SPORT MANAGEMENT EXCEL DESCRIPTION

Football Field Excel Financial Model template presents the business case of a brand new start-up Online Shop with an upfront investment in a website, SEO, logo, and copywriting. The model contains the three financial statementsincluding the cash flows and calculates the relevant metrics (Sensitivity Analysis, Break-even Analysis, Diagnostic Tools, Project evaluation, and Charts). The financing options for the project include a standard long-term loan as well as an investment made by the investors and of course, a marketing sheet (including automated inbound and outbound marketing costs sheet which also contains how many customers will be achieved as a result).

Key Features of the Model

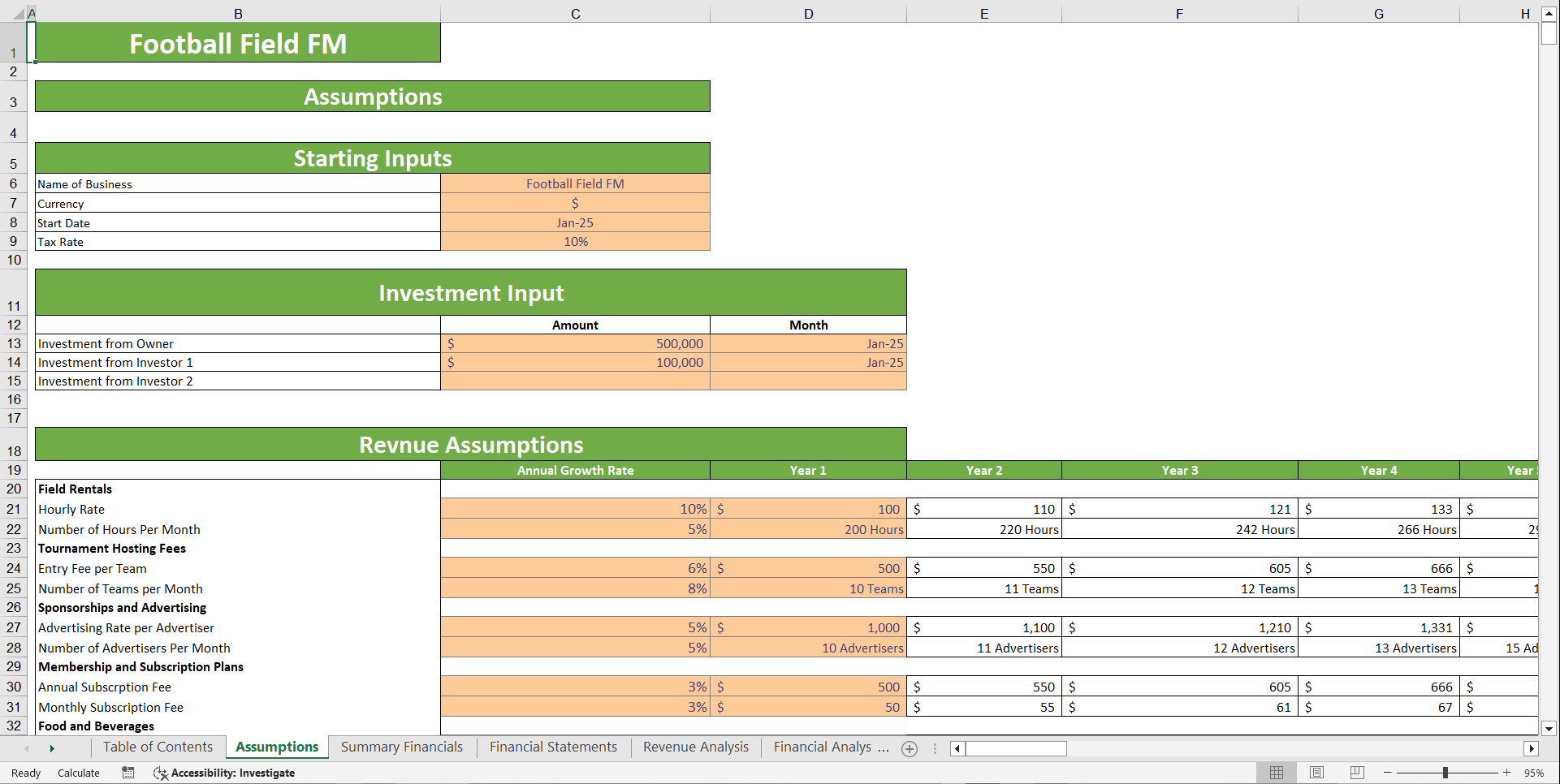

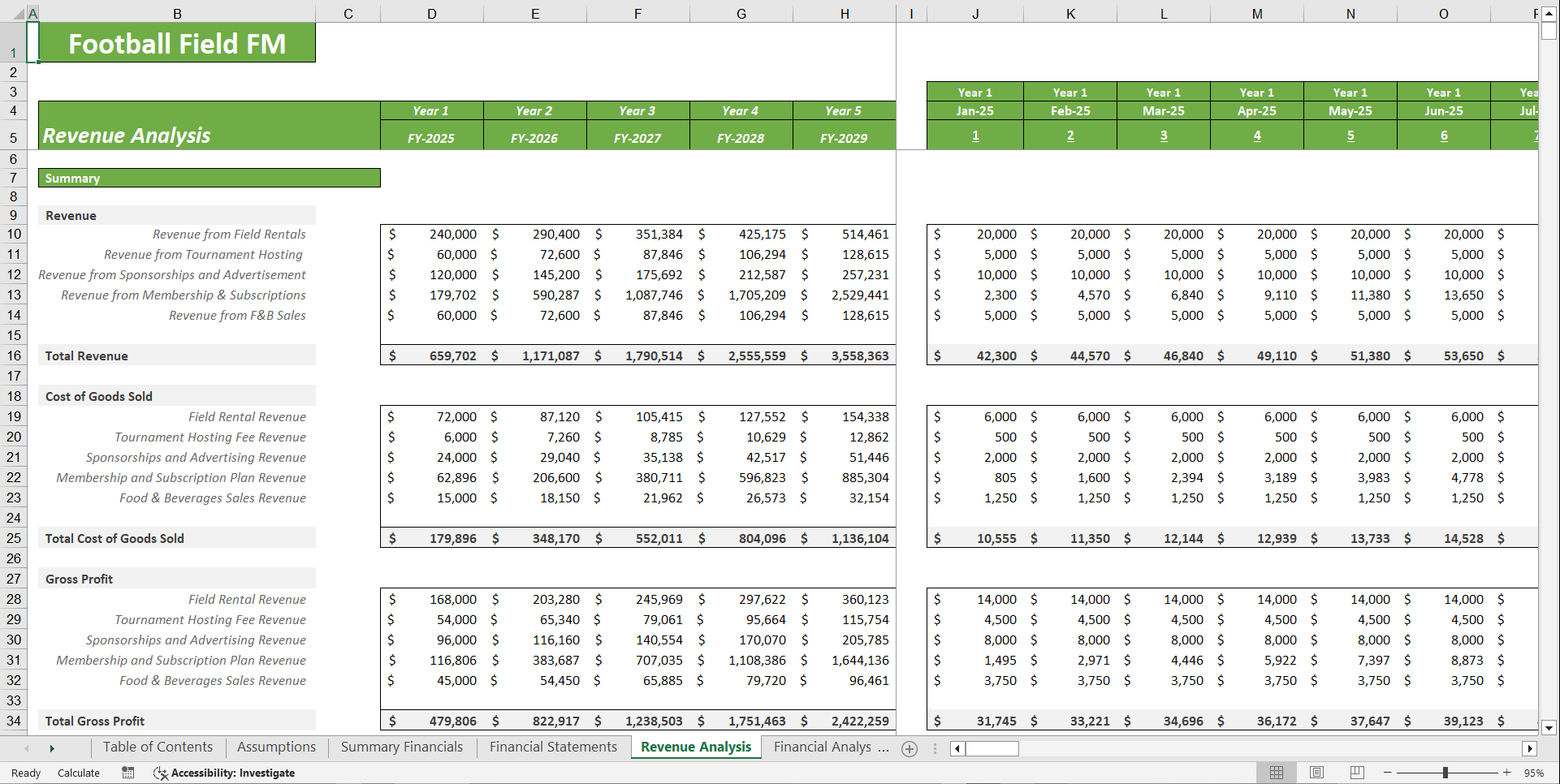

1. Revenue Projections

Field Rentals: Revenue generated from hourly field bookings with assumptions on rental rates, utilization hours, and expected growth.

Tournament Hosting Fees: Income from organizing tournaments, based on entry fees per team and the number of teams participating each month.

Sponsorships and Advertising: Earnings from advertisers and sponsors, considering rate per advertiser and the number of partnerships.

Membership and Subscription Plans: Recurring revenue from annual and monthly subscriptions, with assumptions on client distribution, acquisition, and churn rates.

Food and Beverages: Additional income from on-site sales, based on average spend per customer and customer footfall.

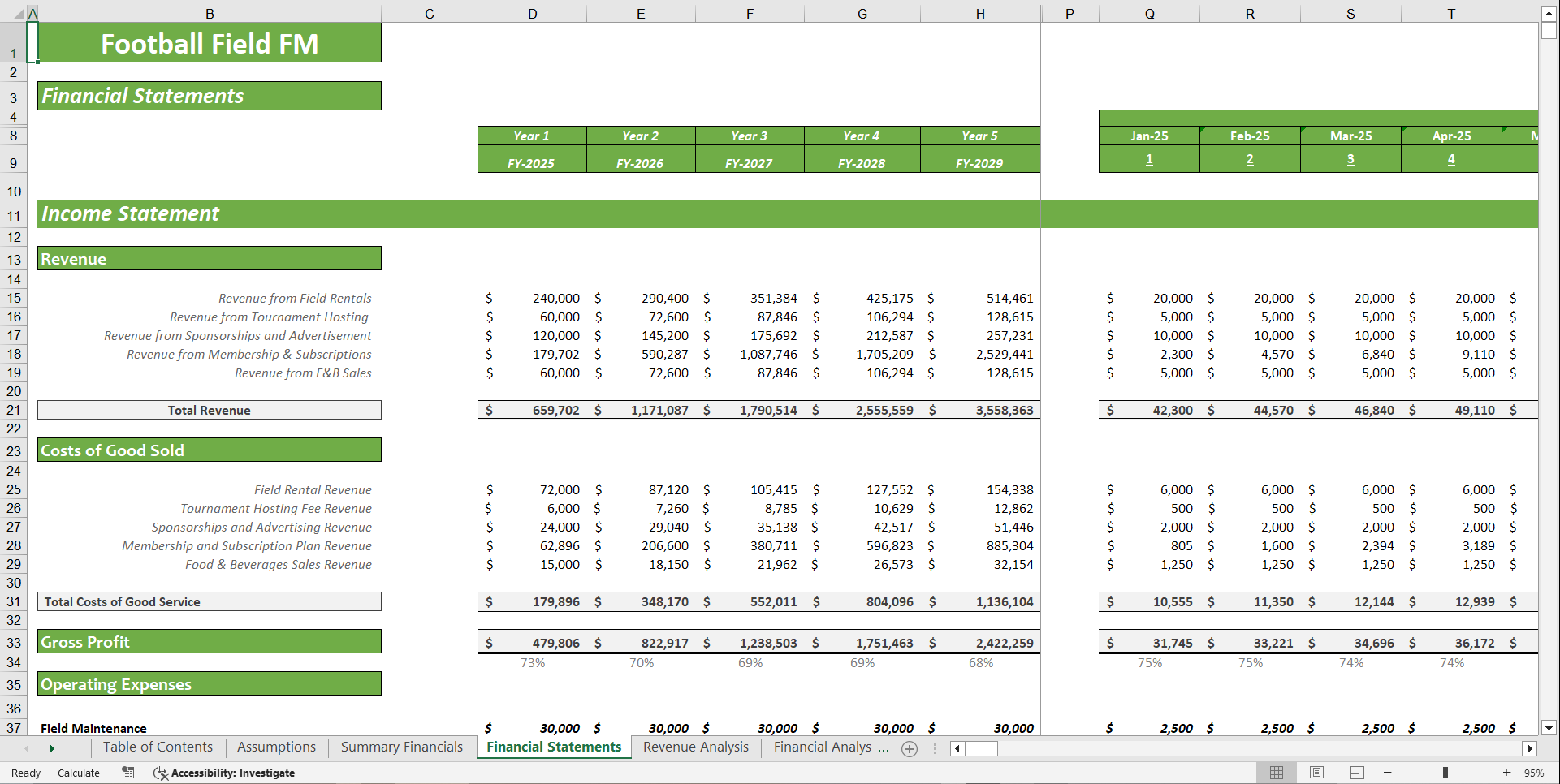

2. Cost Structure

Direct Costs: Variable costs tied to revenue streams such as field maintenance for rentals, event expenses for tournaments, advertising costs for sponsors, servicing expenses for memberships, and cost of goods for food and beverages.

Customer Acquisition Costs: Marketing expenses and cost per new client acquisition, including assumptions for distribution between annual and monthly plans, along with churn impact.

Administrative Expenses: Fixed overheads including staff salaries, utilities, rent, and general office management.

Business Expenses: Broader operational costs such as insurance, staff training, professional services, depreciation of facilities, and loan repayments for infrastructure.

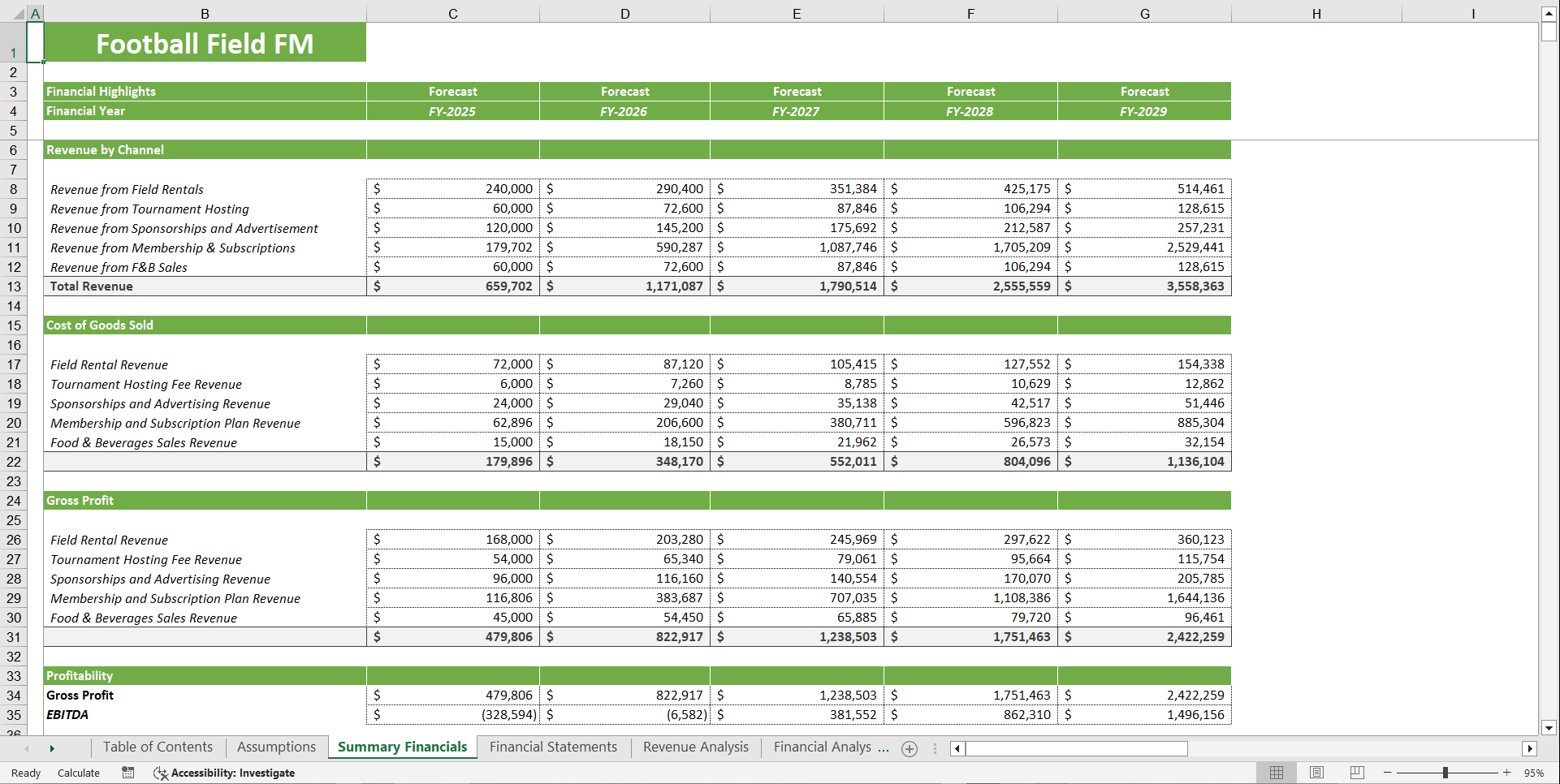

3. Profitability Analysis

Profit and Loss Statement: Track income, expenses, and profit over 5 years.

Gross Margin & Net Profit: Get to know what is the performance of the Industrial based on gross and net profit.

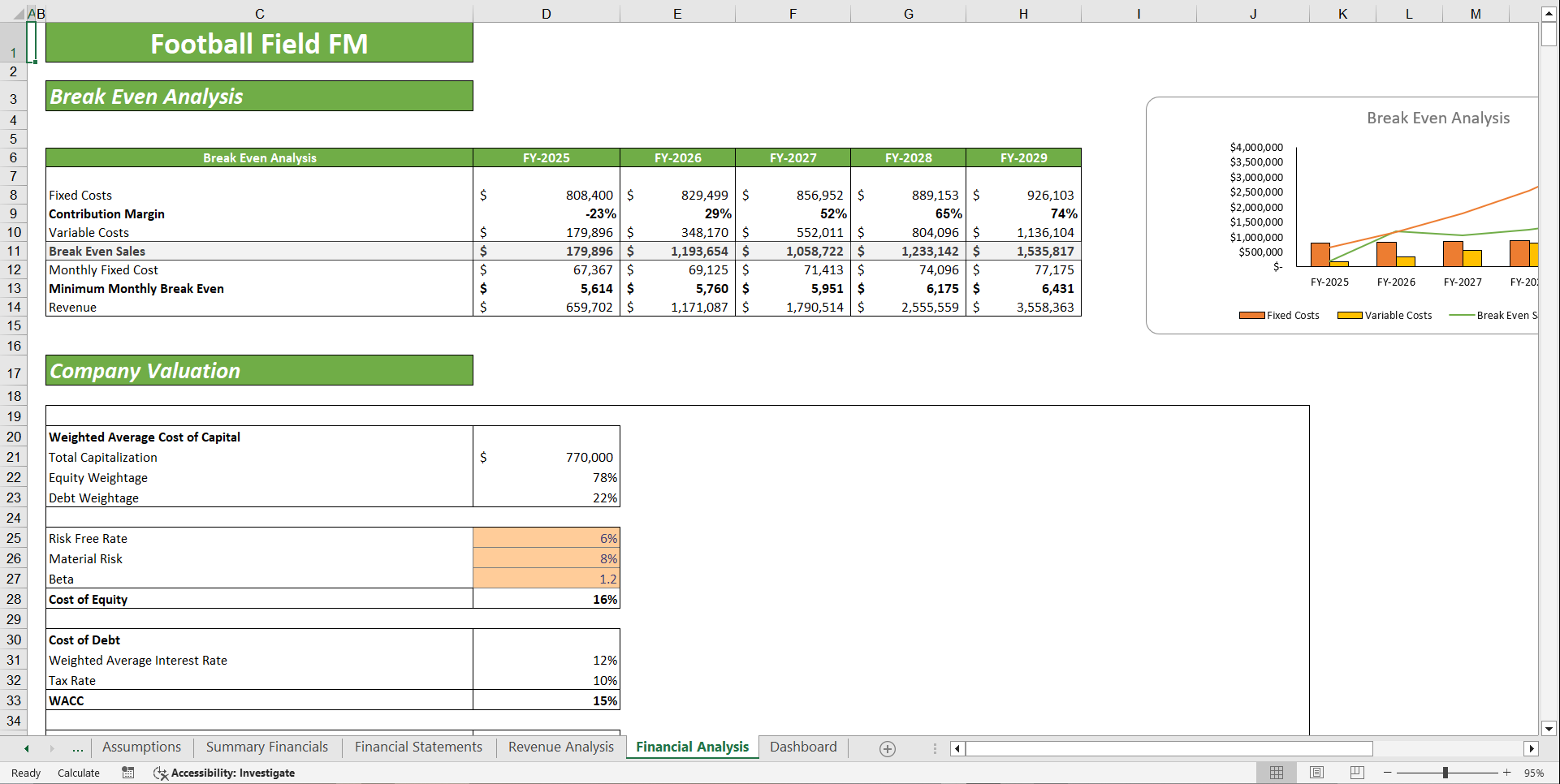

Break-Even Analysis: Determine the number of Customers needed to cover costs and achieve profitability.

4. Cash Flow Management

Cash Flow Statement: Track money flowing in and out of your business.

Financial Position: Ensure adequate working capital for seamless operations.

Investment Scheduling: Plan accordingly the cashflow to make your investment decisions for a smoother flow of operations.

5. Financial Forecasting & Scenario Analysis

5-Year Financial Plan: Develop long term projections for revenue, expenses, and profitability.

Market Conditions & Trends: Adjust financial forecasts based on industry changes and customer behavior.

Best-Case, Base-Case, and Worst-Case Scenarios: Evaluate different financial outcomes and prepare accordingly.

6. Key Performance Indicators (KPIs)

Valuation Methods & Ranges: Compare valuation outcomes across approaches such as DCF, trading multiples, and precedent transactions to understand value spread.

Scenario & Sensitivity Analysis: Track how different assumptions like growth rates, discount rates, or margins impact valuation ranges.

7. Investor Readiness & Business Strategy

Attract Potential Investors: Present a professional financial plan to secure funding.

Strategic Planning: Align business objectives with financial projections for long term success.

Cost Analysis & Optimization: Better understand which costs can be minimized and which one have to most impact on profitability.

Key Benefits of Using This Model

1. Better Financial Planning: Gain a clear understanding of your business's financial feasibility.

2. Optimized Operations: Enhance cost analysis and resource allocation.

3. Risk Mitigation: Plan ahead for financial uncertainties and avoid cash shortages.

4. Customizable Tool: Adapt the model to fit different business needs.

5. Scalability: Suitable for both small startups and established agencies.

FAQ's

What is a Football Field Excel Financial Model used for?

It is used to visually compare valuation ranges from multiple methods in one chart.

How does the Football Field model help in decision-making?

It provides a clear comparison of valuation outcomes to support strategic choices.

Who can use this model effectively?

It is useful for finance professionals, investors, and business owners.

Can I update the inputs easily in this model?

Yes, all inputs are structured and easy to update for quick analysis.

Do I need advanced Excel skills to use this model effectively?

No, it's user-friendly and designed for easy use with basic Excel knowledge.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Sport Management, Integrated Financial Model Excel: Football Field Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant