Retail Clothing Store Financial Model & Inventory Analysis (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides thorough oversight, tracking, and reporting of retail clothing store finances, including updates on budget utilisation and projections.

RETAIL STRATEGY EXCEL DESCRIPTION

This financial model is designed to provide a comprehensive analysis of a Clothing Stores financial health and projections. The model includes key financial statements such as the Income Statement, Cash Flow Statement, and Balance Sheet. It also highlights critical metrics for evaluating the company's performance and financial sustainability.

Additionally, the model can incorporate detailed funding requirements for various strategic initiatives.

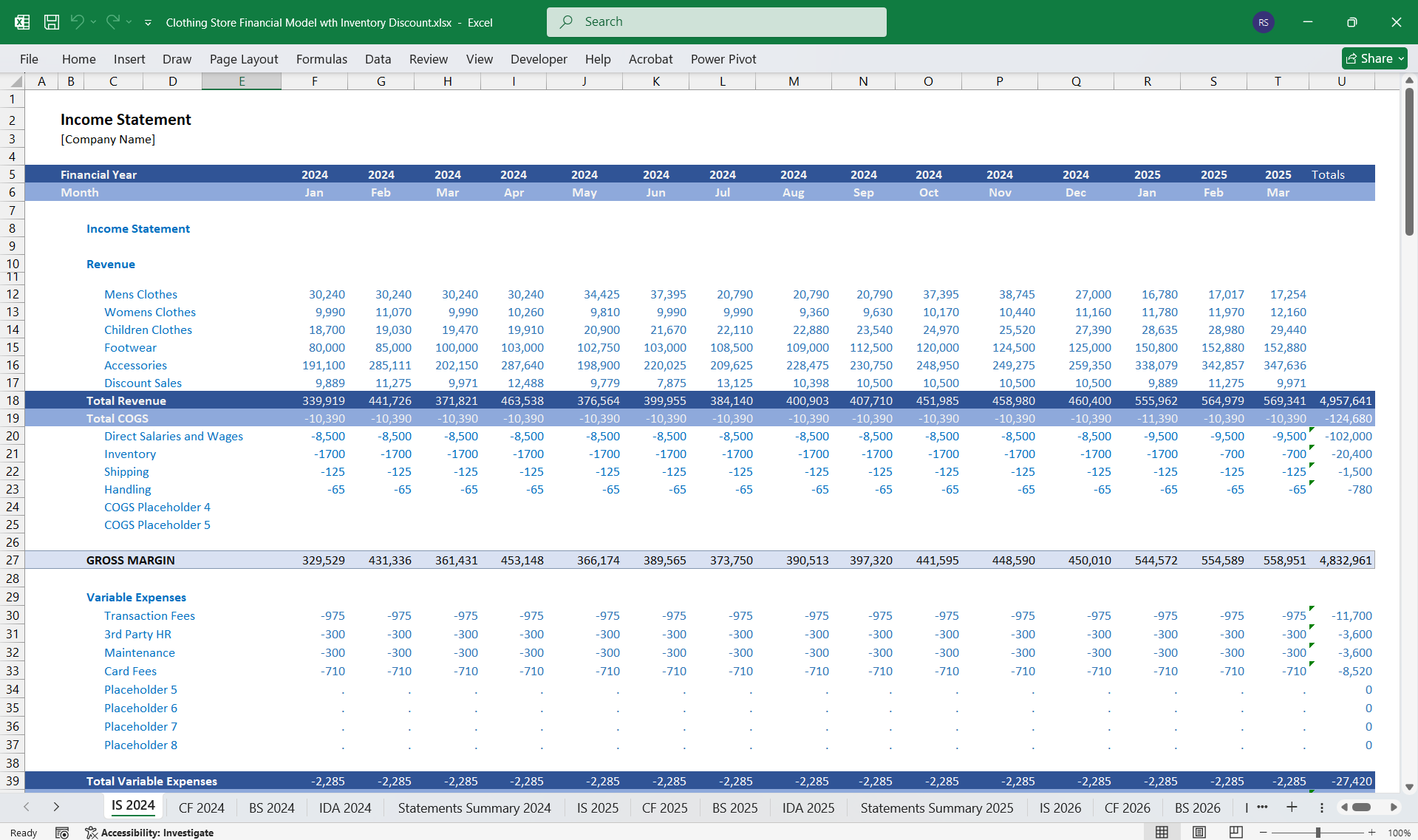

1. Income Statement (Profit & Loss Statement)

The Income Statement details revenue and expenses, showing profitability over a specific period (usually monthly or yearly). For a clothing store, key items to include are:

Revenue:

Sales Revenue: Derived from clothing and accessories sales.

Other Revenue: Includes revenue from additional services (e.g., customizations, styling consultations) if applicable.

Cost of Goods Sold (COGS):

Product Costs: Direct costs of purchasing inventory, including shipping and import fees for clothing items.

Inventory Shrinkage: Losses due to damage, theft, or obsolescence.

Gross Profit: Calculated as Revenue – COGS.

Operating Expenses:

Rent and Utilities: Cost of store rental and utility bills.

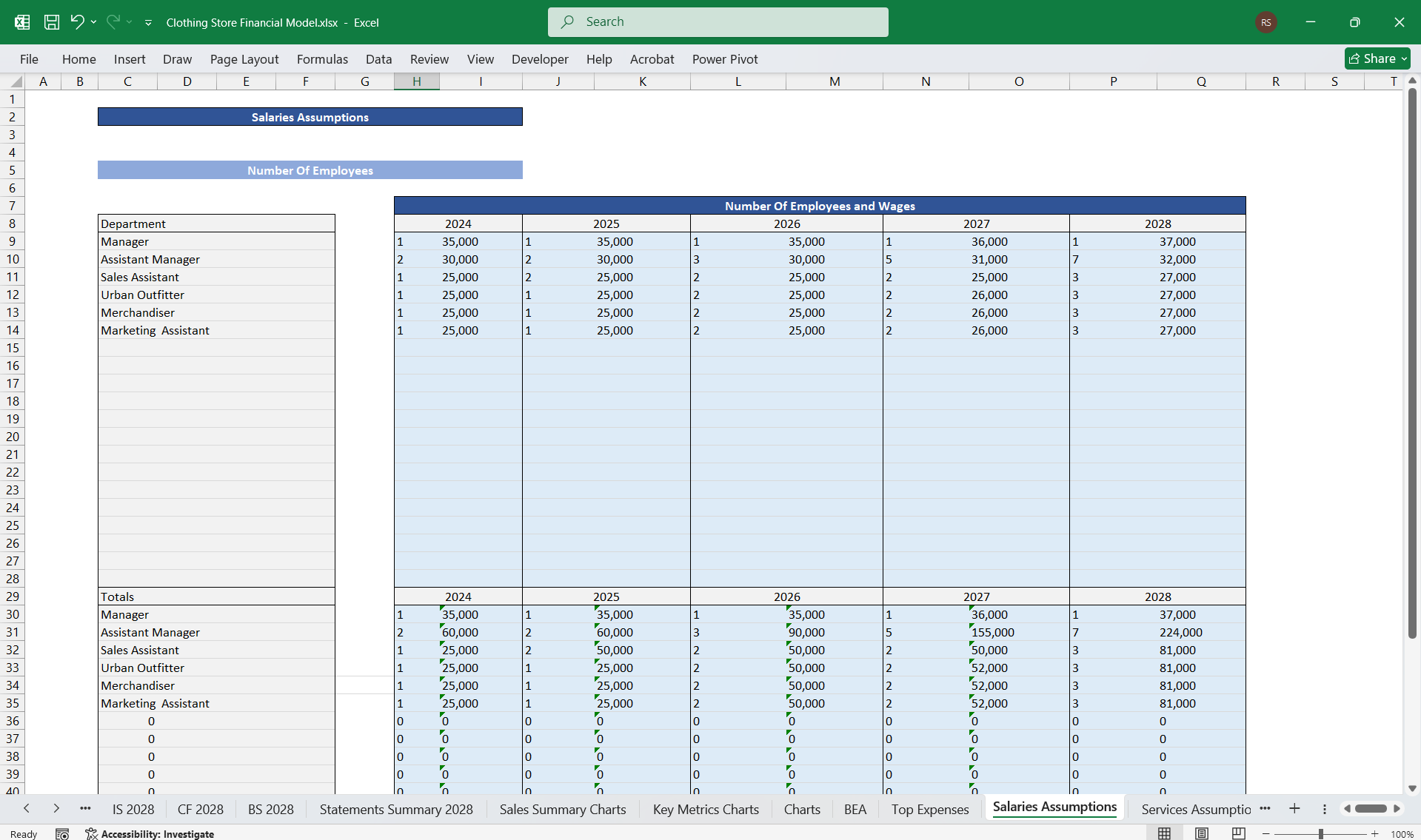

Employee Salaries: Payroll for sales associates, managers, and other staff.

Marketing and Advertising: Expenses on marketing, such as digital ads, in-store promotions, and signage.

Insurance and Security: Costs for insuring the store and implementing theft-prevention measures.

Depreciation: Depreciation of store fixtures, furniture, and equipment.

Miscellaneous Expenses: Other operating costs, such as office supplies and minor maintenance.

Operating Income (EBIT): Gross Profit – Operating Expenses.

Interest and Taxes:

Interest Expense: If any loans are taken for capital, the interest payable is recorded here.

Taxes: Income tax on the store's profit.

Net Income: Operating Income – Interest and Taxes.

2. Cash Flow Statement

The Cash Flow Statement projects cash inflows and outflows over time, helping assess liquidity and cash availability for operational needs. Key sections include:

Cash Flows from Operating Activities:

Cash Receipts: Cash received from sales, both cash and credit card sales (after transaction fees).

Cash Payments for COGS: Payment to suppliers for inventory.

Operating Expenses Paid in Cash: Salaries, rent, utilities, marketing, and other operating expenses.

Cash Flows from Investing Activities:

Initial Investments: Cash spent on initial store setup (e.g., furniture, fixtures, and renovation).

Equipment Purchases: Expenditures on IT systems, POS systems, and display equipment.

Cash Flows from Financing Activities:

Loan Proceeds: Any funds raised from bank loans or investors.

Loan Repayment: Principal repayments on any outstanding loans.

Equity Contributions: Cash contributed by the owners or investors.

Net Cash Flow: Summed cash flow from operating, investing, and financing activities, reflecting overall cash movement.

3. Balance Sheet

The Balance Sheet provides a snapshot of the store's financial position at a specific point in time. It covers Assets, Liabilities, and Equity:

Assets:

Current Assets: Cash, Accounts Receivable (e.g., if some customers buy on credit), and Inventory.

Non-Current Assets: Fixed assets like store fixtures, POS systems, and furniture. These are depreciated over time.

Liabilities:

Current Liabilities: Accounts Payable (amounts due to suppliers for inventory), short-term loans, and accrued expenses (e.g., unpaid wages).

Long-Term Liabilities: Long-term loans or any other financing obligations.

Equity:

Owner's Equity: Initial investments by owners and retained earnings (accumulated net income).

Balance Sheet Equation: Assets = Liabilities + Equity. This ensures that all resources of the business are funded by liabilities or equity.

4. Inventory Tracking and Discount Analysis:

These are essential components of effective inventory management and profitability. Inventory tracking involves monitoring stock levels in real time, enabling businesses to optimize inventory levels, avoid stockouts, and reduce overstock situations. It also helps to streamline reordering processes and maintain an efficient supply chain, which is particularly crucial in industries with high turnover or perishable goods. Discount analysis complements inventory tracking by examining the impact of discounts on product sales and profit margins. Through discount analysis, businesses can identify which discounts drive higher sales volume, assess the profitability of discount campaigns, and determine optimal discount levels that attract customers without significantly eroding profits. Together, these practices enable companies to make data-driven decisions, align inventory with demand, and maximize overall profitability.

5. IRR Calculations

The Internal Rate of Return (IRR) measures the expected profitability of the store over a given time period, typically five to ten years. It is calculated by finding the discount rate at which the Net Present Value (NPV) of cash flows equals zero.

To calculate IRR, include:

Initial Investment: Upfront costs such as store setup, equipment purchases, and any inventory purchasing.

Annual Net Cash Flows:

From the cash flow statement, include all net cash flows (after taxes) for each period.

Terminal Value (if applicable): An estimated exit value if the store is sold at the end of the period. This can be based on an industry multiple of the store's annual profit or cash flow.

The IRR will give insight into whether the expected returns exceed the store's cost of capital, allowing the investor to decide if the store is a viable investment.

Additional Features:

Scenario Analysis: Tools for modelling different business scenarios and their financial impacts.

Sensitivity Analysis: Examination of how changes in key assumptions affect the financial outcomes.

Dashboards: Visual representations of key metrics and financial statements for quick insights and decision-making.

This financial model serves as a critical tool for strategic planning, investor presentations, and day-to-day financial management, ensuring that the Clothing Store can efficiently allocate resources, manage risks, and pursue growth opportunities.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Retail Strategy, Integrated Financial Model Excel: Retail Clothing Store Financial Model & Inventory Analysis Excel (XLSX) Spreadsheet, Willcox PMO