100+ M&A Consulting SOPs (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- rovides a comprehensive framework for executing M&A deals, covering every stage from deal sourcing to post-merger integration.

- Offers 100+ fully structured SOPs detailing Purpose, Scope, Owner, Inputs, Workflow, Outputs, KPIs, Risks, and Review Frequency for consistent, risk-free execution.

- Empowers consultants and corporate teams to streamline processes, ensure compliance, and maximize transaction value with ready-to-use Excel templates.

M&A EXCEL DESCRIPTION

Curated by McKinsey-trained Executives

Unlock the Ultimate M&A Advantage: 100+ SOPs Excel Package for Dealmakers & Consultants

Are you an M&A professional, corporate strategist, or deal advisory consultant looking to streamline mergers and acquisitions processes, maximize efficiency, and mitigate risks? Our comprehensive 100+ M&A Consulting SOPs Excel Package is your one-stop solution. Designed by industry experts, this all-in-one template provides ready-to-use Standard Operating Procedures (SOPs) across the full deal lifecycle – from deal sourcing to post-merger integration and exit planning.

Whether you're a boutique advisory firm, corporate development team, or independent M&A consultant, this SOPs package ensures consistency, accuracy, and operational excellence in every transaction.

Each SOP in this package is fully detailed with Purpose, Scope, Owner/Role, Required Inputs, Step-by-Step Workflow, Outputs/Deliverables, KPIs/Success Metrics, Risks/Controls, and Review Frequency.

What's Inside: 15 Core Clusters Covering Every Critical M&A Process

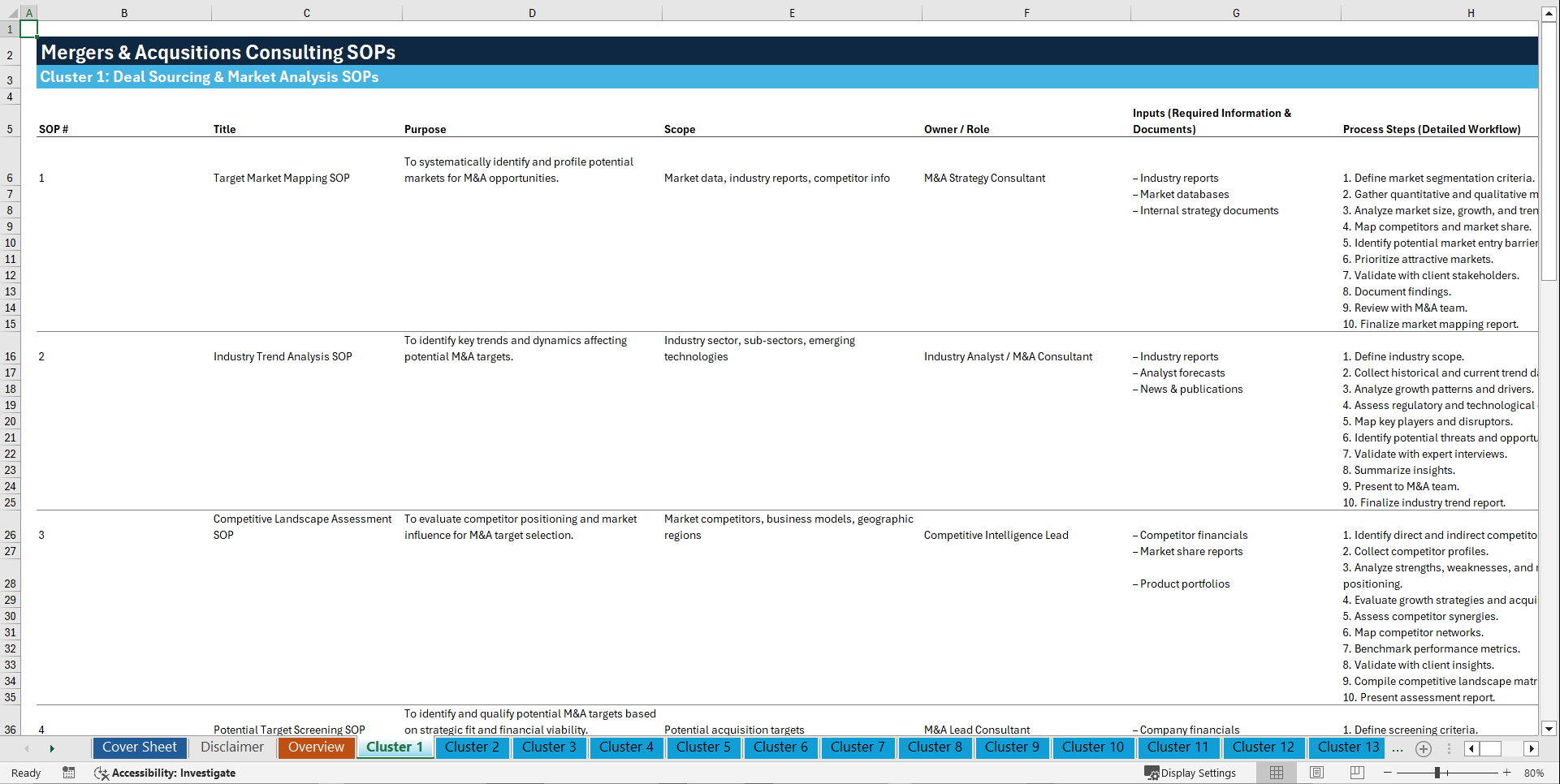

Cluster 1: Deal Sourcing & Market Analysis

• Target Market Mapping SOP

• Industry Trend Analysis SOP

• Competitive Landscape Assessment SOP

• Potential Target Screening SOP

• Strategic Fit Evaluation SOP

• Deal Origination Process SOP

• Confidential Approach Procedure SOP

• Initial Market Intelligence Report SOP

• Deal Qualification Checklist SOP

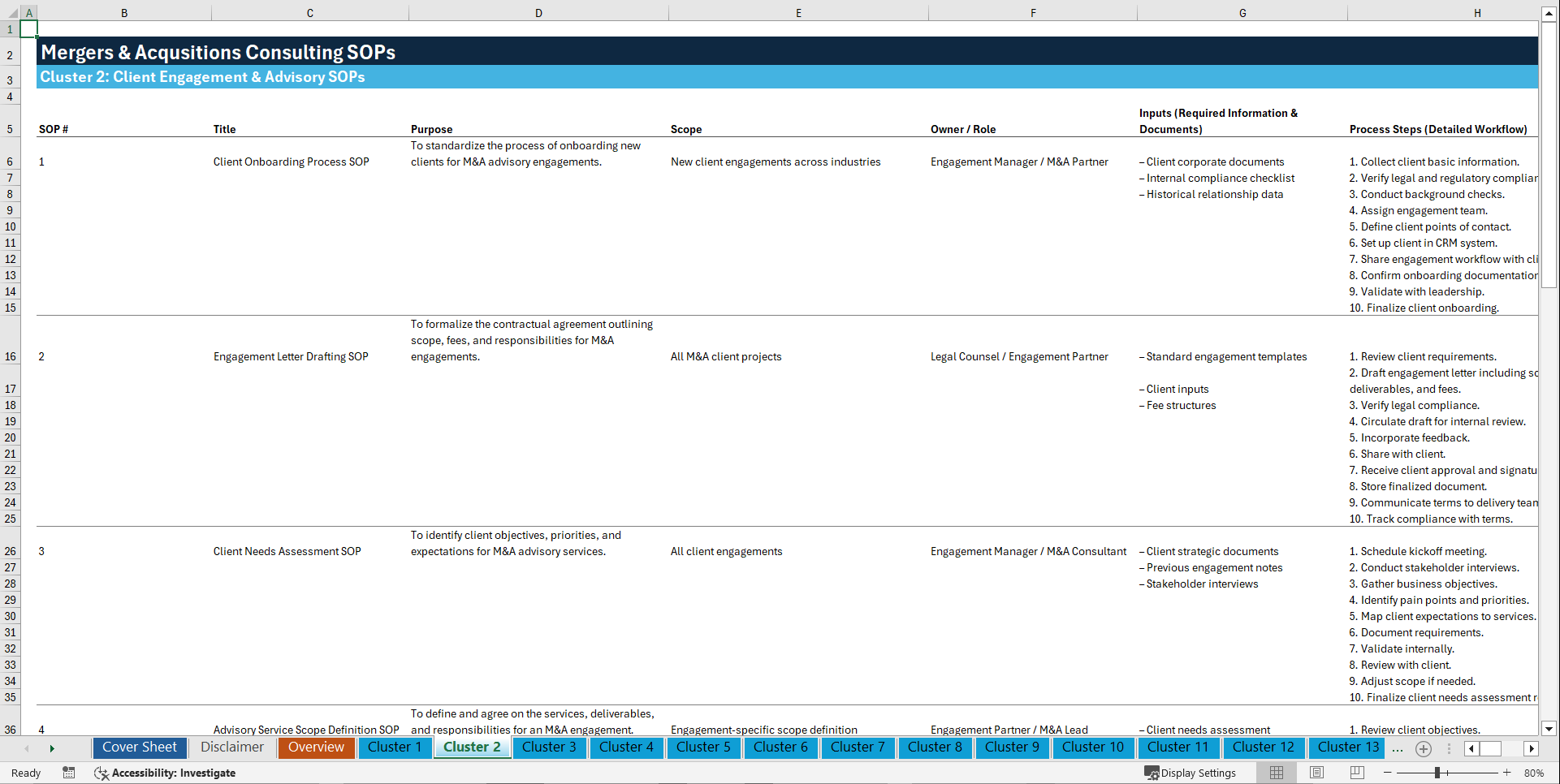

Cluster 2: Client Engagement & Advisory

• Client Onboarding Process SOP

• Engagement Letter Drafting SOP

• Client Needs Assessment SOP

• Advisory Service Scope Definition SOP

• Lead Generation & Tracking SOP

• Stakeholder Communication Protocol SOP

• Client Reporting Template SOP

• Confidential Meeting Preparation SOP

• Relationship Management SOP

• Retainer Fee Structuring SOP

Cluster 3: Financial Due Diligence

• Financial Statement Review SOP

• Cash Flow Analysis SOP

• Balance Sheet Assessment SOP

• Profit & Loss Analysis SOP

• Working Capital Review SOP

• Revenue Recognition Check SOP

• EBITDA Reconciliation Process SOP

• Forecasting & Projections SOP

• Financial Risk Identification SOP

Cluster 4: Operational & Commercial Due Diligence

• Operational Assessment Checklist SOP

• Supply Chain Review SOP

• Production Capacity Evaluation SOP

• Customer Base Analysis SOP

• Sales Process Review SOP

• Cost Structure Analysis SOP

• IT Systems Assessment SOP

• Operational Risk Report SOP

Cluster 5: Legal & Regulatory Due Diligence

• Corporate Structure Review SOP

• Intellectual Property Check SOP

• Contract & Agreement Review SOP

• Employment Law Compliance SOP

• Vendor & Contract Review SOP

• Litigation & Dispute Check SOP

• Regulatory Compliance Assessment SOP

• Licensing & Permits Verification SOP

• Anti-Trust & Competition Screening SOP

• Environmental Compliance Review SOP

• Legal Risk Report SOP

Cluster 6: Tax & Accounting Due Diligence

• Tax Compliance Review SOP

• Deferred Tax Analysis SOP

• Transfer Pricing Review SOP

• Tax Exposure Identification SOP

• Accounting Policies Assessment SOP

• Tax Structuring Options SOP

• Audit Report Evaluation SOP

• Tax Risk Mitigation SOP

• Historical Tax Filing Review SOP

• Integration Tax Planning SOP

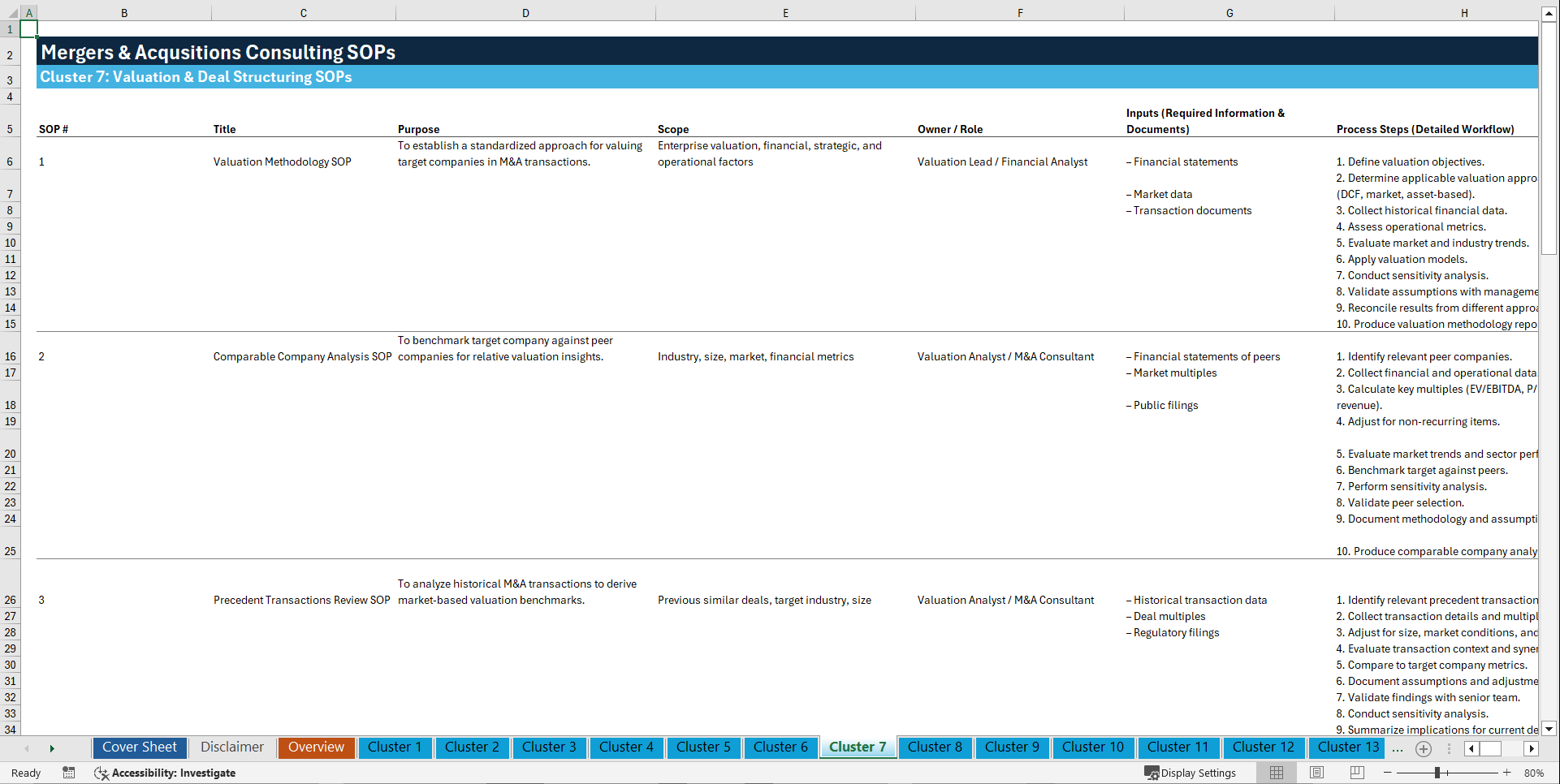

Cluster 7: Valuation & Deal Structuring

• Valuation Methodology SOP

• Comparable Company Analysis SOP

• Precedent Transactions Review SOP

• Discounted Cash Flow Model SOP

• Synergy Identification SOP

• Deal Pricing Strategy SOP

• Capital Structure Assessment SOP

• Contingent Consideration Planning SOP

• Scenario Analysis Report SOP

Cluster 8: Negotiation & Deal Execution

• Negotiation Planning SOP

• Bid/Offer Preparation SOP

• Term Sheet Drafting SOP

• Letter of Intent Checklist SOP

• Key Deal Terms Analysis SOP

• Risk Allocation Planning SOP

• Confidentiality & NDA Process SOP

• Payment Mechanism SOP

• Deal Approval Workflow SOP

• Counterparty Engagement SOP

• Closing Preparation Checklist SOP

Cluster 9: Post-Merger Integration Planning

• Integration Strategy Framework SOP

• Integration Workstream Setup SOP

• Change Management SOP

• Culture Assessment & Alignment SOP

• Organizational Structure Planning SOP

• Process Harmonization SOP

• IT & Systems Integration SOP

• HR & Talent Retention Plan SOP

• Synergy Tracking & Monitoring SOP

• Integration Risk Assessment SOP

Cluster 10: Project Management & Governance

• Deal Project Plan SOP

• Milestone Tracking SOP

• Internal Reporting Protocol SOP

• Decision-Making Governance SOP

• Task Ownership Assignment SOP

• Quality Assurance SOP

• Internal Audit Checklist SOP

• Communication & Escalation SOP

Cluster 11: Stakeholder & Investor Management

• Investor Communication SOP

• Board Reporting Templates SOP

• Shareholder Engagement SOP

• Key Stakeholder Mapping SOP

• Investor Due Diligence Support SOP

• Confidential Information Management SOP

• Investor Meeting Preparation SOP

• Shareholder Approval Process SOP

• External Advisor Coordination SOP

• Stakeholder Risk Analysis SOP

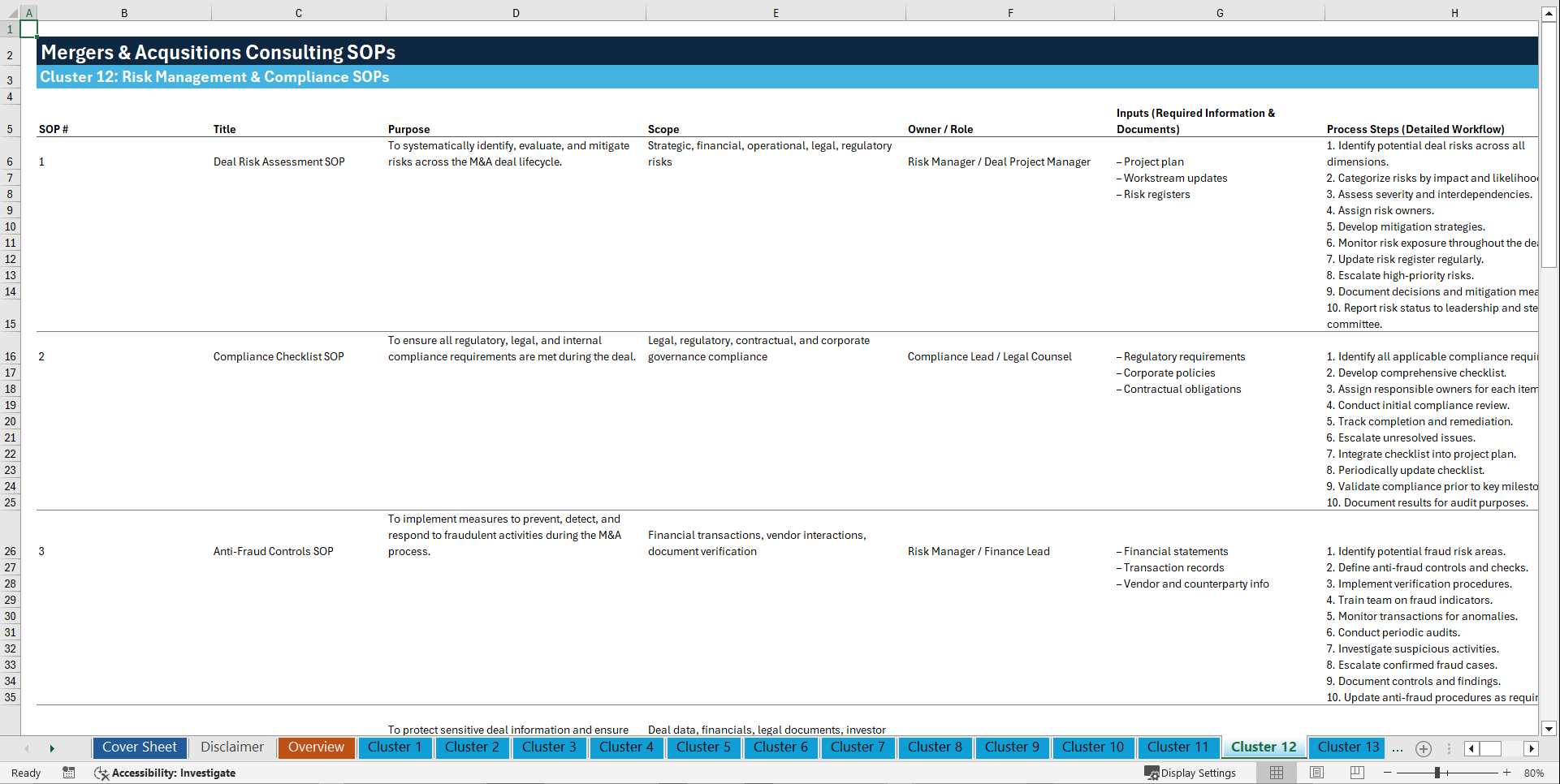

Cluster 12: Risk Management & Compliance

• Deal Risk Assessment SOP

• Compliance Checklist SOP

• Anti-Fraud Controls SOP

• Confidential Data Handling SOP

• Information Security Protocol SOP

• Sanctions & AML Check SOP

• Cybersecurity Risk Assessment SOP

• Regulatory Reporting SOP

• Contingency Planning SOP

• Litigation Risk Monitoring SOP

Cluster 13: Communication & Reporting

• Internal Status Reporting SOP

• Executive Summary SOP

• Board Presentation SOP

• Investor Update SOP

• Due Diligence Report SOP

• Deal Memorandum SOP

• Management Presentation Checklist SOP

• Internal Newsletter SOP

• Confidential Information Memo SOP

• Performance Dashboard SOP

Cluster 14: Knowledge Management & Training

• Best Practices Documentation SOP

• Template Management SOP

• Training & Onboarding SOP

• Knowledge Repository Maintenance SOP

• Advisory Methodology Updates SOP

• Employee Skill Assessment SOP

• Continuous Improvement SOP

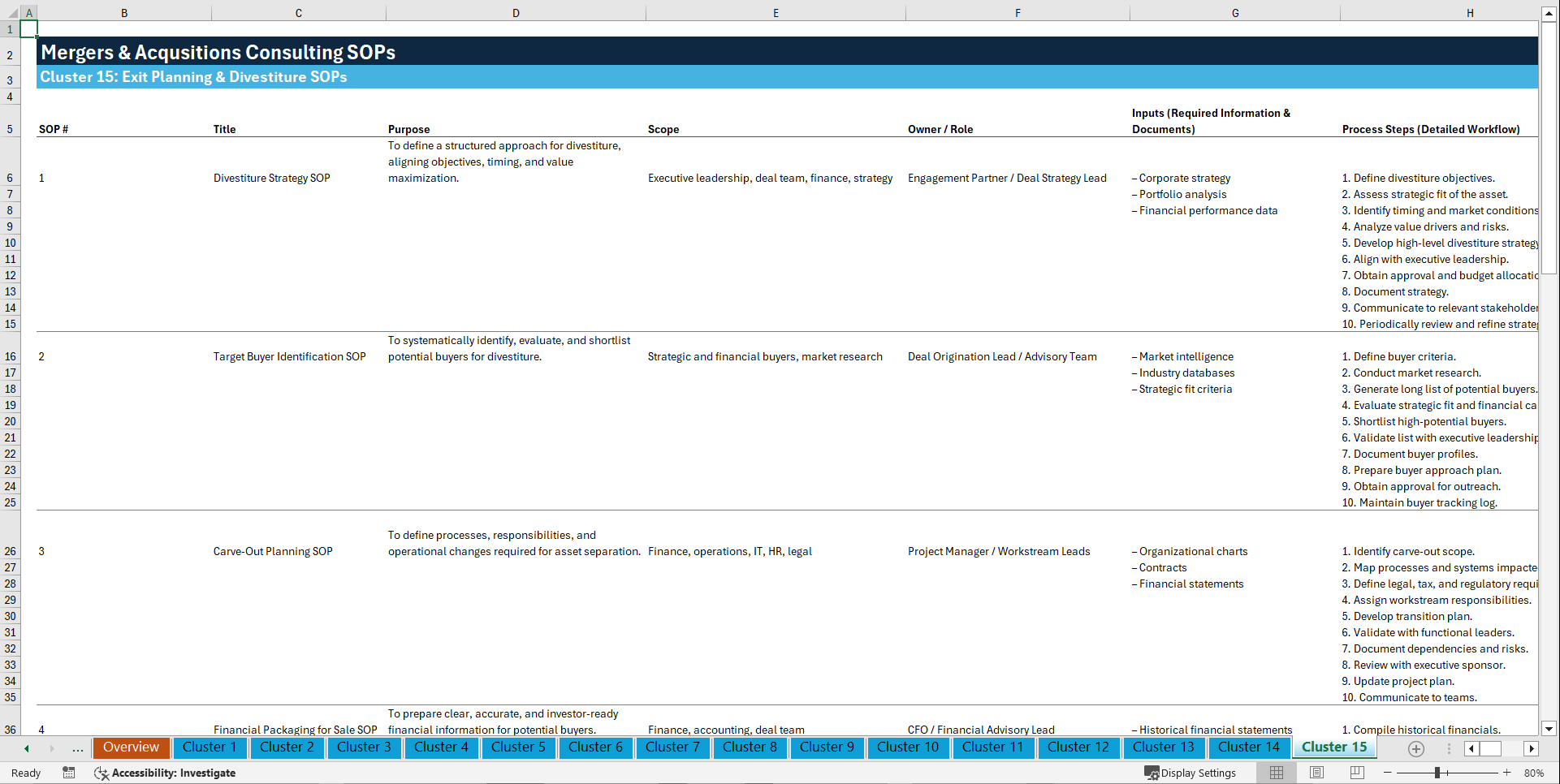

Cluster 15: Exit Planning & Divestiture

• Divestiture Strategy SOP

• Target Buyer Identification SOP

• Financial Packaging for Sale SOP

• Legal & Regulatory Clearance SOP

• Sale Process Timeline SOP

• Bid Evaluation Checklist SOP

• Carve-Out Planning SOP

• Closing & Handover Process SOP

• Post-Sale Performance Review SOP

Why This M&A SOPs Excel Package is a Game-Changer

✅ Over 100 SOPs Covering the Entire M&A Lifecycle – No more guesswork, missed steps, or inconsistent workflows.

✅ Detailed Workflow Structure – Each SOP includes Purpose, Scope, Owner/Role, Inputs, Process Steps, Outputs, KPIs, Risks, Controls, and Review Frequency.

✅ Plug-and-Play Excel Templates – Immediately integrate into your team's operations and scale your advisory capabilities.

✅ Mitigate Risk, Ensure Compliance, and Boost Efficiency – Covering financial, operational, legal, tax, accounting, negotiation, integration, and exit processes.

✅ Investor-Ready Documentation – Impress stakeholders with professional templates for reporting, governance, and deal communications.

✅ Expertly Designed by M&A Practitioners – Practical, real-world SOPs used in top-tier advisory and corporate M&A projects.

This is the ultimate M&A consulting toolkit, meticulously structured to ensure your deals are faster, safer, and more profitable. Don't leave your next transaction to chance – equip your team with 100+ SOPs Excel templates today and transform how you source, structure, execute, and close deals.

Key Words:

Strategy & Transformation, Growth Strategy, Strategic Planning, Strategy Frameworks, Innovation Management, Pricing Strategy, Core Competencies, Strategy Development, Business Transformation, Marketing Plan Development, Product Strategy, Breakout Strategy, Competitive Advantage, Mission, Vision, Values, Strategy Deployment & Execution, Innovation, Vision Statement, Core Competencies Analysis, Corporate Strategy, Product Launch Strategy, BMI, Blue Ocean Strategy, Breakthrough Strategy, Business Model Innovation, Business Strategy Example, Corporate Transformation, Critical Success Factors, Customer Segmentation, Customer Value Proposition, Distinctive Capabilities, Enterprise Performance Management, KPI, Key Performance Indicators, Market Analysis, Market Entry Example, Market Entry Plan, Market Intelligence, Market Research, Market Segmentation, Market Sizing, Marketing, Michael Porter's Value Chain, Organizational Transformation, Performance Management, Performance Measurement, Platform Strategy, Product Go-to-Market Strategy, Reorganization, Restructuring, SWOT, SWOT Analysis, Service 4.0, Service Strategy, Service Transformation, Strategic Analysis, Strategic Plan Example, Strategy Deployment, Strategy Execution, Strategy Frameworks Compilation, Strategy Methodologies, Strategy Report Example, Value Chain, Value Chain Analysis, Value Innovation, Value Proposition, Vision Statement, Corporate Strategy, Business Development, Busienss plan pdf, business plan, PDF, Biusiness Plan DOC, Bisiness Plan Template, PPT, Market strategy playbook, strategic market planning, competitive analysis tools, market segmentation frameworks, growth strategy templates, product positioning strategy, market execution toolkit, strategic alignment playbook, KPI and OKR frameworks, business growth strategy guide, cross-functional strategy templates, market risk management, market strategy PowerPoint dec, guide, ebook, e-book ,McKinsey Change Playbook, Organizational change management toolkit, Change management frameworks 2025, Influence model for change, Change leadership strategies, Behavioral change in organizations, Change management PowerPoint templates, Transformational leadership in change, supply chain KPIs, supply chain KPI toolkit, supply chain PowerPoint template, logistics KPIs, procurement KPIs, inventory management KPIs, supply chain performance metrics, manufacturing KPIs, supply chain dashboard, supply chain strategy KPIs, reverse logistics KPIs, sustainability KPIs in supply chain, financial supply chain KPIs, warehouse KPIs, digital supply chain KPIs, 1200 KPIs, supply chain scorecard, KPI examples, supply chain templates, Corporate Finance SOPs, Finance SOP Excel Template, CFO Toolkit, Finance Department Procedures, Financial Planning SOPs, Treasury SOPs, Accounts Payable SOPs, Accounts Receivable SOPs, General Ledger SOPs, Accounting Policies Template, Internal Controls SOPs, Finance Process Standardization, Finance Operating Procedures, Finance Department Excel Template, FP&A Process Documentation, Corporate Finance Template, Finance SOP Toolkit, CFO Process Templates, Accounting SOP Package, Tax Compliance SOPs, Financial Risk Management Procedures.

NOTE: Our digital products are sold on an "as is" basis, making returns and refunds unavailable post-download. Please preview and inquire before purchasing. Please contact us before purchasing if you have any questions! This policy aligns with the standard Flevy Terms of Usage.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in M&A Excel: 100+ M&A Consulting SOPs Excel (XLSX) Spreadsheet, SB Consulting