BENEFITS OF THIS EXCEL DOCUMENT

- This NVIDIA Financial Model Template in Excel has been built for use by anyone looking to analyze NVIDIA and input custom assumptions over a 5 year forecast period.

- This NVIDIA Financial Model Template in Excel has been built for use by anyone looking to analyze NVIDIA and input custom assumptions (such as revenue growth rates by key divisions (Data Center Compute, Data Center Networking, Gaming

- Professional Visualization, Automotive, OEM & Other), Operational costs (Cost of Revenue (ie. COGS), R&D, SG&A), capital expenditure, depreciation and amortization, balance sheet assumptions, cash flow assumptions and other assumptions

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Description

This NVIDIA Financial Model Template in Excel has been built for use by anyone looking to analyze NVIDIA and input custom assumptions (such as revenue growth rates by key divisions (Data Center Compute, Data Center Networking, Gaming, Professional Visualization, Automotive, OEM & Other), Operational costs (Cost of Revenue (ie. COGS), R&D, SG&A), capital expenditure, depreciation and amortization, balance sheet assumptions, cash flow assumptions and other assumptions) over a 5 year forecast period to determine an estimated valuation for the company using a DCF approach. Users will easily be able to navigate the model with all input fields highlighted in Blue font and yellow highlights. These models are designed to be the perfect financial tool for investors, students or anyone looking to understand how NVIDIA operates, and how future projections and cash flows could affect the valuation of the business. All historical "actuals" have been input from NVIDIA's financial statements publicly released, and all forecasts currently in the model are based on assumptions we have input for educational purposes only and do not reflect the views of NVIDIA or any other party other than us.

Input Assumptions

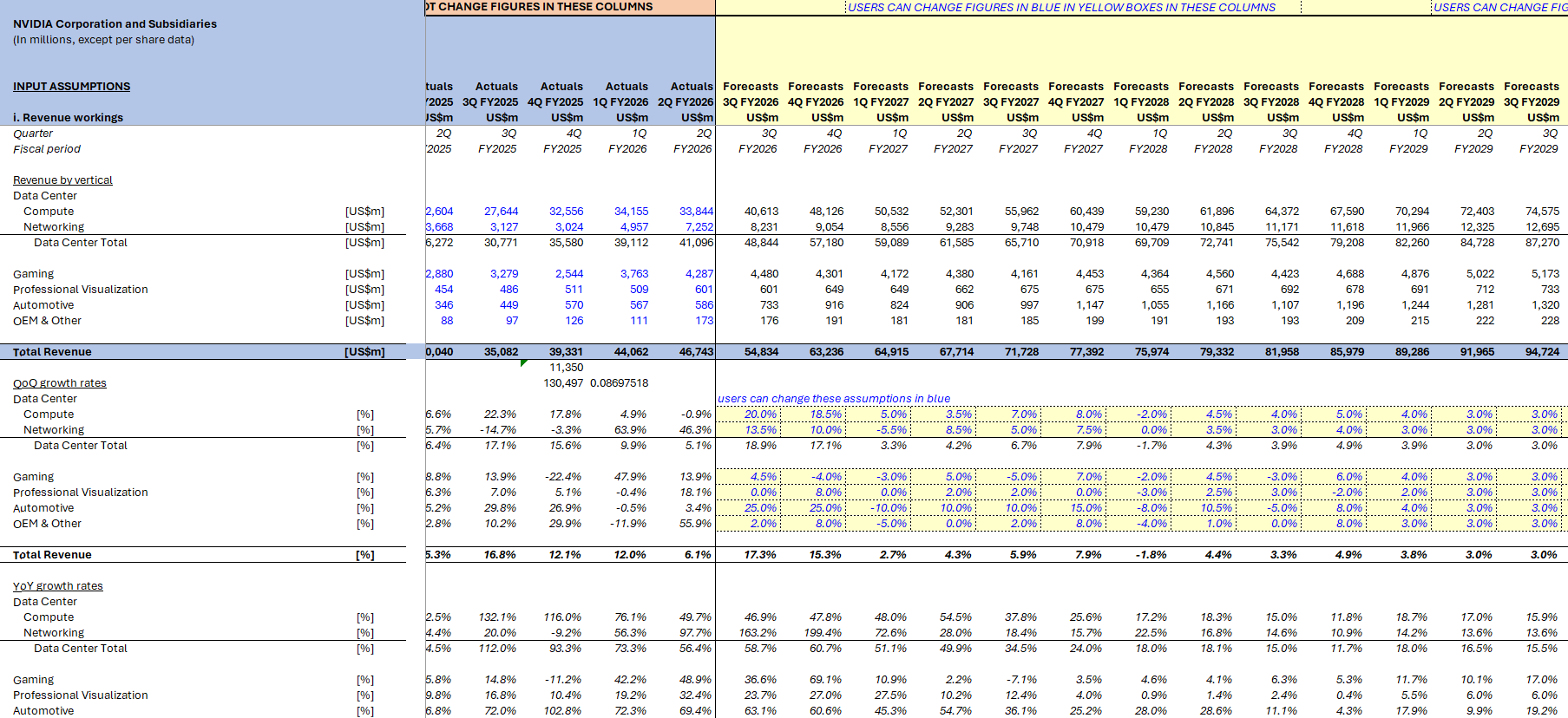

Revenue assumptions have been segregated by each division of NVIDIA. In our model we have included inputs on quarterly growth rates for each of NVIDIA's key divisions including:

Data Center Compute: This segment generates the majority of NVIDIA's revenue, driven by AI compute, server accelerators, and large-scale cloud deployments. When thinking about growth assumptions here, users should reflect continued enterprise demand, AI adoption, product refresh cycles (e.g., new architectures), and key wins with hyperscale customers. In FY25, Data Center Compute revenue reached $102.19 billion, accounting for about 78% of total revenue.

Data Center Networking: This segment ‘Networking' is often grouped with Compute (as "Compute & Networking"), but for detailed modeling you could allocate a portion of total Data Center revenue to networking based on company disclosures or industry estimates. Growth in this segment can be tied to high-speed interconnect sales, InfiniBand/Ethernet solutions, and increased cluster deployments for AI. In FY25, Data Center Networking revenue reached $12.99 billion, accounting for about 10% of total revenue.

Gaming: Gaming revenue was $11.35 billion in FY2025 (8.7% of total), reflecting demand for GeForce GPUs and gaming hardware. When thinking about assumptions in this division, users should account for gaming upgrade cycles, eSports trends, and macroeconomic factors affecting discretionary spending.

Professional Visualization: This segment reported $1.88 billion in FY2025 (1.44% of total), serving professionals with advanced graphics for CAD, visualization, and AI-powered creative workflows. Users should think about assumptions in this division looking at workstation adoption, industry vertical trends (e.g., architecture, media), and potential growth from emerging fields like digital twins.

Automotive: Automotive revenue was $1.69 billion in FY2025 (1.3% of total), covering automotive AI platforms and digital cockpit solutions. Growth rates in this division can be modeled based on autonomous driving adoption, EV trends, and partnerships with major OEMs.

OEM & Other: This segment contributed $389 million in FY2025 (0.3% of total), reflecting sales via original equipment manufacturers apart from the main divisions. This is typically a small, low-growth line that can be projected with flat or modest single-digit growth unless you expect new major partnerships.

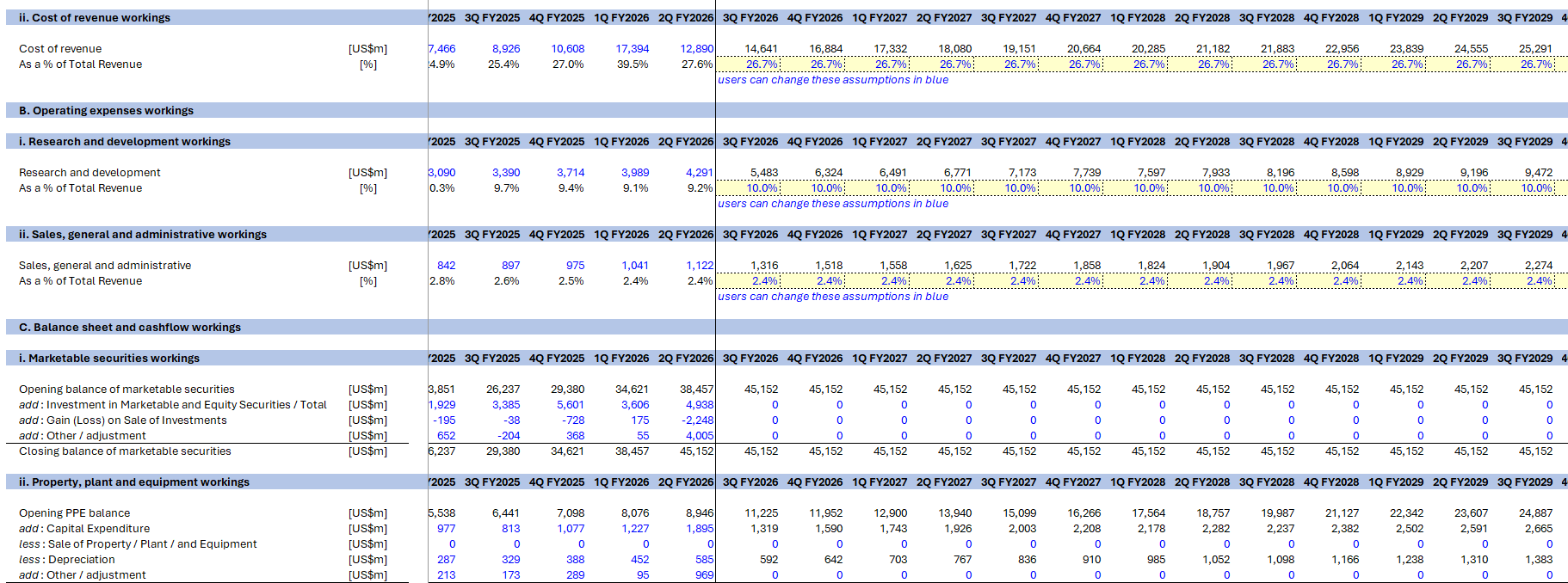

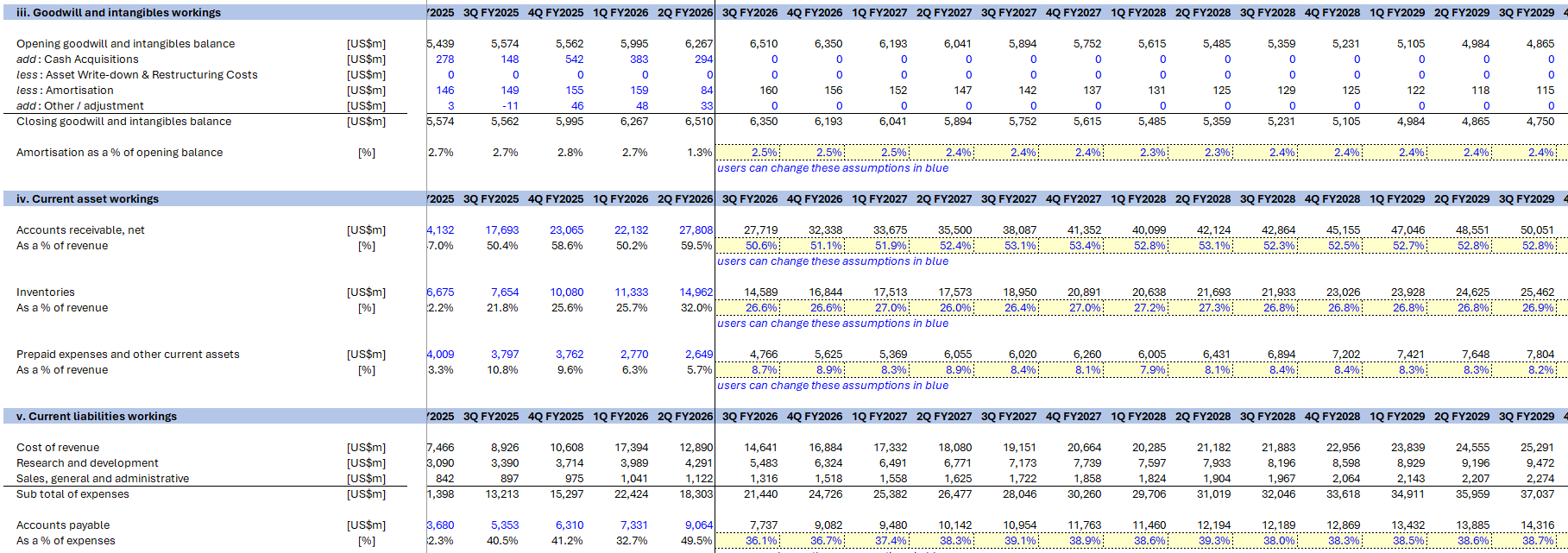

Operating Expenses Assumptions

Operating expense assumptions are typically based on historical data using a % of revenue as a forecasting method. In particular, assumptions have been created for:

Cost of Revenue (i.e. COGS): COGS represents the direct costs to manufacture or acquire the products sold by NVIDIA , such as chips, hardware, and associated production costs. For FY2025, NVIDIA ‘s gross margin is estimated at 74.99%, so COGS as a percentage of revenue is approximately 25%. When modeling out COGS, users should reflect expected changes in production efficiency, supply chain costs, and mix of higher/lower margin products.

Research & Development (R&D): R&D is a major strategic investment for NVIDIA due to its focus on innovation in AI, graphics, and new product pipelines. Historically, the company has spent between 10% and 14% of revenue on R&D, but as absolute revenues grow rapidly, R&D as a percentage of sales may trend lower due to operating leverage. Users may assume that R&D starts at about 10-11% of revenue in the near term, and can choose to either see this % decline over the 5 year period as sales scale up, or keep it constant going forward.

Selling, General & Administrative (SG&A): SG&A includes the company's expenses for sales, marketing, administration, and corporate operations. NVIDIA ‘s SG&A is typically smaller than its R&D as a percentage of revenue, historically around 5-7%. In a growth model, users could assume SG&A is roughly flat or slightly declining as a percentage of revenue as fixed costs are spread over larger sales.

Capex Assumptions and Other Expenses

Capital expenditure (Capex) assumptions refer to the anticipated investments a company plans to make in long-term assets, such as property, equipment, and technology, over a specific period. Capital expenditures are low relative to revenue because NVIDIA operates a fabless model, so capex is often just 2-3% of revenue.

One-time charges, interest, and taxes should be modeled according to disclosure and updated guidance (for example, a tax rate of 17% is expected in FY2025).

Quarterly Projections (5 year period)

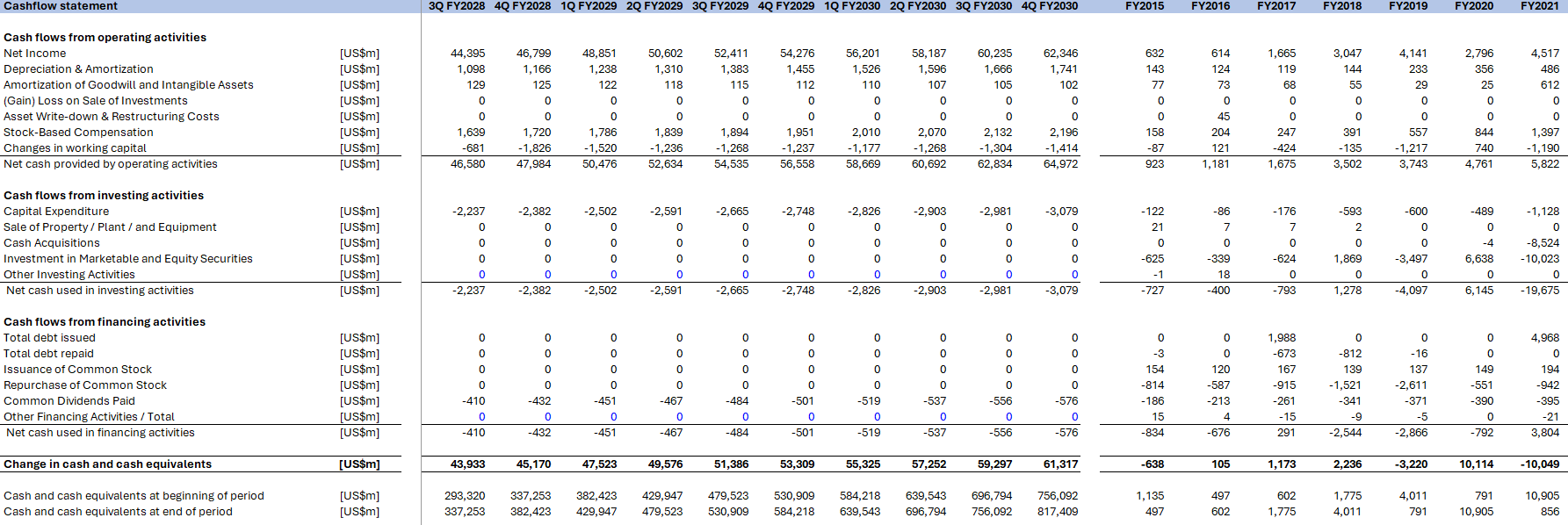

We have broken down projections on a Quarter by Quarter basis when projecting Income Statement, Balance Sheet and Cash Flow Statement items for NVIDIA based on NVIDIA's quarterly reporting cycle. This has been done for a 5 year forecast period to FY2030. Quarterly granularity enables more timely and accurate updates to revenue and expense forecasts, capturing business trends (like AI demand spikes or new product launches), short-term margin variability, and seasonality in core segments such as Data Center and Gaming. Quarterly projections also make the model compatible with NVIDIA ‘s financial reports, which are issued every three months and followed closely by analysts and investors to assess sales momentum, cost management, and forward guidance. This approach allows for scenario testing—such as modeling the impact of a major product or regulatory change—and provides more actionable insights for both short-term trading and long-term strategic analysis.

Annual Projections (5 year period)

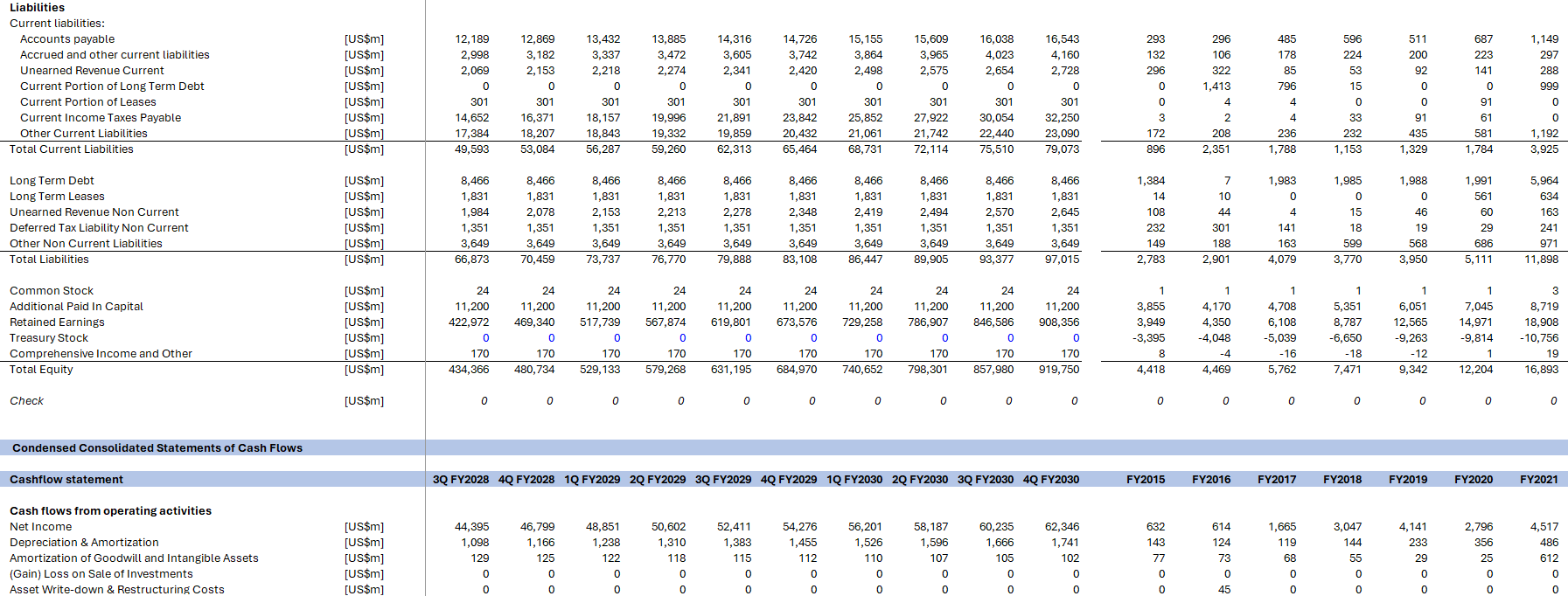

The model has Annualized Financial Projections of Income Statement, Balance Sheet and Cash Flow Statement for NVIDIA over a 5 year time frame. Annual projections provide an excellent overview of expected revenues, expenses, profits, cash flow, and other key financial metrics for the upcoming year. We have also included 10 years worth of historical numbers from FY2015.

Outputs

The outputs section include three core financial statements: Income Statement, Balance Sheet, and Cash Flow Statement. Each serves a different purpose and provides key insights for investors and analysts. Outputs have been provided on both a quarterly and annual basis.

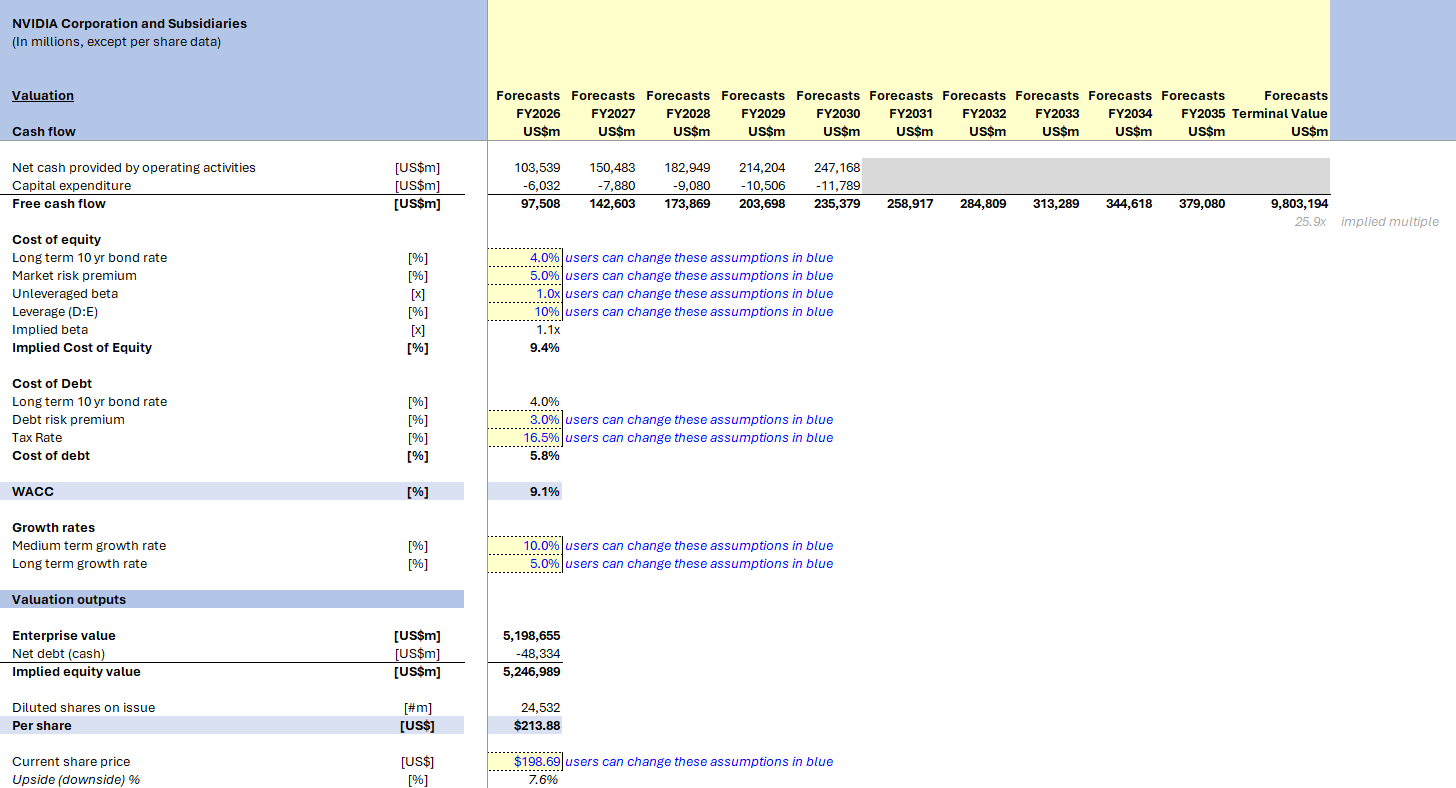

Valuation

The Discounted Cash Flow (DCF) valuation for NVIDIA estimates the intrinsic value of the company by projecting its future free cash flows and discounting them back to present value using a weighted average cost of capital (WACC). Whilst the free cash flow section is driven by earlier input assumptions and cannot be adjusted by the user in this section; the user can adjust the ‘Cost of Equity' assumptions (ie. Bond rate, market risk premium, unleveraged beta, leverage ratio) as well as the ‘Cost of Debt' assumptions (debt risk premium, tax rate) and medium/long-term growth rates. Users can also put in the current NVIDIA share price in order to see what Upside or downside as a %, the model's valuation is relative to the current share price.

Important Disclaimer:

This financial model has been prepared solely for illustrative and educational purposes and should not be relied upon for investment, legal, accounting, or tax decisions. The projections, forecasts, and assumptions contained herein are hypothetical and do not represent the views or financial guidance of NVIDIA Corporation. This model is an independent analysis and is not affiliated with, endorsed by, or approved by NVIDIA Corporation or any of its subsidiaries. All data, including historical figures and forward-looking estimates, are based on publicly available information and should be independently verified. Actual results may differ materially from the assumptions used in this model. By using this model, you acknowledge and agree that the creator bears no responsibility for any decisions or actions taken based on its content.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: NVIDIA Financial Model Excel (XLSX) Spreadsheet, Financial Models Hub