POULTRY FARMING EXCEL DESCRIPTION

Thinking about starting a poultry farm but unsure about the costs and profits? This Poultry Farm Financial Model is here to help. It's designed to make financial planning easy, even if you're new to the farming industry. With this tool, you can estimate costs, analyze revenue generation, and track your performance. It includes important financial statements like cash flow statements, balance sheets, and income statements. Whether you're a first-time farmer or an investor, this financial tool gives you the insights needed to make informed decisions and grow your business with confidence.

Key Features of the Model

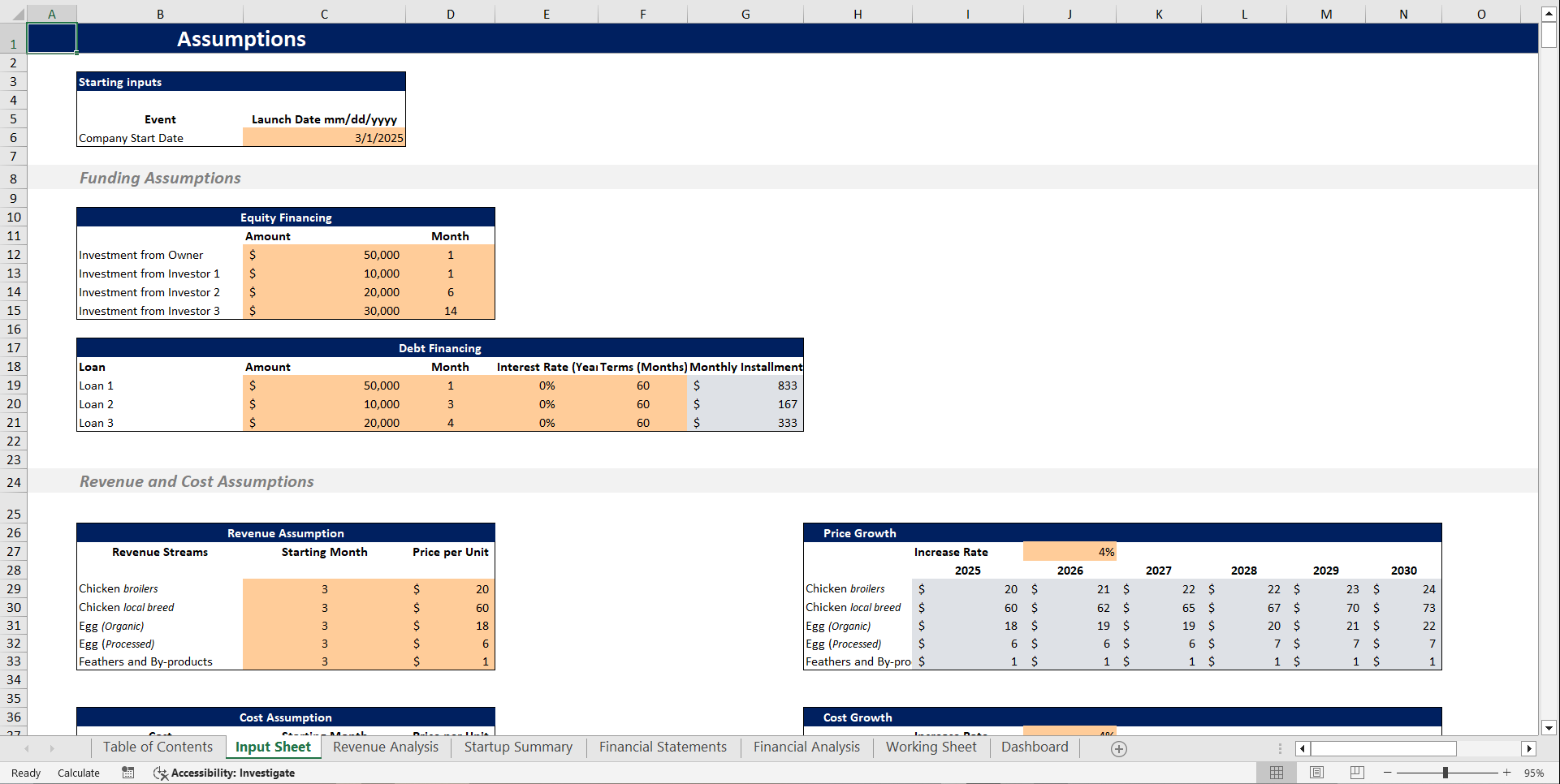

Input Sheet

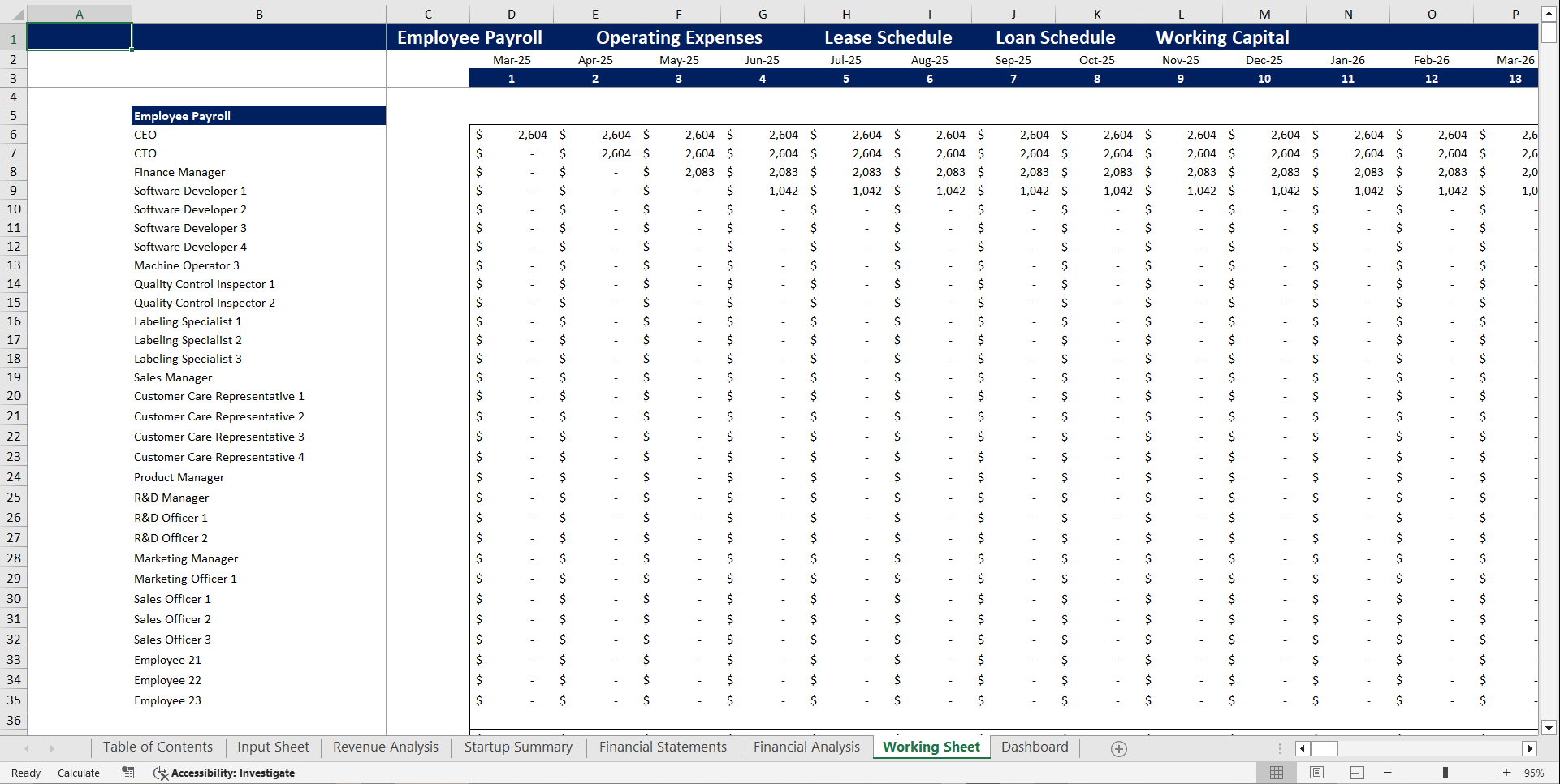

This section allows you to enter all relevant poultry farm details and set pricing strategies for eggs, meat, and other products. You can estimate farm costs, including equipment purchases, feed, and daily operations. Additionally, it helps with:

1. Listing direct costs like feed, labor, veterinary services, and vaccinations.

2. Adjusting growth rate and utilization rate to test different business scenarios.

3. Analyzing operational costs and planning for future financial objectives.

4. Incorporating budgeting processes for better financial management.

5. Improving cash reserves planning for unexpected expenses.

6. Enhancing contingency planning with accurate projections.

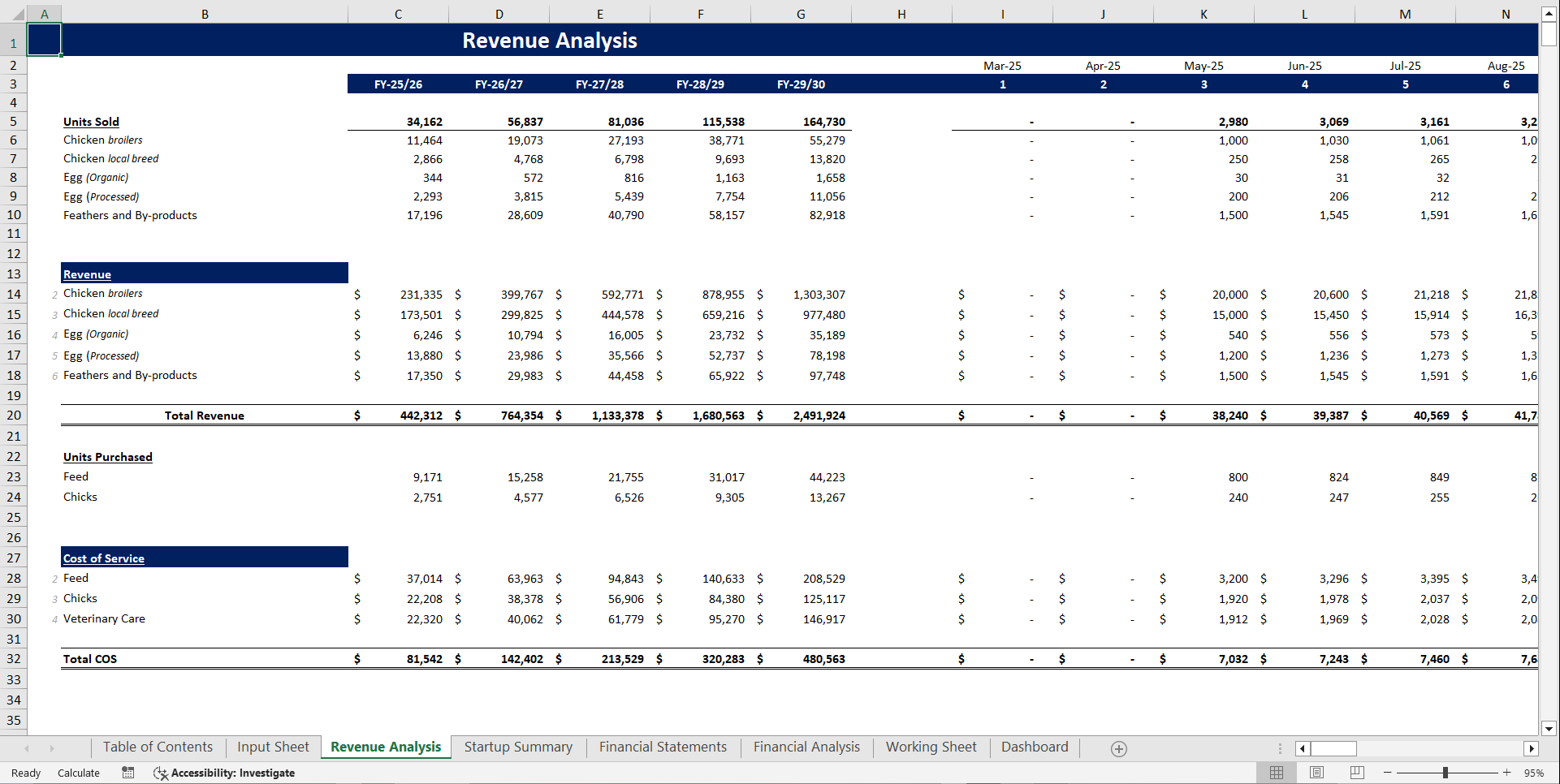

Revenue Analysis

Understanding how your poultry business generates revenue is crucial for profitability. This model helps analyze customer demand and market trends, allowing you to forecast revenue growth based on sales, production, and pricing strategies. It also provides insights into seasonal variations in egg and meat production. By identifying marketing expenses, optimizing for higher profits, and customizing revenue streams, you can ensure accurate budgets for long-term financial stability. The tool also assesses the constant demand for poultry products in the market while utilizing analytical tools for better forecasting accuracy.

Startup Summary

Starting a poultry farm requires significant investment and financial planning. This model provides a detailed breakdown of startup costs and funding options, helping you plan for:

1. Working capital, feed inventory, and housing infrastructure.

2. Financial projections for a 5-year period and funding assumptions.

3. Capital expenditures and additional funds required.

4. A structured financial strategy for financial stability.

5. Accurate cost planning to address potential challenges.

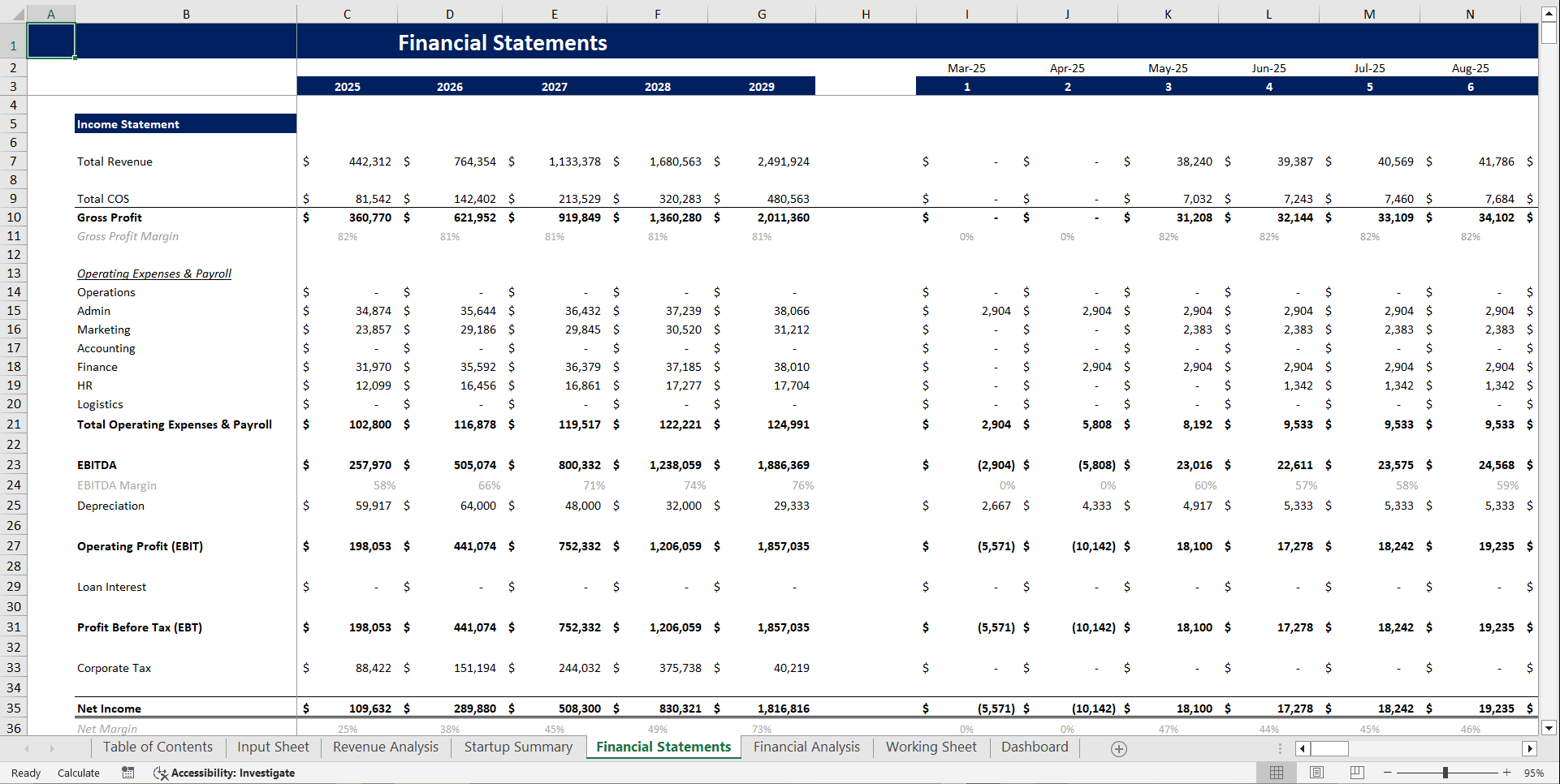

Monthly & Annual Income Statement

Monitoring your farm's financial health is essential, and this model provides a comprehensive breakdown of income statements. It allows you to:

1. Compare earnings, operating costs, and net profit.

2. Identify marketing costs, feed costs, and equipment maintenance expenses.

3. Track key performance indicators (KPIs) to measure business growth.

4. Monitor cash gaps and evaluate cost efficiency ratios for profitability.

Using the annual profit analysis, you can ensure that financial goals are being met while maintaining better control over actual operations and financial aspects.

Cash Flow Statement & Projections

Tracking how money moves in and out of your farm is crucial for sustainability. This model enables effective cash flow management by:

Evaluating future cash flows to ensure business stability.

1. Monitoring sensitivity analysis for different market conditions.

2. Understanding the financial implications of investment decisions.

3. Ensuring smooth business operations with proper cash inflows and outflows.

4. Planning for business model improvements based on actual performance.

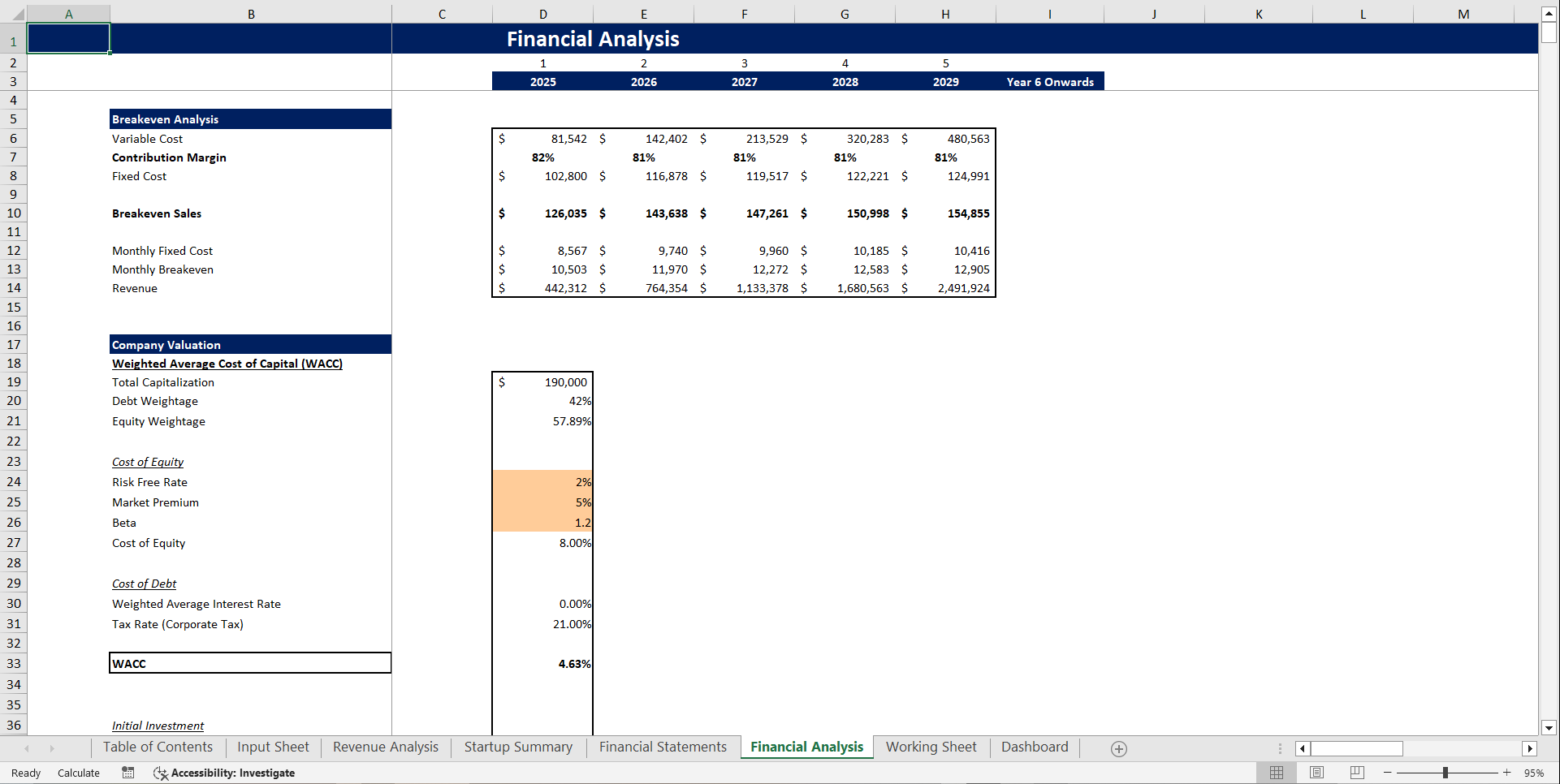

Break-even Analysis

Finding out when your poultry farm starts making a profit is essential. This section calculates variable costs, fixed expenses, and cost efficiency ratios to help you determine the minimum production levels needed for profitability. By conducting break-even calculations, you can align with financial planning, set financial objectives, and evaluate the debt-to-equity ratio for smart financial decisions. The profitability analysis helps you assess future earnings and make data-driven decisions for financial stability.

Company Valuation & Financial Forecasts

Estimating your business worth is made easy with DCF valuation and long-term financial forecasts. This model helps with:

1. Strategic planning for expansion and scaling.

2. Evaluating funding sources and financial assumptions for investment opportunities.

3. Conducting trend analysis for improved economic health planning.

4. Identifying business scenario variations and their economic impact.

5. Assessing return on assets for better profitability measurement.

Dashboard & Reports

Get a quick and comprehensive overview of your poultry farm's finances. The dashboard includes:

1. Revenue, expenses, and financial forecasts.

2. Key reports like balance sheets and cash flow statements.

3. Financial metrics and capital expenditures for effective management.

4. Opportunities for cost reduction and efficiency improvements.

5. Visual representations for easy data interpretation.

Using financial analysis tools, you can make better business decisions, monitor financial ratios, and enhance profitability planning with accurate business operations data.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Poultry Farming, Integrated Financial Model Excel: Poultry Farm Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant