FOOD & BEVERAGE INDUSTRY EXCEL DESCRIPTION

The Restaurant Excel Financial Model is ideal for startup restaurants and has been refined over several years on a wide variety and a number of actual restaurant ventures. This model contains 5-year Monthly and yearly financial statements, relevant KPIs, Financial Ratios, Diagnostic Tools, Cash burn analysis, Investment, Debt service coverage ratio, etc. Moreover, it includes business bank loans and equity funding from the investors' table, which is calculating valuation analysis and startup costs. This Startup Restaurant Excel Financial Model template is a simple and easy-to-use solution for small and medium-sized restaurants.

Key Features of the Model

Revenue Projections

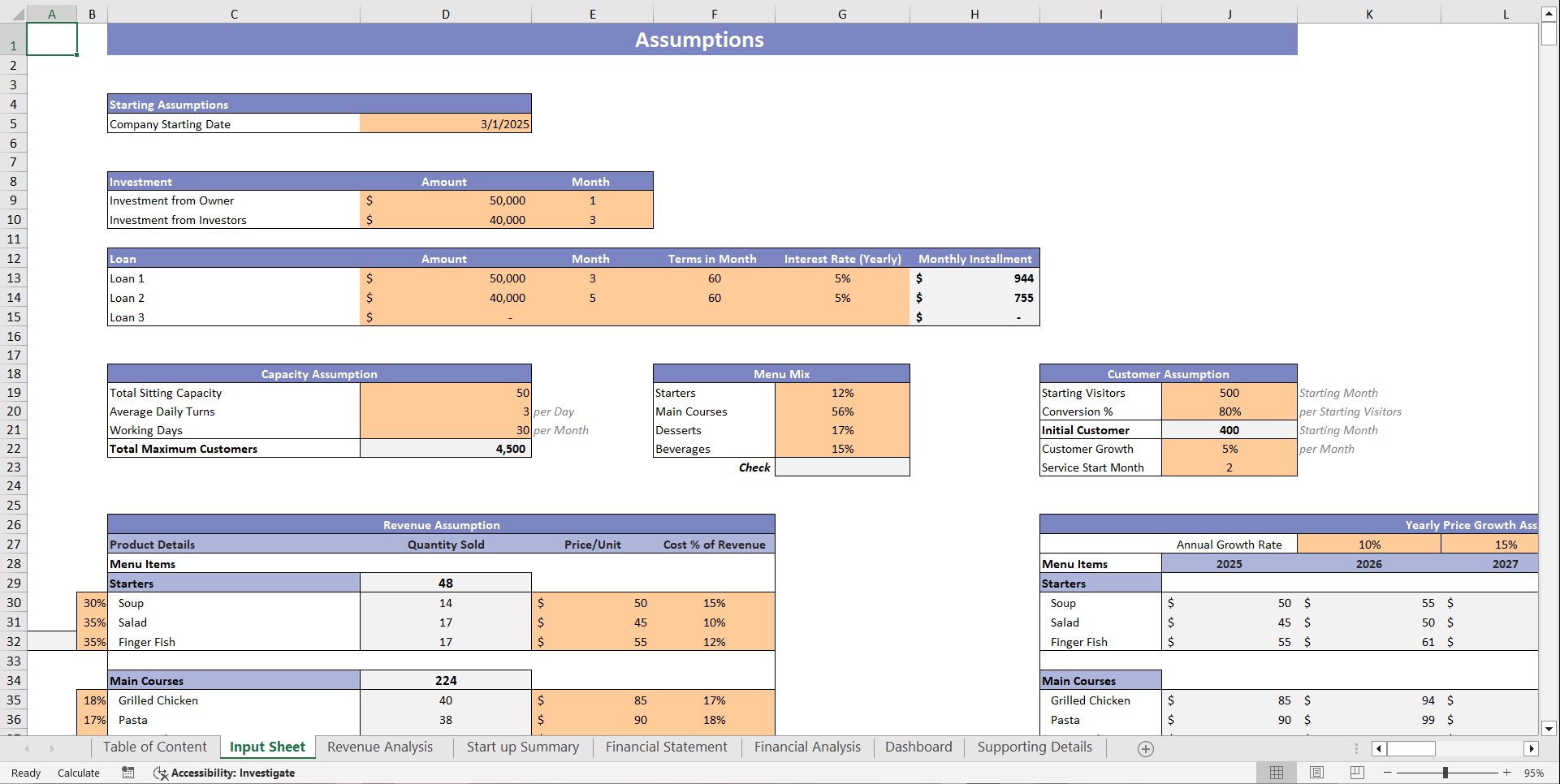

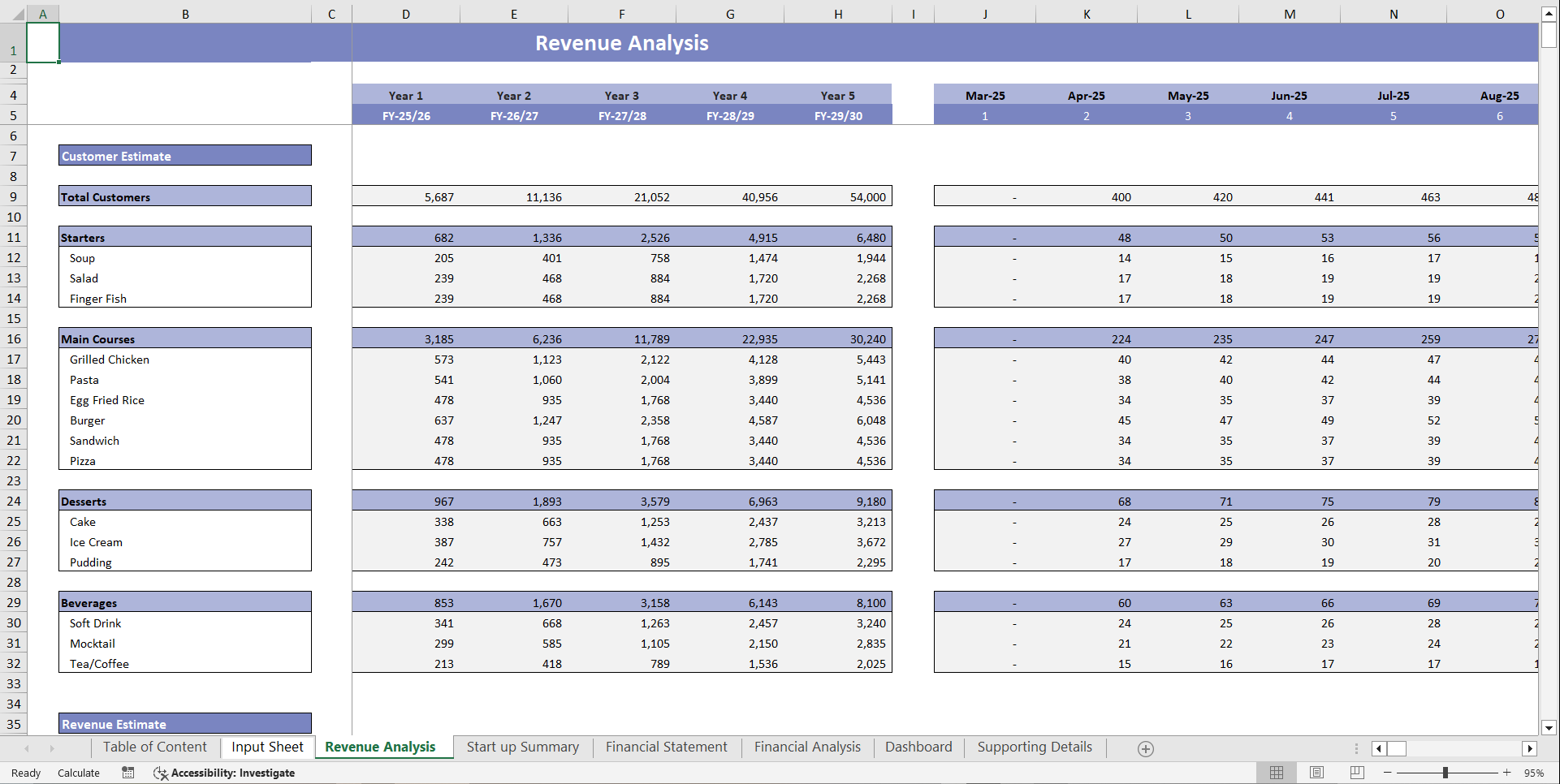

1. Sales Forecasting: Estimate future revenue based on daily customer footfall, average spend per customer, and monthly growth in customer volume.

2. Revenue by Product Category: Break down sales into key categories such as Dine-In, Takeaway, Delivery, Beverages, and Seasonal Specials to understand what drives revenue.

3. Competitive Advantages: Highlight what makes your restaurant stand out—like unique cuisine, chef reputation, prime location, ambiance, pricing strategy, or loyalty programs.

Cost Structure

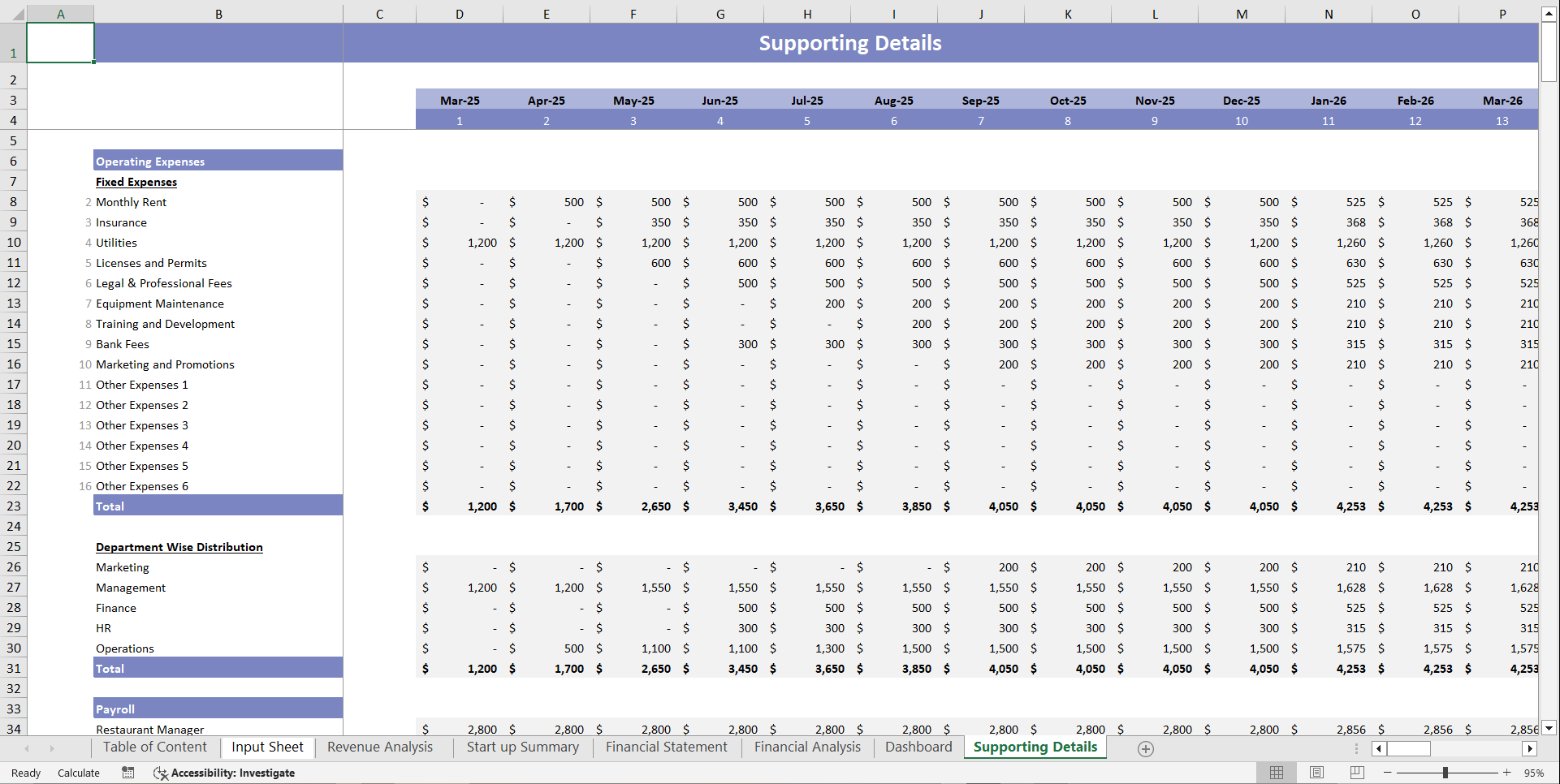

1. Direct Costs: Adjust direct costs like Ingredients, Packaging, and Kitchen Staff Wages as a percentage of your revenue to determine your gross margin.

2. Administrative Expenses: Capture fixed operating costs such as rent, salaried management, utilities, POS systems, and marketing efforts.

3. Business Expenses: Include other financial obligations such as equipment leasing, license renewals, professional fees, loan repayments, and interest charges.

Profitability Analysis

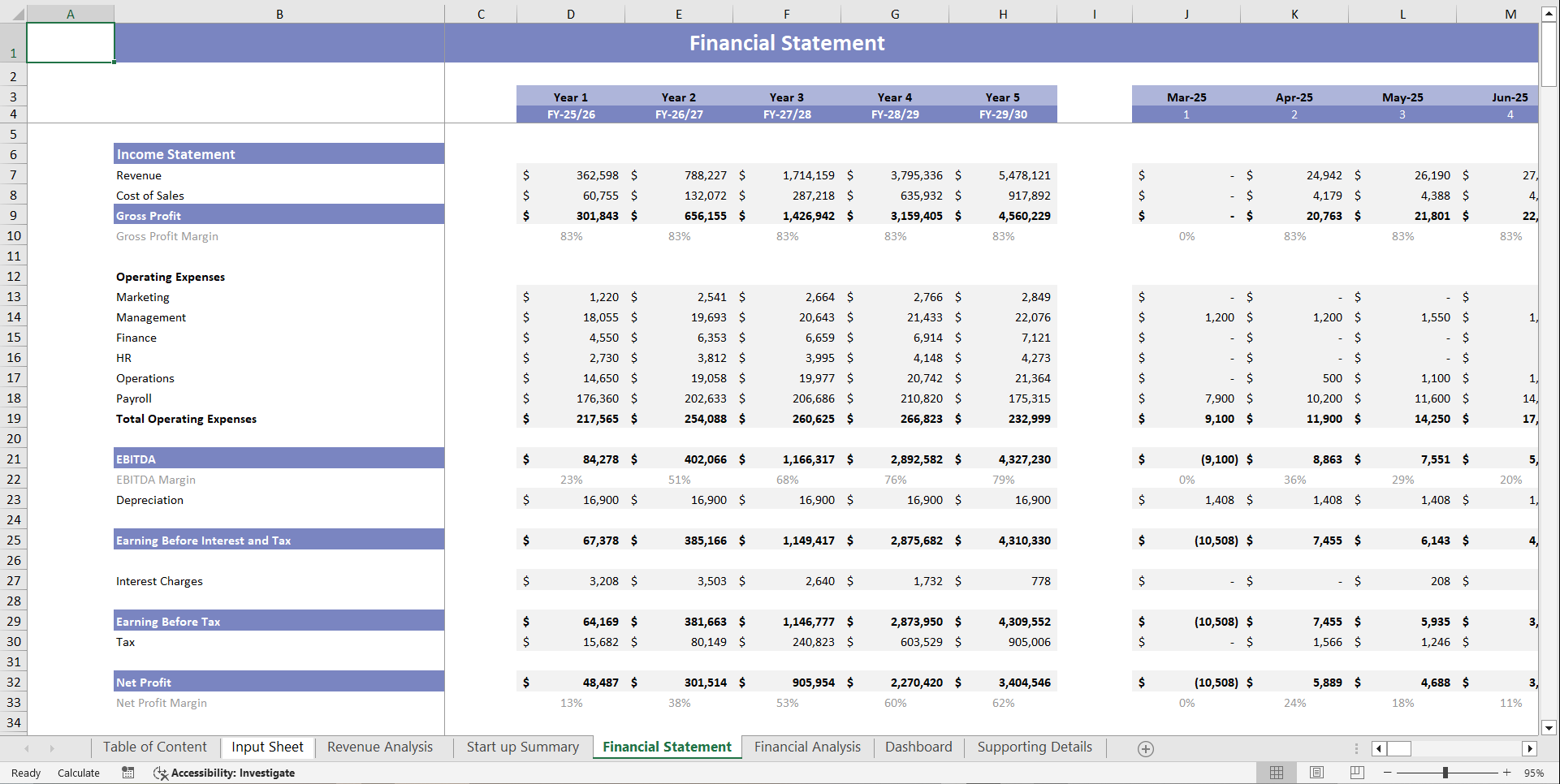

1. Profit and Loss Statement: Track income, expenses, and profit over 5 years.

2. Gross Margin & Net Profit: Get to know what is the performance of the Industrial based on gross and net profit.

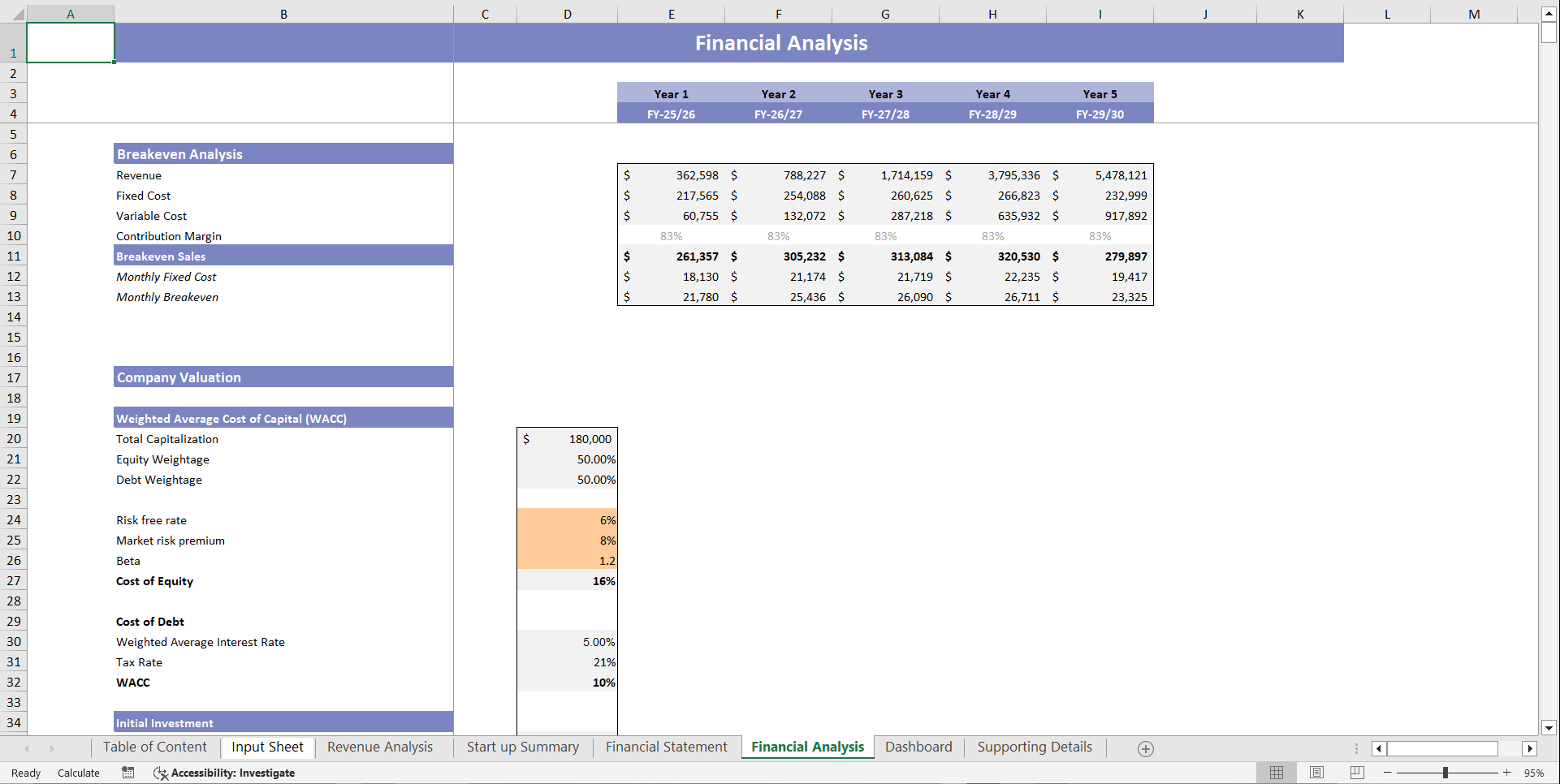

3. Break-Even Analysis: Determine the number of Customers needed to cover costs and achieve profitability.

Cash Flow Management

1. Cash Flow Statement: Track money flowing in and out of your business.

2. Financial Position: Ensure adequate working capital for seamless operations.

3. Investment Scheduling: Plan accordingly the cashflow to make your investment decisions for a smoother flow of operations.

Financial Forecasting & Scenario Analysis

1. 5-Year Financial Plan: Develop long term projections for revenue, expenses, and profitability.

2. Market Conditions & Trends: Adjust financial forecasts based on industry changes and customer behavior.

3. Best-Case, Base-Case, and Worst-Case Scenarios: Evaluate different financial outcomes and prepare accordingly.

Key Performance Indicators (KPIs)

1. Customer Types & Sales Volume: Monitor sales across different customer groups such as dine-in, takeaway, and delivery to spot revenue trends.

2. Customer Retention & Growth Potential: Track repeat visits, average table spend, and identify growth opportunities like expanding hours, new menu items, or opening additional branches.

3. Financial Statements: Access dynamic financial statements including income statement, cash flow statement, and balance sheet for detailed performance insights and planning.

Investor Readiness & Business Strategy

1. Attract Potential Investors: Present a professional financial plan to secure funding.

2. Strategic Planning: Align business objectives with financial projections for long term success.

3. Cost Analysis & Optimization: Better understand which costs can be minimized and which one have to most impact on profitability.

Key Benefits of Using This Model

1. Better Financial Planning: Gain a clear understanding of your business's financial feasibility.

2. Optimized Operations: Enhance cost analysis and resource allocation.

3. Risk Mitigation: Plan ahead for financial uncertainties and avoid cash shortages.

4. Customizable Tool: Adapt the model to fit different business needs.

5. Scalability: Suitable for both small startups and established agencies.

FAQ's

1. What does the restaurant financial model include?

It includes revenue projections, cost of goods sold, operating expenses, payroll, break-even analysis, and detailed financial statements.

2. Can I adjust assumptions like food cost and daily customers?

Yes, all inputs like average spend, customer footfall, and cost percentages are fully customizable.

3. Is this model suitable for dine-in, delivery, or takeaway?

Absolutely, the model supports all restaurant formats and allows you to track each revenue stream separately.

4. Does the model show when the restaurant becomes profitable?

Yes, the built-in break-even analysis and profit/loss tracking show when you reach profitability.

5. Can this be used for investor presentations or loan applications?

Yes, it's designed to be presentation-ready with clear visuals, KPIs, and financial summaries for banks or investors.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Food & Beverage Industry, Integrated Financial Model Excel: Startup Restaurant Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant