MRR Monthly Recurring Revenue (Subscription) Finance Model (Excel XLSX)

Excel (XLSX)

SAAS EXCEL DESCRIPTION

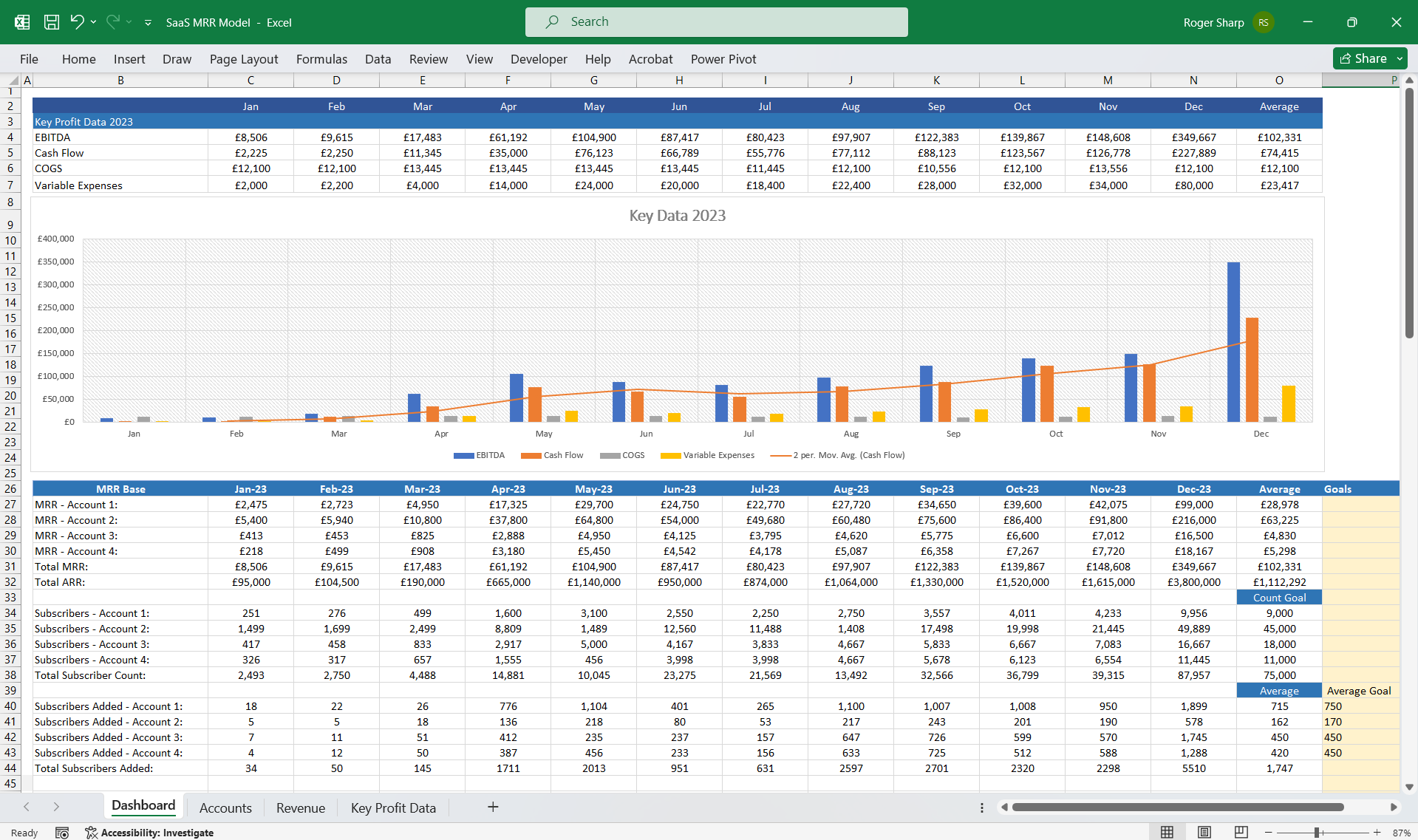

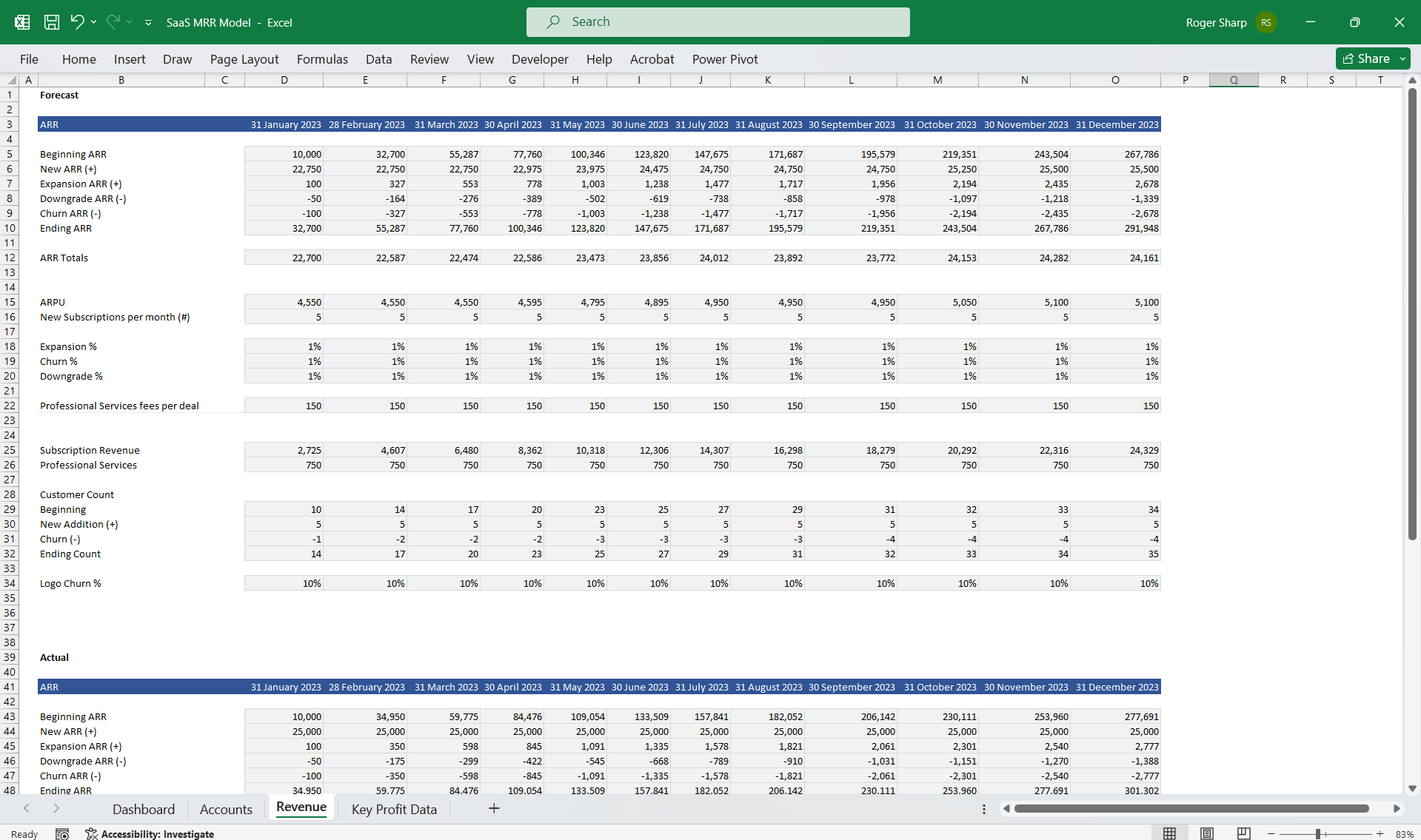

MRR represents the predictable, recurring revenue generated from active subscriptions.

This model helps you as a CFO to track MRR and ARR by analyzing subscription plans, pricing tiers, and customer segments.

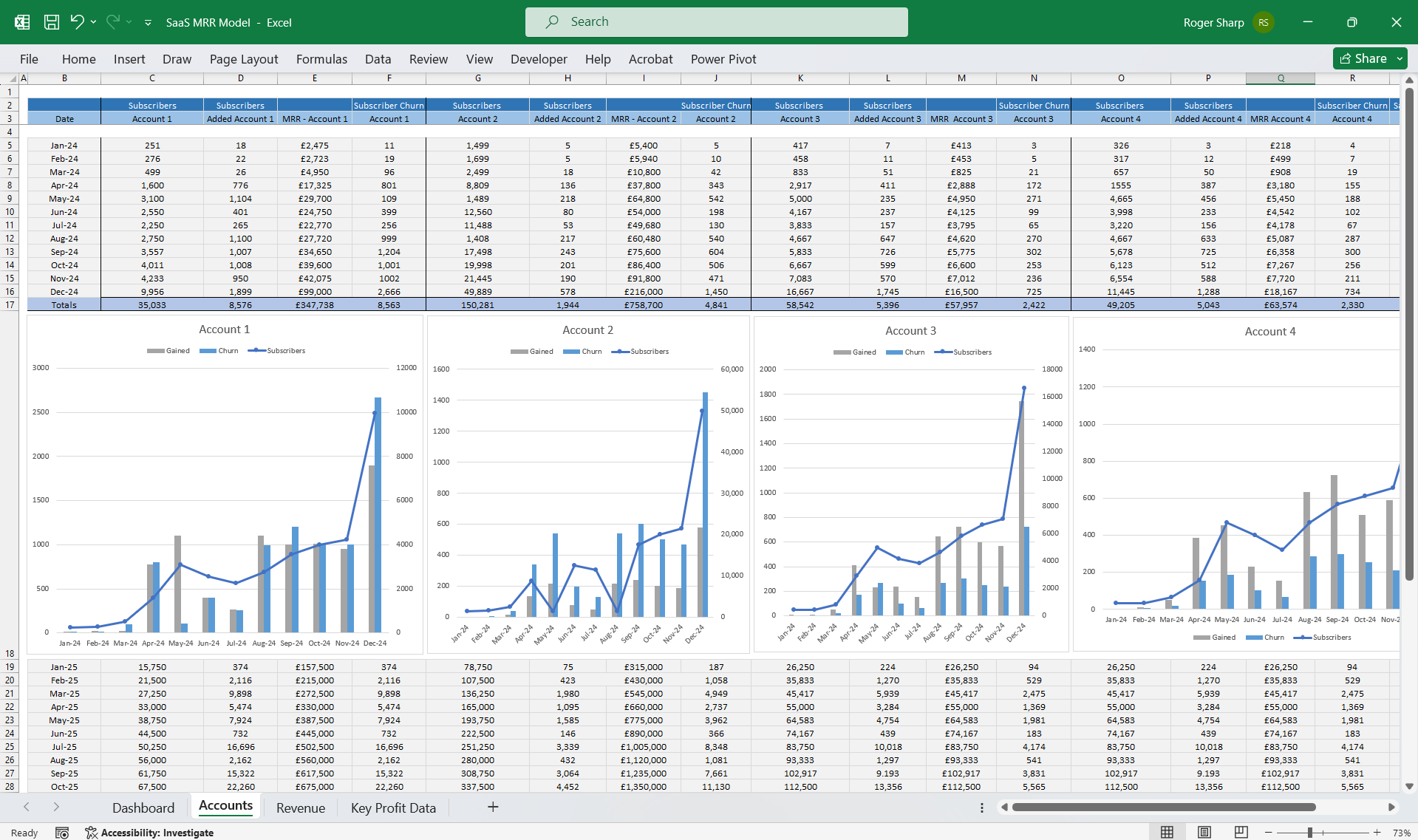

You monitor MRR growth, identify trends, and assess the impact of changes (e.g., upsells, downgrades) on overall revenue.

Churn Rate:

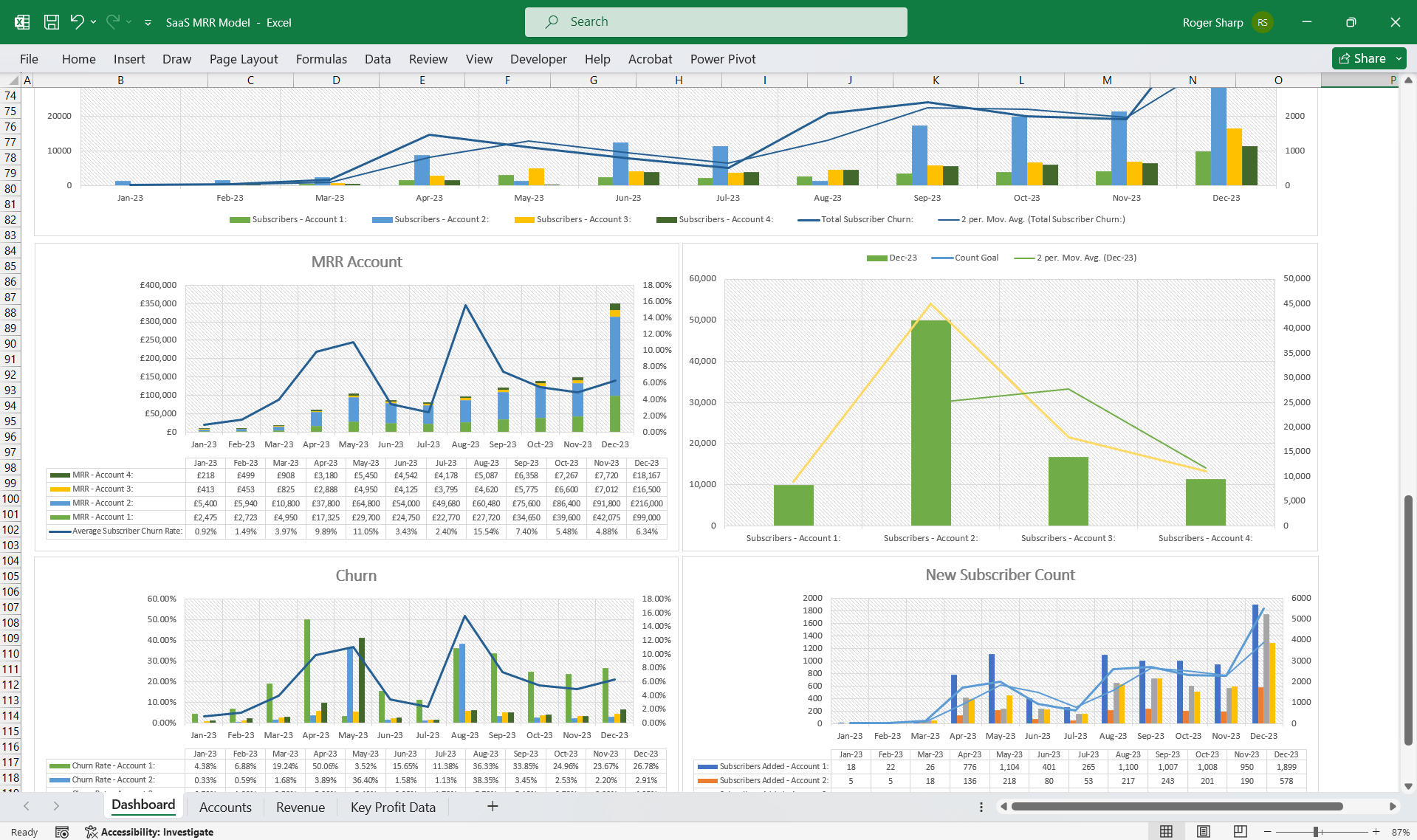

The churn rate measures the percentage of customers who cancel their subscriptions within a specific period (usually monthly). It directly affects MRR.

As a SaaS CFO, you analyze churn patterns, identify reasons for attrition, and develop strategies to reduce churn (e.g., improving customer experience, and addressing pain points).

Active Subscribers:

Active subscribers are the heart of your business. These are customers who continue to pay for your SaaS product.

You track active subscribers, segment them (e.g., by plan type, and industry), and ensure their satisfaction to maintain long-term relationships.

New Subscribers:

Acquiring new subscribers is essential for growth. As a SaaS CFO, you collaborate with marketing and sales teams to optimize customer acquisition.

You analyze conversion rates, evaluate marketing campaigns, and assess the cost-effectiveness of acquiring new customers (Customer Acquisition Cost, or CAC).

Strategic Insights and Decision-Making:

Pricing Strategies: You work closely with product and marketing teams to set competitive pricing. Balancing affordability with profitability is crucial.

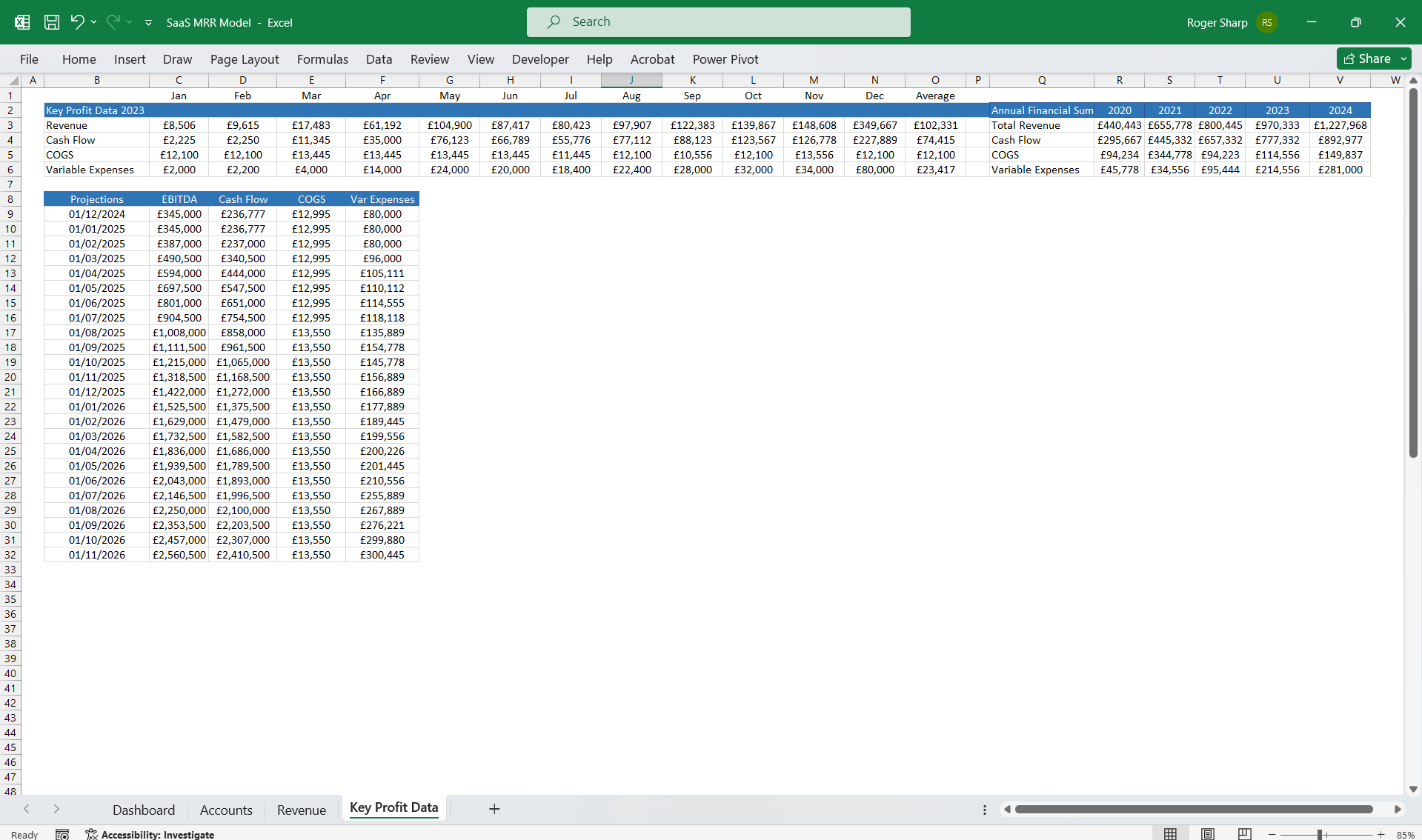

Forecasting and Budgeting: You create financial projections based on MRR, churn, and growth rates. These projections guide resource allocation and strategic planning.

Cash Flow Management: You ensure sufficient cash reserves to cover operational expenses, investments, and growth initiatives.

Investor Relations: You communicate financial performance to investors, secure funding, and maintain investor confidence.

Risk Mitigation: You identify and mitigate financial risks (e.g., economic downturns, and regulatory changes) to protect the company's financial health.

Remember, as a SaaS CFO, your decisions impact not only financial metrics but also customer satisfaction, product development, and overall

business success. Your ability to balance growth and stability is critical in the dynamic SaaS landscape.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

TOPIC FAQ

What is Monthly Recurring Revenue (MRR) and how is it used in SaaS finance?

MRR is the predictable recurring revenue from active subscriptions, used to monitor growth and trends in subscription businesses. SaaS finance teams use MRR alongside ARR to assess pricing, customer segments, and the effects of upsells or downgrades on revenue, focusing on MRR and ARR metrics.How do I calculate churn rate for monthly subscriptions?

Churn rate measures the percentage of customers who cancel within a specific period, typically calculated monthly by dividing lost customers by starting customers. It directly affects recurring revenue and is analyzed to identify attrition reasons and reduction strategies, expressed as a monthly churn rate.Which subscriber metrics should I track to manage subscription health?

Key metrics include active subscribers (by plan and industry), new subscriber acquisition, conversion rates, and Customer Acquisition Cost (CAC). Tracking these alongside churn and pricing tiers helps evaluate growth, retention, and unit economics, with emphasis on active subscriber and new subscriber counts.How should pricing strategy be assessed for its impact on recurring revenue?

Pricing must balance affordability and profitability; CFOs collaborate with product and marketing to set competitive tiers. Assess how changes affect subscription plans, upsells, and downgrades, and model those effects on MRR and ARR to determine net revenue impact, focusing on pricing tiers and upsell/downgrade impacts.What features should I expect from a subscription finance model template?

A useful template will enable MRR/ARR tracking, churn modeling, subscriber segmentation, CAC and conversion analysis, forecasting and budgeting, cash flow projections, and investor reporting. Flevy's MRR Monthly Recurring Revenue (Subscription) Finance Model explicitly includes a 5-year 3-statement model for these purposes.Who needs to be involved to implement an MRR model and what data is required?

Implementation typically requires collaboration between the CFO, finance/FP&A teams, marketing and sales to supply subscription plan details, pricing tiers, conversion/CAC data, and churn history. The model is populated and validated using subscription plan and churn data.What modeling approach should I use to measure upsell and downgrade effects on revenue?

Model subscription cohorts by plan and segment, incorporate expected upsell/downgrade rates, and simulate impacts on active subscribers, MRR, and ARR over time. Use scenario analysis to compare outcomes and quantify impacts on cash flow; Flevy's model supports MRR and ARR impact analysis.How do SaaS CFOs use MRR models when communicating with investors?

CFOs use MRR-based forecasts to demonstrate recurring revenue trends, retention dynamics, CAC efficiency, and cashflow sufficiency. These projections support funding discussions, performance updates, and risk mitigation explanations, relying on financial projections based on MRR, churn, and growth rates.Source: Best Practices in SaaS Excel: MRR Monthly Recurring Revenue (Subscription) Finance Model Excel (XLSX) Spreadsheet, Willcox PMO