BENEFITS OF THIS EXCEL DOCUMENT

- This Laundromat Financial Model Template (5 Year Financial Forecasts, Income Statement, Balance Sheet, Cash Flow, Laundromat Metrics & Ratios) has been built for use by any company founder or executive in the Laundromat space

- Featuring specific Laundromat metrics you can track (Washer Revenue, Washer Utilization %, Average Washer Revenue Per Unit, Dryer Revenue, Dryer Utilization %, Average Dryer Revenue Per Unit and more), users will easily be able to navigate the mod

- These models are designed to be the perfect financial tool for business owners to use to make decisions for their company. They also provide investors with a snapshot of how the business is currently performing and what the forecasts look like.

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Description

This Laundromat Financial Model Template (5 Year Financial Forecasts, Income Statement, Balance Sheet, Cash Flow, Laundromat Metrics & Ratios) has been built for use by any company founder or executive in the Laundromat space, Investors or Analysts looking at researching Laundromat businesses or Students looking to study how a Laundromat Business operates and the key variables underpinning it.

Featuring specific Laundromat metrics you can track (Washer Revenue, Washer Utilization %, Average Washer Revenue Per Unit, Dryer Revenue, Dryer Utilization %, Average Dryer Revenue Per Unit and more), users will easily be able to navigate the model with all input fields highlighted in Blue font. These models are designed to be the perfect financial tool for business owners to use to make decisions for their company. They also provide investors with a snapshot of how the business is currently performing and what the forecasts look like.

General Assumptions

Starts with basic model questions on the start date of the model, tax rate assumption, working capital assumptions, and funding assumptions, including owners/partner capital or investment into the business.

Revenue Assumptions

Revenue assumptions are the anticipated factors that drive a company's income generation over a specific period. These assumptions form the basis for financial projections and are crucial for planning and decision-making. In our model we have included detailed inputs on No. of Hours of Operation Per Day at the Laundromat, Hours Capacity Available Per Month Per Machine (hours), Washer and Dryer Cycle duration (minutes), Washer and Dryer Cycle Capacity Per Month Per Machine (# of cycles). We have also included individual Washer (Small, Medium, Large) metrics for 12 machines (you have the ability to add more if needed) where you can input the # of cycles sold, the price per cycle, see what the machine's revenue Is, what its utilization rate % is; and individual Dryers (Medium, Large, Extra Large) metrics for 12 machines (you have the ability to add more if needed) where you can input the # of cycles sold, the price per cycle, see what the machines revenue is and what its utilization rate % is.

We have also included inputs for a Revenue Full Service offering (Wash, Dry, Fold) with inputs to track # of customers, growth %, and price per load charged, as well as Other Income with inputs on Other Items sold (Detergent, Laundry Bags, Other accessories sold).

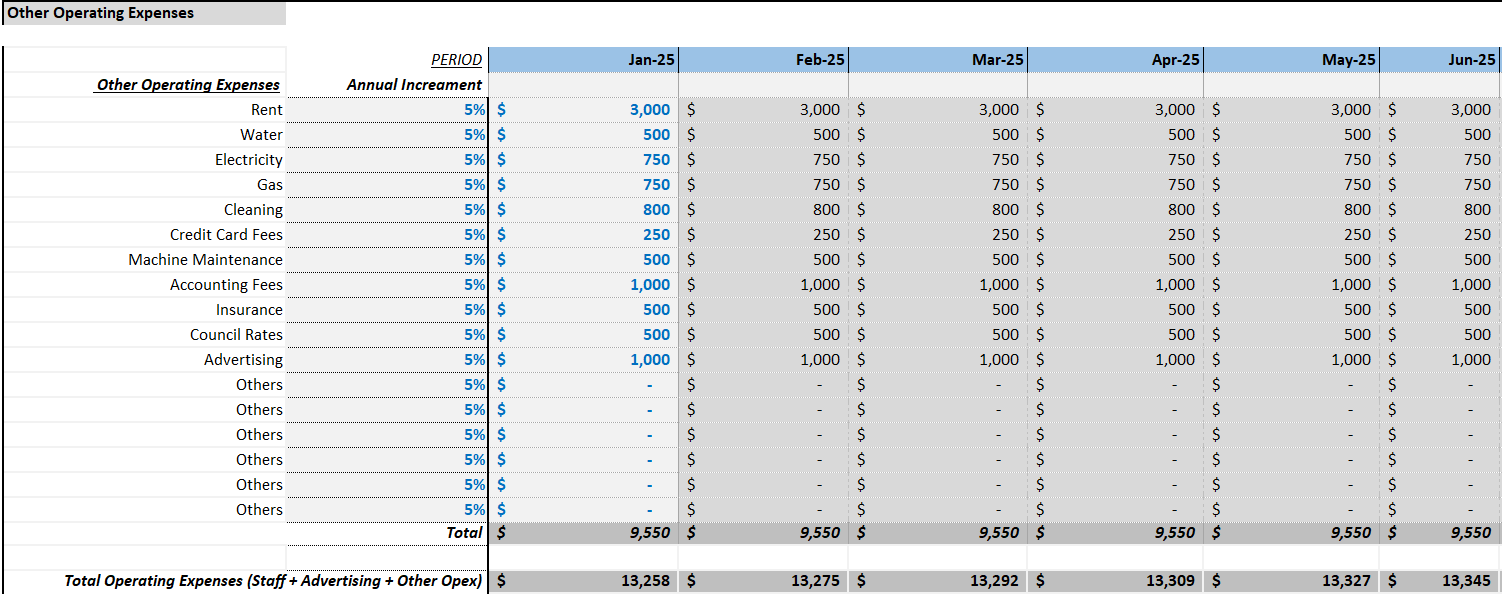

Operating Expenses Assumptions

Operating expense assumptions are typically based on historical data, industry benchmarks, market trends, and management's judgment. They are crucial for estimating the business's total cost and determining profitability. Like revenue assumptions, it's important to regularly review and adjust operating expense assumptions to reflect changes in the business environment and ensure the accuracy of financial forecasts. In our model we have included detailed inputs on Laundromat Staff Costs (Operations Manager, Advertising Team, Other), Typical Laundromat related Operational Expenditure items (Rent, Water, Electricity, Gas, Cleaning, Credit Card Fees, Machine Maintenance Costs, Insurance, Council Rates, Advertising, however, you can add any other expenses you think may be relevant to your business in this sheet.

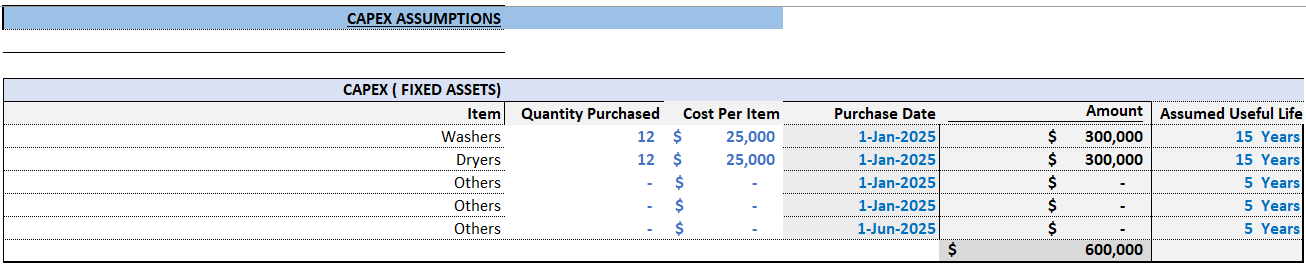

Capex Assumptions

Capital expenditure (Capex) assumptions refer to the anticipated investments a company plans to make in long-term assets, such as property, plant, equipment, and technology, over a specific period. These assumptions are crucial for financial planning, budgeting, and forecasting, as they impact the company's cash flow, profitability, and growth prospects. We have included a Fixed asset cost assumption schedule here for the main items likely to be on a company's capex sheet and also a Use Of Funds assumption list with corresponding pie chart. We have included Capex costs for both Washers and Dryers (by the # of machines you have) and the average useful life of the machines.

Monthly Projections

We have broken down projections on a Month by Month basis when projecting Income Statement, Balance Sheet and Cash Flow Statement items. The monthly projections are provided over a 5 year time frame. This is particularly useful for businesses looking at month-on-month trends and insights in the business, which leads to better decision making and also better budgeting should there be a need to either raise more capital, pursue growth opportunities from excess capital, or pay down interest-bearing debt. Monthly projections also help a business ascertain what performance may be seasonal in nature when looking at growth projections on a month-over-previous-years-month basis.

Annual Projections

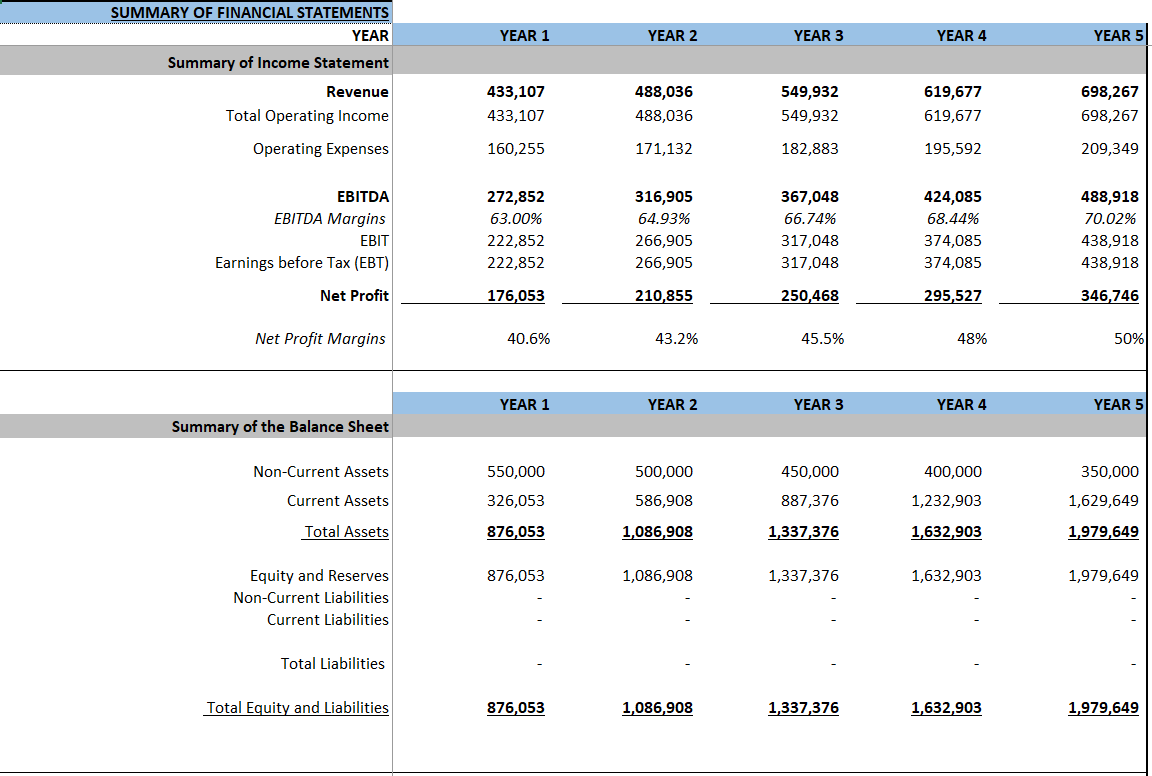

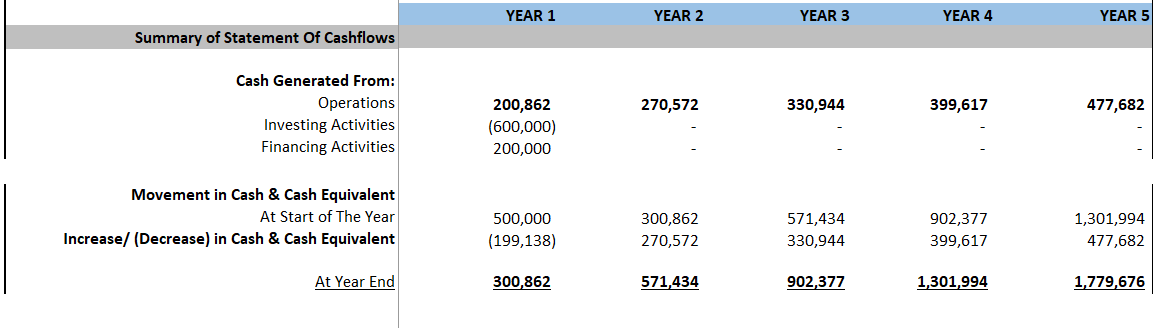

The model has Annualized Financial Projections of Income Statement, Balance Sheet and Cash Flow Statement over a 5 year time frame. Annual projections provide an excellent overview of expected revenues, expenses, profits, cash flow, and other key financial metrics for the upcoming year. Annual projections are essential for strategic planning, budgeting, fundraising, and performance evaluation for any company at any stage of their business cycle.

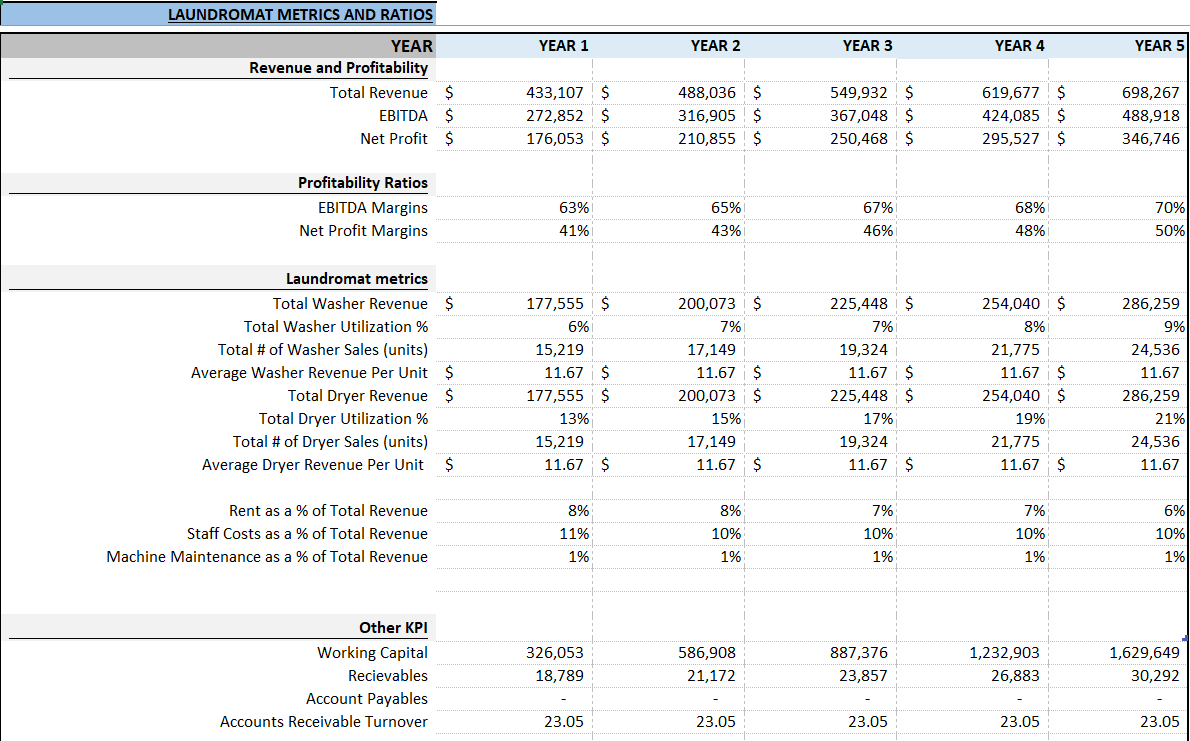

Laundromat Metrics & Other Metrics

Laundromat specific metrics (Average Customer Spend, Total Customers Served, ARR, CAC, ARPU, Average Cost Of Service), Profitability Ratios, Liquidity Ratios, Asset Turnover Ratios provided.

Summary of Financial Statements

Summarized Financial Statements over a 5 year time frame helps for better snapshots of financial performance. Income Statement, Balance Sheet and Cash Flow Statement all provided.

Charts

Laundromat specific Charts available including Total Washer Revenue, Total Washer Utilization %, Total # of Washer Sales (units), Average Washer Revenue Per Unit, Total Dryer Revenue, Total Dryer Utilization %, Total # of Dryer Sales (units), Average Dryer Revenue Per Unit, Profitability Margins (Gross Profit Margin, EBITDA Margin and Net Profit Margin), Other KPIs (Working Capital, Receivables) and Liquidity Ratios.

DCF Valuation

We have included a Discounted Cash Flow (DCF) Valuation model showing the Net Present Value (NPV) of the Business based on a series of growth rates and assumptions. Weighted Average Cost of Capital Assumptions also provided including Risk Free rate, Beta, Risk Premium and Equity Risk Premium. A DCF valuation is a method used to estimate the value of an investment, business, or asset by discounting its expected future cash flows to present value. It is based on the principle that the value of an investment is determined by the present value of its future cash flows. The DCF valuation technique is widely used in finance, investment analysis, and corporate finance for making investment decisions, determining the fair value of securities, and evaluating the worth of businesses.

Depreciation Schedule

Detailed Depreciation Schedule shows additions/disposals to the Fixed Asset Register of the business. Sections included for Computer Equipment, Furniture & Fittings, Others.

Debt Schedule

Debt schedule provided with interest rate assumptions and payback period assumptions included.

Equity Schedule

Equity schedule provided with assumptions on all investments into the business by investors or owners.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Laundromat Financial Model Excel (XLSX) Spreadsheet, Financial Models Hub