Commercial Janitorial Services 5-Year Financial Model (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Delivers a structured framework to build accurate 5-year revenue, cost, and cash flow projections for a commercial janitorial business.

- Enables informed decision-making by quantifying labor capacity, pricing strategy, contract profitability, and operational scalability.

- Supports investor, lender, and stakeholder communication with clear financial outputs, dashboards, valuation metrics, and professional reporting.

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

This financial model is engineered to evaluate and forecast the operating and financial performance of a commercial janitorial services company, capturing contract-driven revenue, workforce productivity, and monthly recurring operating dynamics across industrial, office, and medical facility cleaning segments.

It provides a full 5-Year (60-Month) forward-looking forecast, including detailed monthly schedules and annual summaries, enabling decision-makers to assess growth scalability, profitability, payroll cost exposure, staffing requirements, and return on investment.

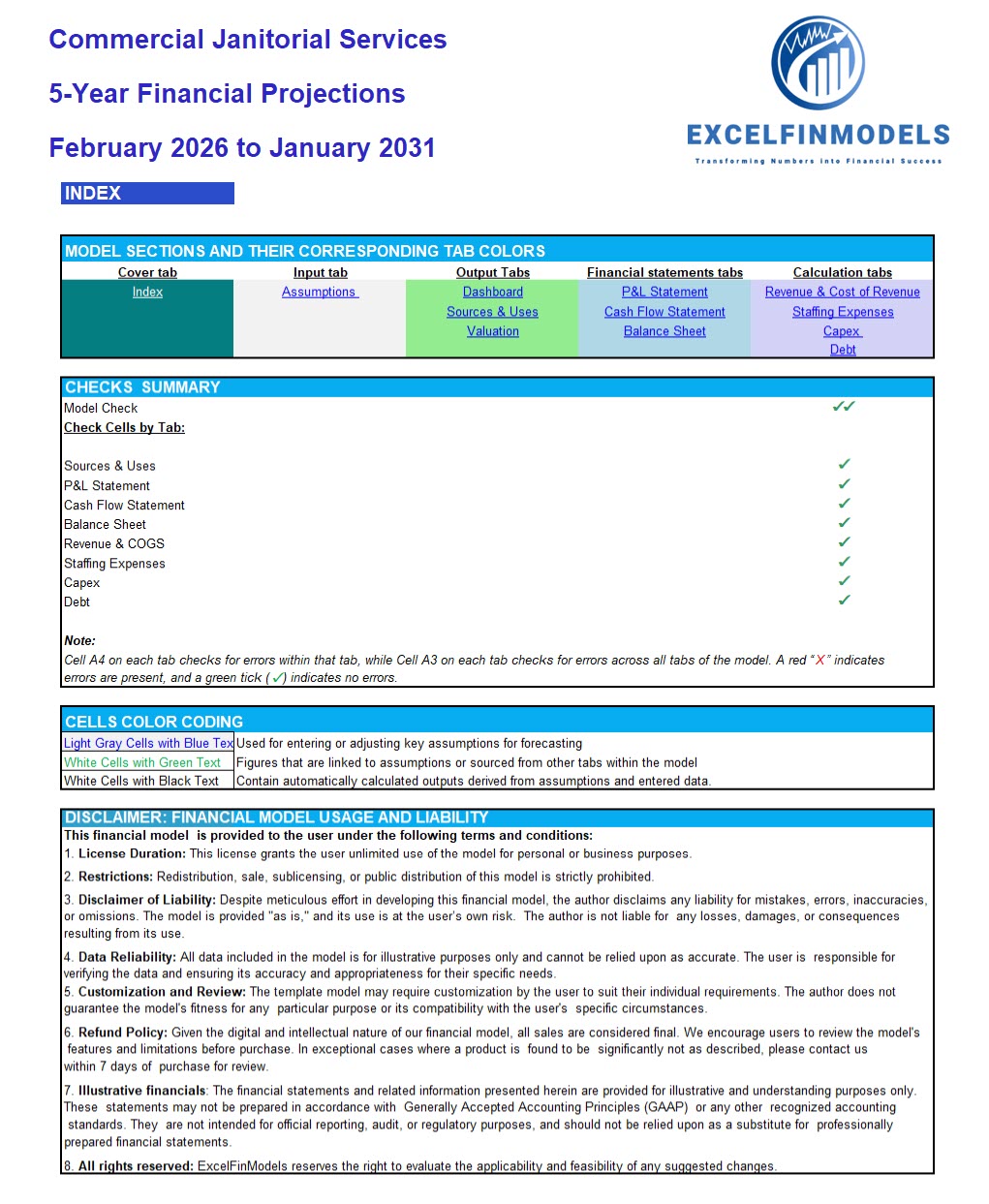

Model Structure – 5 Main Sections

1. Cover Section

• Organized index of all model tabs with navigation mapping

• Model validation summary to ensure structural integrity

• Formatting legend for editable inputs, linked cells, formulas, and protected computations

2. Input Assumptions Section

All business drivers are consolidated into one centralized assumptions interface, with editable inputs formatted in Light Gray with Blue Text for ease of modification.

Revenue Assumptions

The model supports industry-standard commercial janitorial revenue structures:

• Service lines

• Billing structure

• Contracted square footage

• Price per sq. ft. per cleaning cycle

• Cleaning frequency per month

• Travel/setup time

• Targeted improvement in friction efficiency over time

• Labor Payroll & Wage Structure

• Hourly wage rates by service segment

• Payroll taxes and employee benefits

Other Cost of Revenue (COGS)

• Supplies & consumables cost as % of revenue by service line

SG&A Expense Structure

• Operations management & administrative payroll

• Marketing, advertising, and sales acquisition spend etc.

Capital Expenditure (CapEx)

• Cleaning equipment acquisition schedule

• Vehicle and floor-machine assets

• Depreciation schedules

Working Capital

• Accounts receivable days

• Accounts payable days

• Inventory/consumables working capital

• Minimum cash reserve threshold

Financing

• Equity injections

• Term loan schedules

• Interest, principal amortization

• One-time setup expenses

3. Output & Analytics Section

Dashboard

• Revenue trend visualization

• Gross profit and EBITDA margin evolution

• Revenue segmentation by industry vertical

Sources & Uses

• Deployment of capital funding: equipment, working capital, start-up cost, reserve cash

• Funding mix comparison: equity vs. debt financing

Valuation

• Discounted Cash Flow (DCF) valuation

• Market-based terminal value multiple application

• Sensitivity analytics

4. Full Financial Statements

• Profit & Loss Statement

• Cash Flow Statement

• Balance Sheet

5. Calculations

• Revenue and COGS calculations

• Technician capacity & wage cost modeling

• CapEx and depreciation calculations

• Debt amortization calculations

Technical Specifications

• Fully transparent—no VBA or macros

• Circular reference-free

• Compatible with Excel 2010 or newer versions

• All formulas labeled and traceable

• Model supports unit conversion for multi-currency users

Validation Checks

Built-in validation checks ensure accuracy across the model. Each major tab contains local validation flags, and the Index tab consolidates all checks for quick review.

• Green ticks (✓) indicate correct and consistent logic

• Red crosses (✗) indicate areas requiring input or correction

Why This Model is Ideal for a Commercial Janitorial Business

This financial model enables comprehensive financial planning and institutional-grade analysis for janitorial service operators.

For customization, advisory support, or sector-specific enhancements (medical cleaning, school systems, apartment turnover, union workforce, day/night scheduling), direct assistance can be provided.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Commercial Janitorial Services 5-Year Financial Model Excel (XLSX) Spreadsheet, ExcelFinModels