Account Executive Performance Driven Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

PROFIT AND LOSS EXCEL DESCRIPTION

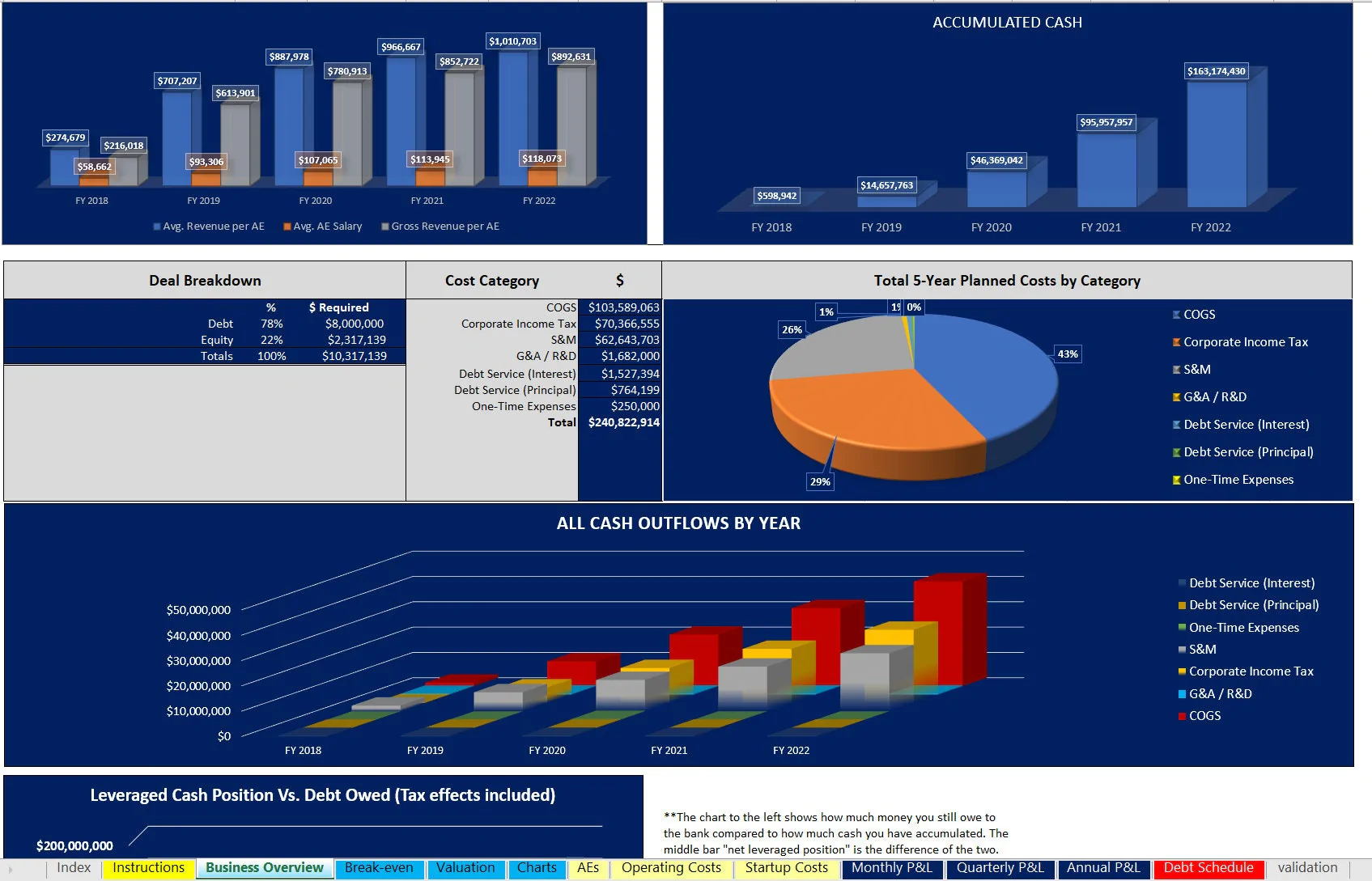

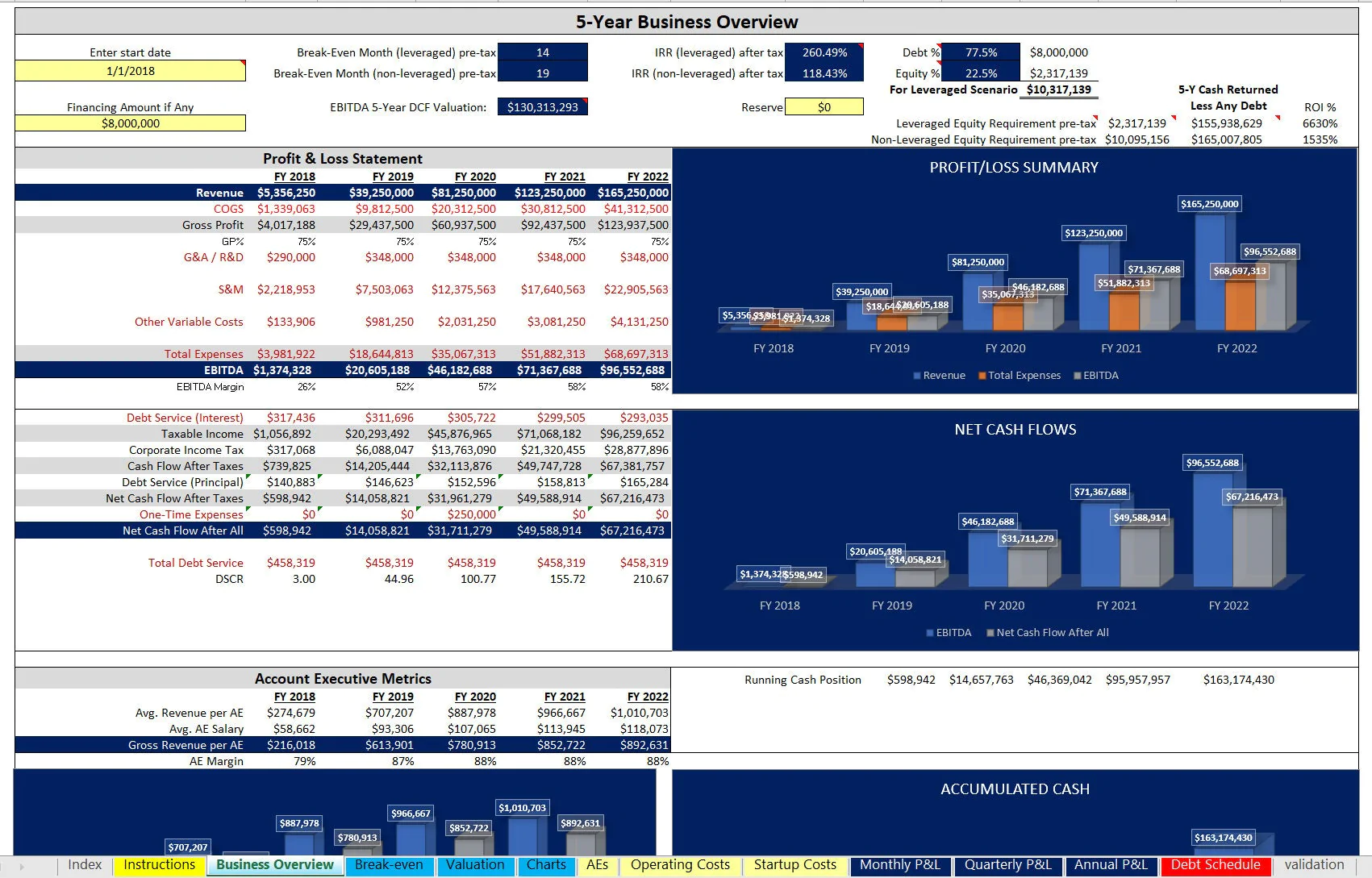

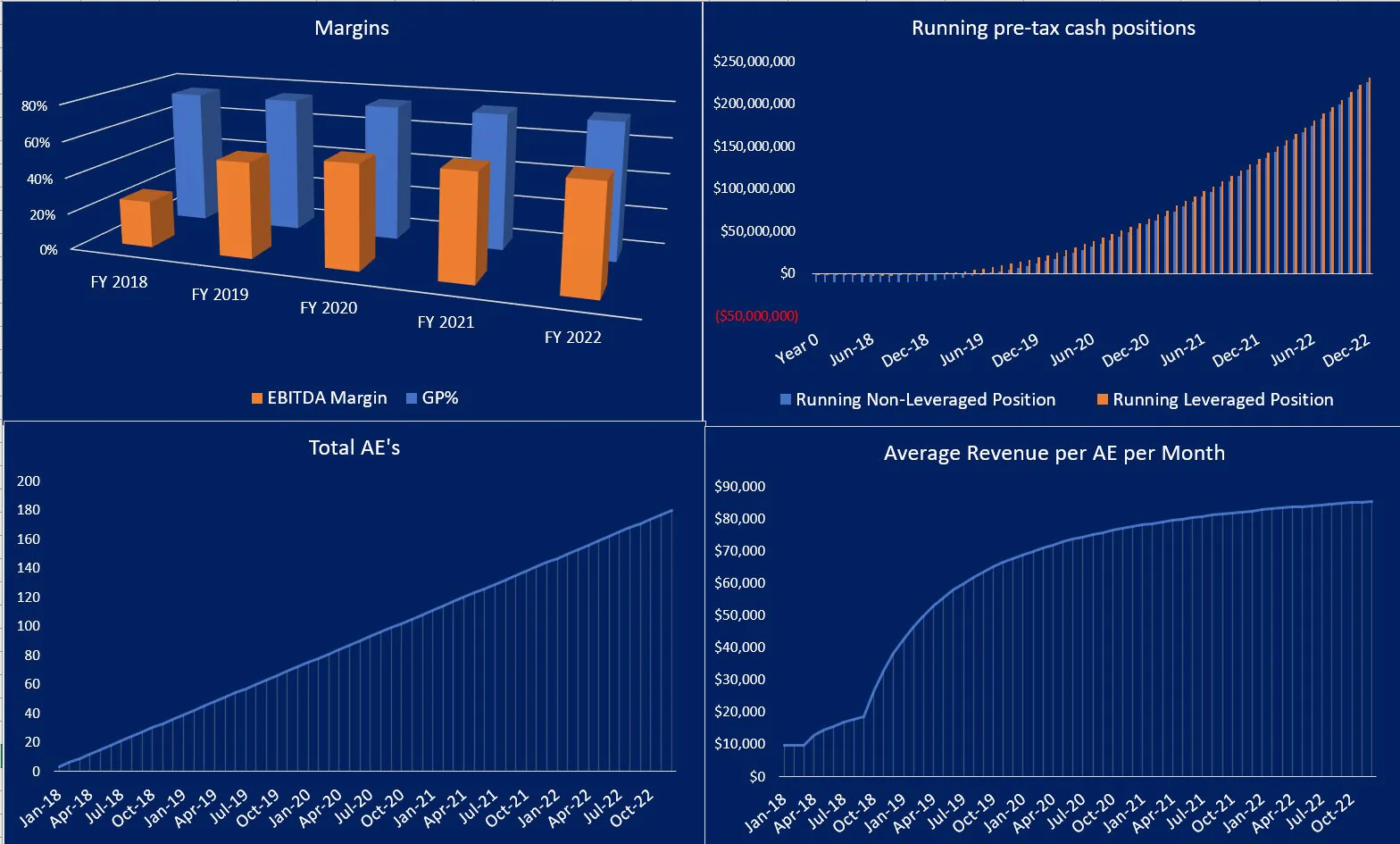

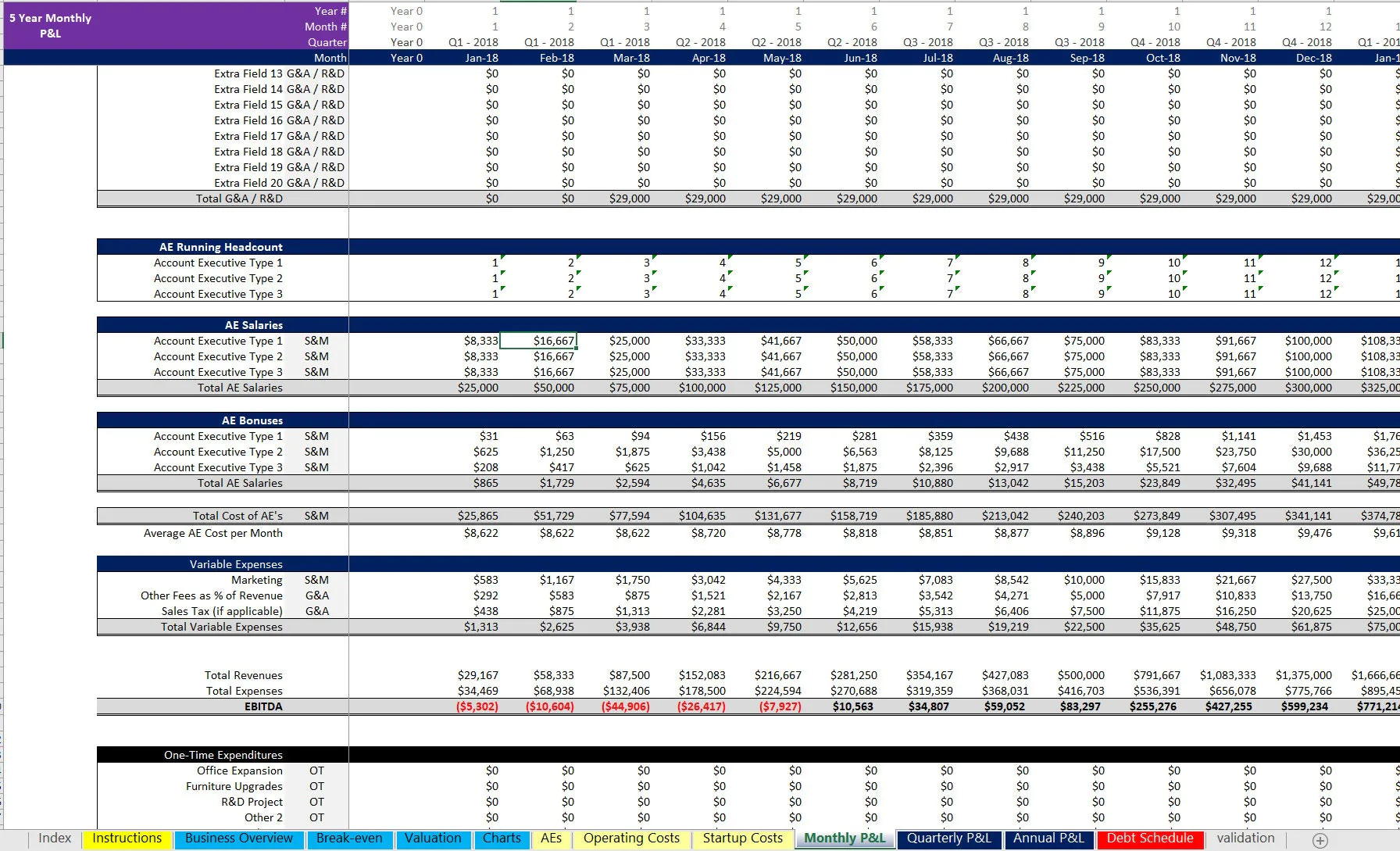

This is a full 5-year monthly, quarterly and annual financial model that uses unique quota attainment revenue logic to drive potential revenues. The use case here is any business that primarily earns revenue based on the performance of account executives.

Report tabs include:

• Monthly, Quarterly and Annual pro forma

• Annual break-even analysis and break even monthly/year for operations

• Valuation

• High level financial summary with IRR (leveraged / non-leveraged)

• DCF Analysis

• Visualizations of primary financial results

The primary advanced forecasting logic this template has deals with AE (account executive) performance.

The user can define up to 3 types of AEs and for each, the user defines:

• Count added per month

• Base Salary

• Flat Bonus %

• Annual Quota

• % of Quota attained in first 3/6/9/12 months of the life of an AE by type

The amount of revenue will dynamically be calculated based on inputs for the above and the goal of this logic is to model out human behavior (performance) dynamically and get a resulting amount of revenue brought in based on this performance.

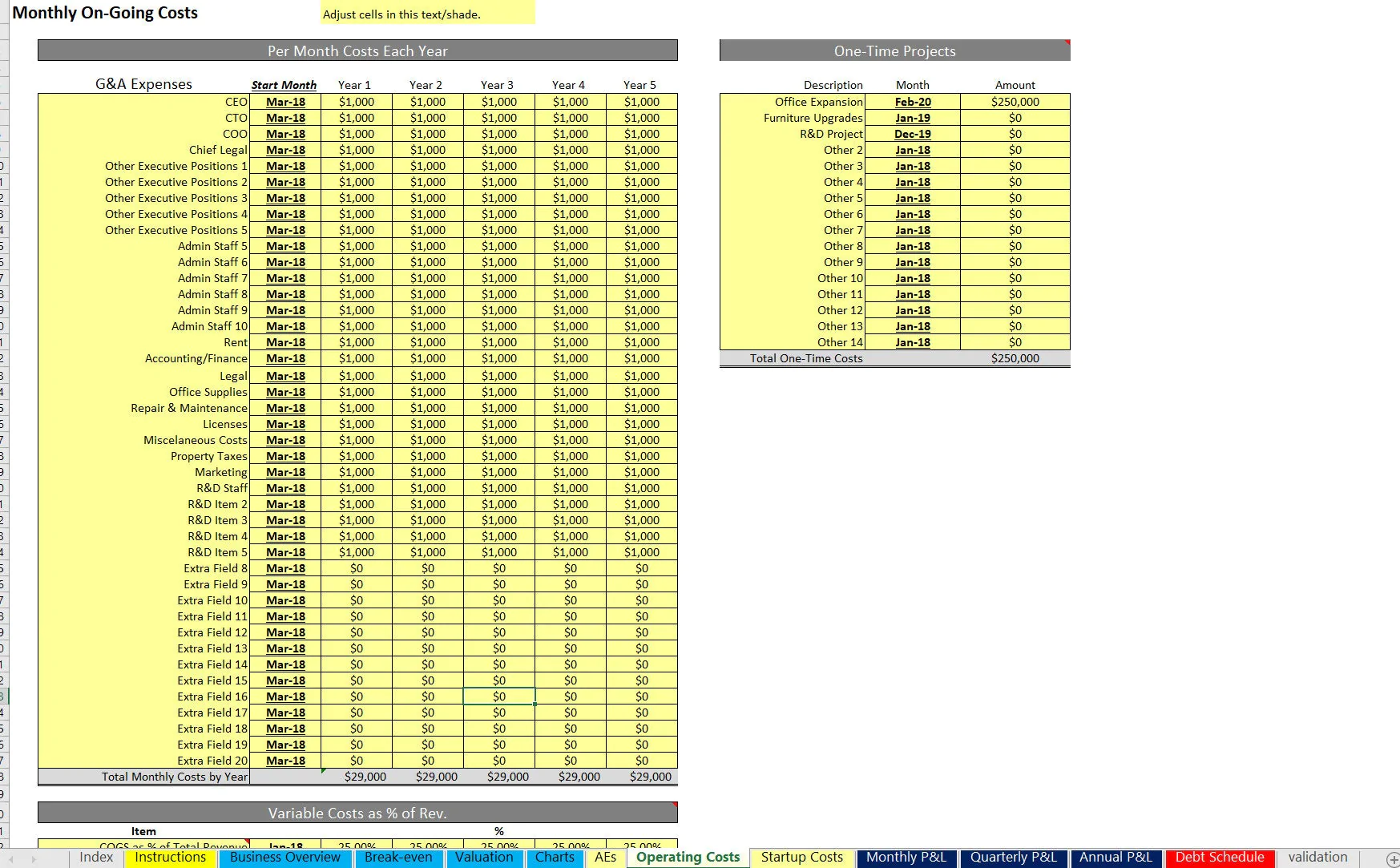

Operating cost schedule is simply defined by the cost description item, start month, and the monthly cost of each can be defined in each year. There are also multiple slots to account for cost of goods sold and/or any costs not already accounted for that are defined by a percentage of total revenue.

Note, the base salary for Account Executives is defined on the ‘AE' tab and not in the ‘Operating Costs' tab. More pieces of logic included are the potential for an exit (and that is used for valuation purposes as well) and is based on either a multiple of EBITDA or Revenue (optional for users to choose).

Also, debt can be a funding source as well as investor and any remaining would fall to the owners/operators. Any debt that exists upon exit is reduced from the exit proceeds. Most summary output data is shown per leveraged and unleveraged.

The monthly and annual pro forma shows EBITDA and cash flow before tax per period as well as cumulative cash position (leveraged/unleveraged).

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Profit and Loss, Key Account Management Excel: Account Executive Performance Driven Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping