing allows stationery businesses to connect with customers, address customers' needs, and create excitement among customers. A strong community presence and engagement in the stationery business can influence purchasing decisions and boost sales.

What financial strategies can help improve stationery store profits?

Financial growth strategies include cost control, pricing techniques for stationery shops, diversifying product lines, and investing in online shopping platforms. Implementing programs for stationery enthusiasts and sustainable stationery products can also drive profitability.

How can a stationery store maintain financial stability in a competitive market?

To maintain financial stability, stationery stores must optimize stationery store operations, focus on stationery store operational efficiency, and analyze customer preferences. Adopting digital rewards cards, personalized stationery products, and DIY stationery workshops can improve customer satisfaction and profitability.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Stationery Shop Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant