INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

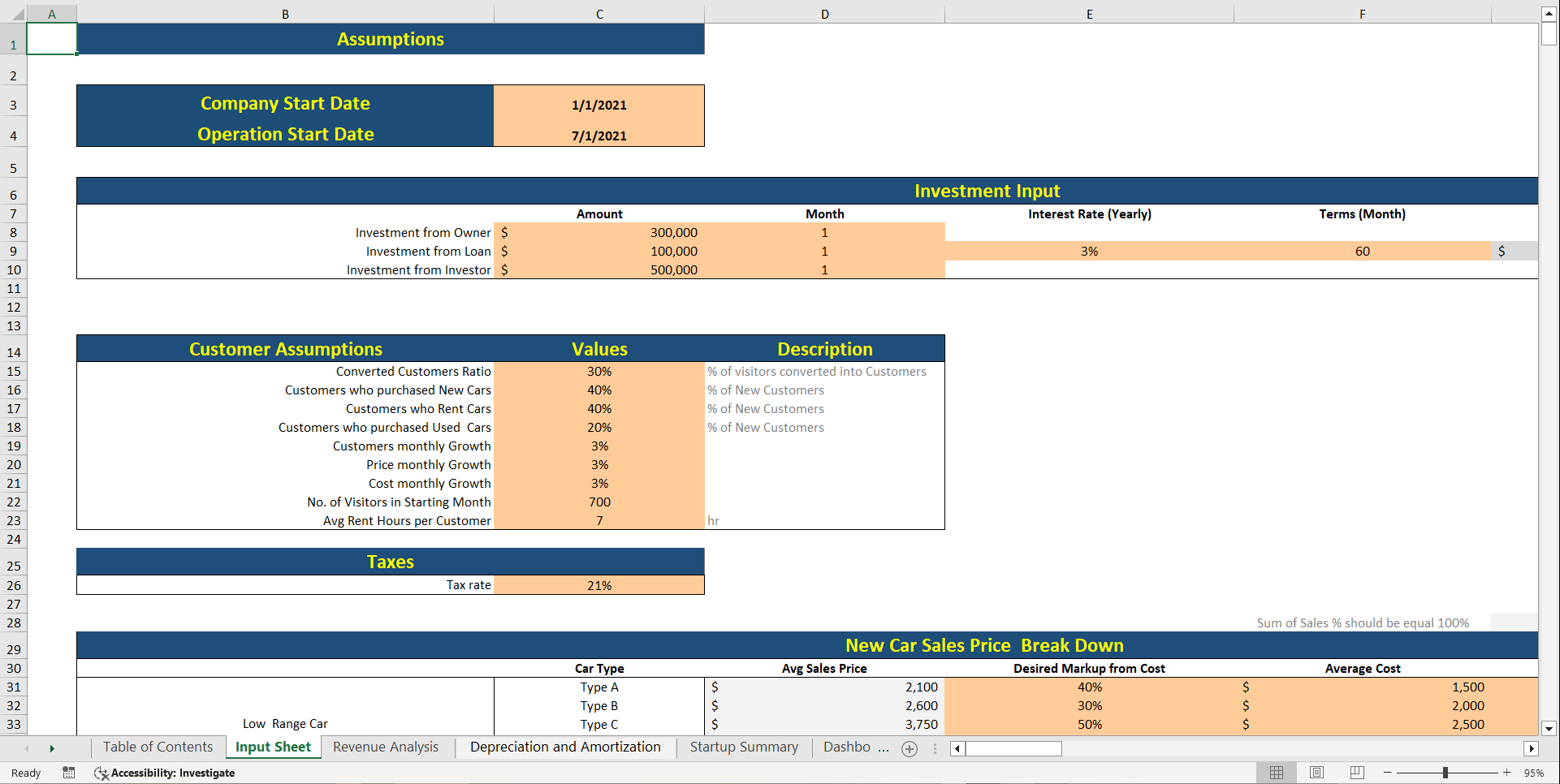

Car Dealers are operating in a disrupted economy, creating the need for car dealers to revisit their own operational and Financial models, identify and unlock operational efficiencies and financial losses, and discover new ways to operate in a digital, omnichannel environment at the lowest cost possible. A Car Dealer Excel Financial Model prepared by Oak Business Consultants includes a complete financial framework to make solid financial plans and projections.

Key Features of the Model

Revenue Projections

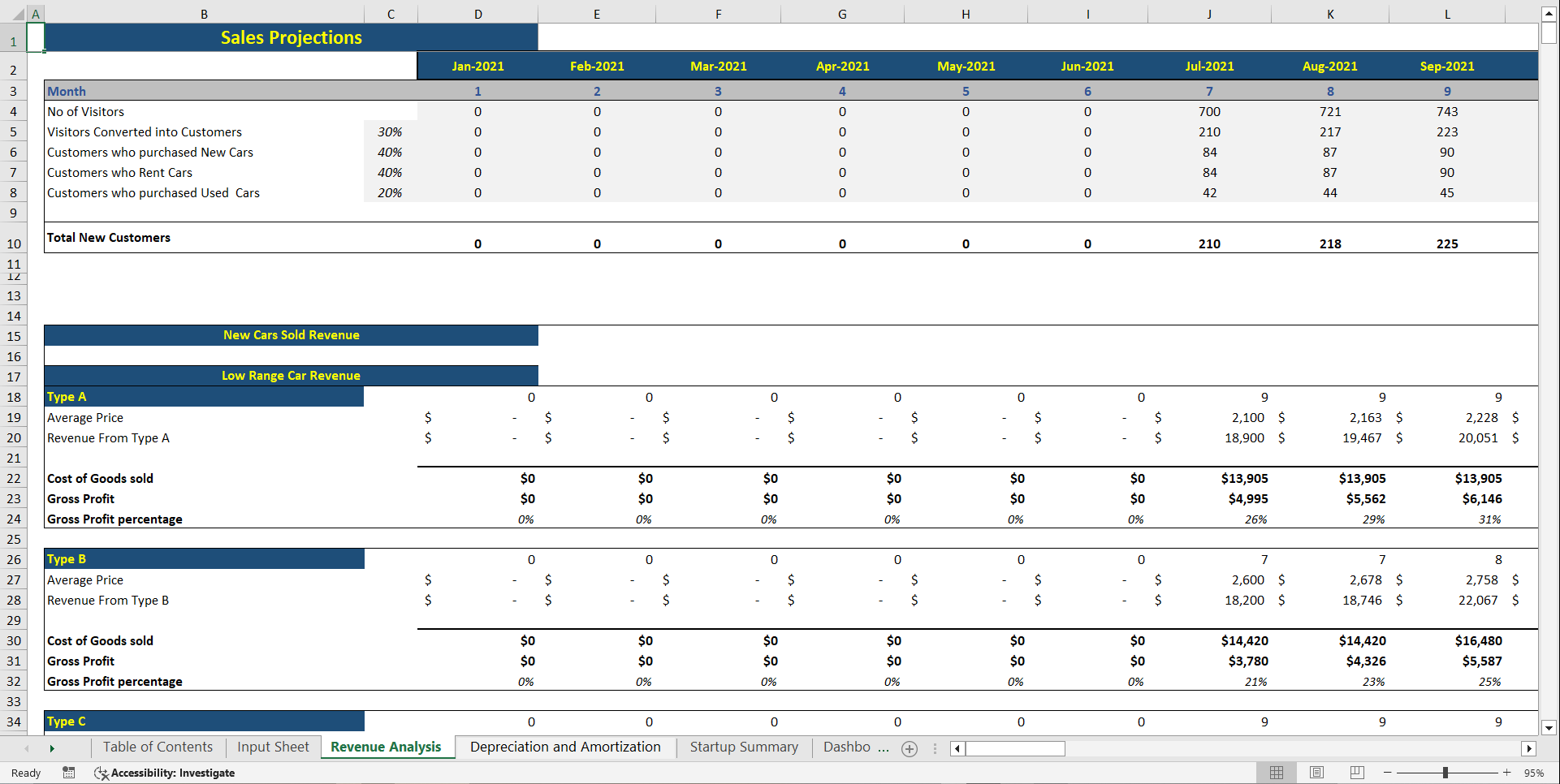

1. Sales Forecasting: Estimate monthly and yearly revenue based on car sales, financing commissions, and market growth assumptions.

2. Revenue by Category: Break down income into categories such as Car Sales, Service & Maintenance.

3. Competitive Advantages: Highlight strengths like diverse car inventory, strategic dealership location, after-sales services, financing partnerships, strong brand reputation, and consistent demand trends driving revenue growth.

Cost Structure

1. Direct Costs: Track vehicle purchase costs, transport & logistics, repairs for used cars.

2. Administrative Expenses: Capture recurring costs such as staff salaries, marketing & advertising campaigns, dealership rent/maintenance, brokerage/agent commissions, and compliance fees.

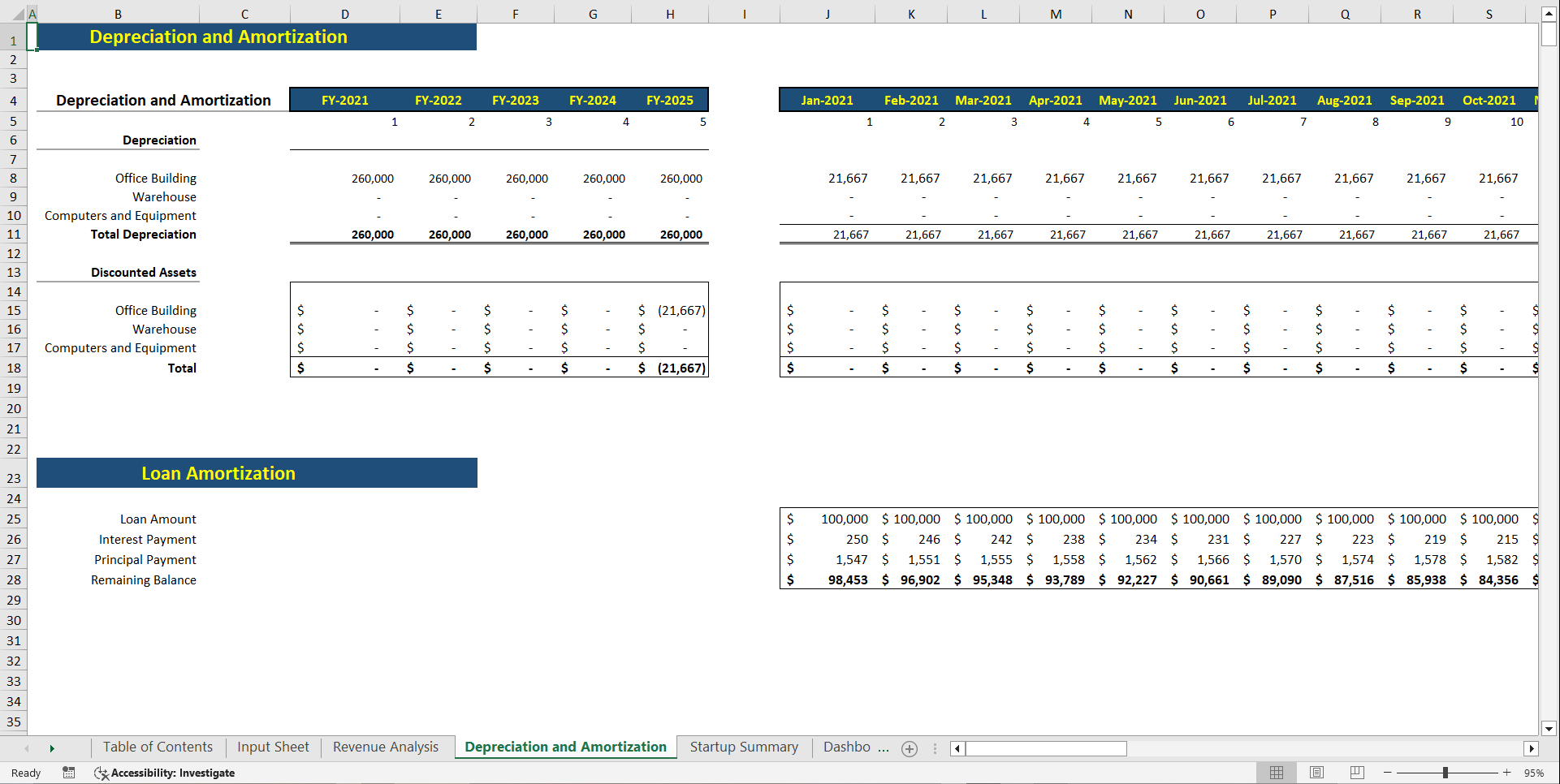

3. Business Expenses: Include broader costs such as financing (loan repayments, interest), insurance, dealership licenses & permits, IT/digital platforms, and expansion-related investments.

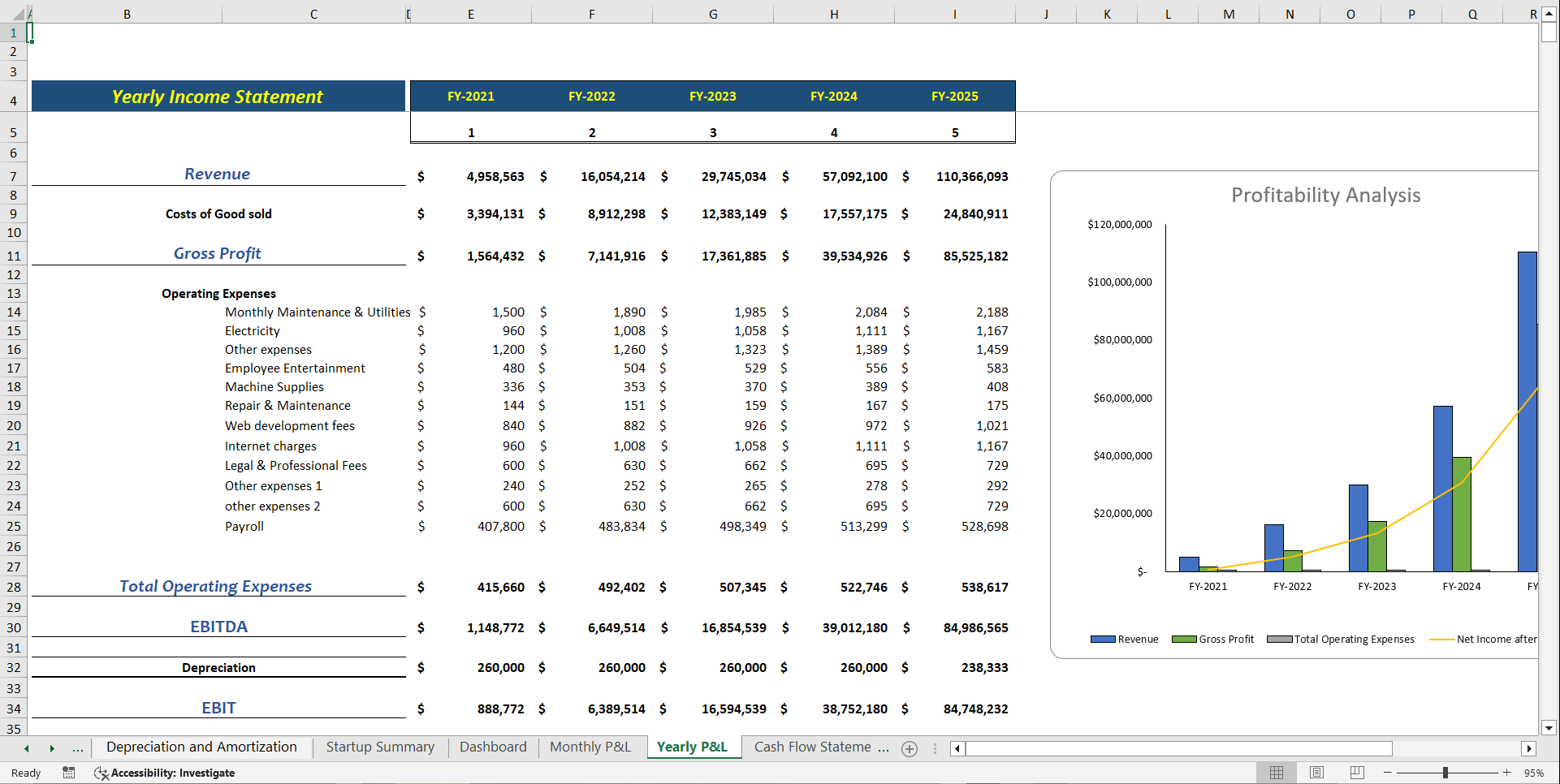

Profitability Analysis

1. Profit and Loss Statement: Track income, expenses, and profit over 5 years.

2. Gross Margin & Net Profit: Get to know what is the performance of the Industrial based on gross and net profit.

3. Break-Even Analysis: Determine the number of Customers needed to cover costs and achieve profitability.

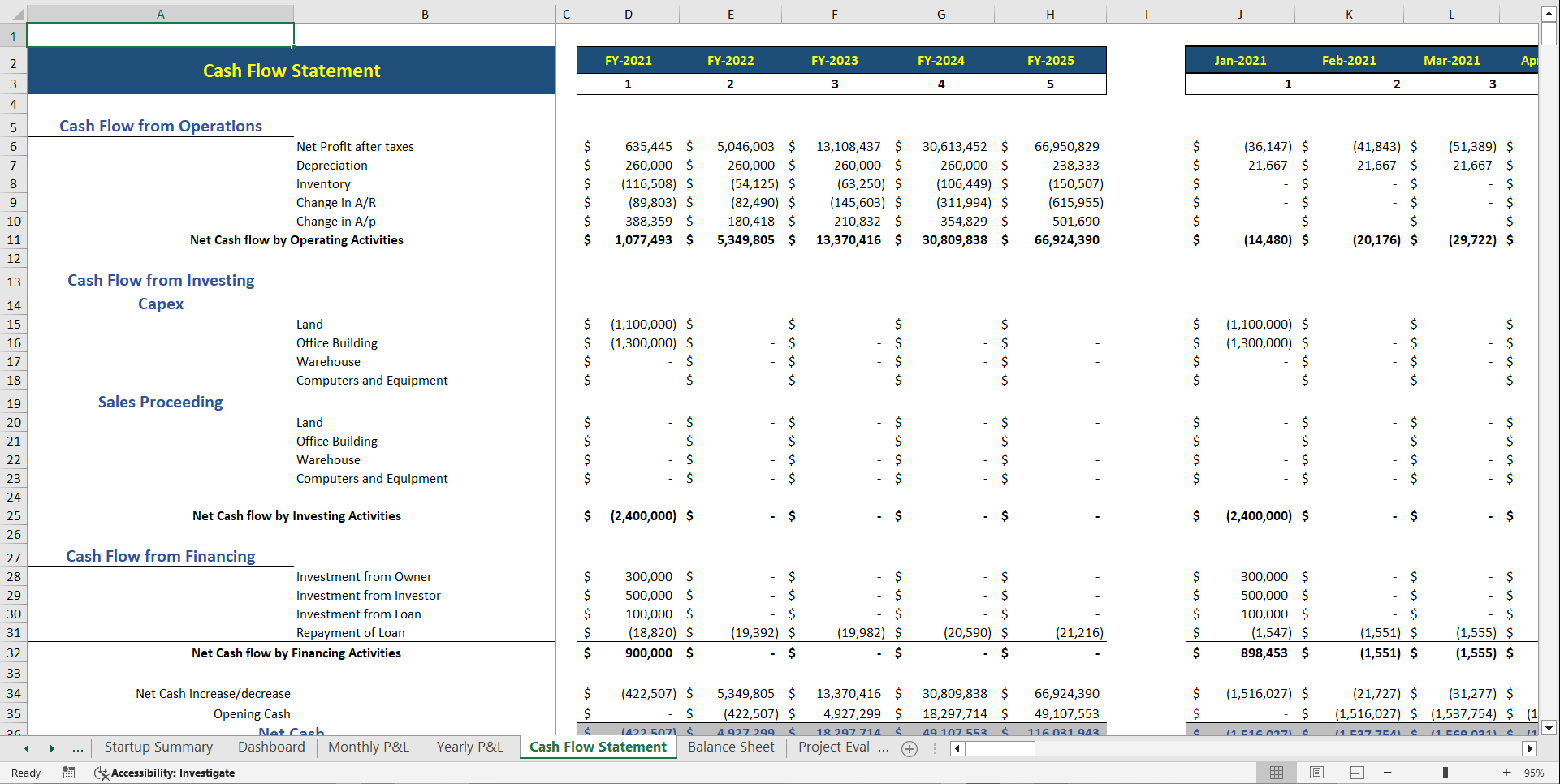

Cash Flow Management

1. Cash Flow Statement: Track money flowing in and out of your business.

2. Financial Position: Ensure adequate working capital for seamless operations.

3. Investment Scheduling: Plan accordingly the cashflow to make your investment decisions for a smoother flow of operations.

Financial Forecasting & Scenario Analysis

1. 5-Year Financial Plan: Develop long term projections for revenue, expenses, and profitability.

2. Market Conditions & Trends: Adjust financial forecasts based on industry changes and customer behavior.

3. Best-Case, Base-Case, and Worst-Case Scenarios: Evaluate different financial outcomes and prepare accordingly.

Key Performance Indicators (KPIs)

1. Sales Volume: Track the number of new and used cars sold to measure dealership performance and market demand.

2. Revenue Growth: Monitor car sales, service income, and financing/insurance commissions to assess business scalability.

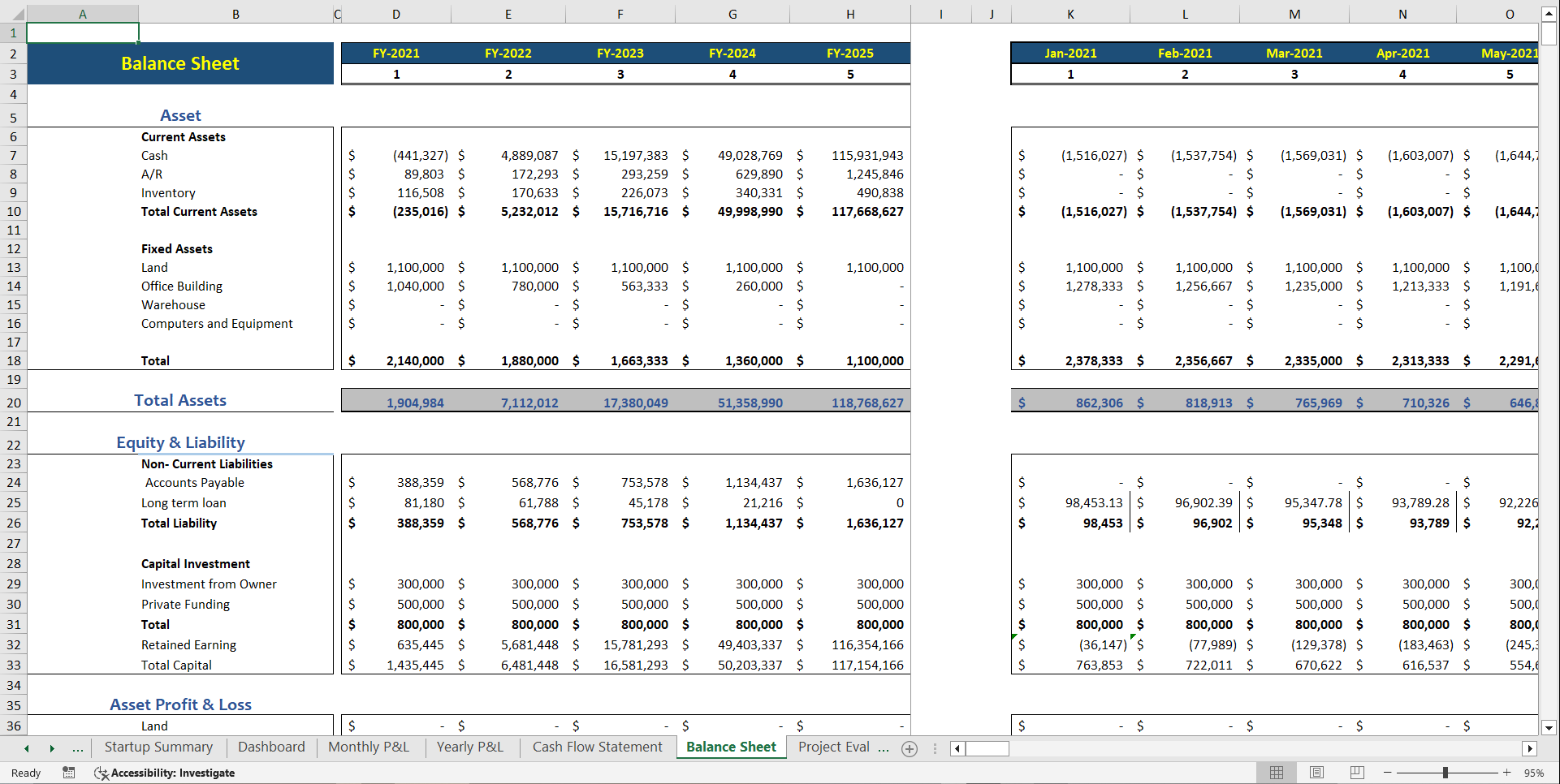

3. Financial Statements: Access automated income statement, cash flow, and balance sheet to evaluate profitability, manage expenses, and ensure long-term financial stability.

Investor Readiness & Business Strategy

1. Attract Potential Investors: Present a professional financial plan to secure funding.

2. Strategic Planning: Align business objectives with financial projections for long term success.

3. Cost Analysis & Optimization: Better understand which costs can be minimized and which one have to most impact on profitability.

Key Benefits of Using This Model

1. Better Financial Planning: Gain a clear understanding of your business's financial feasibility.

2. Optimized Operations: Enhance cost analysis and resource allocation.

3. Risk Mitigation: Plan ahead for financial uncertainties and avoid cash shortages.

4. Customizable Tool: Adapt the model to fit different business needs.

5. Scalability: Suitable for both small startups and established agencies.

FAQ's

What does the Car Dealer Excel Financial Model include?

The model covers revenue forecasts, expense tracking, profit and loss statements, cash flow, and balance sheet projections tailored for car dealerships.

Can I track sales in the model?

Yes, the model allows you to input revenue from car sales.

Does the model calculate loan or financing options?

Yes, it includes financing schedules, interest expense calculations, and repayment plans.

How long is the financial projection period?

The model provides a 5-year projection with monthly and yearly breakdowns.

Is the dashboard automated?

Yes, the dashboard auto-updates with charts, KPIs, and financial ratios for quick insights.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Car Dealer Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant