Hotel Development Financial Model (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a framework for evaluating hotel development projects with clear forecasting of investments, revenues, and expenses over a 10-year horizon.

- Delivers investor-ready outputs including IRR, MOIC, payback period, P&L, and cash flow metrics to support funding, valuation, and decision-making.

- Ensures clarity and consistency through structured layouts, color-coding, and built-in checks, reducing errors and enhancing stakeholder confidence.

HOTEL INDUSTRY EXCEL DESCRIPTION

This financial model is designed to evaluate the investment feasibility, operating performance, and return metrics of a hotel development project. This financial model provides a comprehensive 10-year projection of revenues, expenses, and cash flows, structured on a monthly basis with annual summaries for ease of reporting. An additional 11th projection year is included specifically to compute the stabilized Net Operating Income (NOI), which serves as the basis for determining the exit or terminal value at the conclusion of the 10-year investment horizon.

The structure captures land acquisition, construction outlays, pre-opening expenses, ramp-up after opening, and eventual stabilization, ensuring both short-term operational detail and long-term financial visibility.

Model Structure – 5 Main Sections

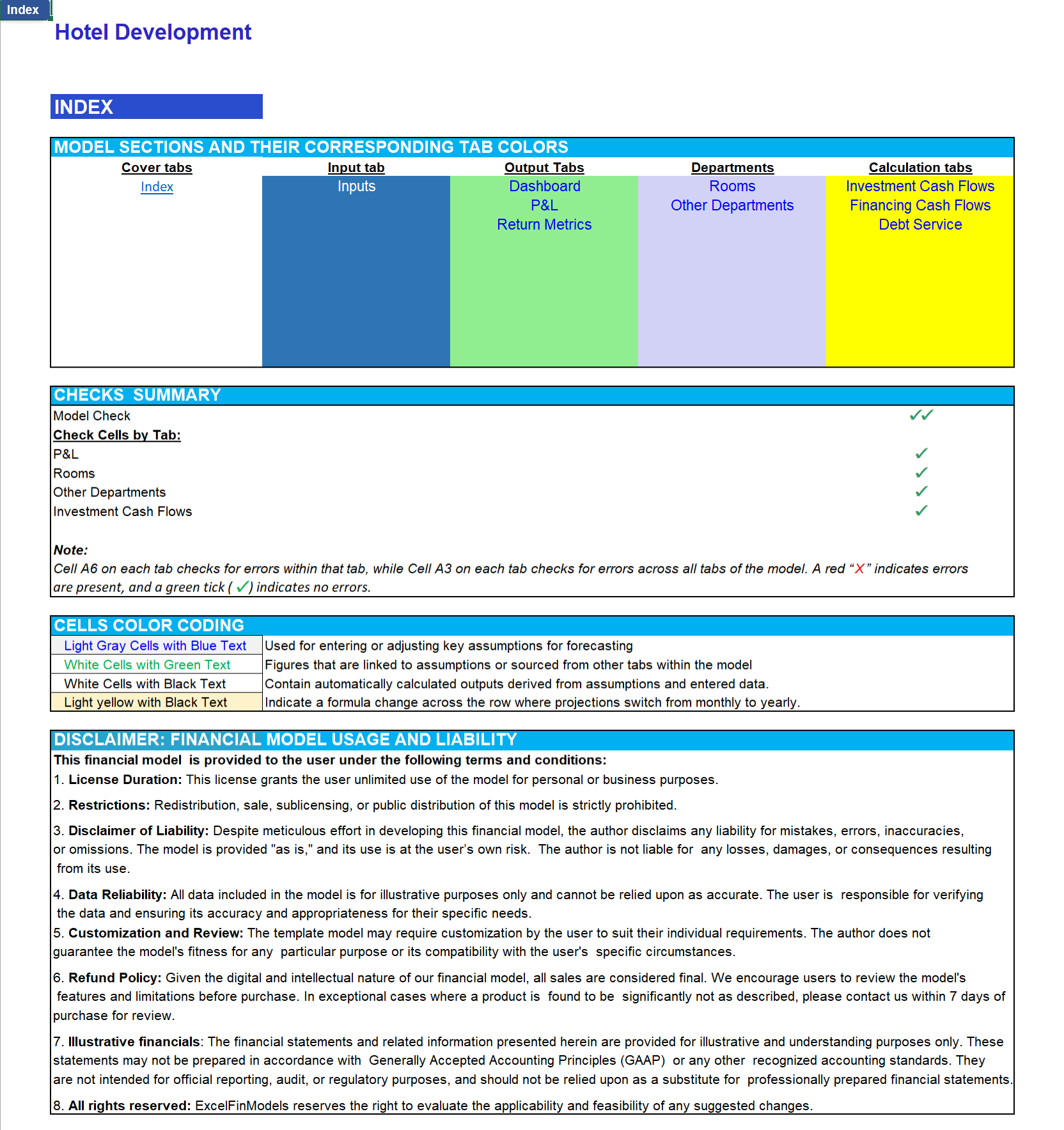

1. Index Section

• Provides a centralized navigation and summary interface.

• Includes cell color-coding guidelines, tab color-coding for user orientation, a checks summary showing the error status across different tabs, and a disclaimer regarding the intended use of the model.

• Cell A1 in every tab links directly back to this Index tab.

2. Assumptions Section

• Core input area for all project and operating assumptions, structured for transparency and ease of use.

• Key assumptions captured include:

• Investment costs (land, hard, soft, and financing costs).

• Sources of funding (equity and debt).

• Depreciation policy and ramp-up schedule.

• Room mix, tariff, and occupancy assumptions across different seasons with up to 3 scenarios.

• Season-wise occupancy.

• Departmental assumptions: F&B (revenues, costs, payroll), Spa (revenues, costs, payroll), and other departments.

• Overheads and other costs: repairs, sales & marketing, utilities, admin, management fees, property taxes, insurance, and FF&E reserve.

• Inputs for waterfall distribution (preferred return, hurdle rates, promote structure etc.).

3. Output Section

• Presents the key financial results in both tabular and graphical form.

• Includes:

• Return Metrics Tab: Unlevered IRR, Levered IRR, cash-on-cash multiples, payback period.

• Dashboard Tab: Charts and summary tables for quick review.

• P&L Tab: Projected profit & loss statement – fully monthly for 10 years with the option to roll into annualized summaries.

• Waterfall Distribution Tab: Detailed LP/GP distributions across hurdles, with IRR splits and promote allocation.

4. Department Section

• Rooms Department Tab:

• Calculates available room nights, occupied room nights, ADR, and room revenues.

• Includes departmental expenses, payroll, and allocable costs.

• Produces key hotel metrics such as ADR and RevPAR.

• Other Departments Tab:

• Summarizes revenues and expenses of supporting departments such as F&B, Spa, and other ancillary services.

• Includes payroll, direct costs, and allocated overheads such as admin, repairs & maintenance, utilities, and sales & marketing.

5. Calculations Section

• Investments Tab: Tracks monthly investment outlays across cost heads, using an S-curve to reflect realistic phasing.

• Financing Tab: Records monthly sources of equity and debt funding, aligned with investment cash flows and operating shortfalls.

• Debt Service Tab: Calculates interest expense, principal repayments, amortization schedules, and outstanding balances including payoff.

Other Features

• Error-checking framework:

• Cell A6 in each tab checks for tab-level errors.

• Cell A3 in each tab checks for model-wide consistency errors.

• Indicators display a green tick (✔) for no errors or a red X (✘) if issues are detected.

• Navigation aid: Cell A1 on every tab links back to the Index tab.

• Compatibility: Fully functional in Excel 2010 and later versions.

Why Choose This Model?

This model is purpose-built for hotel development and investment projects. It balances clarity, flexibility, and investor-readiness, making it ideal for both internal feasibility analysis and external fundraising efforts. The structure provides 11 years of monthly forecasting with roll-up to annual summaries, ensuring detailed operational tracking and long-term efficiency. It incorporates S-curve investment phasing, departmental revenues and costs (Rooms, F&B, Spa, etc.), and comprehensive return metrics such as levered/unlevered IRR, MOIC, and payback period. Whether you're evaluating a new hotel project, securing financing, or preparing investor presentations, this model adapts to your requirements and provides the analytical depth stakeholders expect.

Need Customization?

Our team can tailor the model to align with your specific property, renovation scope, funding structure, and market assumptions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Hotel Industry, Integrated Financial Model Excel: Hotel Development Financial Model Excel (XLSX) Spreadsheet, ExcelFinModels