Integrated Financial Statements (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Delivers an end-to-end, driver-based financial framework that seamlessly links the income statement, balance sheet, and cash flow statement for high-quality analysis and decision support.

- Enables rapid scenario planning and sensitivity testing through adjustable assumptions, providing stakeholders with actionable insights into profitability, liquidity, leverage, and valuation outcomes.

- Enhances executive-level communication with a consolidated summary dashboard and visual analytics that streamline financial storytelling and accelerate strategic planning.

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

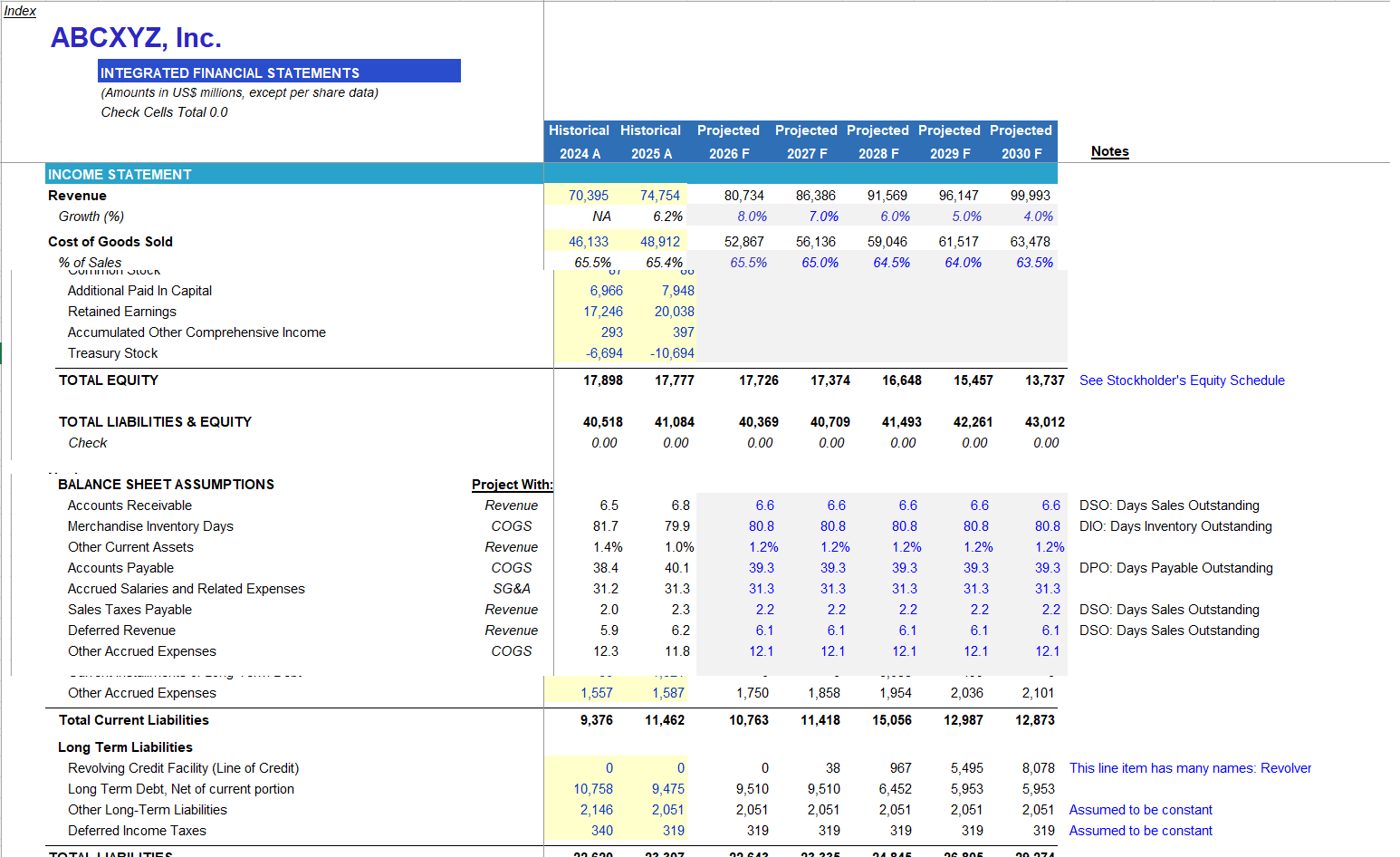

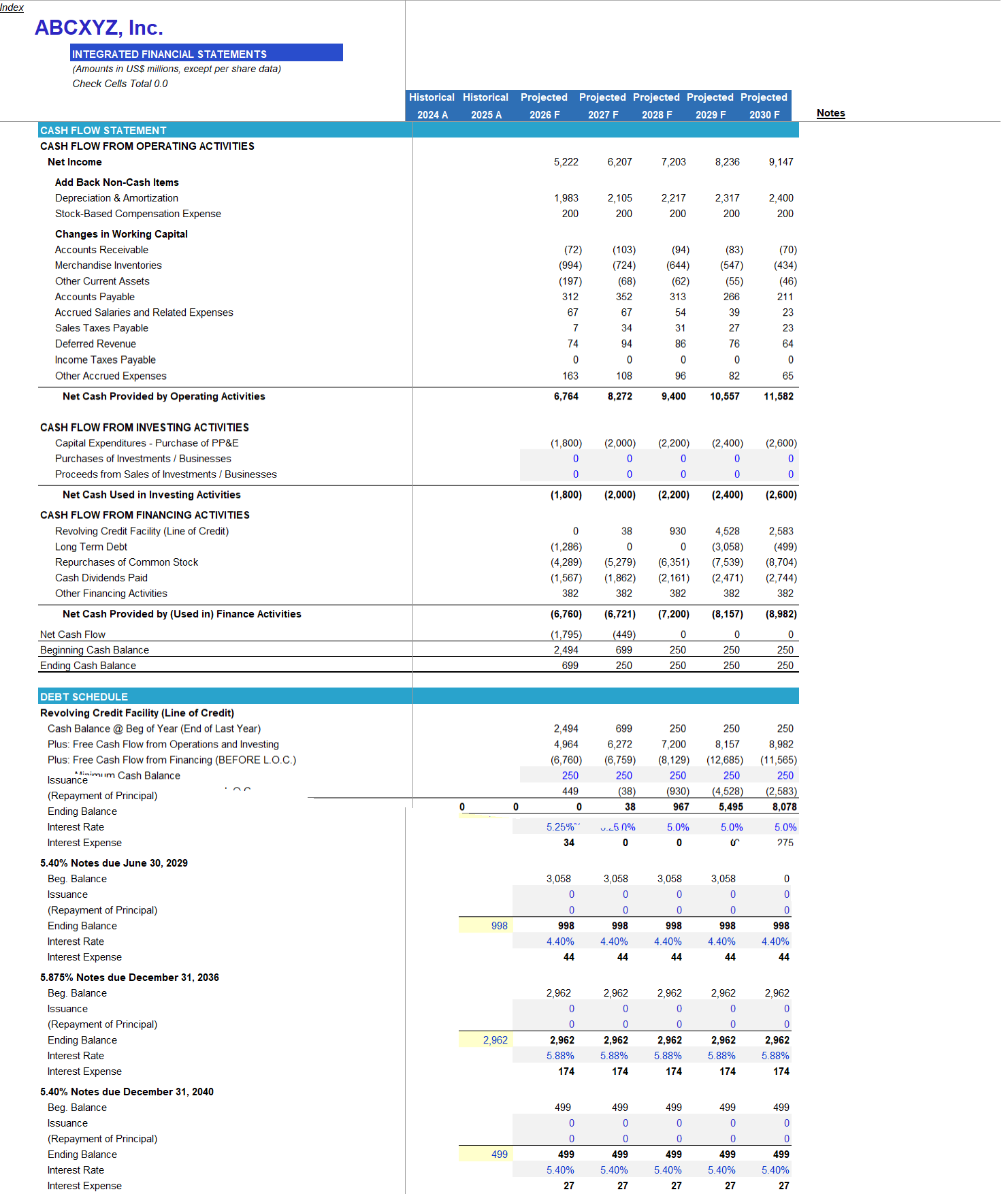

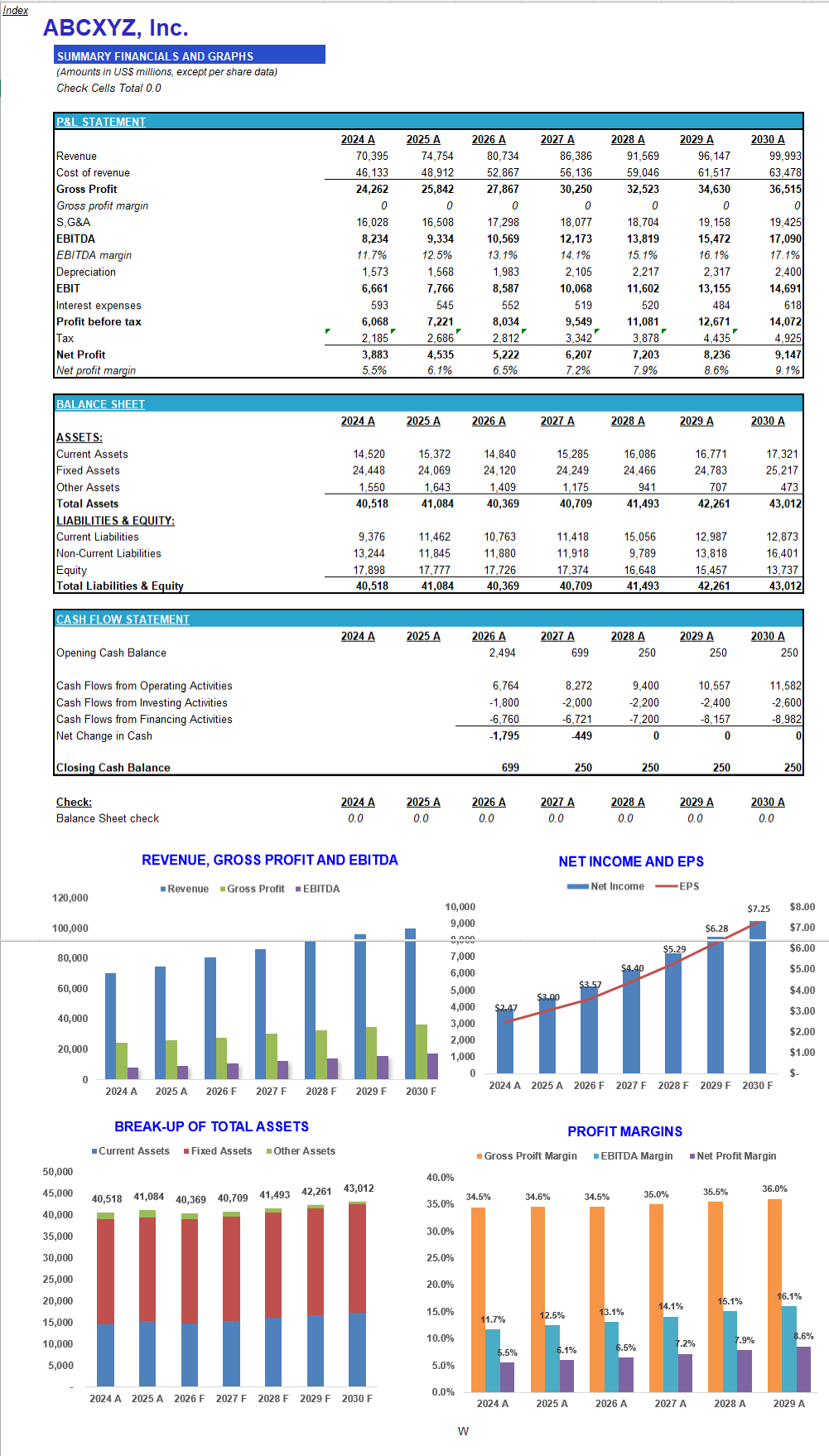

This integrated financial model provides a comprehensive analysis of a U.S.-listed company's financial health, with both historical data and forward-looking projections. The model contains actual results for the past two years, offering a solid foundation for trend analysis and forecasting. The financial statements, including the income statement, balance sheet, and cash flow statement, are integrated, allowing for seamless analysis across different financial aspects of the business.

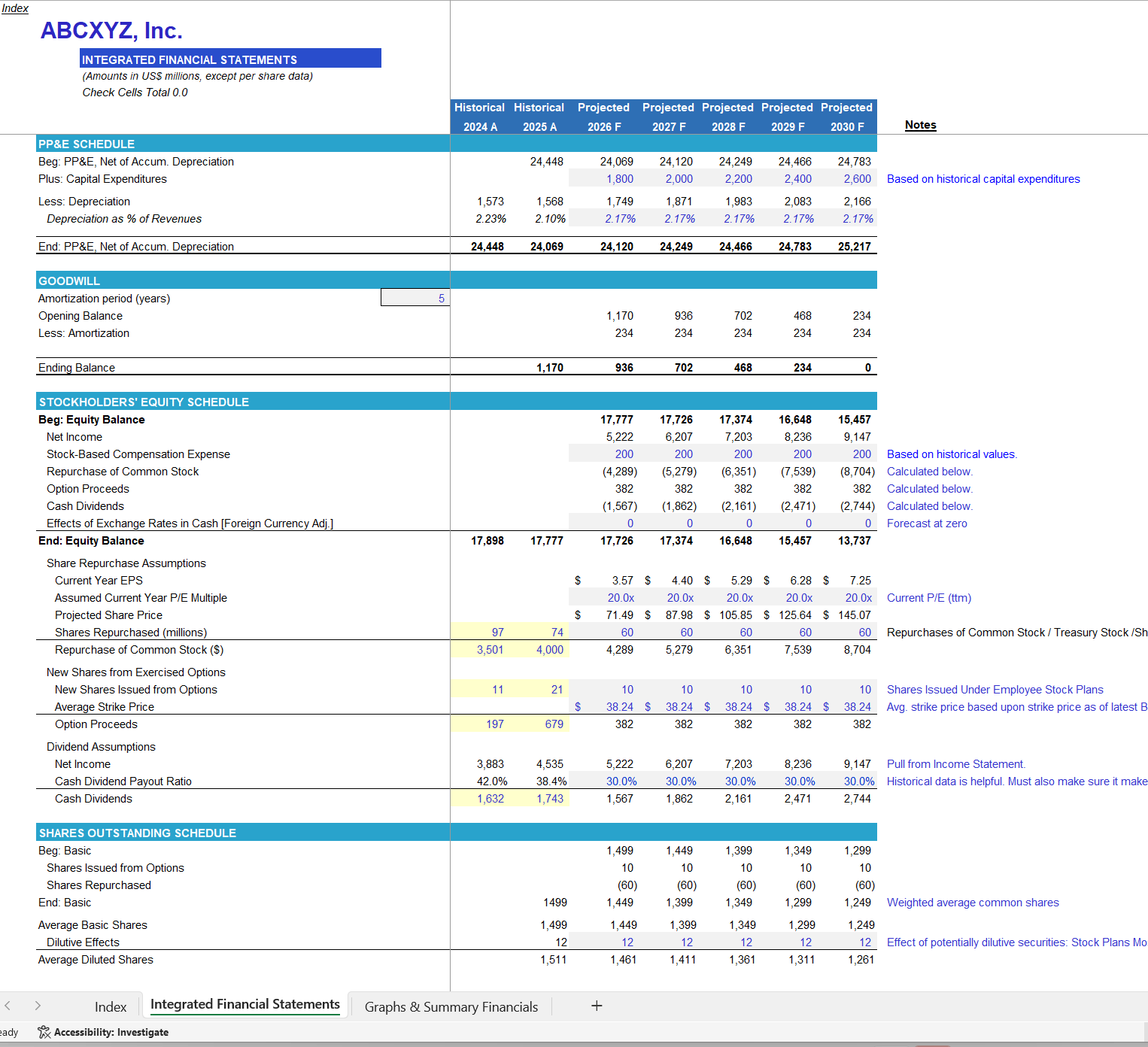

The model incorporates a range of assumptions that drive calculations for key line items in the income statement, balance sheet, and cash flow statement. These assumptions are adjustable, giving users flexibility to explore various scenarios and conduct sensitivity analysis. Additionally, the model includes specific schedules, such as the Debt Schedule, PP&E (Property, Plant, and Equipment) Schedule, Stockholders' Equity Schedule, and Shares Outstanding Schedule. Each schedule provides detailed insights into these critical areas, contributing to a deeper understanding of the company's financial position and future prospects.

A separate tab in the model consolidates the key financial data into a summary view, presenting the Income Statement, Balance Sheet, and Cash Flow Statement. This summary view is designed for easy readability, offering users a snapshot of the company's financial performance and position at a glance. The tab also includes graphical representations, making it easier to visualize trends and relationships among different financial metrics.

The integrated financial model is an invaluable tool for financial analysts, investors, and other stakeholders interested in a detailed examination of a company's financials. It combines historical data with forward-looking forecasts, providing a robust framework for financial analysis, valuation, and strategic planning. With its comprehensive structure and flexibility, the model is suitable for a wide range of financial analysis purposes.

Technical Specification:

• No VBA or Macros: The model is devoid of any VBA or macro components.

• Circular Reference-Free

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Integrated Financial Statements Excel (XLSX) Spreadsheet, ExcelFinModels