Capex Budget (Excel XLSX)

Excel (XLSX) + supplemental PDF

BENEFITS OF THIS EXCEL DOCUMENT

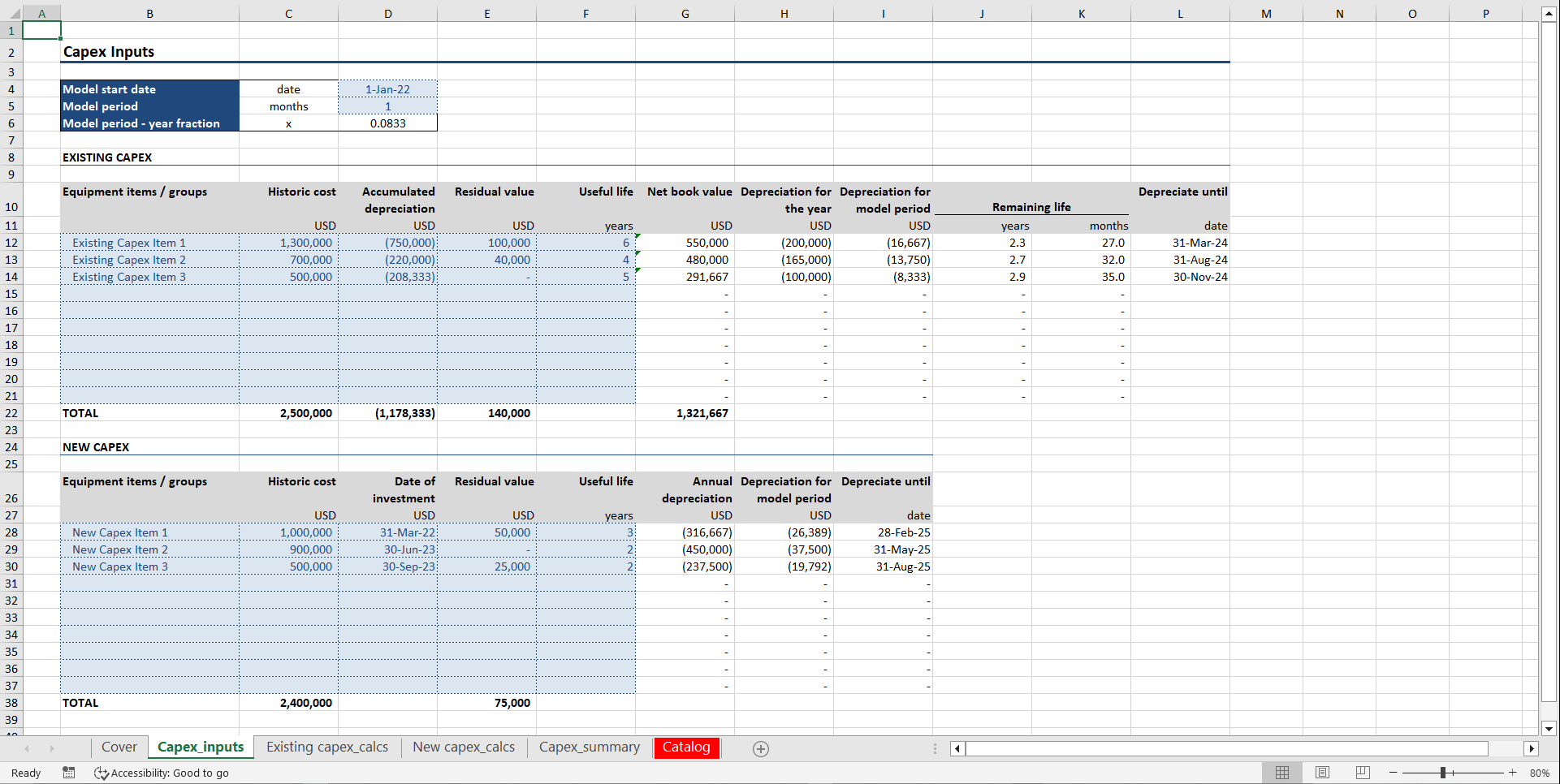

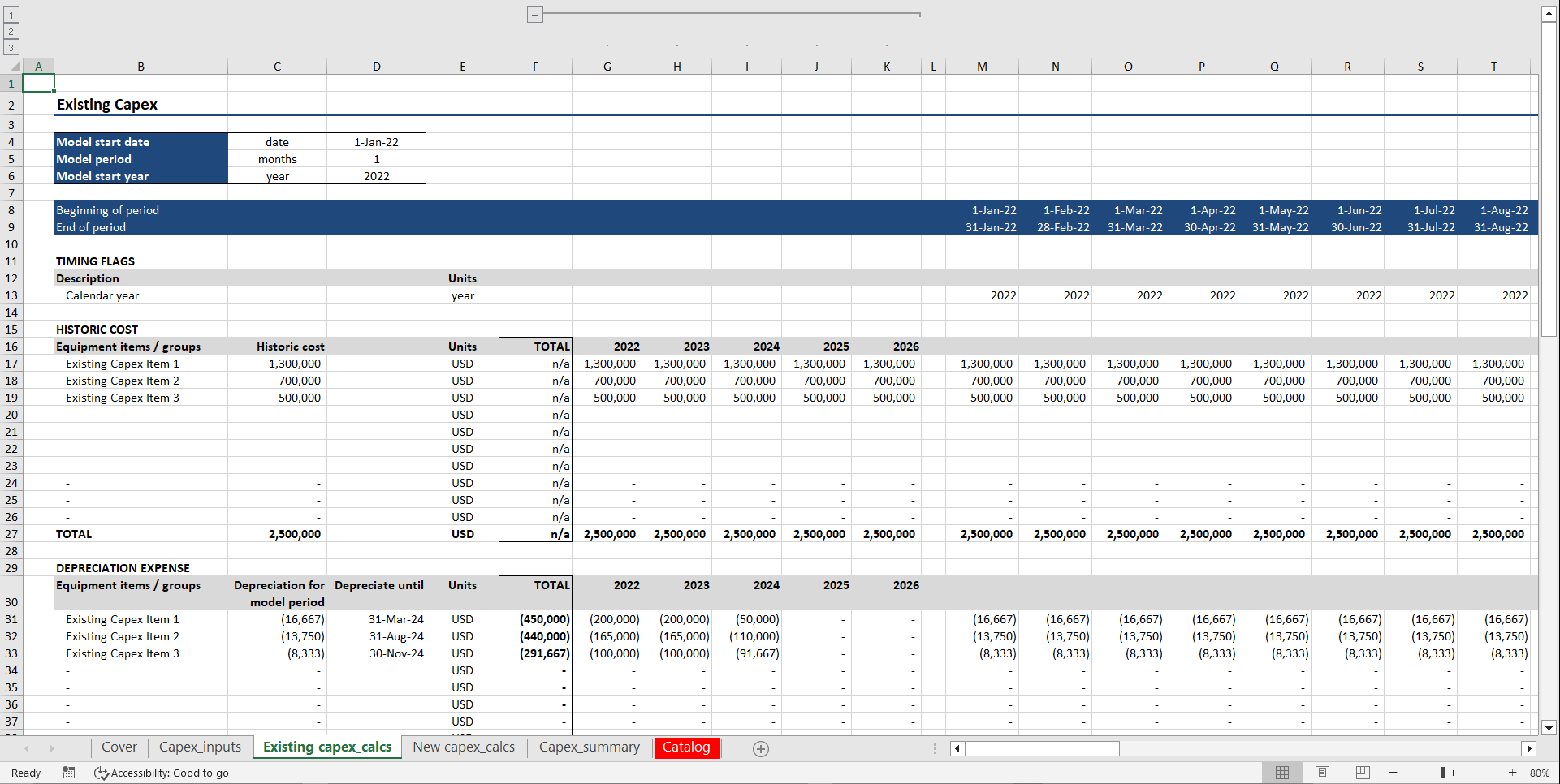

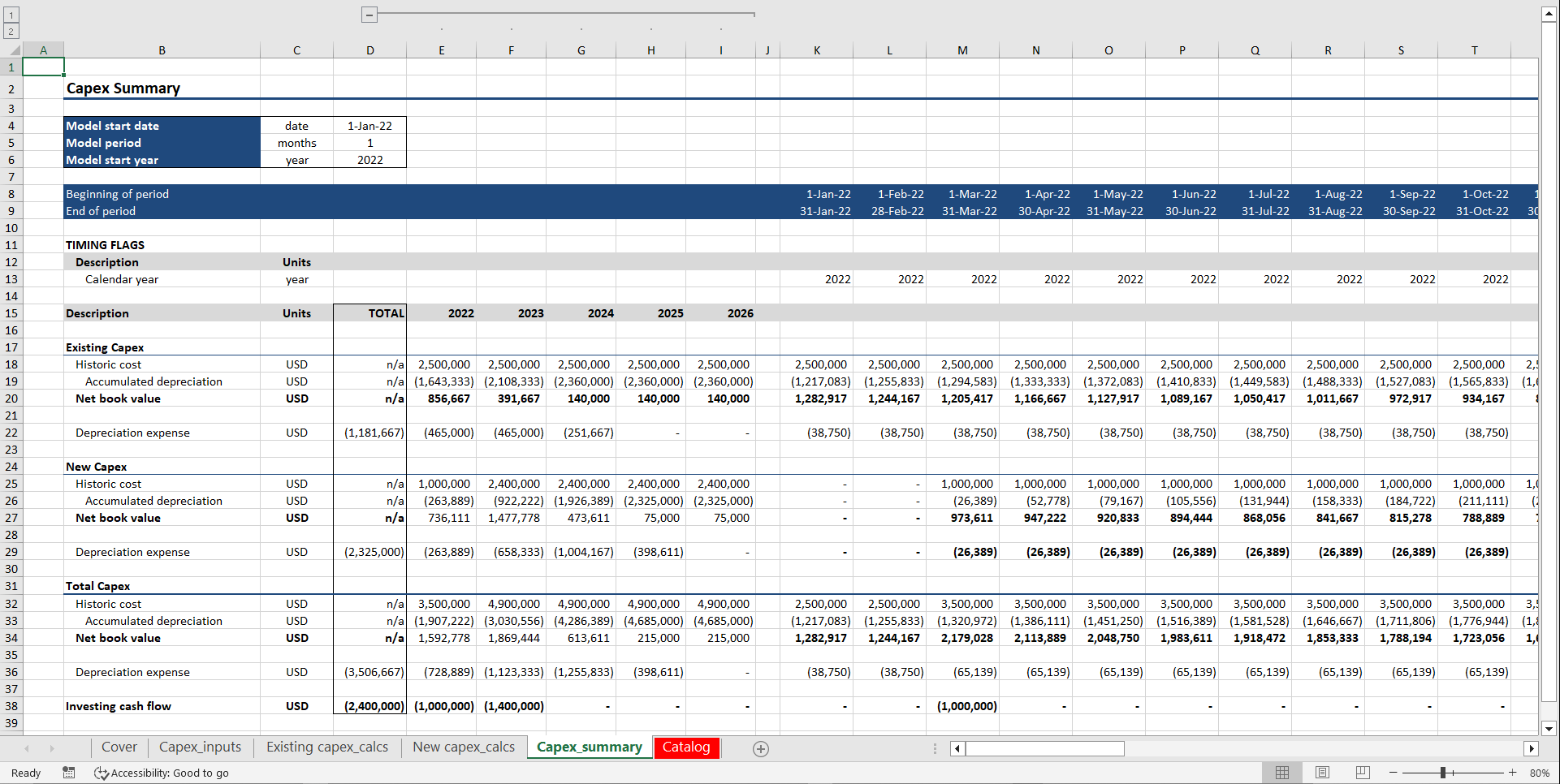

- A professional template to forecast and analyze capital expenses

- Incorporates granular inputs

- Produces detailed reports and summary

BUSINESS CASE DEVELOPMENT EXCEL DESCRIPTION

Any company which uses fixed assets in its operations needs to know:

• Investment cash flow related to new fixed assets

• Future book value of fixed assets

• Residual value

• Future depreciation expense

This template built to the highest financial modelling standards will help you calculate these parameters. It analyzes capex in two major categories

1. Existing capex which your company already has on its balance sheet. Having its net book value, useful life period and other parameters you will be able to calculate its net book value and depreciation expense going forward

2. New capex which will be acquired in the future. The template will calculate the amount of cash by month required for such capex, its net book value and depreciation going forward.

The template is very detailed, user-friendly, features a convenient input section, clear calculation blocks and includes an overall summary.

The template is very flexible and you can adjust the forecast period (currently five years), forecasting interval (currently one month), the number of capex items and other parameters. Due to its flexible nature the template can be used on a stand-alone basis (just for future capex analysis) or incorporated into larger budgeting packs or financial models.

The template is accompanied by a text guide with detailed explanations.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Business Case Development Excel: Capex Budget Excel (XLSX) Spreadsheet, Andrei Okhlopkov