Photography Studio Financial Model (Excel XLSX)

Excel (XLSX) + supplemental PDF

BENEFITS OF THIS EXCEL DOCUMENT

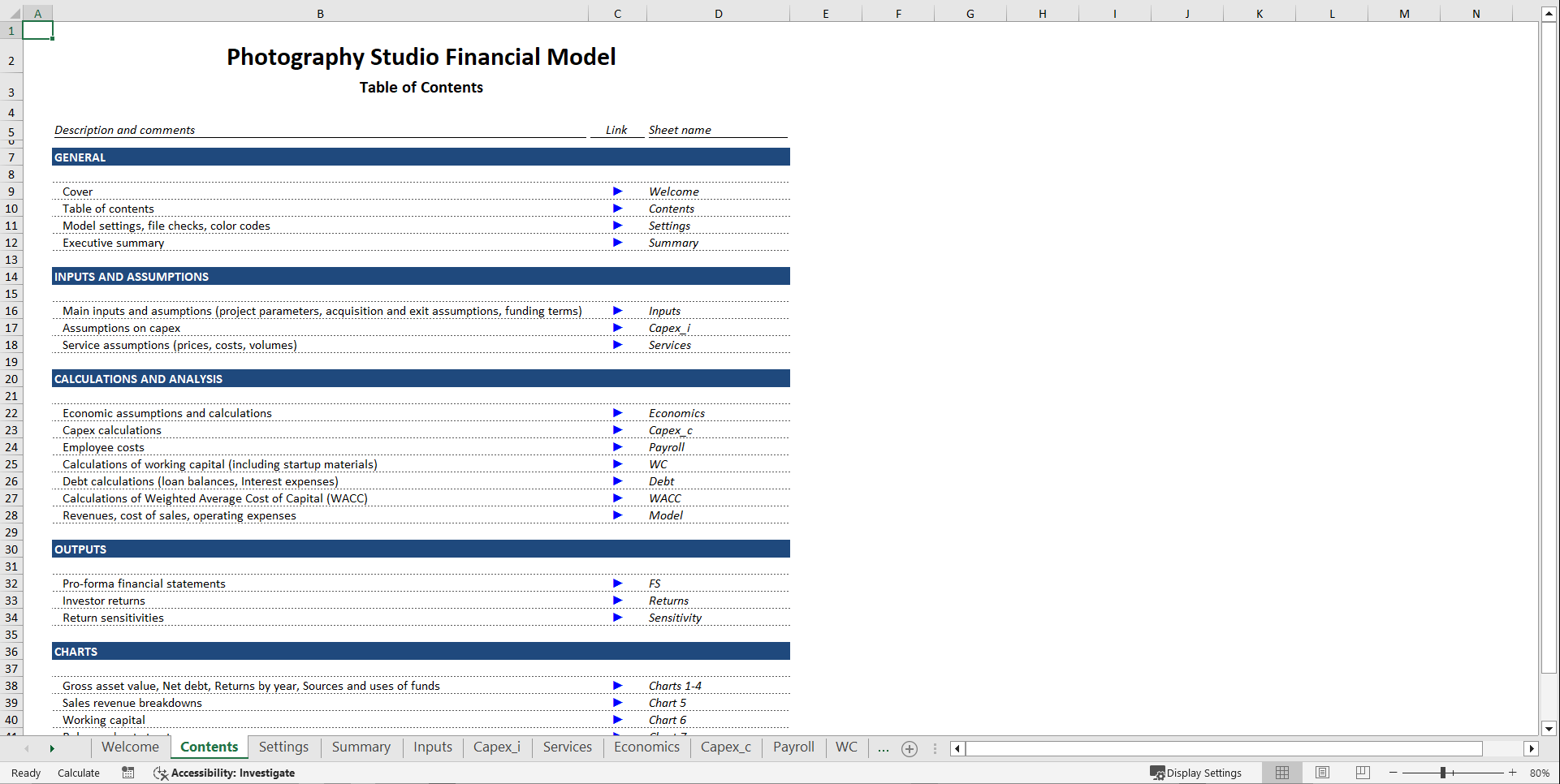

- A professional financial model of a photography studio startup

- Cover of financial aspects of launching a new photography studio

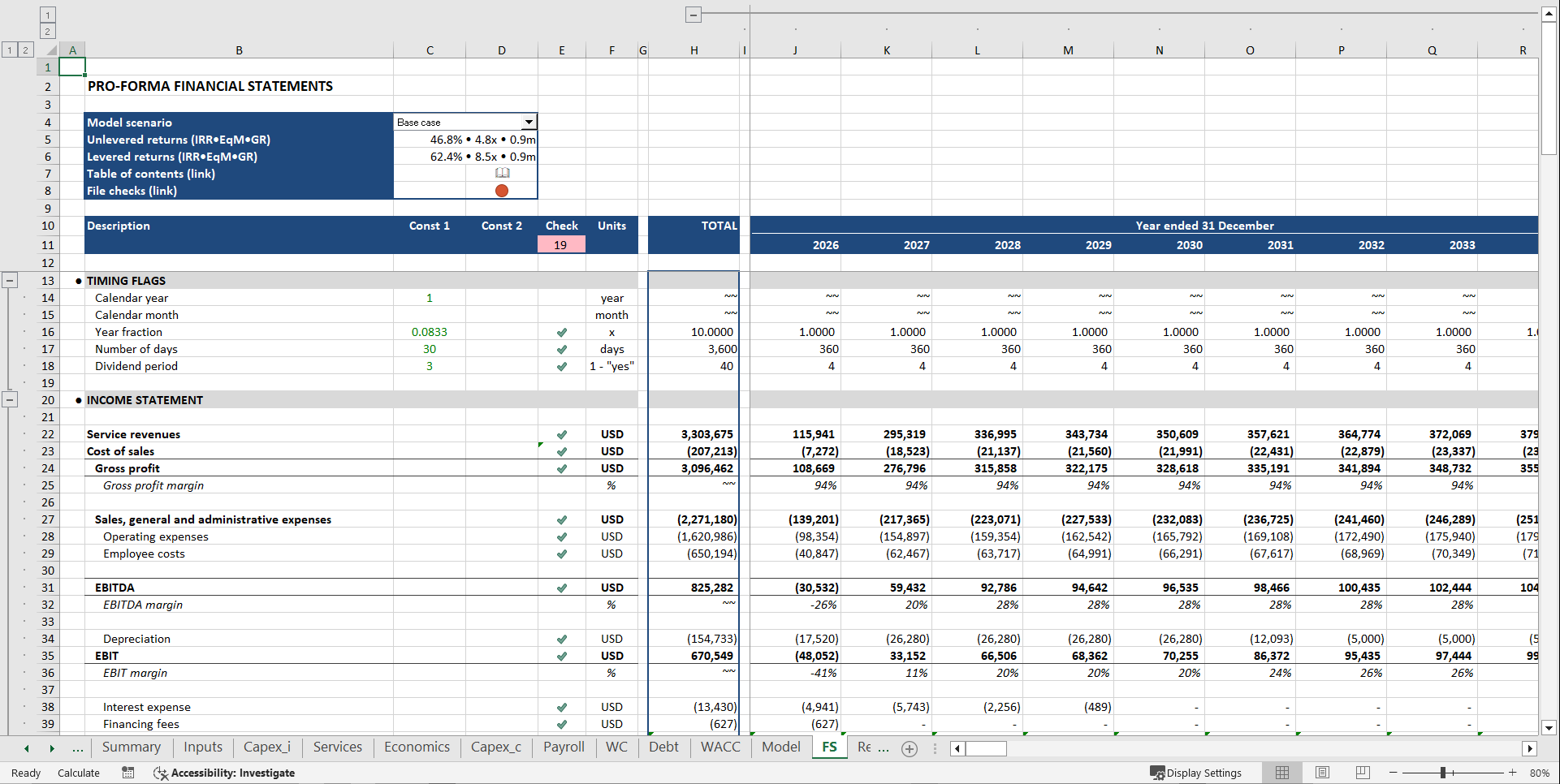

- Produces the three financial statements, detailed return and sensitivity analysis

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

This is a comprehensive and professional yet user-friendly financial model for a startup photography studio. I have developed this model with those beginning entrepreneurs in mind who are not familiar with sophisticated financial concepts but need an industry grade investment banking quality financial model for their startups.

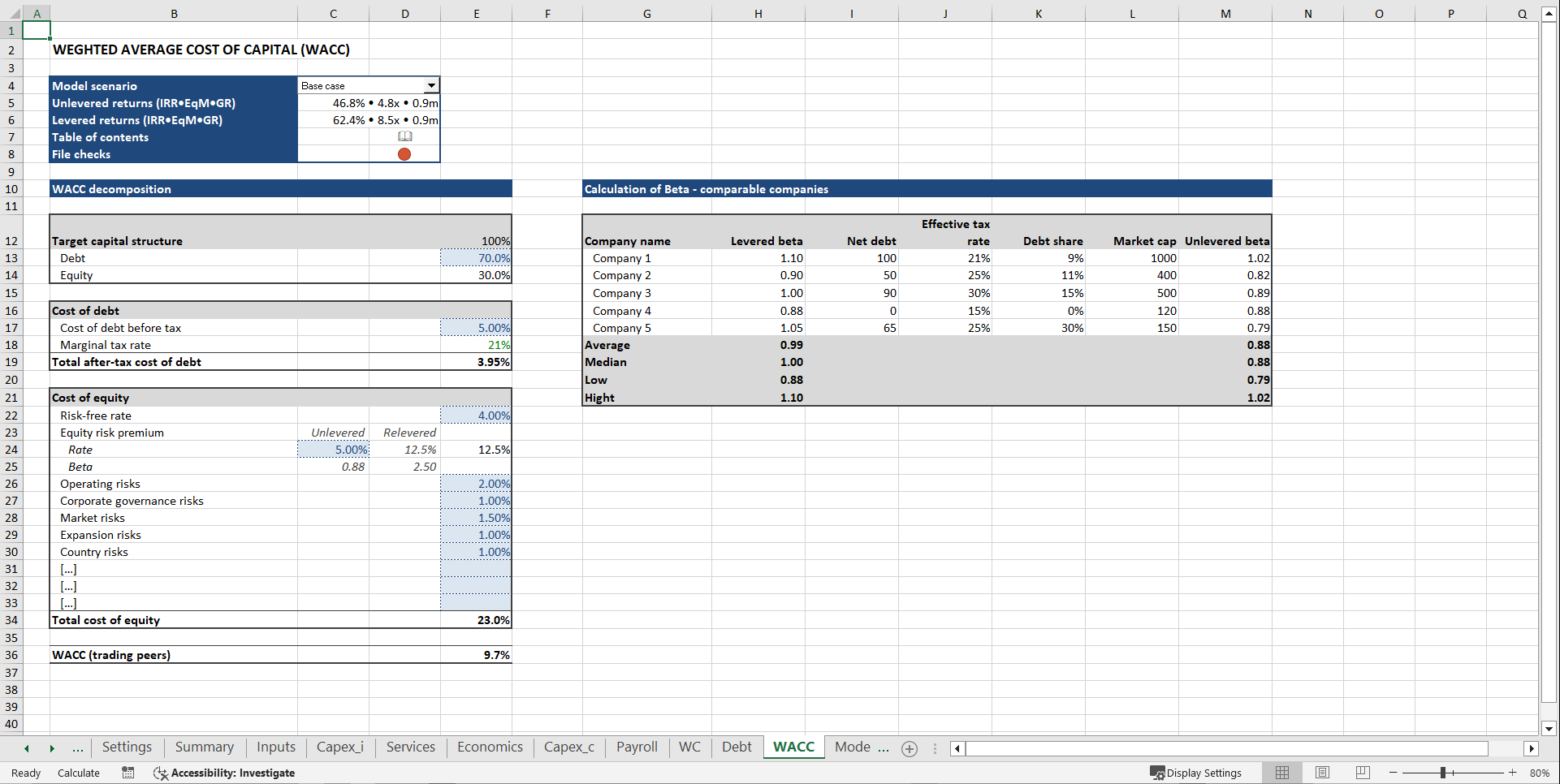

The model includes three scenarios and generates the three financial statements and return analysis. It covers the period of 10 years and is illustrated by professionally designed magazine-quality charts.

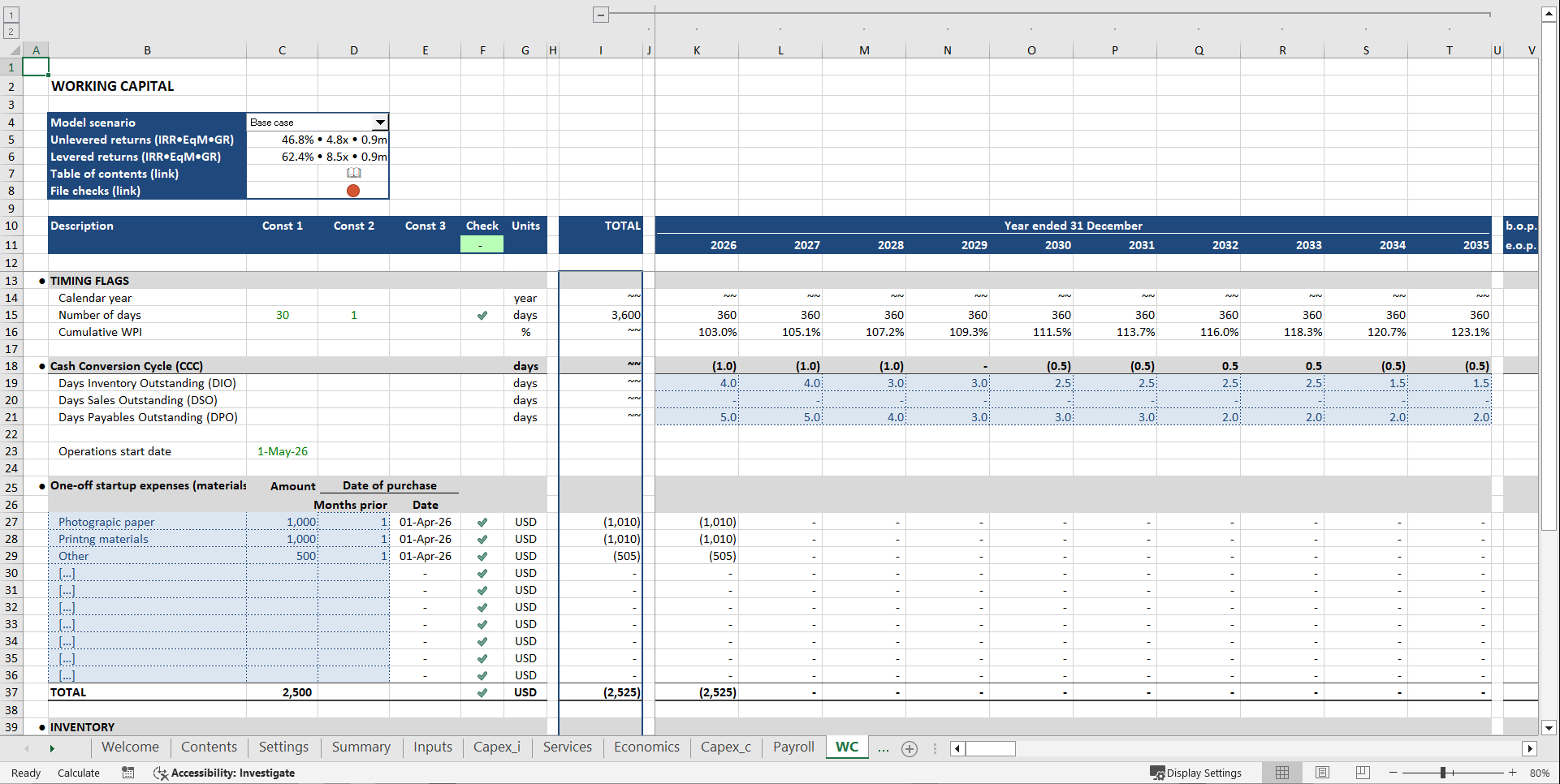

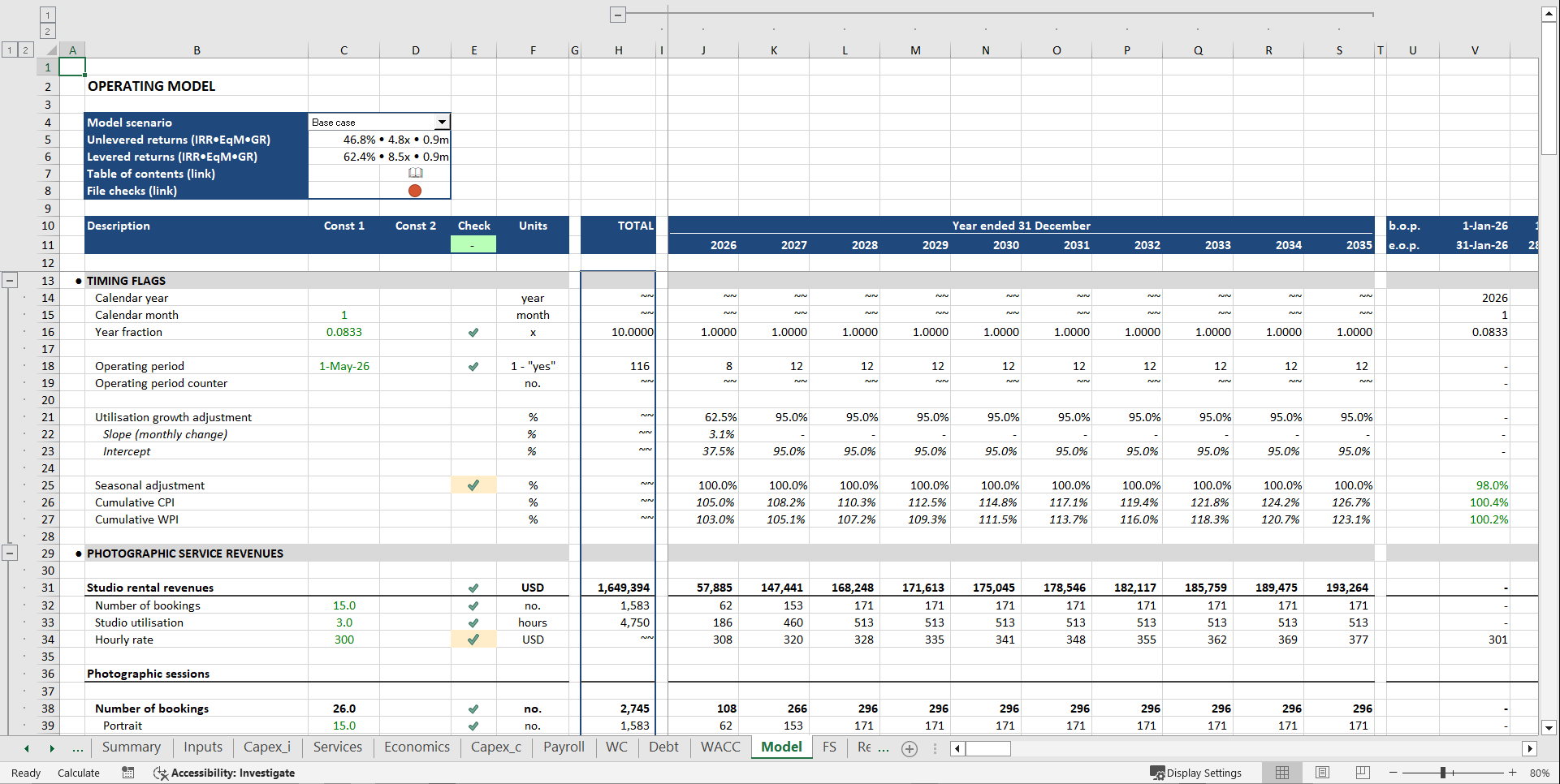

Any new business starts with capital investments and construction. The model has a very flexible capex section which covers up to 30 specific photography studio capex items (can be increased if needed) each having its own cost, acquisition date and useful life period. The model also handles non-capital startup costs.

Once the capex program is completed and necessary equipment and materials are purchased, your photography studio starts generating profits. The model uses a number of drivers to make a granular analysis of revenues and profits: number of bookings per month, booking duration, hourly rates, number of shoots and other drivers. The model also takes into account your ramp-up and monthly seasonality adjustments.

The model forecasts direct costs of sales of the products as well as general operating and overhead expenses. It handles various fixed expenses and those which are driven by revenues.

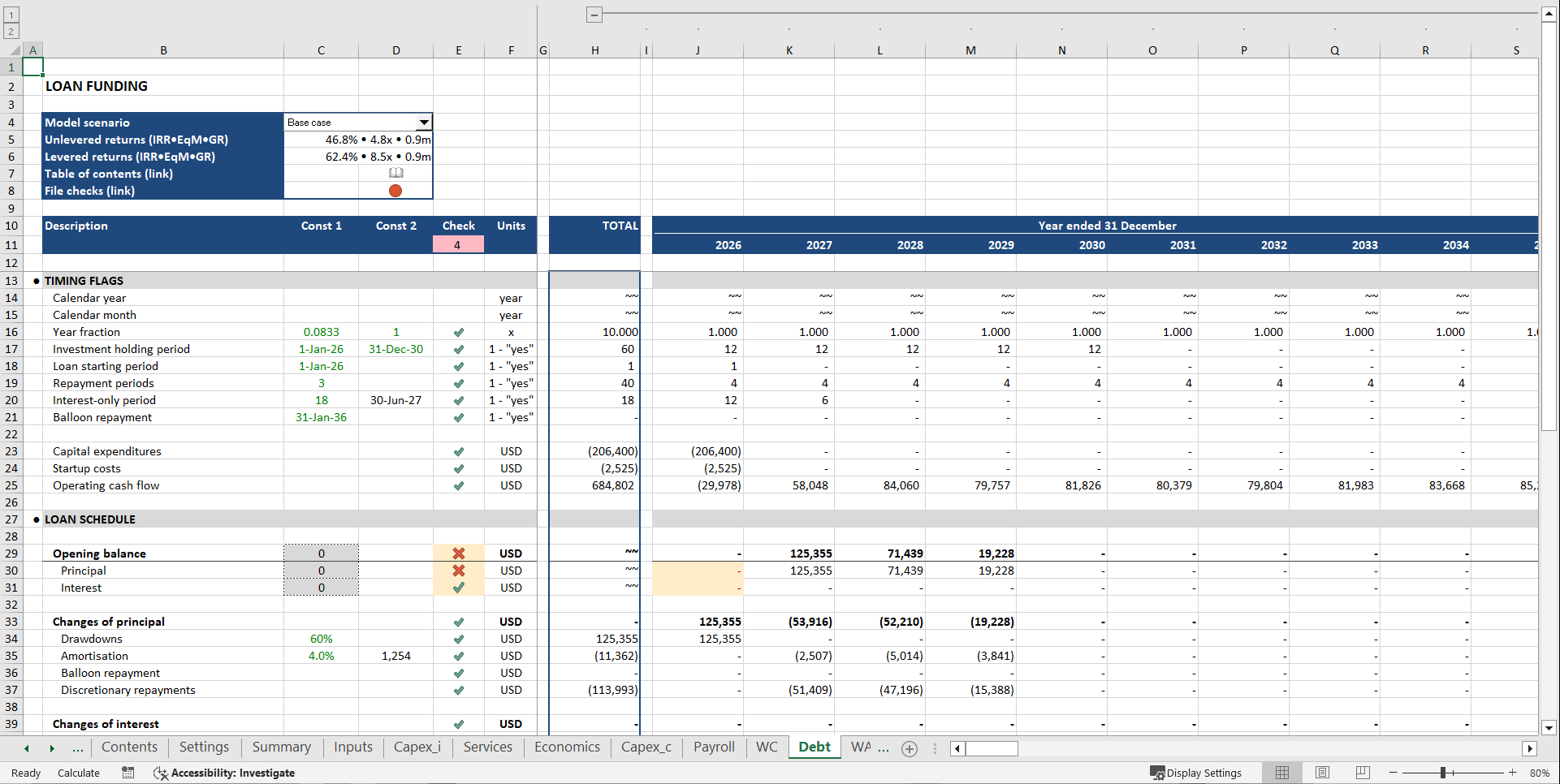

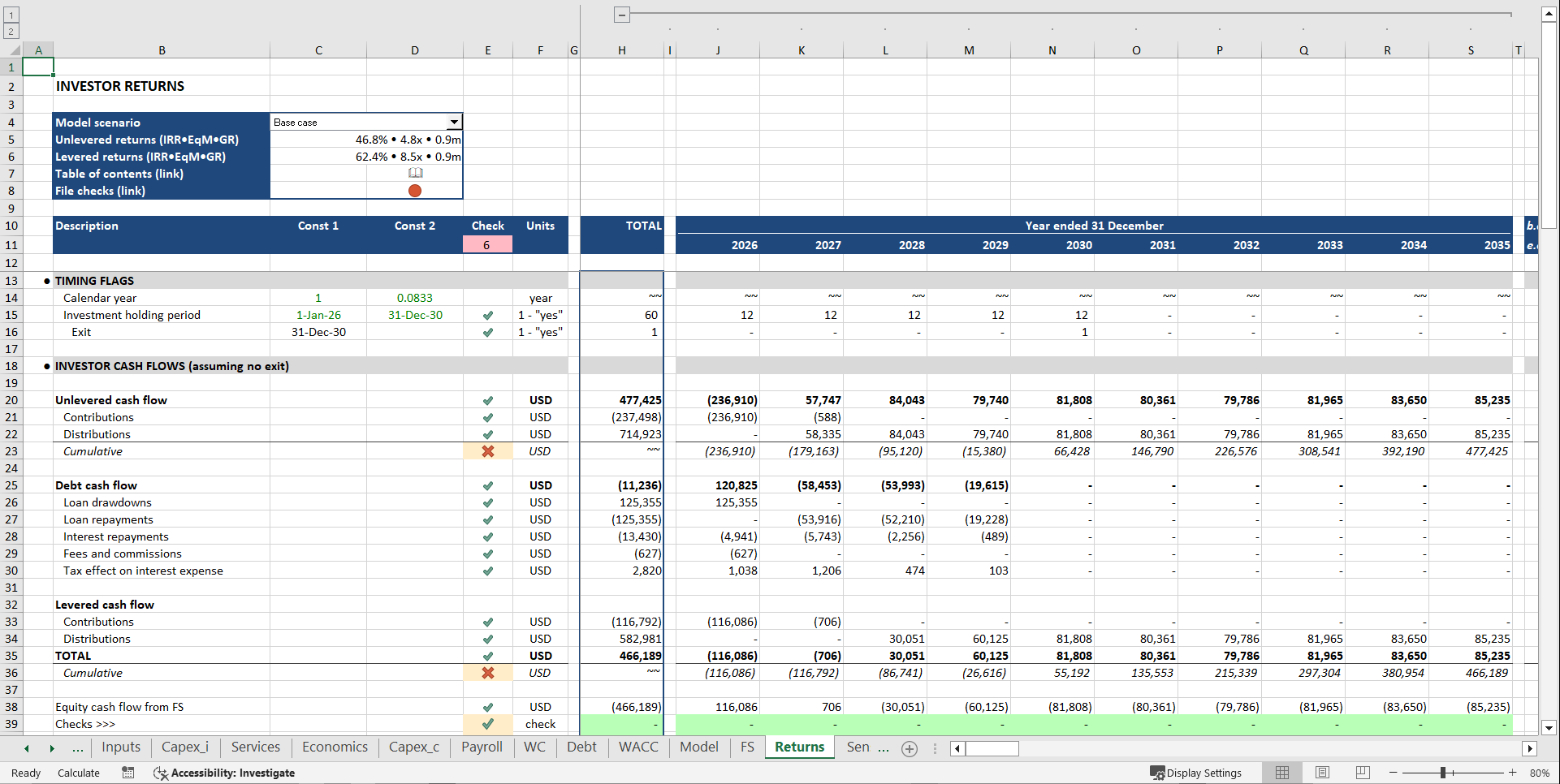

Many startups are partly financed by debt. Drawing debt at right terms provides financial leverage and increases investor returns substantially. In this model you can choose the LTV ratio, interest rate and other loan conditions.

The last stage of analysis is calculating exit proceeds (or terminal value) for proper valuation and profitability assessment.

Teamed up together, these calculations and schedules are used to build the financial statements (income statement, cash flow statement and balance sheet), calculate returns (IRR, equity multiple, peak equity, breakeven and payback periods and others) and perform KPI analysis (number of bookings per month, average revenue per session, utilization rate, profitability per square meter etc.) for your photography studio startup project.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Photography Studio Financial Model Excel (XLSX) Spreadsheet, Andrei Okhlopkov