100+ SaaS Business Financial Ratios (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a complete framework for analyzing, benchmarking, and optimizing SaaS financial performance across growth, profitability, cash flow, and valuation.

- Delivers a structured, CFO-grade system of 150+ SaaS financial ratios to support investor reporting, strategic planning, and data-driven decision-making.

- Enables founders, finance teams, and investors to accurately measure what matters, identify red flags early, and scale SaaS businesses with confidence.

SAAS EXCEL DESCRIPTION

Curated by McKinsey-trained Executives

🚀 150+ SaaS Business Financial Ratios Database – Ultimate Excel Template for SaaS Founders, CFOs & Investors

If you are searching for a SaaS Financial Ratios Database, SaaS metrics Excel template, or a complete SaaS KPI framework, this is the most comprehensive SaaS-focused financial ratios system available.

This 150+ SaaS Business Financial Ratios Database (Excel Template) is engineered for SaaS startups, scaleups, CFOs, VCs, private equity, FP&A teams, and M&A analysts who need precision, clarity, and decision-grade metrics—not generic finance fluff.

🔥 What You Get

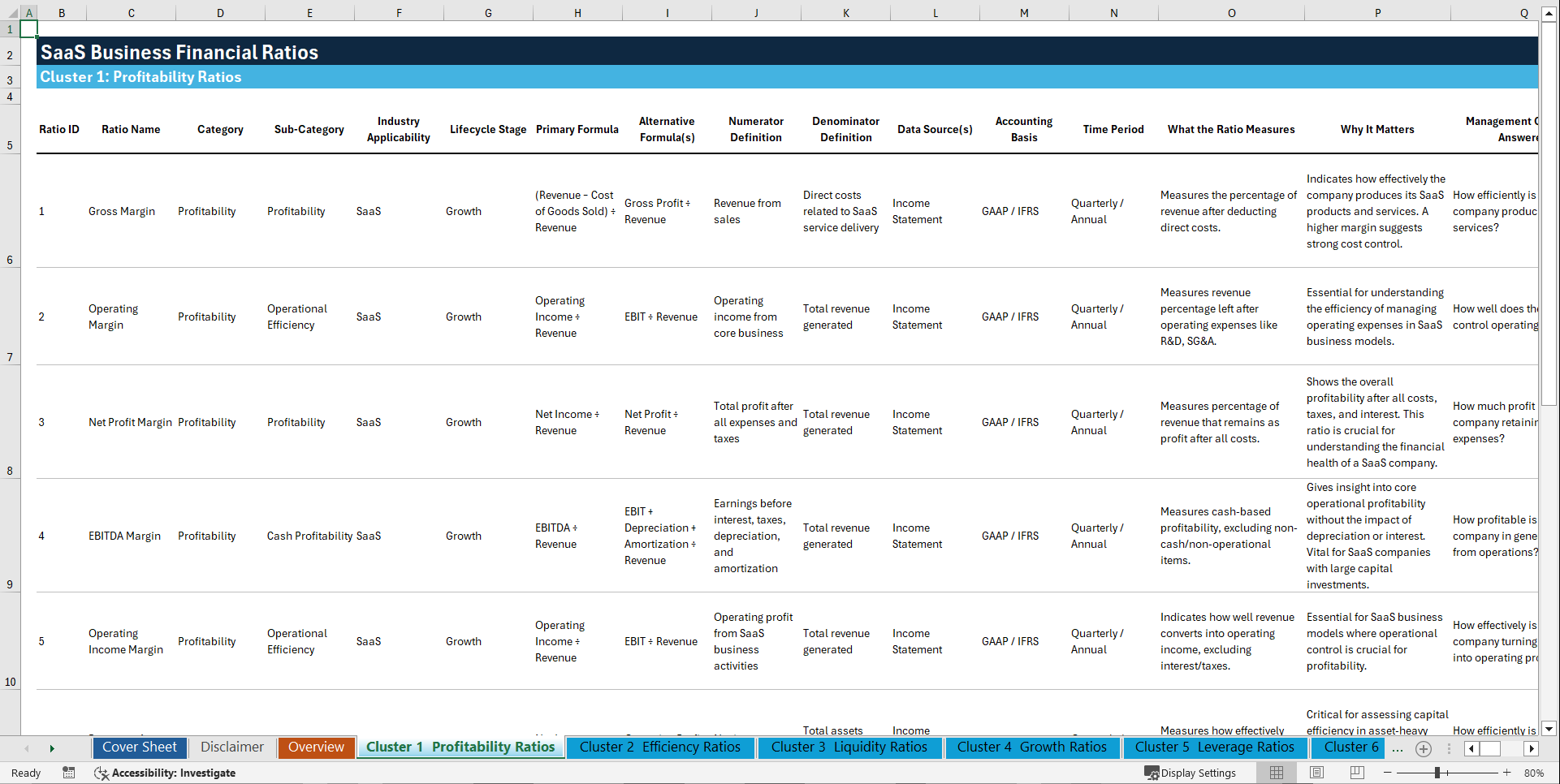

Every single ratio listed below is included exactly as named and is fully documented with:

Ratio ID, Ratio Name, Category, Sub-Category, Industry Applicability, Lifecycle Stage, Primary Formula, Alternative Formula(s), Numerator Definition, Denominator Definition, Data Source(s), Accounting Basis, Time Period, What the Ratio Measures, Why It Matters, Management Question Answered, Directionality, Typical Healthy Range, Red Flag Threshold, Primary Use Case, Decision Type Supported, Stakeholders, Comparable Analysis Use, Key Assumptions, Common Misinterpretations, Limitations, Sensitivity Factors, Accounting or Industry Distortions

This is not just a list – it's a decision system.

📊 COMPLETE LIST OF INCLUDED RATIOS

Cluster 1: Profitability Ratios

1. Gross Margin

2. Operating Margin

3. Net Profit Margin

4. EBITDA Margin

5. Operating Income Margin

6. Return on Assets (ROA)

7. Return on Equity (ROE)

8. Return on Investment (ROI)

9. Contribution Margin

10. Earnings Per Share (EPS)

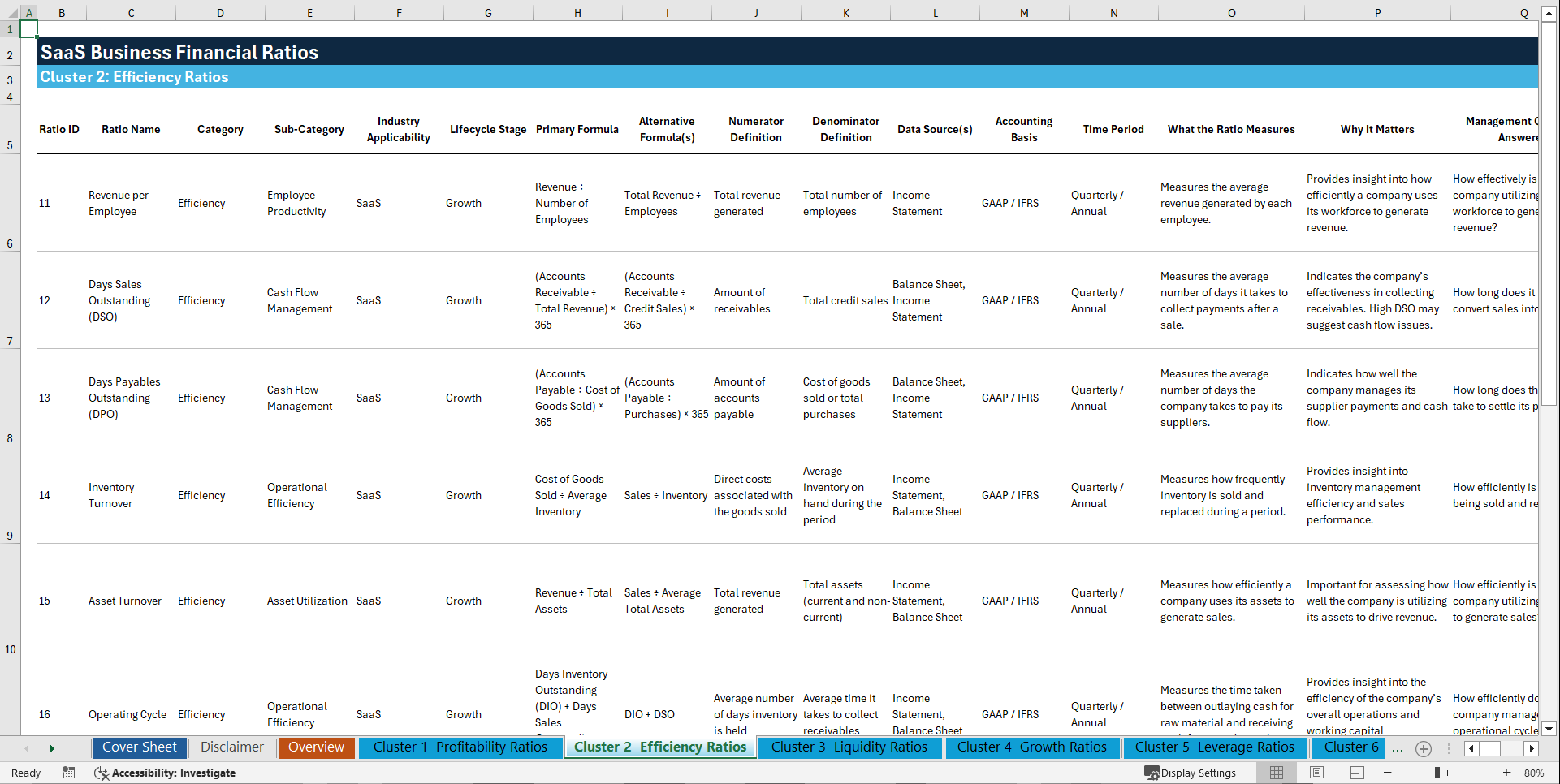

Cluster 2: Efficiency Ratios

11. Revenue per Employee

12. Days Sales Outstanding (DSO)

13. Days Payables Outstanding (DPO)

14. Inventory Turnover

15. Asset Turnover

16. Operating Cycle

17. Cash Conversion Cycle

18. Accounts Receivable Turnover

19. Accounts Payable Turnover

20. Cost per Acquisition (CPA)

Cluster 3: Liquidity Ratios

21. Current Ratio

22. Quick Ratio (Acid-Test Ratio)

23. Cash Ratio

24. Operating Cash Flow Ratio

25. Free Cash Flow Ratio

26. Working Capital

27. Cash Conversion Efficiency

28. Net Working Capital to Revenue

29. Quick Assets Ratio

30. Immediate Liquidity Ratio

Cluster 4: Growth Ratios

31. Revenue Growth Rate

32. Customer Growth Rate

33. Market Share Growth

34. Monthly Recurring Revenue (MRR) Growth

35. Annual Recurring Revenue (ARR) Growth

36. Net Revenue Retention (NRR)

37. Gross Revenue Retention (GRR)

38. Subscriber Growth Rate

39. Organic Growth Rate

40. Product or Service Expansion Rate

Cluster 5: Leverage Ratios

41. Debt-to-Equity Ratio

42. Debt-to-Asset Ratio

43. Debt-to-EBITDA Ratio

44. Debt Service Coverage Ratio (DSCR)

45. Financial Leverage

46. Interest Coverage Ratio

47. Net Debt to EBITDA

48. Total Debt to Equity

49. Debt Ratio

50. Long-Term Debt to Equity Ratio

Cluster 6: Efficiency & Productivity Ratios

51. Customer Acquisition Cost (CAC)

52. Customer Lifetime Value (CLTV)

53. CAC Payback Period

54. LTV/CAC Ratio

55. Churn Rate

56. Monthly Active Users (MAU)

57. Average Revenue per User (ARPU)

58. Annual Revenue per User (ARPU)

59. Customer Retention Rate

60. Customer Profitability Index

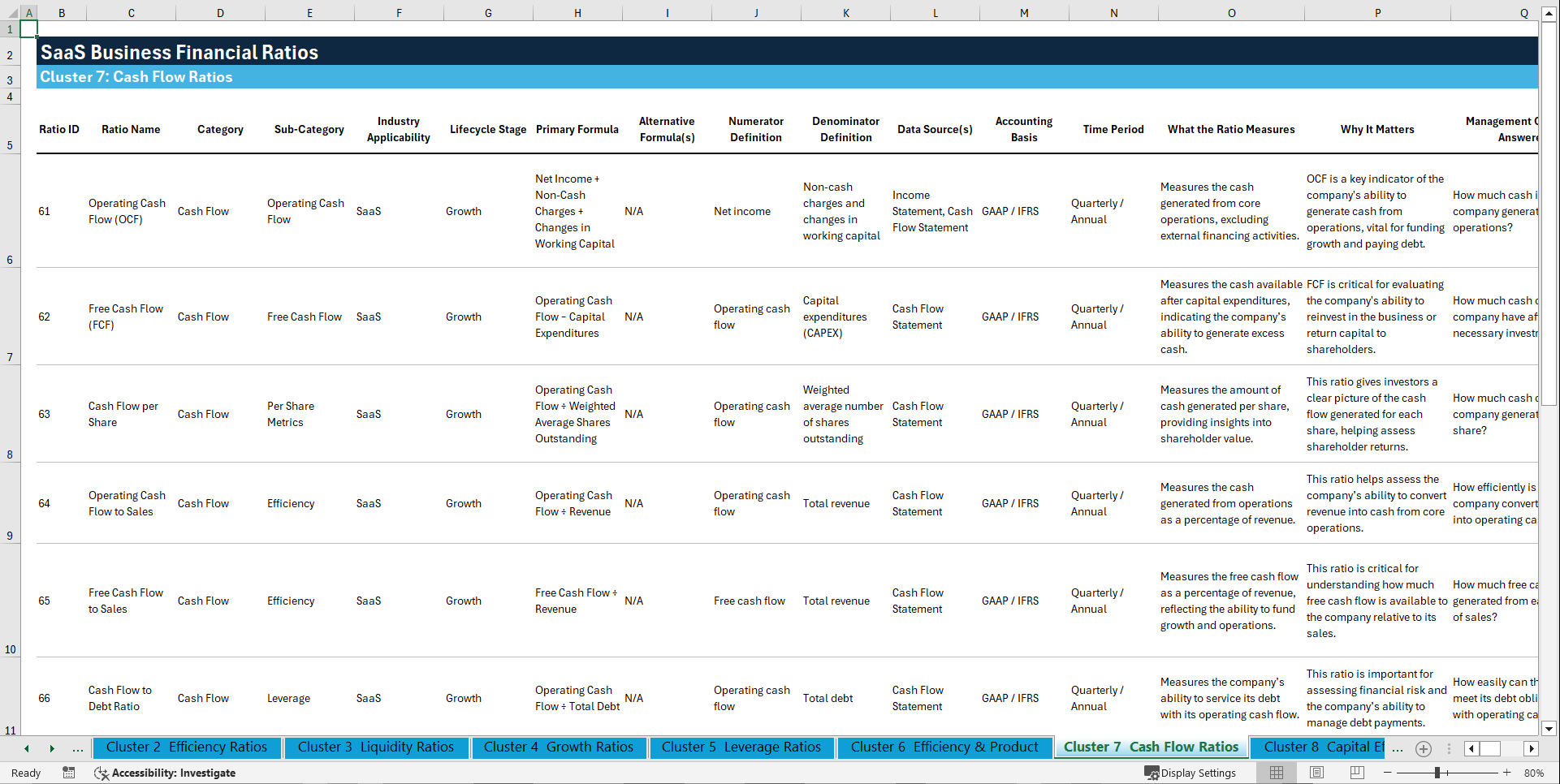

Cluster 7: Cash Flow Ratios

61. Operating Cash Flow (OCF)

62. Free Cash Flow (FCF)

63. Cash Flow per Share

64. Operating Cash Flow to Sales

65. Free Cash Flow to Sales

66. Cash Flow to Debt Ratio

67. Cash Flow Margin

68. Cash Flow Return on Investment (CFROI)

69. Free Cash Flow to Equity

70. Cash Flow per Employee

Cluster 8: Capital Efficiency Ratios

71. Capital Expenditure (CapEx)

72. CapEx to Sales Ratio

73. CapEx to Depreciation Ratio

74. Capital Return on Assets (CROA)

75. Return on Capital Employed (ROCE)

76. Fixed Asset Turnover

77. Gross Capital Expenditure Ratio

78. Capital Intensity

79. Capital Structure Ratio

80. Asset Coverage Ratio

Cluster 9: Market Performance Ratios

81. Price to Earnings (P/E) Ratio

82. Price to Sales (P/S) Ratio

83. Price to Book (P/B) Ratio

84. Market Cap to Revenue Ratio

85. Market Capitalization

86. Enterprise Value (EV)

87. Enterprise Value to EBITDA (EV/EBITDA)

88. Price to Cash Flow Ratio

89. Dividend Payout Ratio

90. Dividend Yield

Cluster 10: Risk & Solvency Ratios

91. Altman Z-Score

92. Credit Risk Ratio

93. Beta Coefficient

94. Risk-Adjusted Return on Capital

95. Coverage Ratio

96. Default Probability

97. Loan to Value Ratio (LTV)

98. Asset Default Probability

99. Solvency Ratio

100. Liquidity Risk Ratio

Cluster 11: Customer-Focused Ratios

101. Average Revenue per Account (ARPA)

102. Customer Satisfaction Score (CSAT)

103. Net Promoter Score (NPS)

104. Customer Engagement Rate

105. Customer Support Cost Ratio

106. Retention Cost per Customer

107. Customer Acquisition Cost to LTV Ratio

108. Trial Conversion Rate

109. Active User Growth Rate

110. Referral Rate

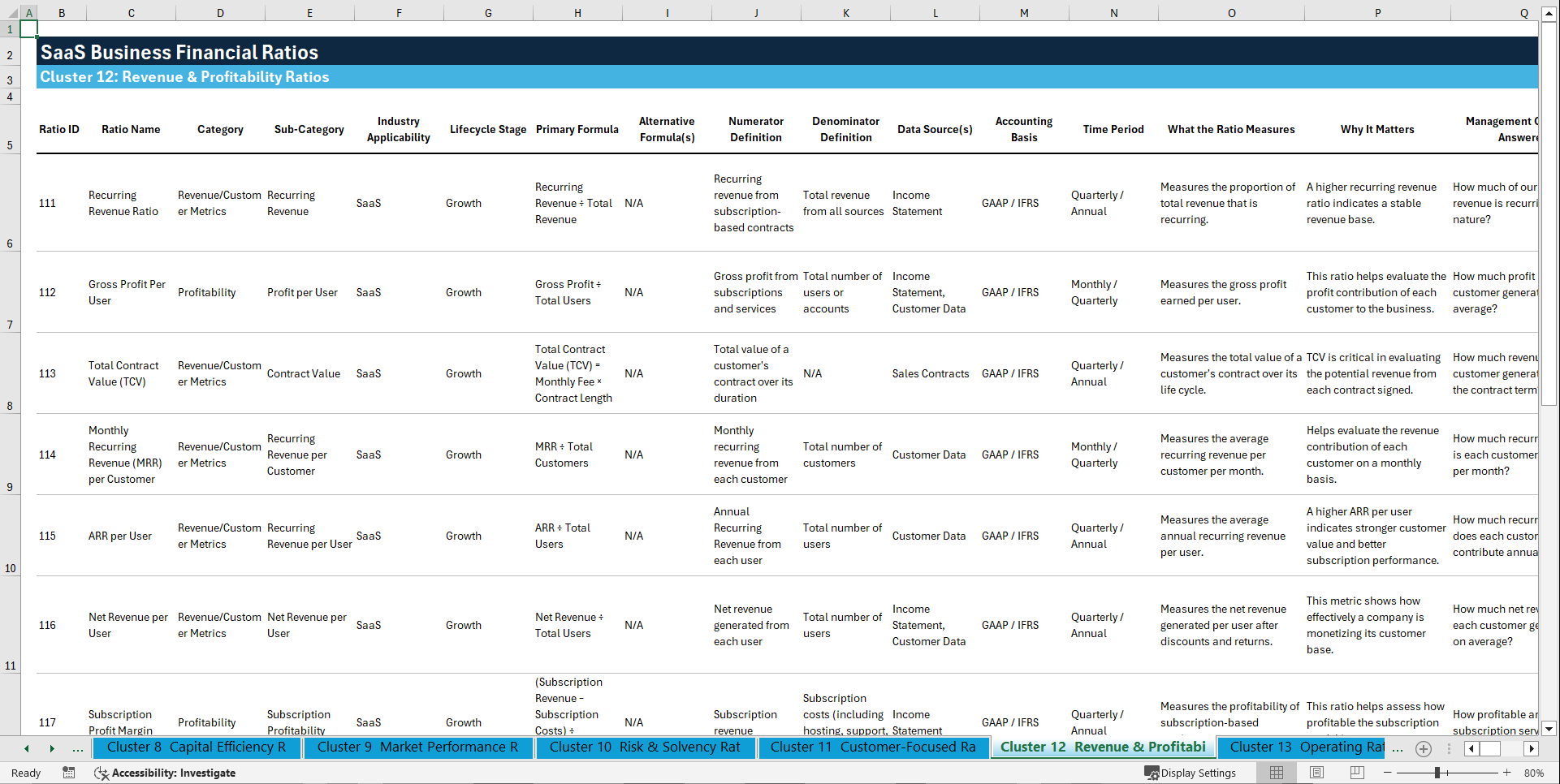

Cluster 12: Revenue & Profitability Ratios

111. Recurring Revenue Ratio

112. Gross Profit Per User

113. Total Contract Value (TCV)

114. Monthly Recurring Revenue (MRR) per Customer

115. ARR per User

116. Net Revenue per User

117. Subscription Profit Margin

118. Churned Revenue

119. Customer Contribution Margin

120. Profit per Customer

Cluster 13: Operating Ratios

121. Operating Profit Per Employee

122. Average Revenue per Employee

123. Operating Expenses to Revenue

124. Administrative Expense Ratio

125. Research & Development Expense Ratio

126. Sales & Marketing Expense Ratio

127. General & Administrative Expense Ratio

128. Total Operating Expenses Ratio

129. EBITDA to Revenue Ratio

130. Cost of Goods Sold (COGS) Ratio

Cluster 14: SaaS-Specific Ratios

131. Monthly Recurring Revenue (MRR)

132. Annual Recurring Revenue (ARR)

133. Customer Churn Rate

134. Customer Retention Rate

135. Customer Lifetime Value (CLTV)

136. Revenue Retention Rate

137. New Customer Growth

138. Existing Customer Revenue Growth

139. Expansion Revenue

140. Net New ARR

Cluster 15: Investment & Valuation Ratios

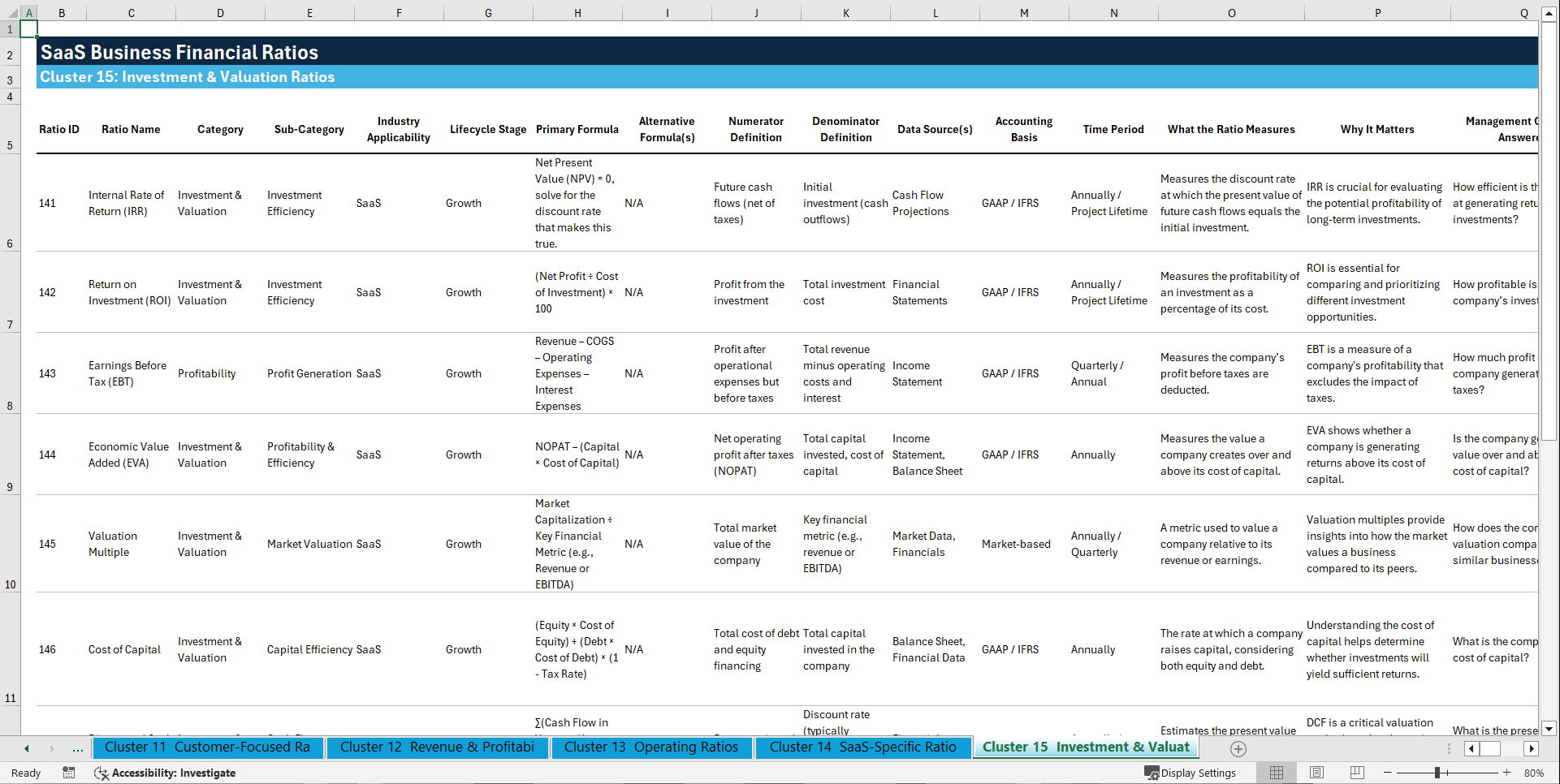

141. Internal Rate of Return (IRR)

142. Return on Investment (ROI)

143. Earnings Before Tax (EBT)

144. Economic Value Added (EVA)

145. Valuation Multiple

146. Cost of Capital

147. Discounted Cash Flow (DCF)

148. Residual Income

149. Market Value Added (MVA)

150. Investment Turnover Ratio

💼 Why This SaaS Financial Ratios Excel Template Wins

✅ Built specifically for SaaS business models

✅ Investor-grade, CFO-ready, board-ready

✅ Perfect for fundraising, valuation, benchmarking, FP&A, and M&A

✅ Eliminates metric misuse and KPI confusion

✅ Scales from early-stage SaaS to enterprise SaaS

🎯 Bottom Line

If you want total control over SaaS financial performance, clean metrics, and decision-ready insights, this 150+ SaaS Business Financial Ratios Database (Excel Template) is not optional – it's essential.

📈 Measure smarter. Explain better. Decide faster. Win harder.

Key Words:

Strategy & Transformation, Growth Strategy, Strategic Planning, Strategy Frameworks, Innovation Management, Pricing Strategy, Core Competencies, Strategy Development, Business Transformation, Marketing Plan Development, Product Strategy, Breakout Strategy, Competitive Advantage, Mission, Vision, Values, Strategy Deployment & Execution, Innovation, Vision Statement, Core Competencies Analysis, Corporate Strategy, Product Launch Strategy, BMI, Blue Ocean Strategy, Breakthrough Strategy, Business Model Innovation, Business Strategy Example, Corporate Transformation, Critical Success Factors, Customer Segmentation, Customer Value Proposition, Distinctive Capabilities, Enterprise Performance Management, KPI, Key Performance Indicators, Market Analysis, Market Entry Example, Market Entry Plan, Market Intelligence, Market Research, Market Segmentation, Market Sizing, Marketing, Michael Porter's Value Chain, Organizational Transformation, Performance Management, Performance Measurement, Platform Strategy, Product Go-to-Market Strategy, Reorganization, Restructuring, SWOT, SWOT Analysis, Service 4.0, Service Strategy, Service Transformation, Strategic Analysis, Strategic Plan Example, Strategy Deployment, Strategy Execution, Strategy Frameworks Compilation, Strategy Methodologies, Strategy Report Example, Value Chain, Value Chain Analysis, Value Innovation, Value Proposition, Vision Statement, Corporate Strategy, Business Development, Busienss plan pdf, business plan, PDF, Biusiness Plan DOC, Bisiness Plan Template, PPT, Market strategy playbook, strategic market planning, competitive analysis tools, market segmentation frameworks, growth strategy templates, product positioning strategy, market execution toolkit, strategic alignment playbook, KPI and OKR frameworks, business growth strategy guide, cross-functional strategy templates, market risk management, market strategy PowerPoint dec, guide, ebook, e-book ,McKinsey Change Playbook, Organizational change management toolkit, Change management frameworks 2025, Influence model for change, Change leadership strategies, Behavioral change in organizations, Change management PowerPoint templates, Transformational leadership in change, supply chain KPIs, supply chain KPI toolkit, supply chain PowerPoint template, logistics KPIs, procurement KPIs, inventory management KPIs, supply chain performance metrics, manufacturing KPIs, supply chain dashboard, supply chain strategy KPIs, reverse logistics KPIs, sustainability KPIs in supply chain, financial supply chain KPIs, warehouse KPIs, digital supply chain KPIs, 1200 KPIs, supply chain scorecard, KPI examples, supply chain templates, Corporate Finance SOPs, Finance SOP Excel Template, CFO Toolkit, Finance Department Procedures, Financial Planning SOPs, Treasury SOPs, Accounts Payable SOPs, Accounts Receivable SOPs, General Ledger SOPs, Accounting Policies Template, Internal Controls SOPs, Finance Process Standardization, Finance Operating Procedures, Finance Department Excel Template, FP&A Process Documentation, Corporate Finance Template, Finance SOP Toolkit, CFO Process Templates, Accounting SOP Package, Tax Compliance SOPs, Financial Risk Management Procedures.

NOTE: Our digital products are sold on an "as is" basis, making returns and refunds unavailable post-download. Please preview and inquire before purchasing. Please contact us before purchasing if you have any questions! This policy aligns with the standard Flevy Terms of Usage.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in SaaS Excel: 100+ SaaS Business Financial Ratios Excel (XLSX) Spreadsheet, SB Consulting