EBITDA Valuation Model: Enterprise Value and Equity Value (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

VALUATION MODEL EXAMPLE EXCEL DESCRIPTION

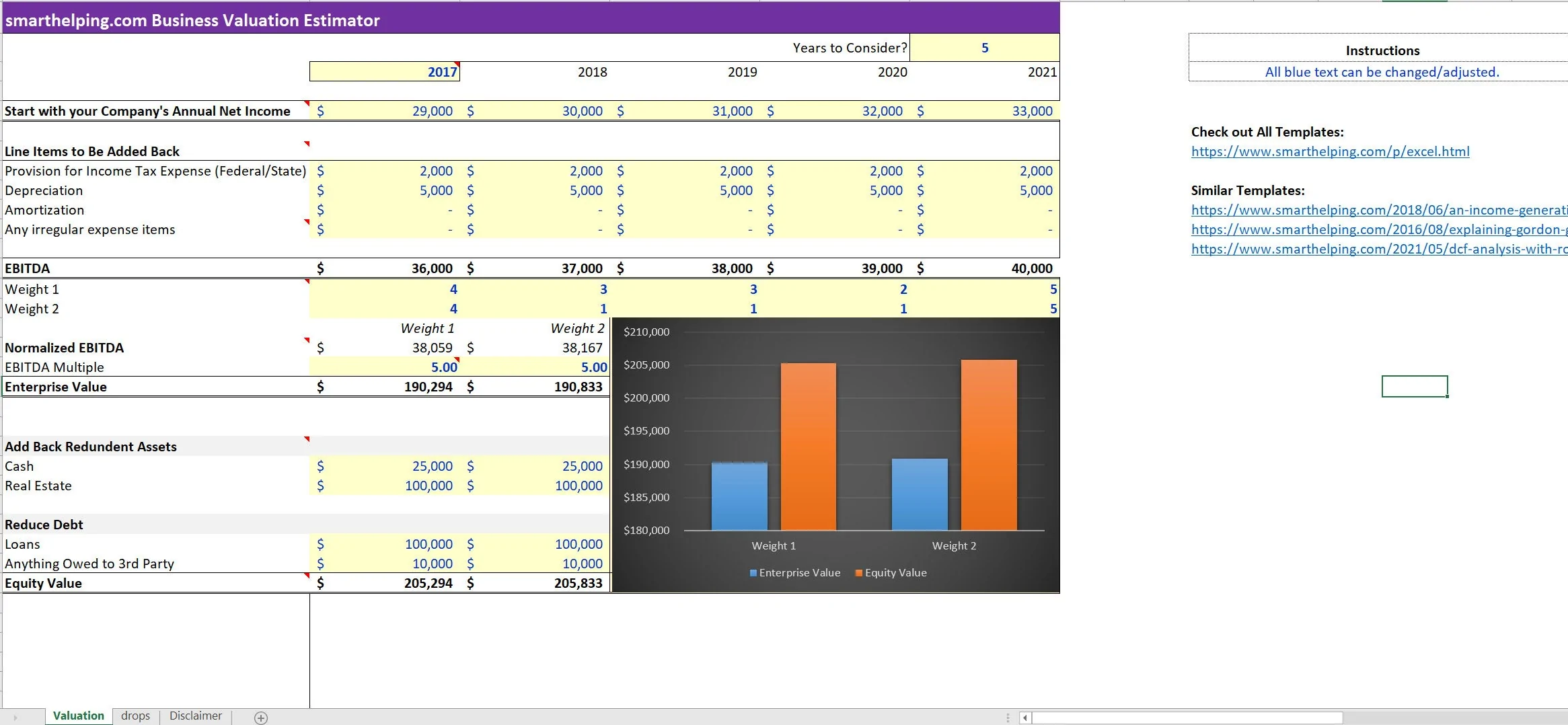

This is not looking at the present value of future cash flows in order to come up with the value of a given business. Instead, it is looking at historical EBITDA per year against a defined multiple. To 'weight' different years more than others, each past year has an assigned value of 1-5 and the model can be adjusted to take 3 or 5 years into account.

This is a nice little one-pager valuation model that is focused on historical weighted average EBITDA over 5 years and applies a multiple in order to arrive at an enterprise value for a given business.

The inputs are straightforward and there is a visual to sum up the potential scenarios. The primary use case of this is not for a growing startup but rather an on-going operation that may have some modest growth.

The user is able to enter:

• Start Year

• Years to consider (3 or 5)

• Net income in each year

• Taxes/depreciation/amortization/other irregular expense items are added back

• User applies a weight (from 1-5) to each year's EBITDA and can configure two separate weighting arrangements for two possible enterprise valuations.

• A multiple is then defined for the aggregate weighted average EBITDA for each of the two scenarios.

This is how two potential enterprise values are arrived at. The model also goes down to equity value and that is calculated by inputting any cash / real estate as well as any debt or money owed to 3rd parties.

The assets and liabilities are netted out and applied to the enterprise value to arrive at a final equity value. This is a very simple model to use and all you need are the financial statements for 3 or 5 years in order to run the model for any business.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Model Example Excel: EBITDA Valuation Model: Enterprise Value and Equity Value Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

General Valuation

This bundle contains 10 total documents. See all the documents to the right.