Transaction Services – FDD Working Capital Analysis Model (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

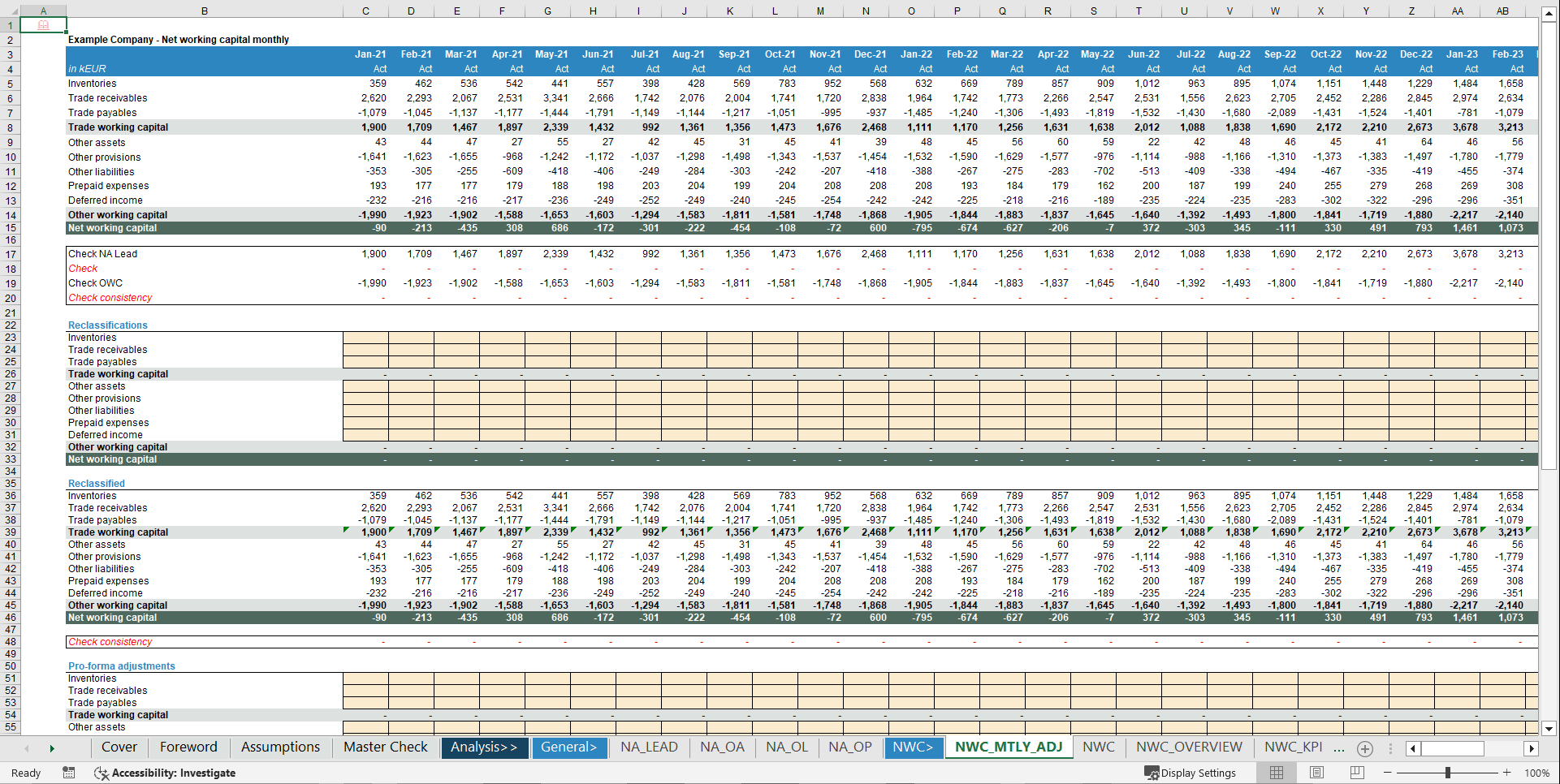

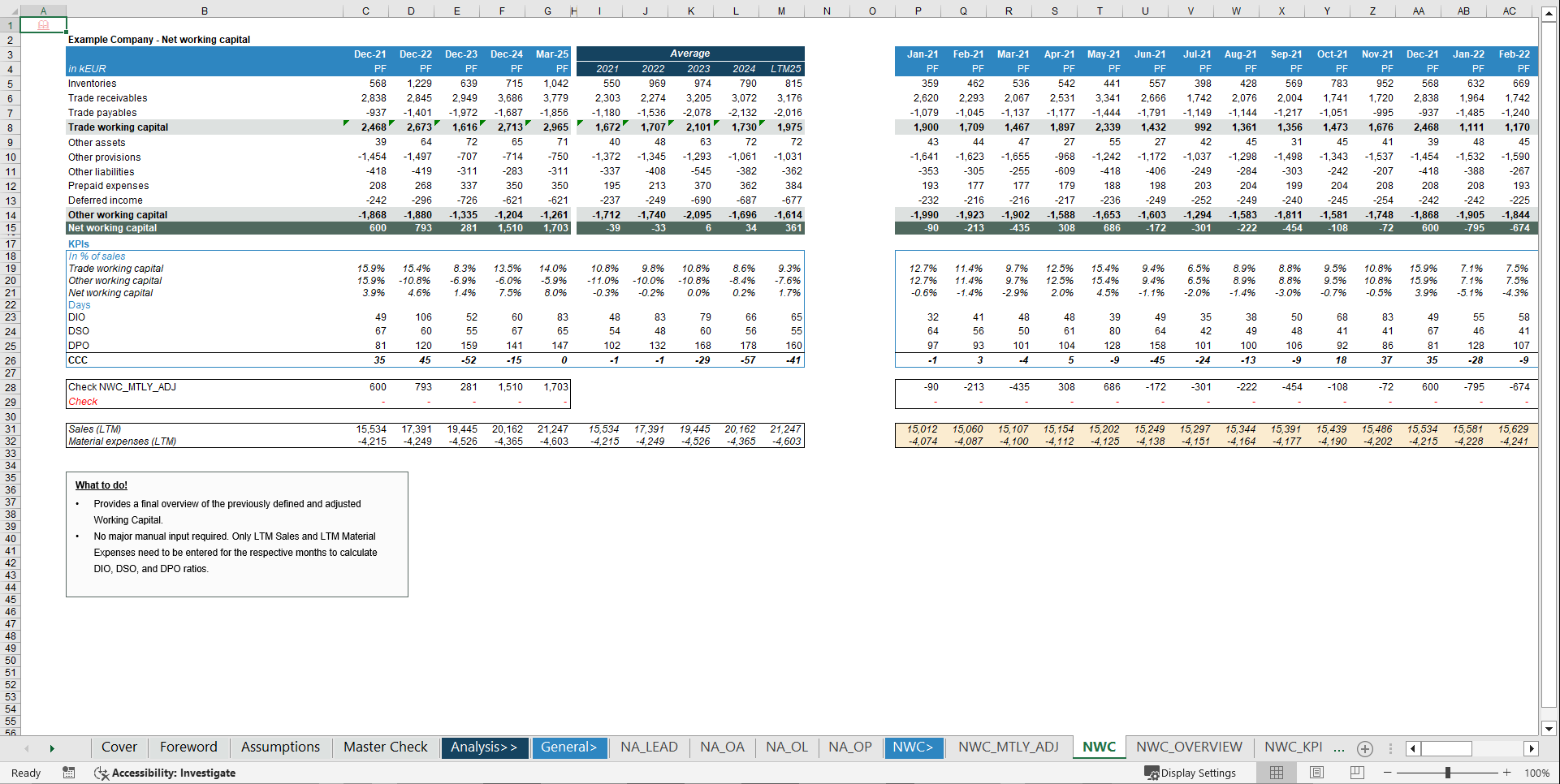

- Provides a clear NWC view with a strict OWC vs. Net Debt split across balance sheet accounts.

- Includes aging, seasonality and KPI analytics (DIO, DSO, DPO, CCC) to assess Working Capital quality and efficiency.

- Supports pro-forma and monthly adjustments to reflect carve-outs, restatements and analytical reclassifications.

DUE DILIGENCE EXCEL DESCRIPTION

Purpose of the tool

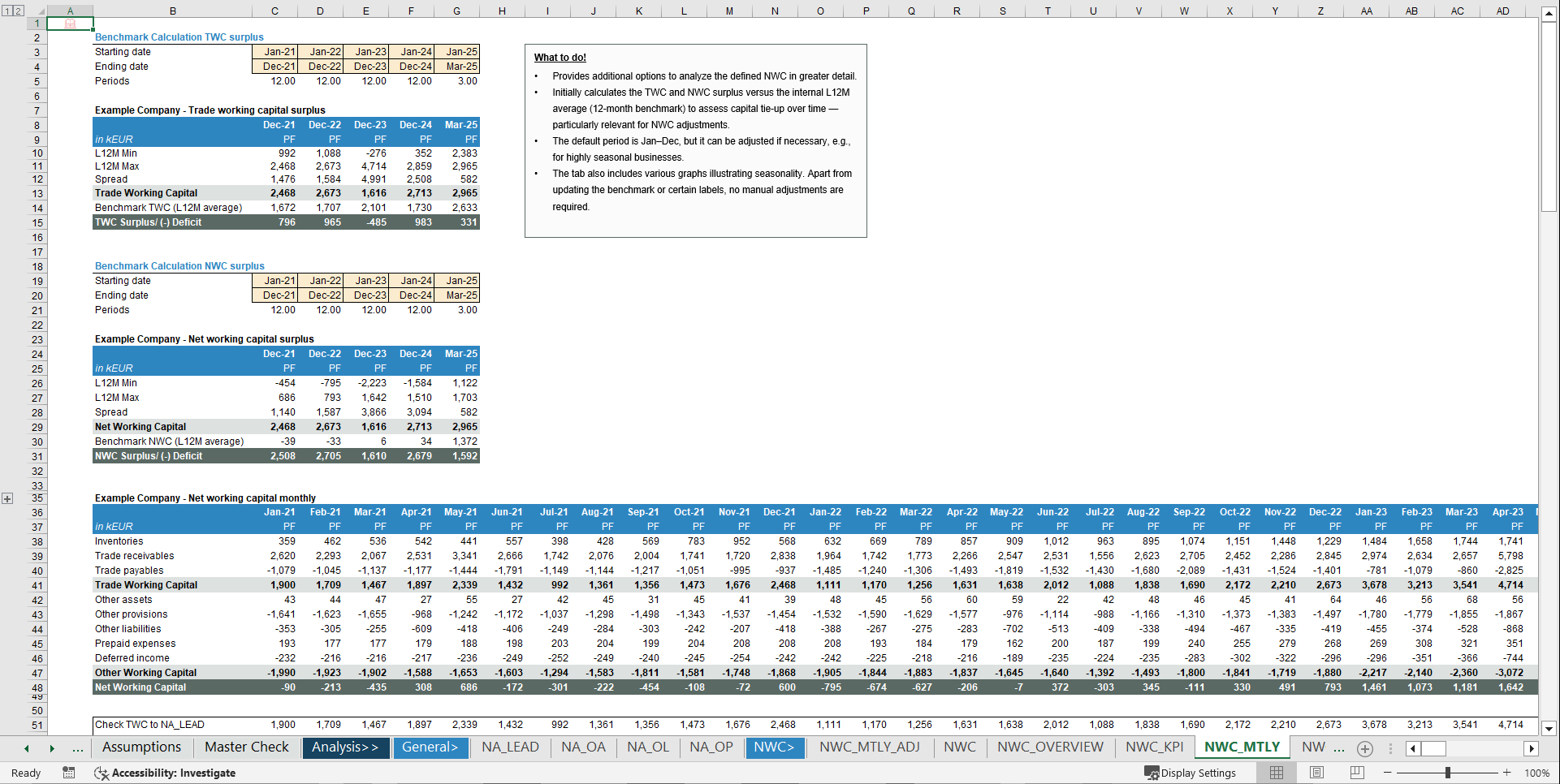

This Excel-based Working Capital Analysis Model provides a structured and transparent view of Net Working Capital (NWC) and its key drivers over time. It separates Operating Working Capital (OWC) from Net Debt (ND), making it clear which balance sheet items are operational versus financing-related and how they impact cash tied up in the business. The model consolidates inventories, trade receivables, trade payables and other current assets and liabilities into one consistent framework. It includes detailed aging analyses for receivables and payables, KPI calculations such as DIO, DSO, DPO and the Cash Conversion Cycle (CCC), as well as seasonality views. This allows you to understand not only the level of Working Capital, but also its quality, efficiency and sustainability. The tool is particularly useful for Transaction Services, financial due diligence and factbook preparation, but it can also support ongoing cash management, performance reviews and internal reporting where visibility on Working Capital and its development is critical.

Key Outputs

The model provides Net Working Capital by component, covering inventories, trade receivables, trade payables and other current assets and liabilities. It delivers a clear split of accounts into Operating Working Capital versus Net Debt / non-operating items and supports pro-forma and monthly adjusted NWC to reflect carve-outs, restatements or analytical reclassifications. Key Working Capital KPIs such as DIO, DSO, DPO, CCC and NWC as a percentage of sales or material expenses are calculated consistently, while trade receivables and payables aging schedules are available including overdue buckets and visualisations. Seasonality and trend views for major Working Capital components and total NWC complete the output set.

Key Inputs & Assumptions

The model is based on trial balance / balance sheet data, preferably at account level and by period. Accounts are mapped to Working Capital categories and to the OWC vs. Net Debt split via simple dropdowns. Optional pro-forma and monthly adjustment entries can be included to reflect structural or analytical changes, and sales plus material expense data is used for KPI calculations.

How to use

Start by setting the core parameters such as time horizon, reporting currency and basic options in the Assumptions sheet. Then load balance sheet / trial balance data into the lead and Working Capital mapping tabs and classify accounts as OWC or Net Debt. After entering relevant pro-forma or monthly adjustments, review the overview, KPI, aging and seasonality tabs to analyse Working Capital level, structure and efficiency.

Customization & support

The model is highly customisable and can be adapted to your chart of accounts, industry requirements or reporting standards by adjusting categories, thresholds, labels, KPIs and charts. For more complex customisations or individual requirements—such as firm-specific versions, integration into broader workbooks or additional analysis modules—feel free to reach out and we can discuss a tailored solution. Each download includes both a fully blank "Clean Template" for working directly with your own data and a pre-populated Example Template that illustrates the model's logic and calculations using realistic sample data. If you want to cover the full analysis scope—from Earnings/QoE and Working Capital to Net Debt plus Sales and customer analytics—you may also want to have a look at the "Transaction Services All-in-One Financial Analysis Workbook."

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Due Diligence, Working Capital Management Excel: Transaction Services – FDD Working Capital Analysis Model Excel (XLSX) Spreadsheet, Finance Model Hub