100+ Battery Energy Storage System (BESS) Financial Ratios (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a comprehensive framework for analyzing the financial, operational, and technical performance of Battery Energy Storage System (BESS) projects.

- Enables investors, developers, and lenders to evaluate profitability, risk, liquidity, and valuation of BESS assets using industry-specific financial ratios.

- Supports data-driven decision-making across the full BESS lifecycle, from project development and financing to operation and long-term optimization.

RENEWABLE ENERGY EXCEL DESCRIPTION

Curated by McKinsey-trained Executives

100+ Battery Energy Storage System (BESS) Financial Ratios Excel Template

The Most Advanced Financial Intelligence Toolkit for BESS Projects, Investors, Developers & Lenders

If you are serious about Battery Energy Storage System (BESS) project finance, valuation, bankability, and investment-grade decision-making, this 100+ BESS Financial Ratios Excel Template is not optional – it is essential.

This professionally engineered Excel model delivers over 100 fully structured financial, operational, technical, valuation, risk, sustainability, and sector-specific BESS ratios, designed specifically for utility-scale, commercial, and grid-scale energy storage projects.

Unlike generic financial models, this template is purpose-built for the energy storage industry, enabling developers, investors, lenders, EPCs, asset managers, utilities, and analysts to instantly assess profitability, liquidity, leverage, risk, efficiency, valuation, lifecycle performance, and long-term sustainability of BESS assets.

Whether you are preparing an investment memo, lender due diligence, PPA negotiation, IRR optimization, or portfolio benchmarking, this Excel template gives you institutional-grade financial clarity – fast, accurate, and defensible.

What Makes This BESS Financial Ratios Excel Template Different?

✔ 100+ industry-aligned BESS financial ratios

✔ Covers project development, construction, operation, and maturity stages

✔ Integrates financial, technical, operational, sustainability, and risk metrics

✔ Designed for equity investors, debt providers, rating agencies, and regulators

✔ Perfect for financial modeling, feasibility studies, credit analysis, and valuation

✔ Built in Excel for full transparency, customization, and auditability

This is not just an Excel file – it is a decision-support system for Battery Energy Storage investments.

COMPLETE LIST OF ALL RATIOS INCLUDED

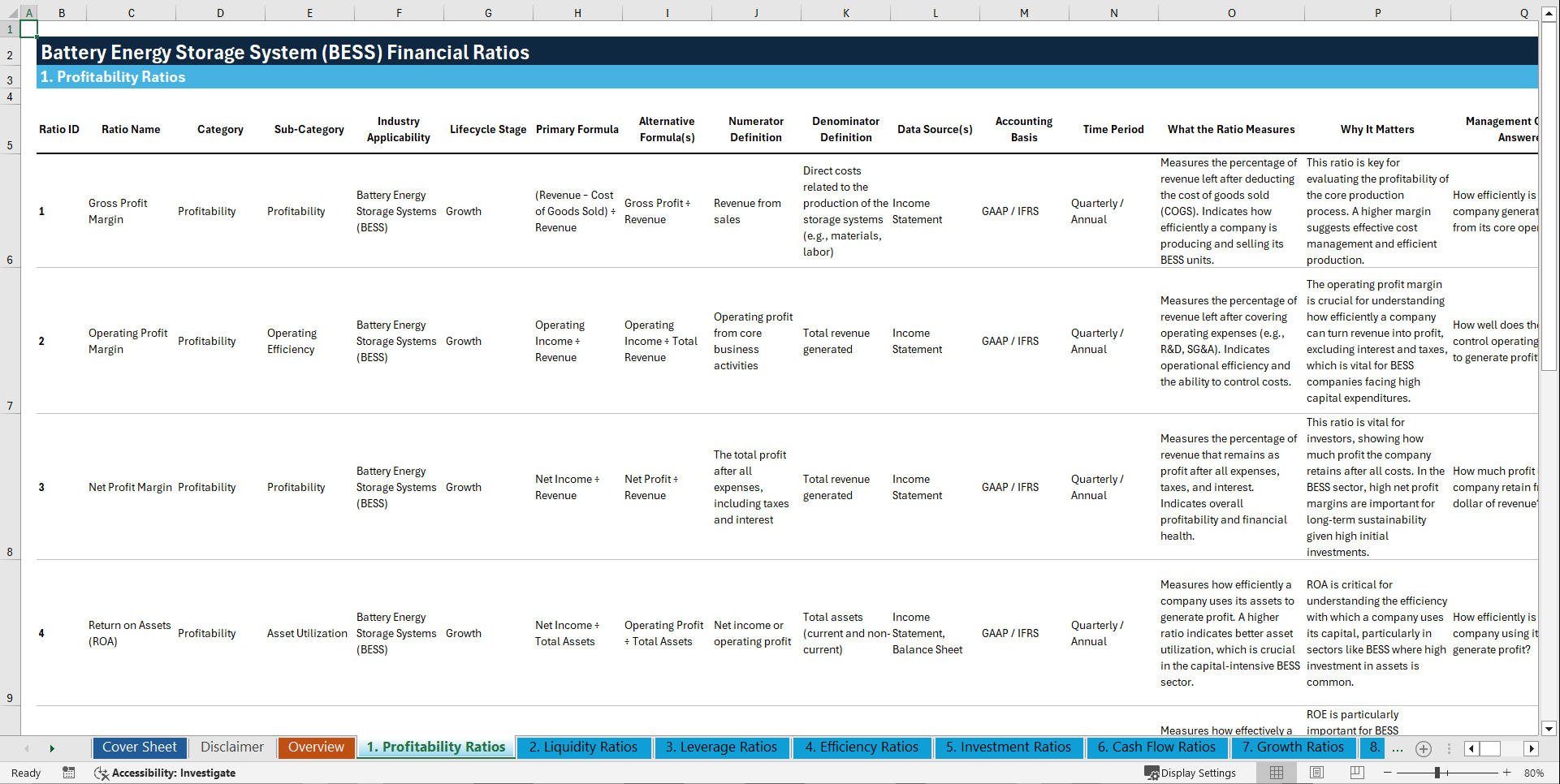

1. Profitability Ratios

1. Gross Profit Margin

2. Operating Profit Margin

3. Net Profit Margin

4. Return on Assets (ROA)

5. Return on Equity (ROE)

6. Return on Investment (ROI)

7. Return on Capital Employed (ROCE)

8. Operating Income Margin

9. EBITDA Margin

10. Net Income to Revenue Ratio

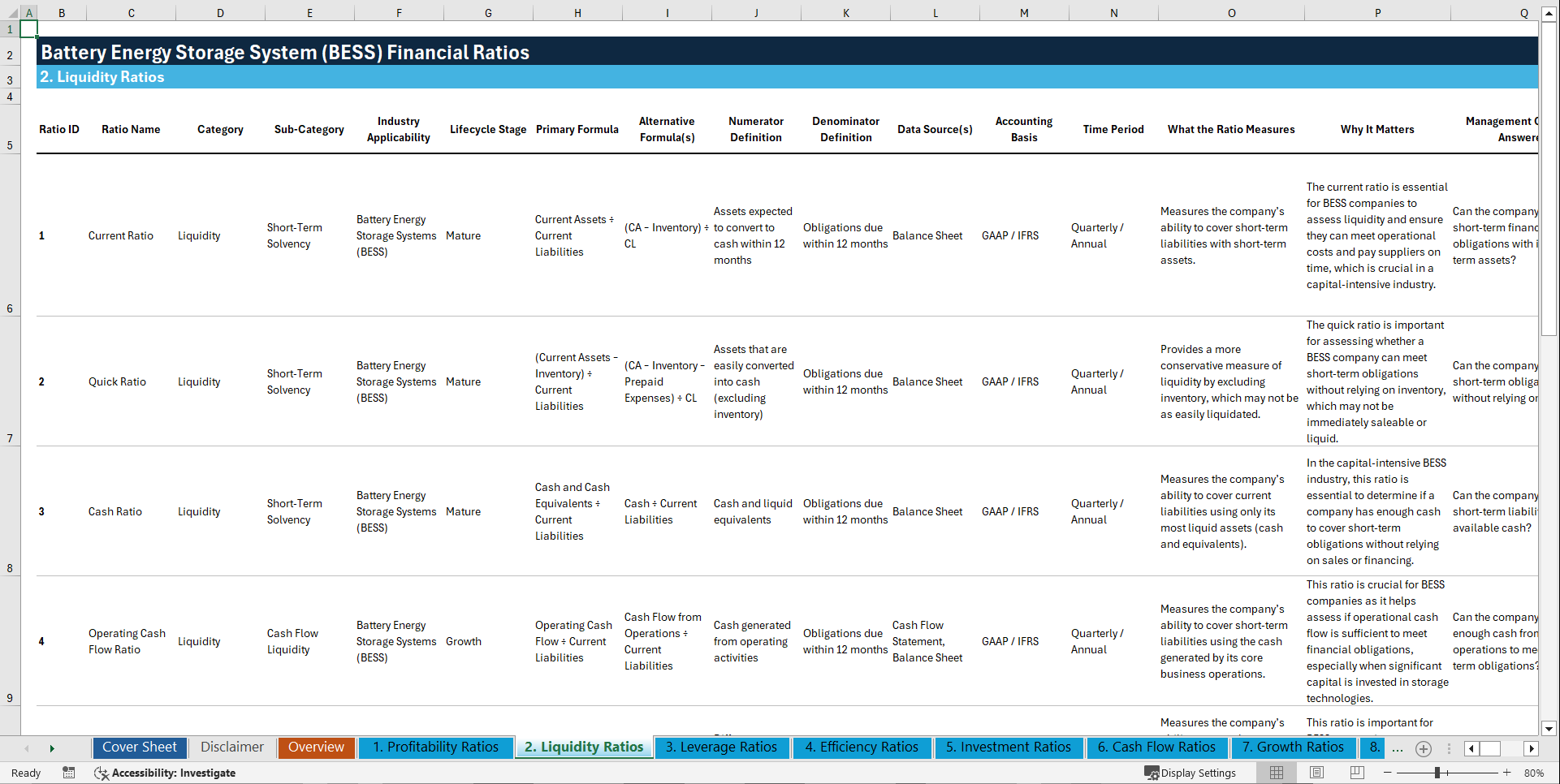

2. Liquidity Ratios

1. Current Ratio

2. Quick Ratio

3. Cash Ratio

4. Operating Cash Flow Ratio

5. Working Capital Ratio

6. Cash Conversion Cycle

7. Free Cash Flow to Sales Ratio

8. Net Working Capital

9. Cash Flow from Operations to Current Liabilities

10. Short-Term Debt to Assets Ratio

3. Leverage Ratios

1. Debt to Equity Ratio

2. Debt to Total Assets Ratio

3. Interest Coverage Ratio

4. Debt to EBITDA Ratio

5. Debt to Capital Ratio

6. Long-Term Debt to Equity Ratio

7. Total Debt to Total Capital Ratio

8. Net Debt to EBITDA Ratio

9. Financial Leverage Ratio

10. Debt Service Coverage Ratio

4. Efficiency Ratios

1. Asset Turnover Ratio

2. Inventory Turnover Ratio

3. Receivables Turnover Ratio

4. Payables Turnover Ratio

5. Fixed Asset Turnover Ratio

6. Working Capital Turnover Ratio

7. Total Asset Turnover Ratio

8. Revenue per Employee

9. Operating Efficiency Ratio

10. Capacity Utilization Ratio

5. Investment Ratios

1. Price-to-Earnings (P/E) Ratio

2. Price-to-Book (P/B) Ratio

3. Dividend Yield

4. Dividend Payout Ratio

5. Earnings per Share (EPS)

6. Price-to-Sales (P/S) Ratio

7. Market Capitalization

8. Return on Investment (ROI) for Projects

9. Market-to-Book Ratio

10. Price-to-Cash Flow Ratio

6. Cash Flow Ratios

1. Cash Flow Margin

2. Free Cash Flow

3. Operating Cash Flow to Net Income Ratio

4. Free Cash Flow to Debt Ratio

5. Cash Flow Return on Investment (CFROI)

6. Cash Flow Coverage Ratio

7. Operating Cash Flow per Share

8. Cash Flow to Capital Expenditures Ratio

9. Cash Flow to Sales Ratio

10. Cash Flow to Assets Ratio

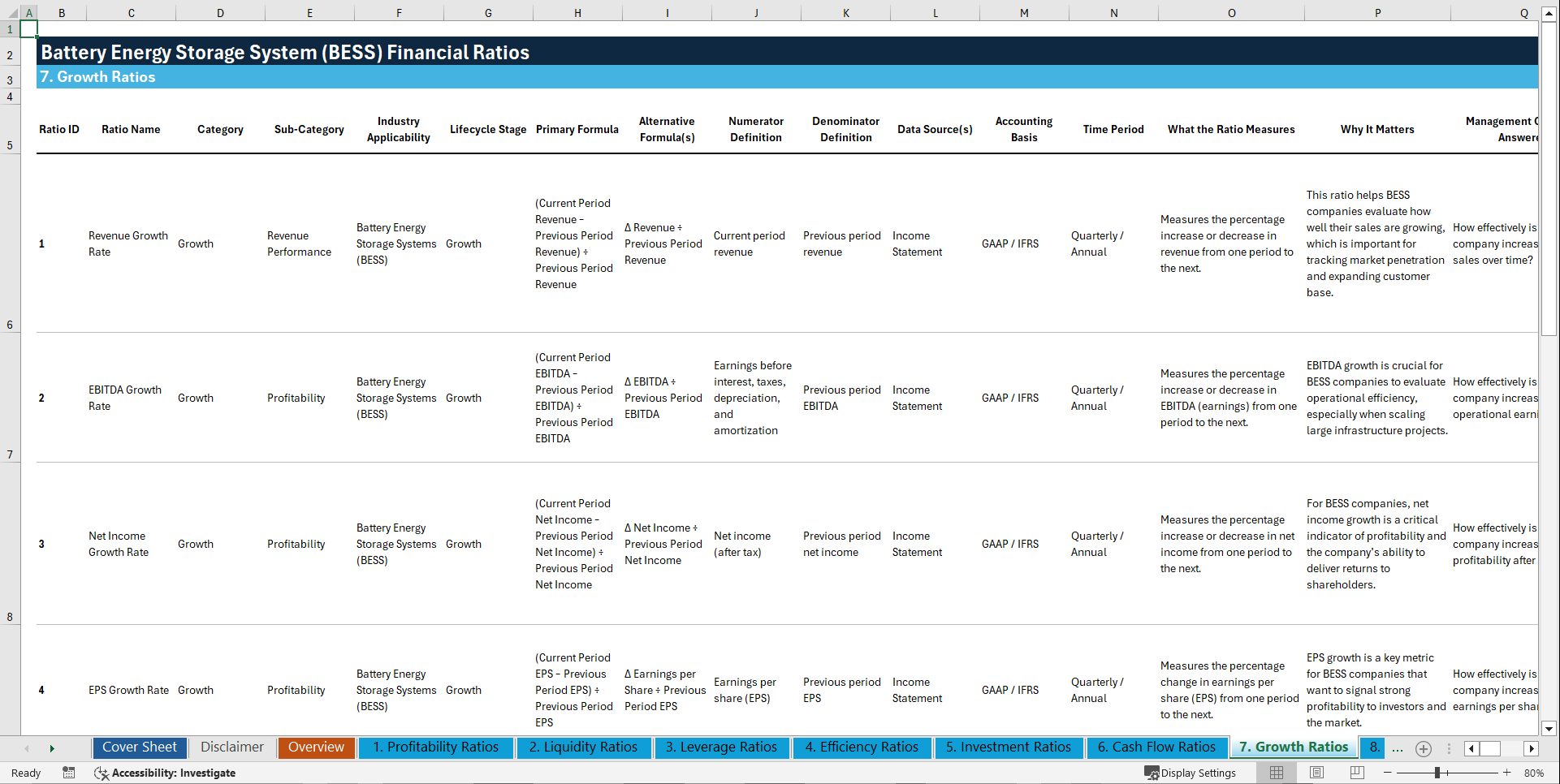

7. Growth Ratios

1. Revenue Growth Rate

2. EBITDA Growth Rate

3. Net Income Growth Rate

4. EPS Growth Rate

5. Operating Income Growth Rate

6. Return on Equity Growth Rate

7. Asset Growth Rate

8. Capital Expenditure Growth Rate

9. Free Cash Flow Growth Rate

10. Customer Growth Rate

8. Cost Ratios

1. Cost of Goods Sold (COGS) to Revenue Ratio

2. Operating Expense Ratio

3. Selling, General & Administrative (SG&A) Ratio

4. Fixed Cost Ratio

5. Variable Cost Ratio

6. Direct Cost Ratio

7. Energy Storage System Cost per KWh

8. Cost per MW Installed

9. Maintenance Cost per MW

10. Total Cost to Revenue Ratio

9. Capital Structure Ratios

1. Equity Ratio

2. Capital Adequacy Ratio

3. Leverage Ratio

4. Capital Intensity Ratio

5. Tangible Net Worth

6. Total Debt to Equity Ratio

7. Capital to Asset Ratio

8. Debt to Equity (Industry Specific)

9. Debt to Free Cash Flow Ratio

10. Tangible Asset to Equity Ratio

10. Risk Ratios

1. Beta Coefficient (Stock Risk)

2. Value at Risk (VaR)

3. Systematic Risk Ratio

4. Unsystematic Risk Ratio

5. Credit Risk Ratio

6. Default Probability Ratio

7. Operational Risk Ratio

8. Market Risk Exposure

9. Liquidity Risk Ratio

10. Business Risk Ratio

11. Valuation Ratios

1. Enterprise Value to EBITDA

2. EV to Revenue Ratio

3. Price to Earnings Growth (PEG) Ratio

4. Price to Free Cash Flow Ratio

5. Price to Book Value (P/B) Ratio

6. EV to Free Cash Flow Ratio

7. Enterprise Value to Sales (EV/Sales)

8. Dividend Discount Model (DDM) Ratio

9. Gross Enterprise Value (GEV) Ratio

10. Price-to-Assets Ratio

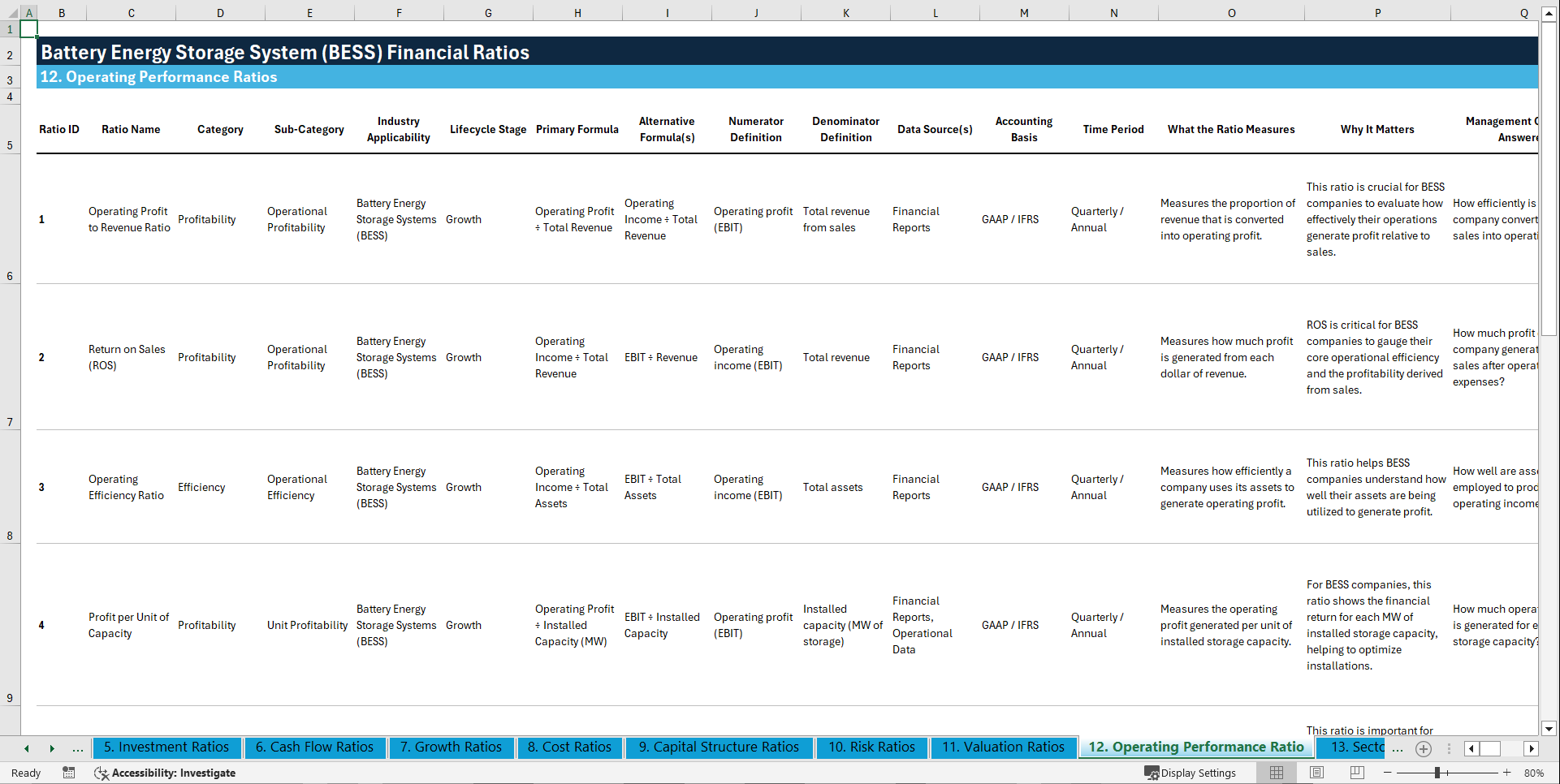

12. Operating Performance Ratios

1. Operating Profit to Revenue Ratio

2. Return on Sales (ROS)

3. Operating Efficiency Ratio

4. Profit per Unit of Capacity

5. Earnings Before Taxes to Revenue

6. EBIT per Unit of Installed Capacity

7. Gross Operating Profit per MW

8. Total Operating Income per KWh

9. Energy Loss Ratio

10. Capacity Utilization to Revenue Ratio

13. Sector-Specific Ratios (BESS)

1. Storage Utilization Ratio

2. Charge/Discharge Efficiency Ratio

3. Energy Storage Cost per KWh

4. Project Capital Cost per MW

5. Energy Density Ratio

6. Storage Capacity per Dollar Ratio

7. Project IRR (Internal Rate of Return)

8. Project ROI (Return on Investment)

9. LCOE (Levelized Cost of Energy)

10. Payback Period

14. Sustainability Ratios

1. Environmental Cost per Unit of Energy

2. Renewable Energy to Total Energy Ratio

3. Carbon Intensity Ratio

4. Sustainability to Revenue Ratio

5. Sustainability Index Score

6. Environmental Efficiency Ratio

7. Carbon Emissions per MW

8. Green Energy Adoption Ratio

9. Energy Efficiency Ratio

10. Resource Utilization Ratio

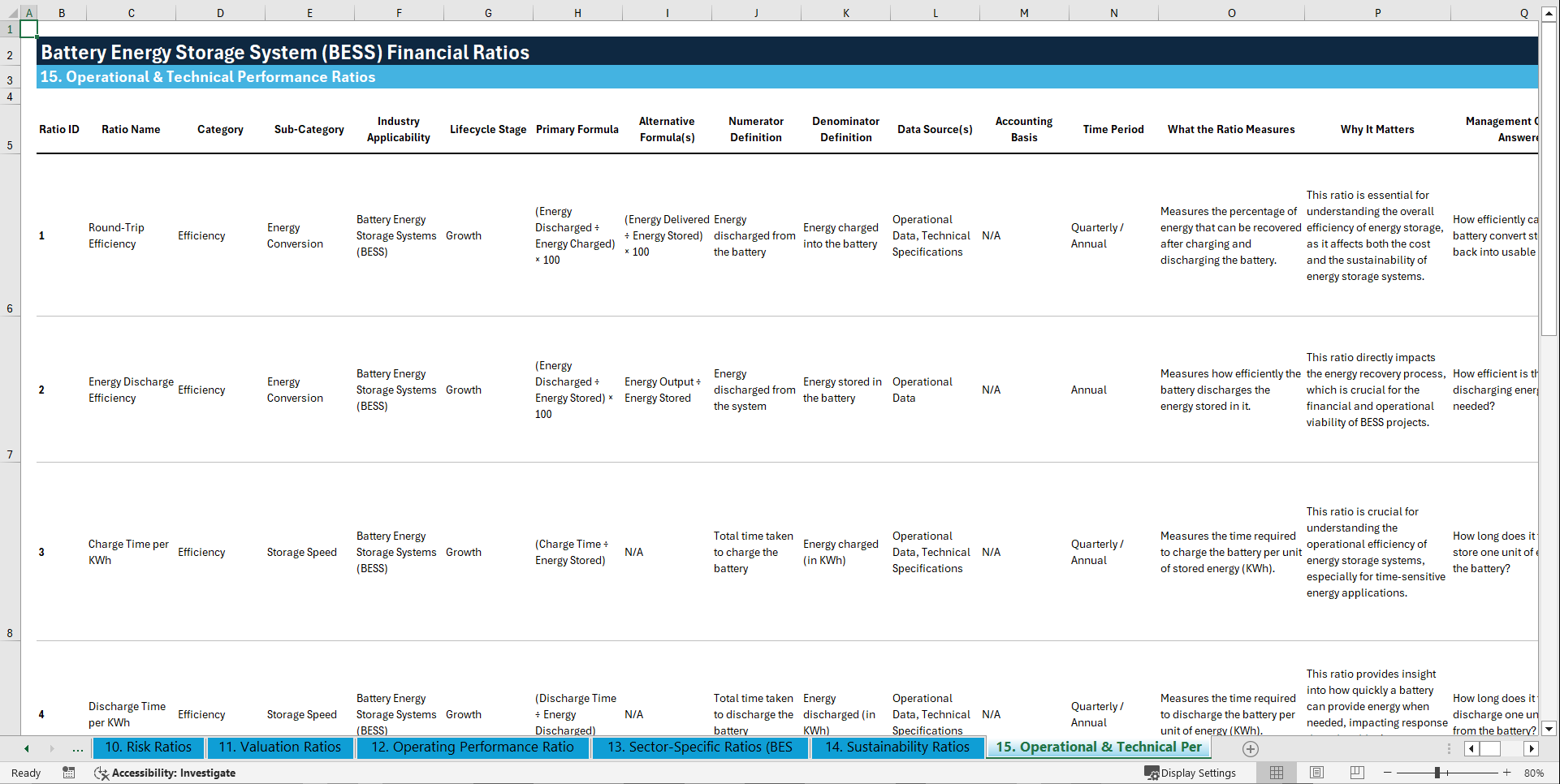

15. Operational & Technical Performance Ratios

1. Round-Trip Efficiency

2. Energy Discharge Efficiency

3. Charge Time per KWh

4. Discharge Time per KWh

5. Energy Density per Unit of Capacity

6. State of Charge (SOC) Efficiency

7. Cycle Life (Capacity Degradation)

8. Depth of Discharge (DoD)

9. Battery Life Span (Years)

10. Energy Storage Capacity Factor

If you want bankable BESS projects, defensible valuations, credible financial models, and investor-ready analytics, this 100+ Battery Energy Storage System Financial Ratios Excel Template is the most comprehensive, practical, and industry-aligned solution available.

This is the Excel toolkit that serious BESS professionals use to win capital, reduce risk, and maximize returns.

Key Words:

Strategy & Transformation, Growth Strategy, Strategic Planning, Strategy Frameworks, Innovation Management, Pricing Strategy, Core Competencies, Strategy Development, Business Transformation, Marketing Plan Development, Product Strategy, Breakout Strategy, Competitive Advantage, Mission, Vision, Values, Strategy Deployment & Execution, Innovation, Vision Statement, Core Competencies Analysis, Corporate Strategy, Product Launch Strategy, BMI, Blue Ocean Strategy, Breakthrough Strategy, Business Model Innovation, Business Strategy Example, Corporate Transformation, Critical Success Factors, Customer Segmentation, Customer Value Proposition, Distinctive Capabilities, Enterprise Performance Management, KPI, Key Performance Indicators, Market Analysis, Market Entry Example, Market Entry Plan, Market Intelligence, Market Research, Market Segmentation, Market Sizing, Marketing, Michael Porter's Value Chain, Organizational Transformation, Performance Management, Performance Measurement, Platform Strategy, Product Go-to-Market Strategy, Reorganization, Restructuring, SWOT, SWOT Analysis, Service 4.0, Service Strategy, Service Transformation, Strategic Analysis, Strategic Plan Example, Strategy Deployment, Strategy Execution, Strategy Frameworks Compilation, Strategy Methodologies, Strategy Report Example, Value Chain, Value Chain Analysis, Value Innovation, Value Proposition, Vision Statement, Corporate Strategy, Business Development, Busienss plan pdf, business plan, PDF, Biusiness Plan DOC, Bisiness Plan Template, PPT, Market strategy playbook, strategic market planning, competitive analysis tools, market segmentation frameworks, growth strategy templates, product positioning strategy, market execution toolkit, strategic alignment playbook, KPI and OKR frameworks, business growth strategy guide, cross-functional strategy templates, market risk management, market strategy PowerPoint dec, guide, ebook, e-book ,McKinsey Change Playbook, Organizational change management toolkit, Change management frameworks 2025, Influence model for change, Change leadership strategies, Behavioral change in organizations, Change management PowerPoint templates, Transformational leadership in change, supply chain KPIs, supply chain KPI toolkit, supply chain PowerPoint template, logistics KPIs, procurement KPIs, inventory management KPIs, supply chain performance metrics, manufacturing KPIs, supply chain dashboard, supply chain strategy KPIs, reverse logistics KPIs, sustainability KPIs in supply chain, financial supply chain KPIs, warehouse KPIs, digital supply chain KPIs, 1200 KPIs, supply chain scorecard, KPI examples, supply chain templates, Corporate Finance SOPs, Finance SOP Excel Template, CFO Toolkit, Finance Department Procedures, Financial Planning SOPs, Treasury SOPs, Accounts Payable SOPs, Accounts Receivable SOPs, General Ledger SOPs, Accounting Policies Template, Internal Controls SOPs, Finance Process Standardization, Finance Operating Procedures, Finance Department Excel Template, FP&A Process Documentation, Corporate Finance Template, Finance SOP Toolkit, CFO Process Templates, Accounting SOP Package, Tax Compliance SOPs, Financial Risk Management Procedures.

NOTE: Our digital products are sold on an "as is" basis, making returns and refunds unavailable post-download. Please preview and inquire before purchasing. Please contact us before purchasing if you have any questions! This policy aligns with the standard Flevy Terms of Usage.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Renewable Energy, Battery Industry Excel: 100+ Battery Energy Storage System (BESS) Financial Ratios Excel (XLSX) Spreadsheet, SB Consulting