Transaction Services – FDD Net Debt & Debt-Like Items Model (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a clear, audit-friendly Net Debt view, including debt-like items and an OWC vs. Net Debt split.

- Supports reported and pro-forma Net Debt with traceable adjustments for transaction-specific items.

- Delivers leverage KPIs and trend charts to monitor Net Debt composition and development over time.

DUE DILIGENCE EXCEL DESCRIPTION

Purpose of the tool

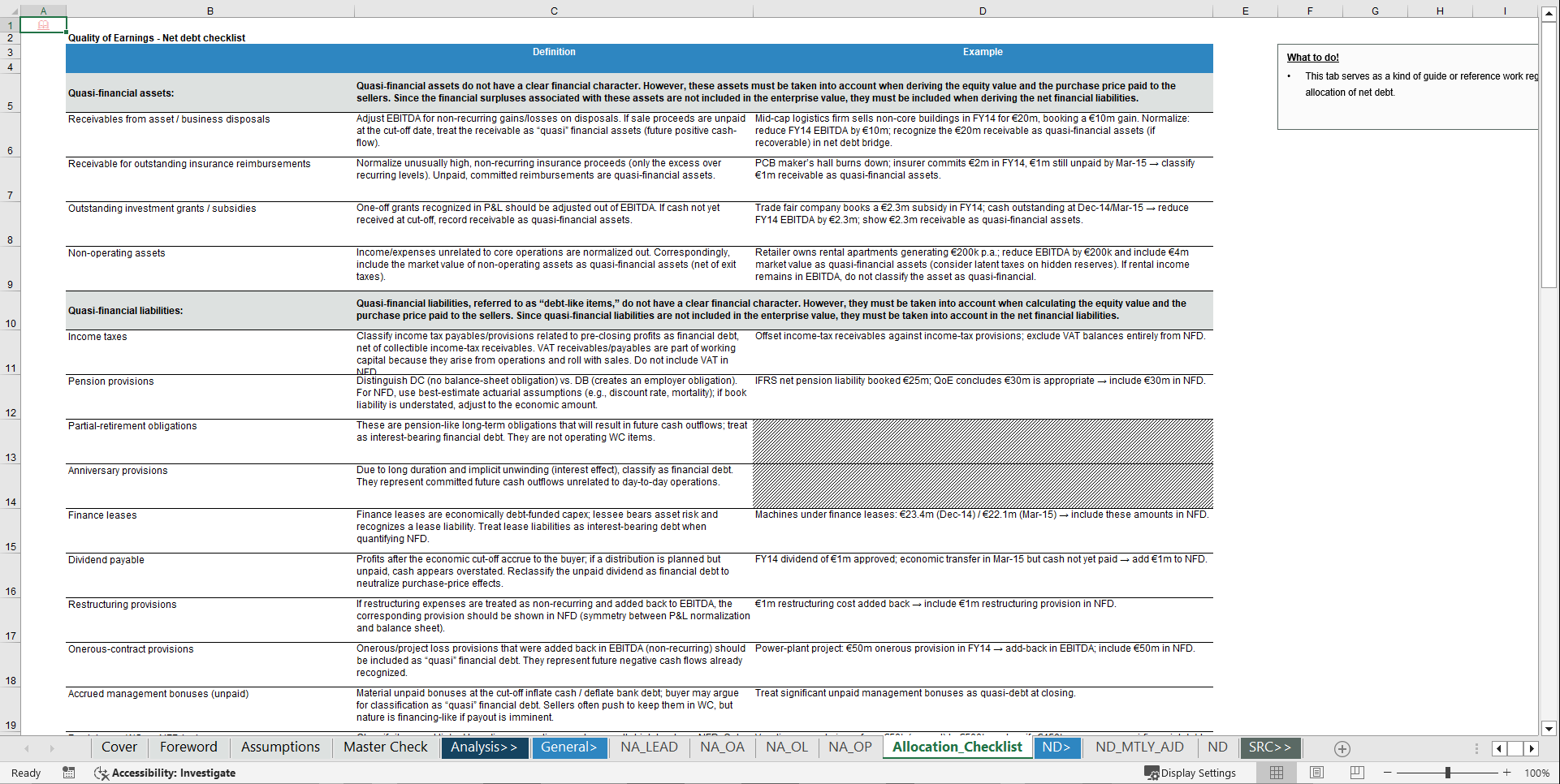

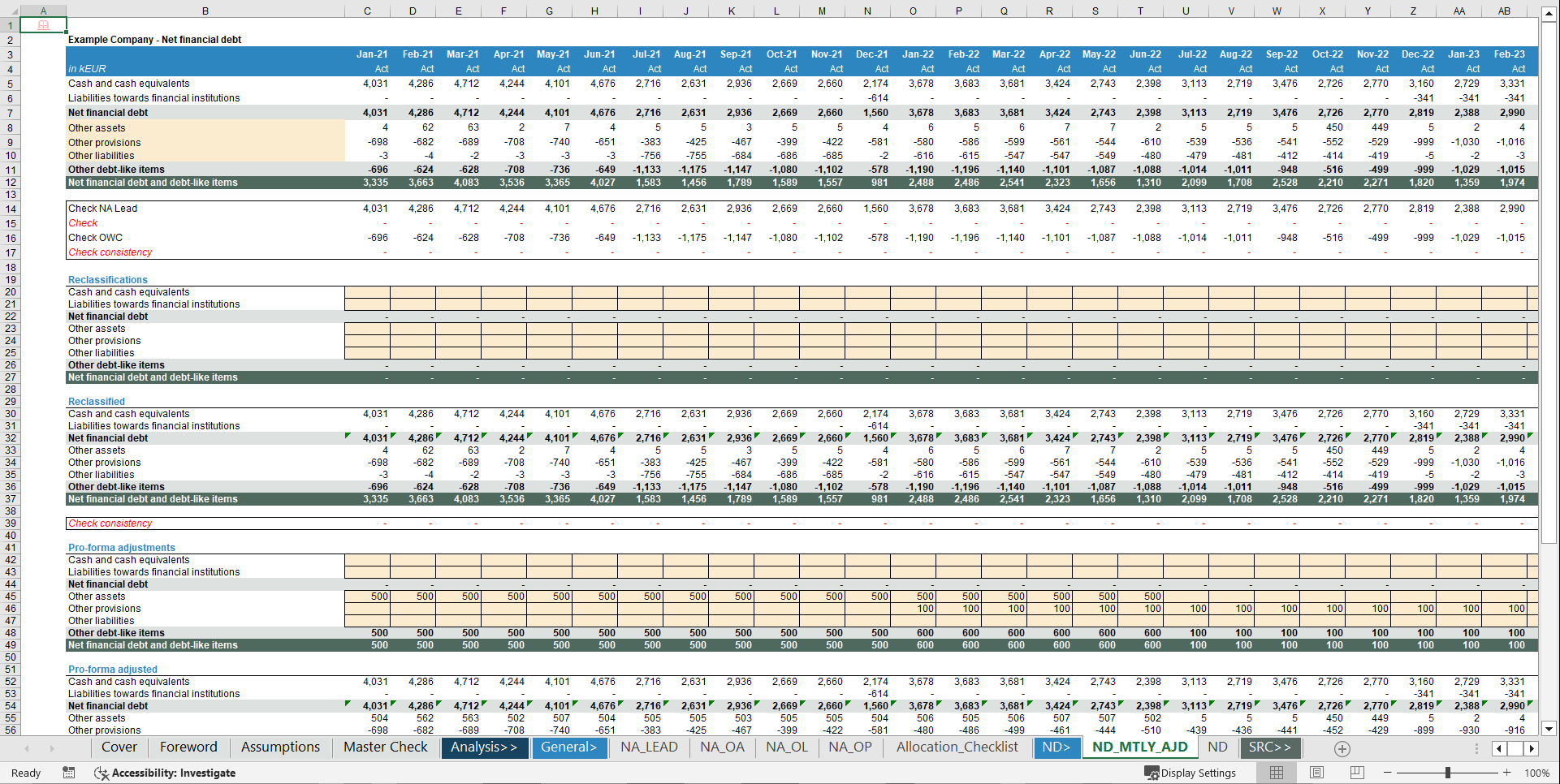

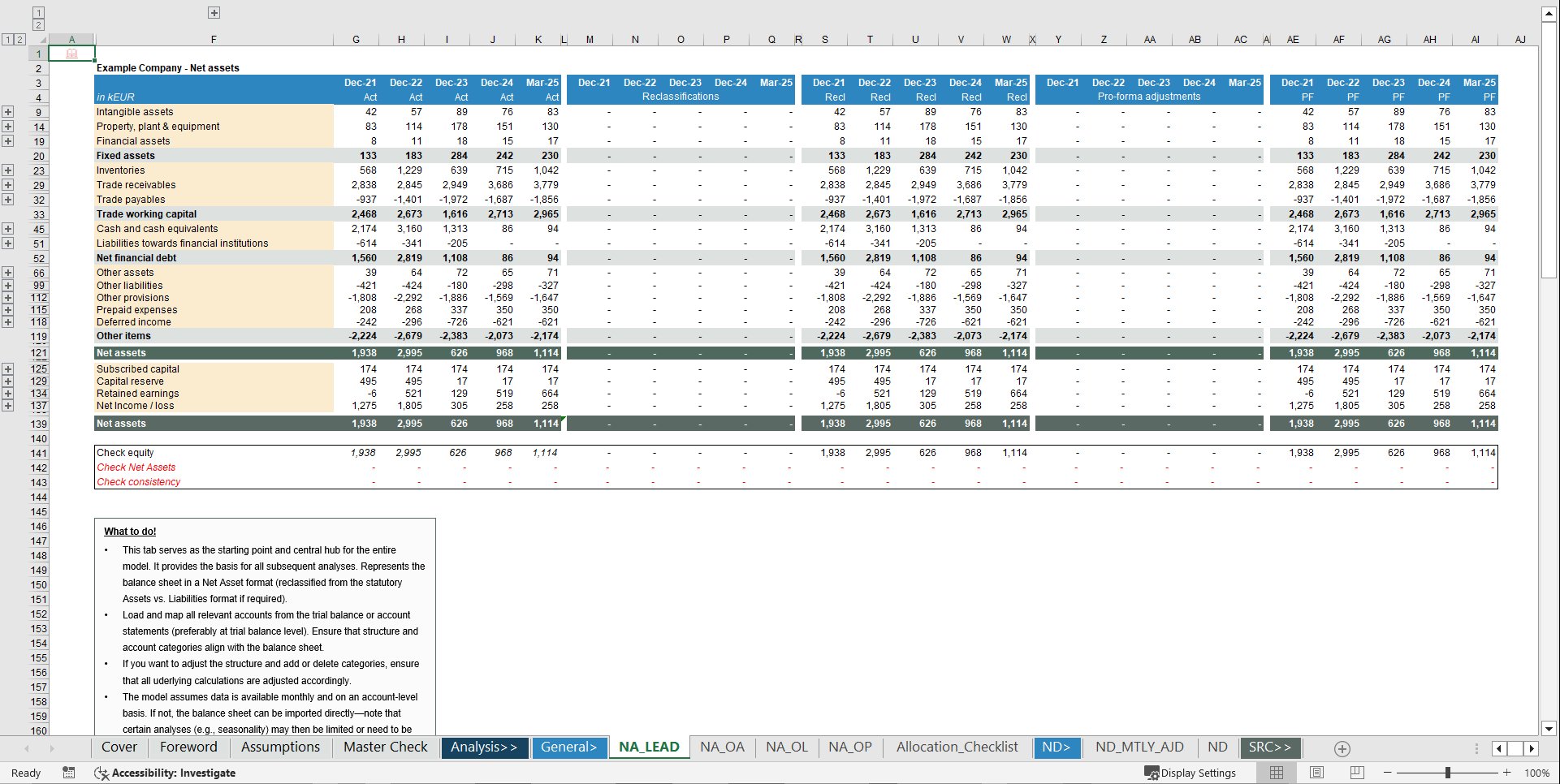

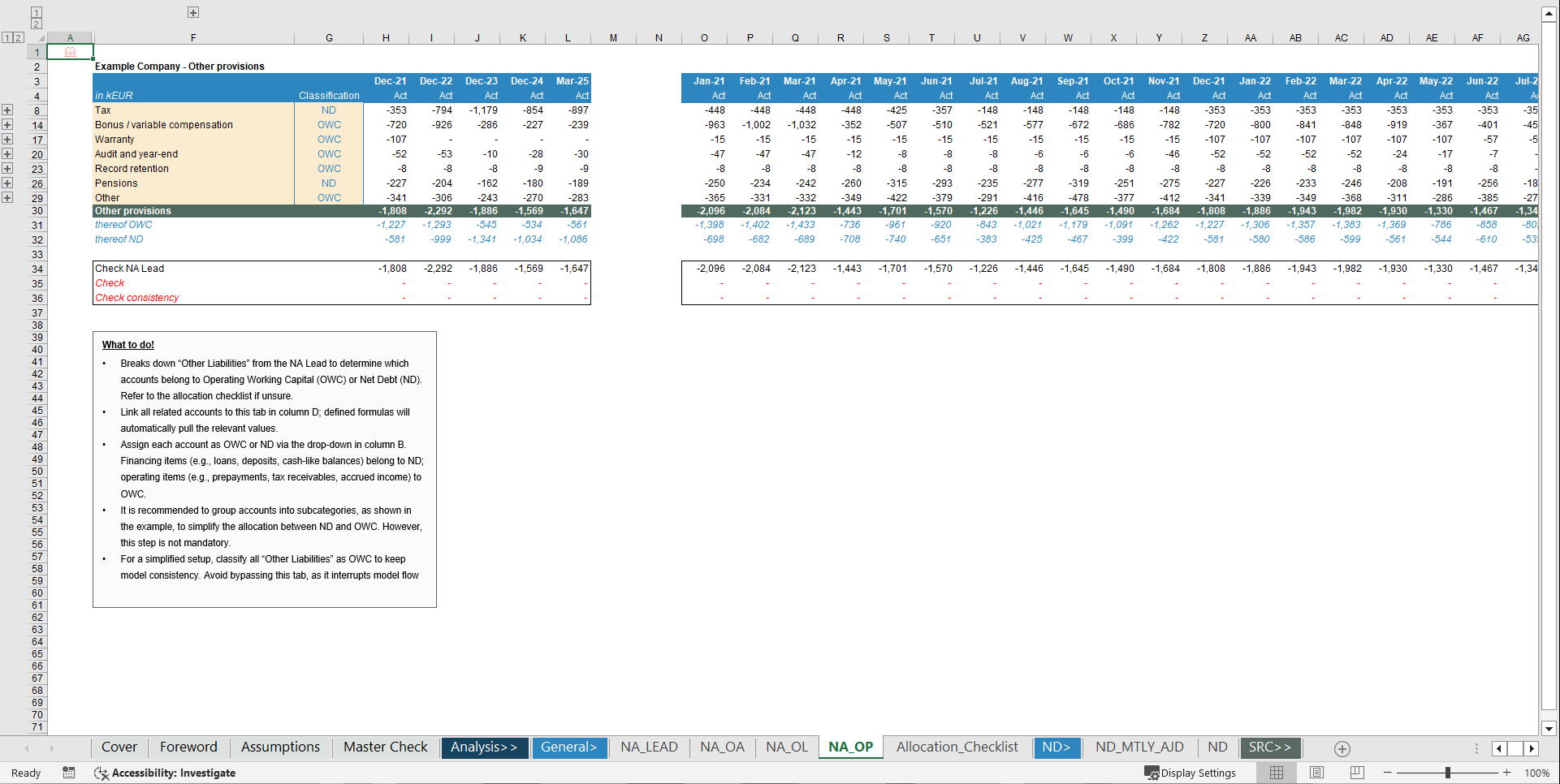

This Excel-based Net Debt Analysis Model provides a structured and transparent view of a company's net financial debt and debt-like items over time. It reconciles balance sheet positions, separates Operating Working Capital from Net Debt, and aggregates all relevant cash, financial liabilities and other debt-like items into a clear, audit-friendly framework. The model allows you to analyse both reported and pro-forma adjusted Net Debt, understand the composition of gross debt and cash positions, and quantify leverage using key ratios such as Net Debt / EBITDA and Adjusted Net Debt / EBITDA. Dedicated mapping and adjustment areas ensure that refinancing effects, carve-outs, shareholder loans and other transaction-specific items can be reflected consistently and traceably. The tool is particularly useful for Transaction Services, financing and refinancing projects, covenant analysis and factbook preparation, but it can also be applied in internal reporting, lender communication and recurring leverage monitoring. Each sheet includes a short "What to do / What to know" box with practical instructions, so you always know exactly what is expected on that tab and how it feeds into the overall model.

Key Outputs

The model provides a Net Debt overview covering cash & cash equivalents, financial liabilities and other debt-like items, while ensuring a clear allocation of balance sheet items to Operating Working Capital versus Net Debt / debt-like categories. It supports a comparison of reported versus pro-forma adjusted Net Debt including specific transaction- and structure-related adjustments, and it delivers leverage KPIs such as Net Debt, Adjusted Net Debt, Net Debt / EBITDA, Adjusted Net Debt / EBITDA and Net Debt / equity. Charts and tables illustrate Net Debt development, composition and leverage trends over time.

Key Inputs & Assumptions

The model is built on trial balance / balance sheet data, ideally at account level and by period. Accounts are mapped to Net Debt categories and to the OWC vs. Net Debt split via simple dropdowns or checklists. Pro-forma and monthly adjustment entries can be added for cash, financial liabilities and other debt-like items, and EBITDA, sales and equity figures are used to calculate leverage and relative KPIs.

How to use

Start by defining the core parameters (reporting periods, currency and basic options) in the Assumptions sheet. Then load balance sheet / trial balance data into the lead and Net Asset mapping tabs and classify accounts as Operating Working Capital or Net Debt / debt-like. After that, enter any relevant pro-forma and monthly adjustments and review the Net Debt overview and KPI tabs to analyse the level, structure and development of Net Debt and leverage.

Customization & support

The model is highly customisable and can be adapted to your chart of accounts, lender-specific Net Debt definitions or internal reporting standards by adjusting categories, labels, KPIs and charts. For more complex customisations or individual requirements—such as firm-specific versions, integration into broader workbooks or additional covenant modules—feel free to reach out and we can discuss a tailored solution. Each download includes both a fully blank "Clean Template" for working directly with your own data and a pre-populated Example Template that illustrates the model's logic and calculations using realistic sample data. If you want to cover the full analysis scope—from Earnings/QoE and Working Capital to Net Debt plus Sales and customer analytics—you may also want to have a look at the "Transaction Services All-in-One Financial Analysis Workbook."

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Due Diligence, Debt Excel: Transaction Services – FDD Net Debt & Debt-Like Items Model Excel (XLSX) Spreadsheet, Finance Model Hub