Equity Fund Model (Investor Cashflows) (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides thorough oversight, tracking, and reporting of equity fund finances, including updates on cash flows and projections.

PRIVATE EQUITY EXCEL DESCRIPTION

This Equity Fund Model (Investor Cashflows) template is a valuable tool used by private equity funds during investing activities. It provides a comprehensive analysis of fund cashflows and returns available to Limited Partners (LPs) and the General Partner (GP).

Input/Assumptions:

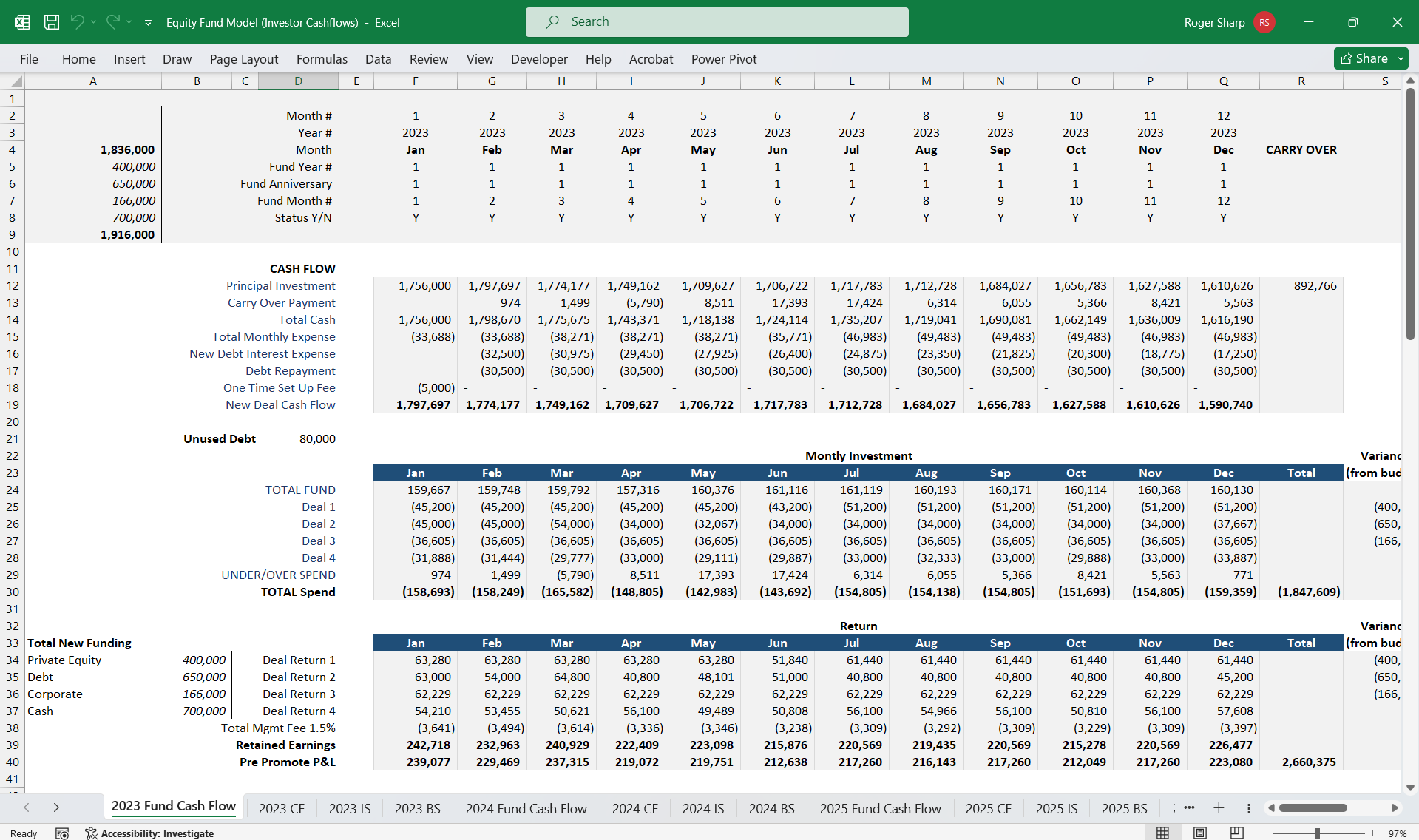

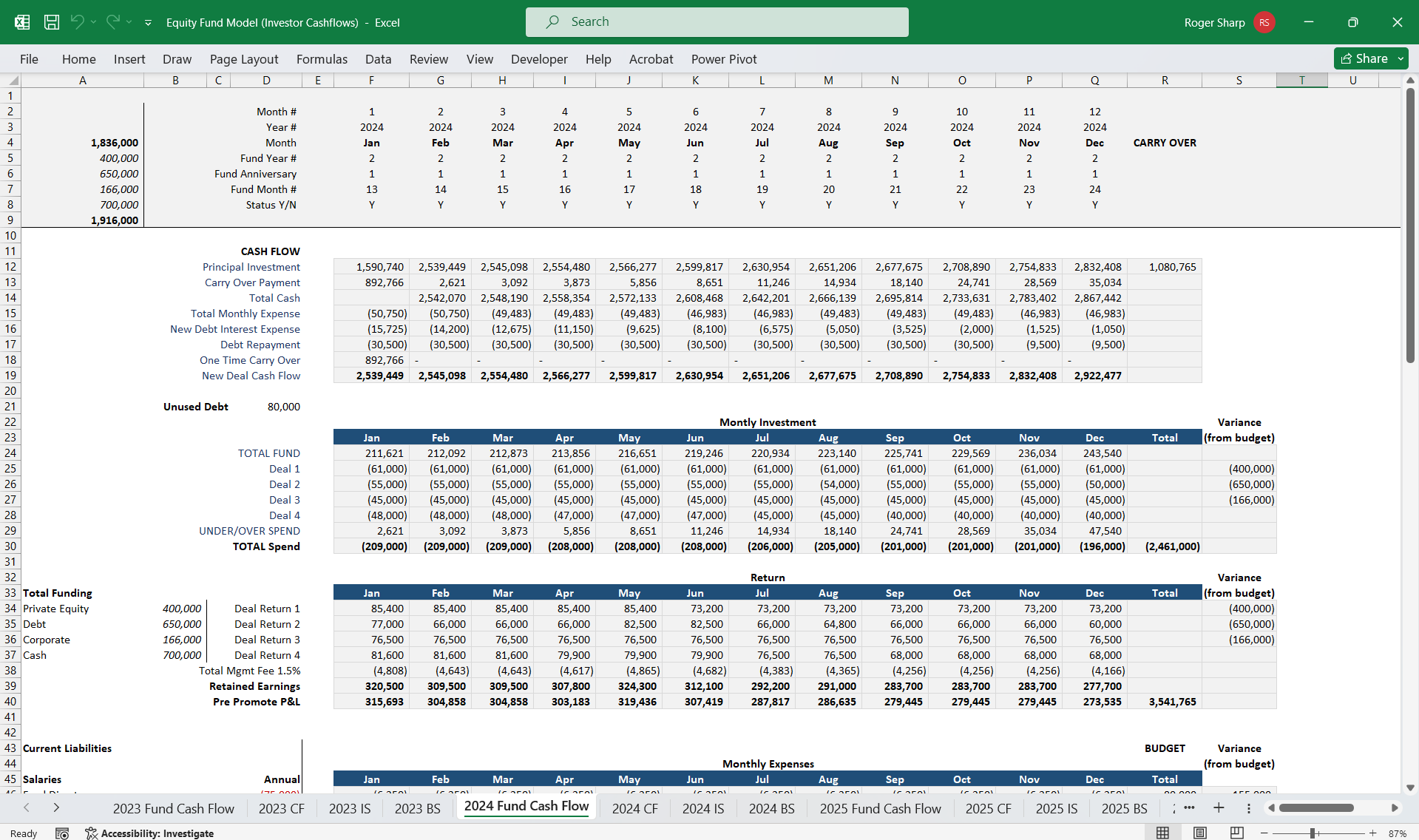

The financial model includes inputs at the fund level (Monthly Investments), such as equity contributions, debt ratio, fund life, commitment period, fund expenses, monthly return ratios, investor management fees, and promote/rollover structure.

Specific assumptions are also provided for availing debt and the expected returns from each portfolio investment, capital contributions and ordinary equity raisings, including a holding period.

Performance Metrics:

Once the inputs are established, the model calculates various performance metrics for each LP and the GP.

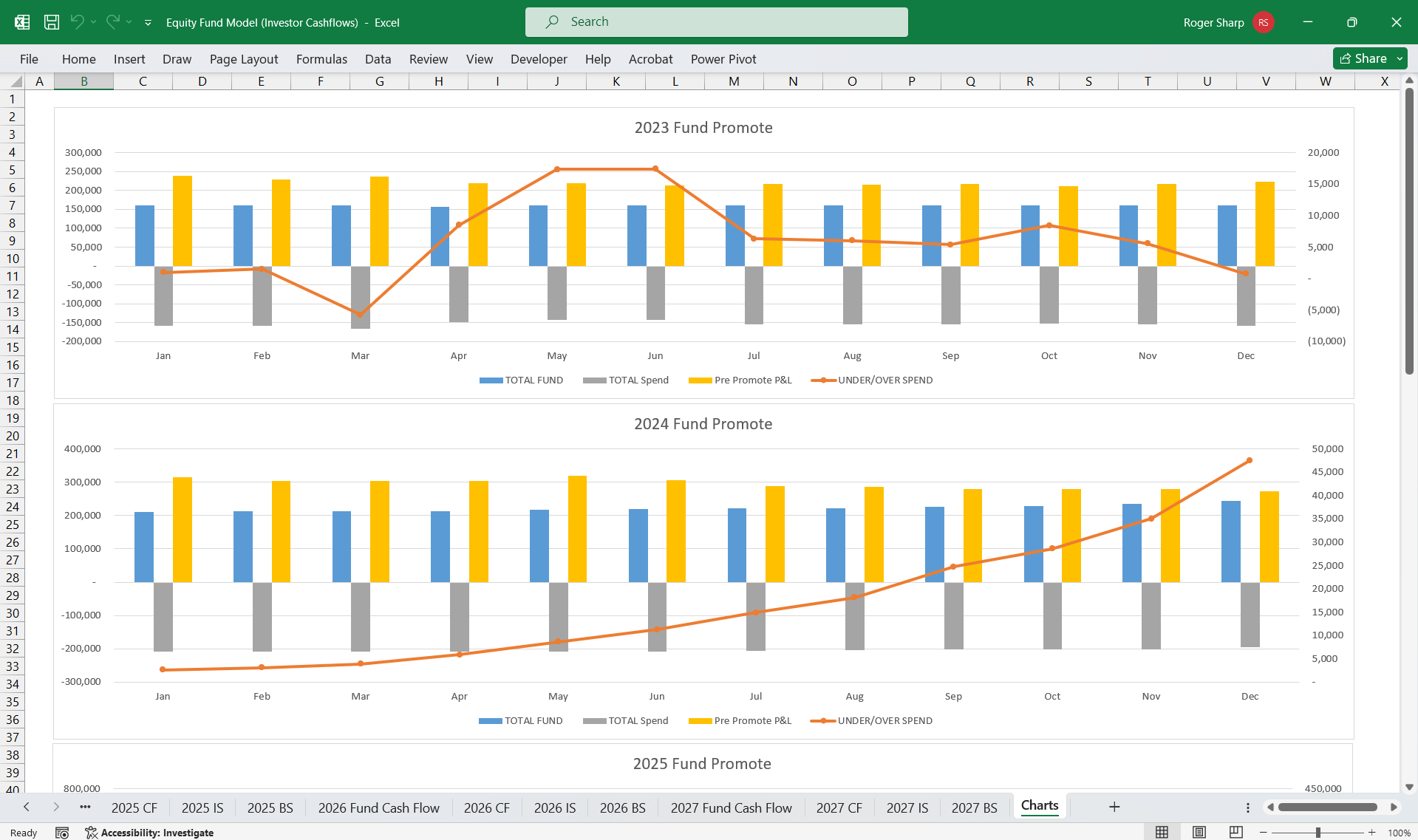

Portfolio-level returns are presented in nominal terms and as IRR/Cash on Cash Multiples.

Fund-level performance charts and key fund ratios are also included.

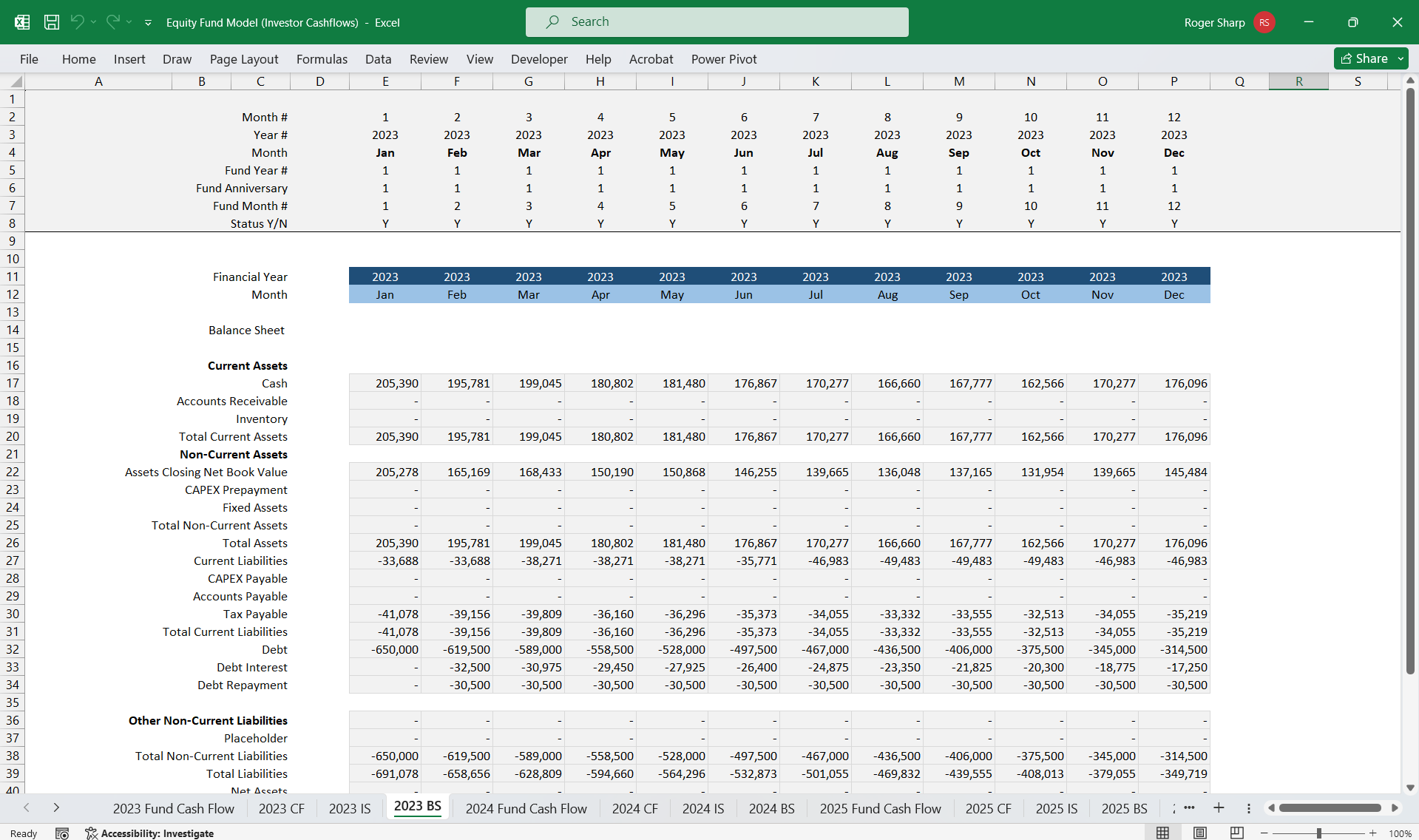

Fund Cashflows:

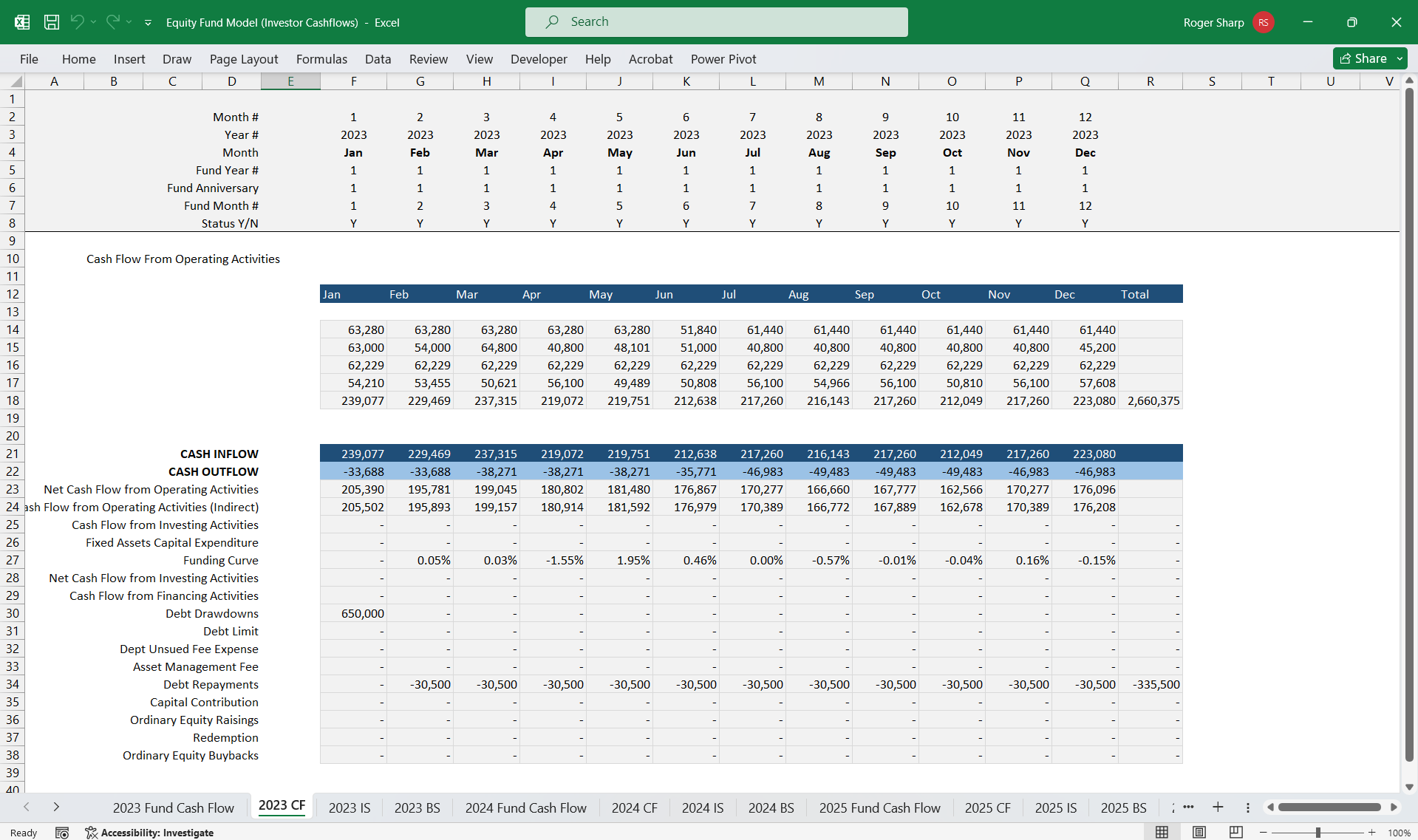

The model tracks total capital contributions (derived from each LP's capital and debt principal) and the take-outs in the form of fees, expenses, debt unused fees and asset management fees.

The net remaining (or net invested capital) is then allocated to the investments.

Cashflows and the Net Asset Value (NAV) calculation are provided for each monthly investment.

Fund Life and Commitment Period:

The fund life represents the entire duration of the fund, including the investment period and any extensions. The commitment period is the time during which investors contribute capital to the fund.

Fund Expenses and Management Fees:

Assumptions about fund expenses (such as legal fees, due diligence costs, and administrative expenses) are critical. Additionally, management fees charged to investors are considered.

Comprehensive Debt and Financing Analysis:

Analyze the impact of debt and equity financing structures on the fund's financial health and growth structure.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Private Equity, Integrated Financial Model Excel: Equity Fund Model (Investor Cashflows) Excel (XLSX) Spreadsheet, Willcox PMO