100+ Mergers & Aquisitions (M&A) Due Diligence SOPs (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a complete, institutional-grade framework for executing end-to-end M&A due diligence with speed, precision, and zero blind spots.

- Delivers a ready-to-use SOP system that standardizes financial, legal, tax, commercial, operational, IT, HR, ESG, and risk due diligence across any deal size.

- Enables deal teams to eliminate chaos, surface red flags early, and run M&A transactions with the discipline and credibility of top-tier private equity firms.

DUE DILIGENCE EXCEL DESCRIPTION

Curated by McKinsey-trained Executives

🚀 100+ M&A Due Diligence SOPs Library

The Ultimate Mergers & Acquisitions Due Diligence Excel Template Used by Serious Dealmakers

If you are buying, selling, investing, advising, or integrating companies and you *don't* have institutional-grade SOPs… you are gambling with millions.

This 100+ Mergers & Acquisitions (M&A) Due Diligence SOPs Library is a battle-tested Excel-based SOP framework that gives you instant structure, speed, and control across every due diligence workstream – financial, legal, tax, commercial, operational, IT, HR, ESG, valuation, integration, and risk.

This is not theory.

This is how professionals run deals.

🔥 What This Is (And Why It Converts Deals Faster)

✔ 150 professionally structured Due Diligence SOPs

✔ Delivered as a clean, scalable Excel template

✔ Built for Private Equity, Corporate M&A, Investment Banking, Search Funds, CFOs, Deal Teams & Advisors

✔ Eliminates chaos, missed risks, and sloppy diligence

✔ Cuts weeks off diligence timelines

✔ Makes your deal team look institutional from Day One

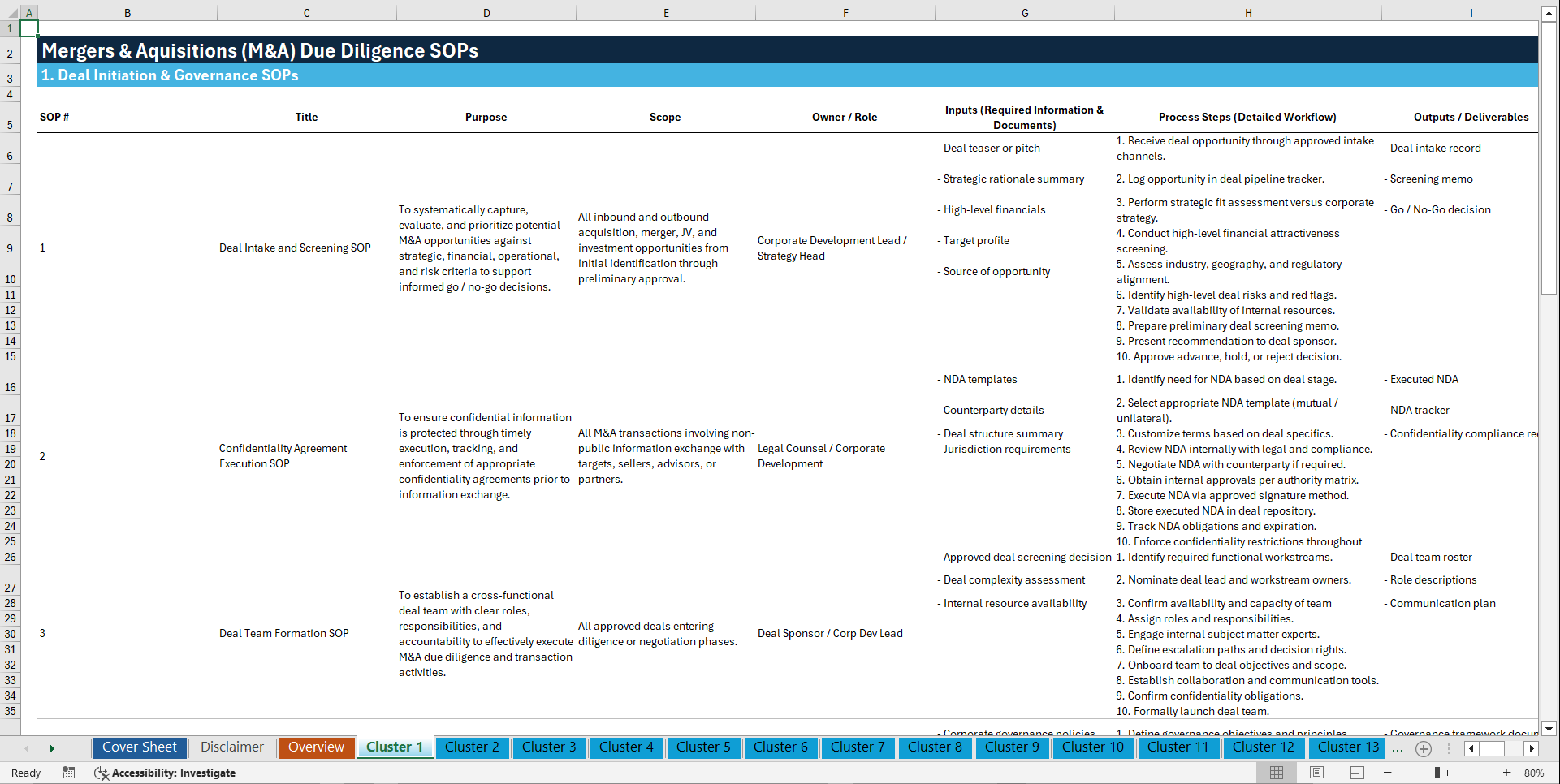

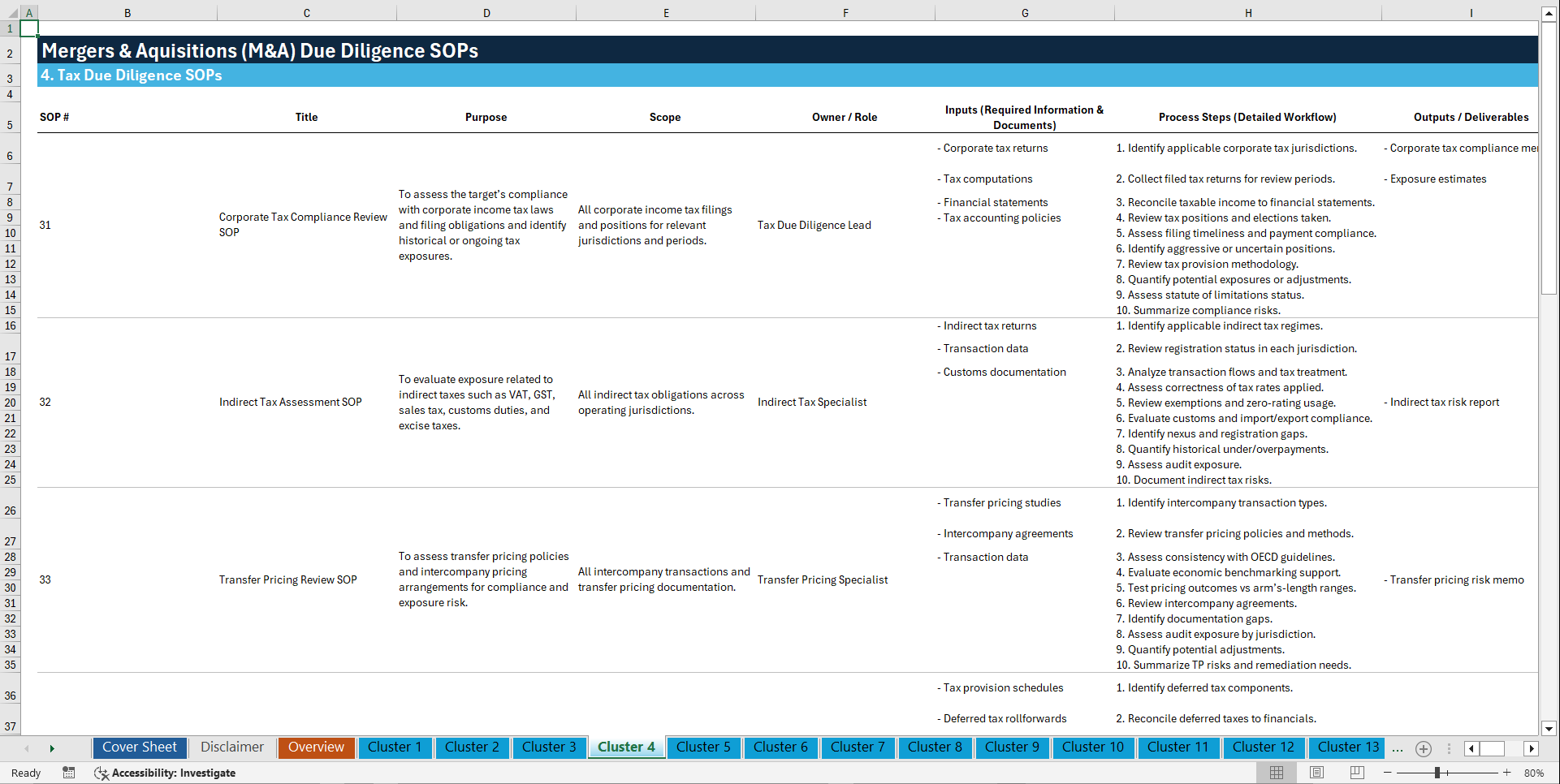

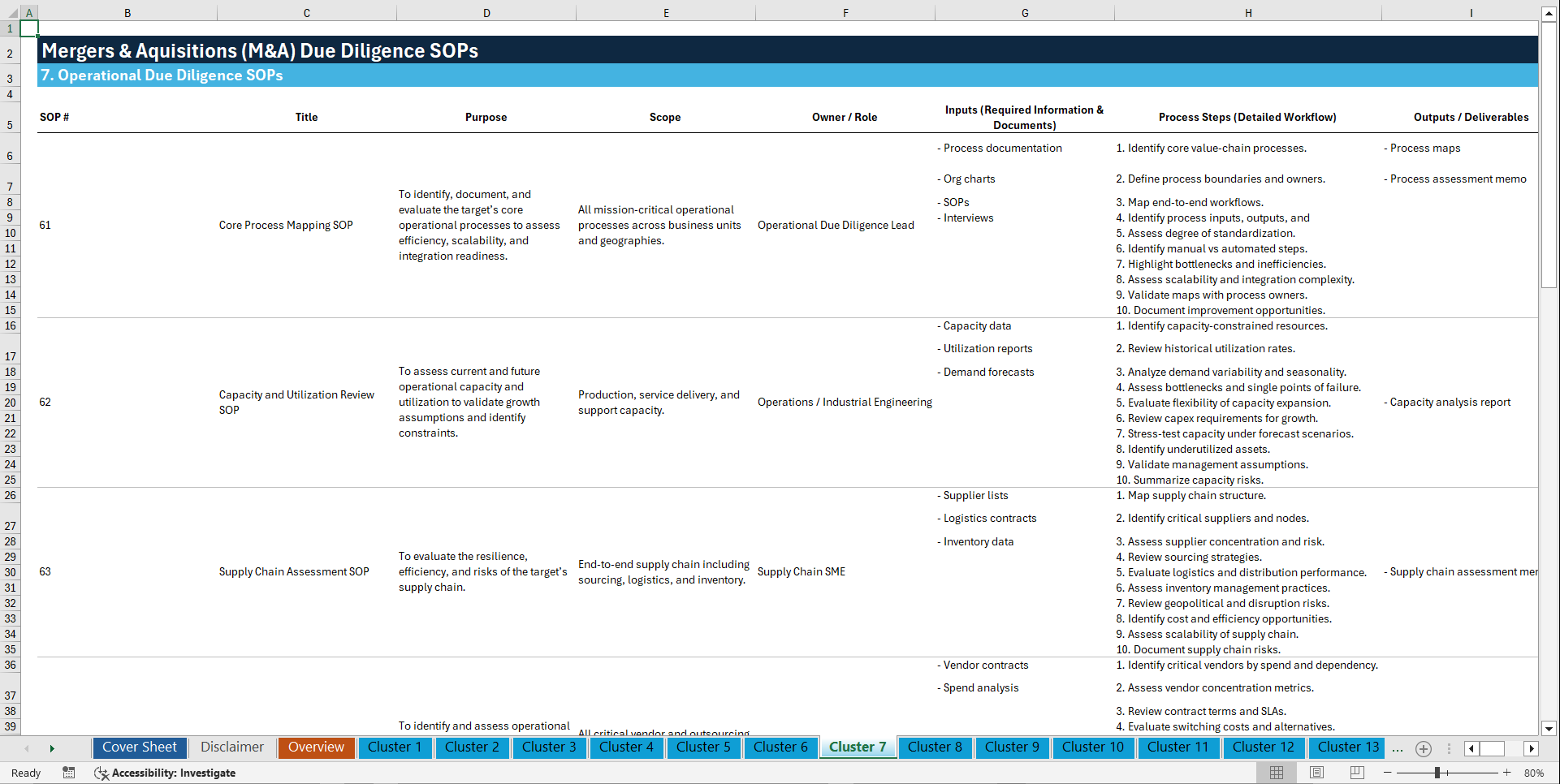

Every single SOP is fully structured with:

• Purpose

• Scope

• Owner / Responsible Role

• Inputs (Required Information & Documents)

• Process Steps (Detailed Workflow)

• Outputs / Deliverables

• KPIs / Success Metrics

• Risks / Controls

• Review Frequency

You don't start from zero.

You start from best practice.

🧠 Who This Is Built For

• M&A Due Diligence Teams

• Private Equity Funds

• Corporate Development Teams

• Investment Banks

• Transaction Advisory Firms

• Search Fund Operators

• CFOs & Finance Leaders

• Deal Execution & Integration Teams

If you touch M&A due diligence, this belongs in your toolkit.

📊 COMPLETE SOP LIBRARY

1. Deal Initiation & Governance

1. Deal Intake and Screening SOP

2. Confidentiality Agreement Execution SOP

3. Deal Team Formation SOP

4. Deal Governance Framework SOP

5. Advisor Engagement SOP

6. Conflict of Interest Management SOP

7. Deal Timeline and Milestone SOP

8. Due Diligence Scope Definition SOP

9. Authority and Approval Matrix SOP

10. Deal Kickoff Meeting SOP

2. Data Room & Information Management

11. Virtual Data Room Setup SOP

12. Data Request List Development SOP

13. Document Indexing and Naming SOP

14. Data Room Access Control SOP

15. Document Version Control SOP

16. Information Gap Tracking SOP

17. Q&A Management SOP

18. Data Integrity Verification SOP

19. Sensitive Information Handling SOP

20. Data Room Close-Out SOP

3. Financial Due Diligence

21. Historical Financial Statement Review SOP

22. Quality of Earnings Analysis SOP

23. Revenue Recognition Review SOP

24. Cost Structure and Margin Analysis SOP

25. Working Capital Assessment SOP

26. Cash Flow Sustainability SOP

27. Debt and Off-Balance Sheet Review SOP

28. Financial Controls Evaluation SOP

29. Financial Forecast Validation SOP

30. Financial Red Flags Reporting SOP

4. Tax Due Diligence

31. Corporate Tax Compliance Review SOP

32. Indirect Tax Assessment SOP

33. Transfer Pricing Review SOP

34. Deferred Tax Analysis SOP

35. Tax Loss and Credit Validation SOP

36. Cross-Border Tax Exposure SOP

37. Tax Audit and Dispute Review SOP

38. Change-in-Control Tax Impact SOP

39. Tax Structuring Options SOP

40. Tax Risk Register SOP

5. Legal Due Diligence

41. Corporate Structure and Charter Review SOP

42. Material Contracts Review SOP

43. Litigation and Disputes Assessment SOP

44. Regulatory Compliance Review SOP

45. Intellectual Property Ownership SOP

46. Data Protection and Privacy Review SOP

47. Change-of-Control Clause Analysis SOP

48. Legal Liabilities Assessment SOP

49. Legal Opinion Coordination SOP

50. Legal Findings Reporting SOP

6. Commercial & Market Due Diligence

51. Market Size and Growth Assessment SOP

52. Competitive Landscape Analysis SOP

53. Customer Segmentation Review SOP

54. Customer Concentration Analysis SOP

55. Pricing and Discount Review SOP

56. Sales Pipeline Validation SOP

57. Go-To-Market Strategy Review SOP

58. Brand Positioning Assessment SOP

59. Customer Retention and Churn Analysis SOP

60. Commercial Risk Summary SOP

7. Operational Due Diligence

61. Core Process Mapping SOP

62. Capacity and Utilization Review SOP

63. Supply Chain Assessment SOP

64. Vendor Dependency Analysis SOP

65. Quality Management Systems Review SOP

66. Health and Safety Compliance SOP

67. Operational KPI Assessment SOP

68. Business Continuity Planning SOP

69. Operational Cost Benchmarking SOP

70. Operational Risk Register SOP

8. Technology & IT Due Diligence

71. IT Architecture Review SOP

72. Core Systems Inventory SOP

73. Cybersecurity Risk Assessment SOP

74. Data Privacy and IT Compliance SOP

75. Software Licensing Review SOP

76. IT Scalability Assessment SOP

77. Technology Debt Evaluation SOP

78. IT Vendor and Outsourcing Review SOP

79. Disaster Recovery and Backup SOP

80. IT Integration Readiness SOP

9. Human Resources Due Diligence

81. Organization Structure Review SOP

82. Key Personnel Identification SOP

83. Compensation and Benefits Analysis SOP

84. Incentive and Equity Plan Review SOP

85. Employment Contract Review SOP

86. Labor Law Compliance SOP

87. Workforce Demographics Analysis SOP

88. Talent Retention Risk Assessment SOP

89. Cultural Assessment SOP

90. HR Risk Summary SOP

10. Intellectual Property Due Diligence

91. IP Asset Inventory SOP

92. Patent Validity and Ownership SOP

93. Trademark and Brand Protection SOP

94. IP Licensing Agreements Review SOP

95. Open-Source Software Review SOP

96. IP Infringement Risk SOP

97. Trade Secrets Protection SOP

98. R&D Pipeline Assessment SOP

99. IP Valuation Inputs SOP

100. IP Risk Register SOP

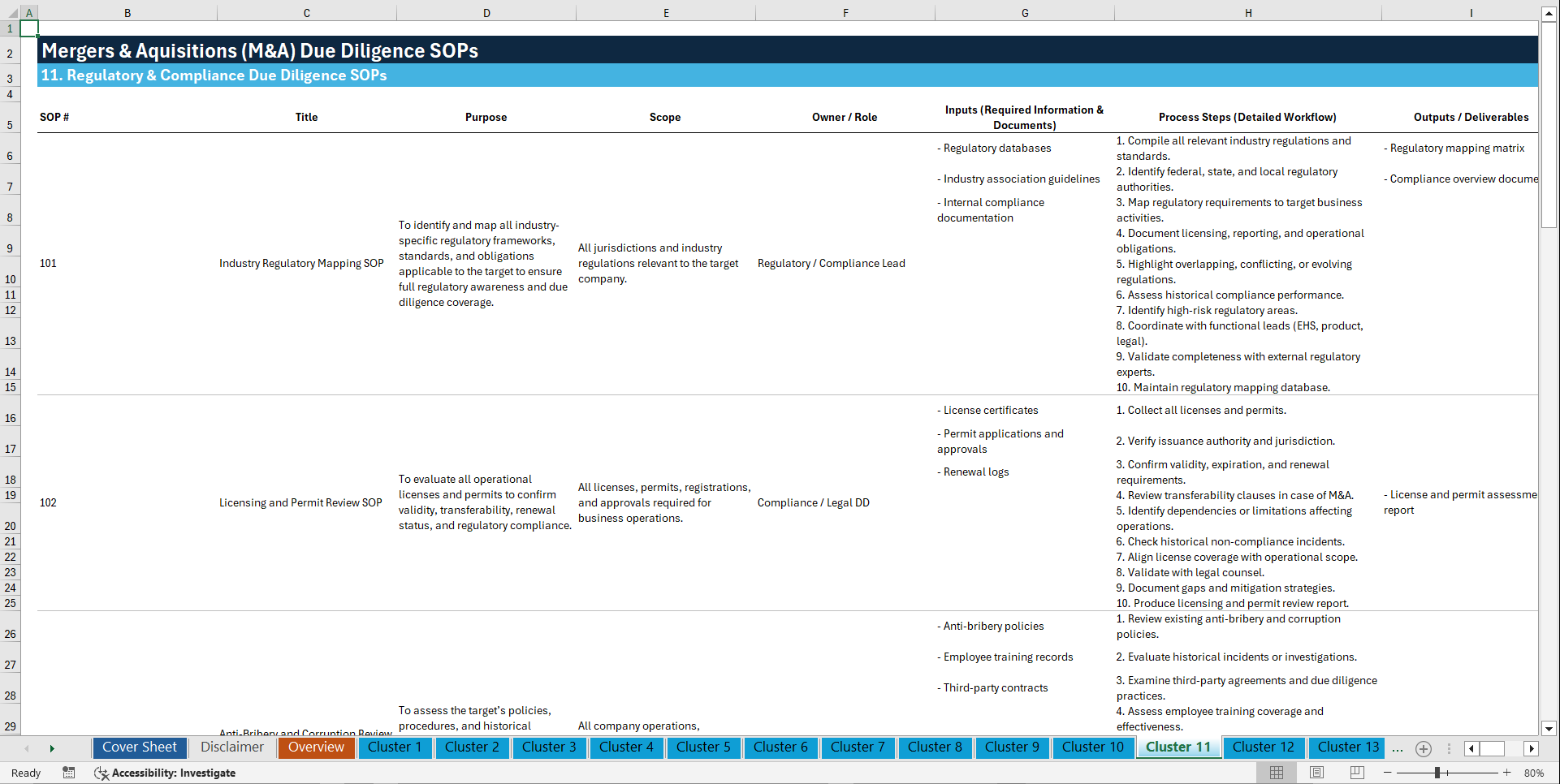

11. Regulatory & Compliance Due Diligence

101. Industry Regulatory Mapping SOP

102. Licensing and Permit Review SOP

103. Anti-Bribery and Corruption Review SOP

104. Sanctions and Trade Compliance SOP

105. Environmental Regulation Review SOP

106. Product Compliance Assessment SOP

107. Government Contract Compliance SOP

108. Regulatory Change Impact SOP

109. Compliance Program Maturity SOP

110. Regulatory Findings Reporting SOP

12. Environmental, Social & ESG Due Diligence

111. Environmental Liability Assessment SOP

112. Climate Risk Exposure SOP

113. Workplace Safety Review SOP

114. Social Impact Assessment SOP

115. ESG Data Validation SOP

116. Sustainability Policy Review SOP

117. Supply Chain ESG Risk SOP

118. ESG Regulatory Compliance SOP

119. ESG Integration Opportunities SOP

120. ESG Risk Summary SOP

13. Valuation & Deal Economics

121. Valuation Methodology Selection SOP

122. Key Value Driver Identification SOP

123. Synergy Identification SOP

124. Cost Synergy Validation SOP

125. Revenue Synergy Assessment SOP

126. Sensitivity and Scenario Analysis SOP

127. Purchase Price Adjustment SOP

128. Earn-Out Structuring SOP

129. Value Leakage Assessment SOP

130. Valuation Committee Review SOP

14. Integration & Separation Planning

131. Day-One Readiness Planning SOP

132. Target Operating Model Design SOP

133. Integration Governance SOP

134. Systems Integration Planning SOP

135. HR Integration Planning SOP

136. Customer and Vendor Transition SOP

137. Communication and Change Management SOP

138. TSA Identification and Management SOP

139. Integration Risk Tracking SOP

140. Synergy Realization Tracking SOP

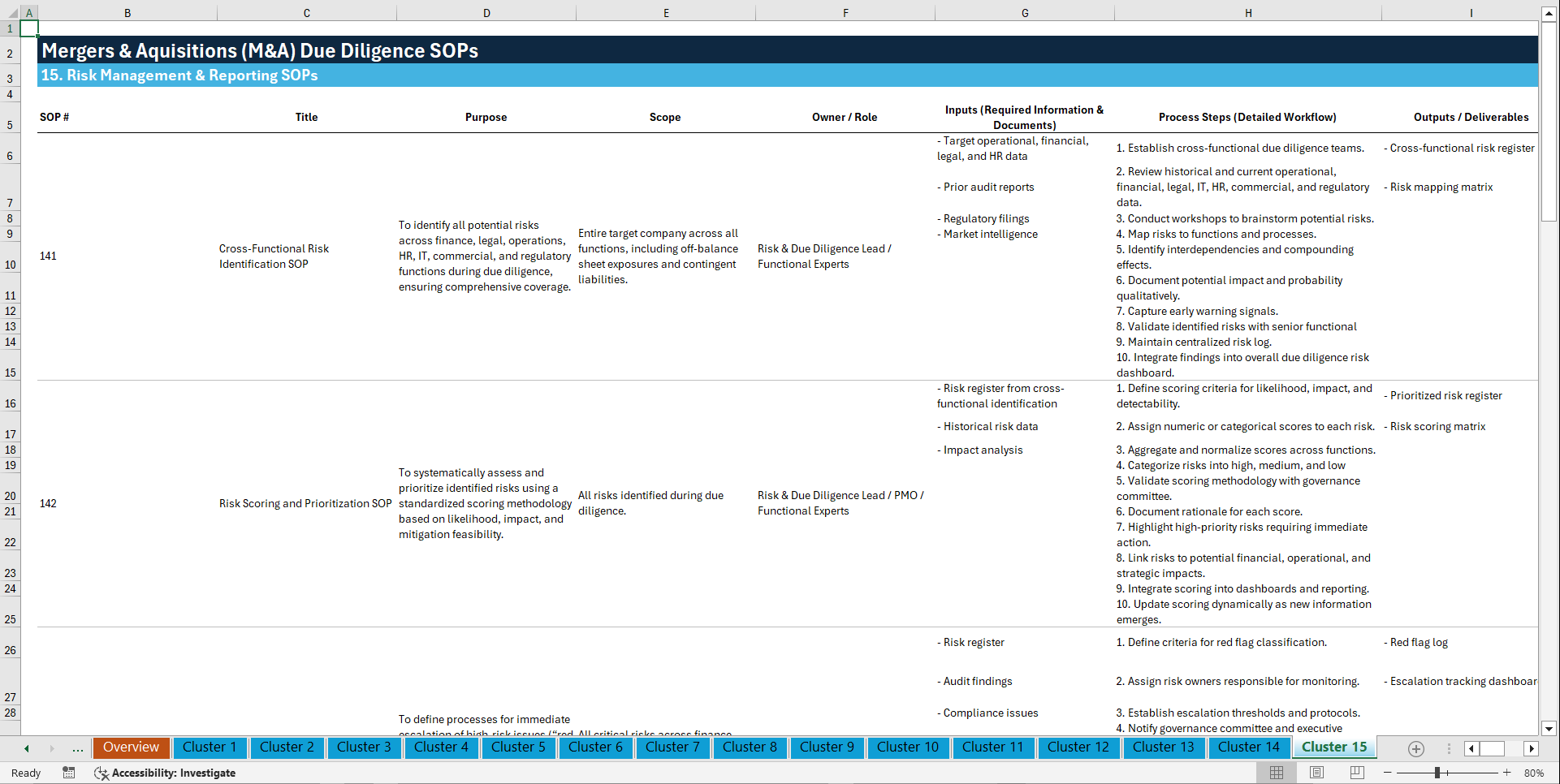

15. Risk Management & Reporting

141. Cross-Functional Risk Identification SOP

142. Risk Scoring and Prioritization SOP

143. Red Flag Escalation SOP

144. Mitigation Action Planning SOP

145. Deal Issue Log Management SOP

146. Executive Steering Updates SOP

147. Final Due Diligence Report SOP

148. Investment Committee Materials SOP

149. Decision Gate Review SOP

150. Post-Deal Lessons Learned SOP

💣 Why This SOP Library Wins Deals

• No more reinventing diligence for every transaction

• No more missed risks

• No more amateur execution

• Instant institutional credibility

• Scales across deals, teams, and geographies

This is what top-tier deal teams already use – now you can too.

⚡ Bottom Line

If your M&A process matters…

If your downside risk matters…

If your reputation matters…

👉 This 100+ M&A Due Diligence SOPs Library is not optional.

Key Words:

Strategy & Transformation, Growth Strategy, Strategic Planning, Strategy Frameworks, Innovation Management, Pricing Strategy, Core Competencies, Strategy Development, Business Transformation, Marketing Plan Development, Product Strategy, Breakout Strategy, Competitive Advantage, Mission, Vision, Values, Strategy Deployment & Execution, Innovation, Vision Statement, Core Competencies Analysis, Corporate Strategy, Product Launch Strategy, BMI, Blue Ocean Strategy, Breakthrough Strategy, Business Model Innovation, Business Strategy Example, Corporate Transformation, Critical Success Factors, Customer Segmentation, Customer Value Proposition, Distinctive Capabilities, Enterprise Performance Management, KPI, Key Performance Indicators, Market Analysis, Market Entry Example, Market Entry Plan, Market Intelligence, Market Research, Market Segmentation, Market Sizing, Marketing, Michael Porter's Value Chain, Organizational Transformation, Performance Management, Performance Measurement, Platform Strategy, Product Go-to-Market Strategy, Reorganization, Restructuring, SWOT, SWOT Analysis, Service 4.0, Service Strategy, Service Transformation, Strategic Analysis, Strategic Plan Example, Strategy Deployment, Strategy Execution, Strategy Frameworks Compilation, Strategy Methodologies, Strategy Report Example, Value Chain, Value Chain Analysis, Value Innovation, Value Proposition, Vision Statement, Corporate Strategy, Business Development, Business plan pdf, business plan, PDF, Business Plan DOC, Business Plan Template, PPT, Market strategy playbook, strategic market planning, competitive analysis tools, market segmentation frameworks, growth strategy templates, product positioning strategy, market execution toolkit, strategic alignment playbook, KPI and OKR frameworks, business growth strategy guide, cross-functional strategy templates, market risk management, market strategy PowerPoint doc, guide, ebook, e-book ,McKinsey Change Playbook, Organizational change management toolkit, Change management frameworks 2025, Influence model for change, Change leadership strategies, Behavioral change in organizations, Change management PowerPoint templates, Transformational leadership in change, supply chain KPIs, supply chain KPI toolkit, supply chain PowerPoint template, logistics KPIs, procurement KPIs, inventory management KPIs, supply chain performance metrics, manufacturing KPIs, supply chain dashboard, supply chain strategy KPIs, reverse logistics KPIs, sustainability KPIs in supply chain, financial supply chain KPIs, warehouse KPIs, digital supply chain KPIs, 1200 KPIs, supply chain scorecard, KPI examples, supply chain templates, Corporate Finance SOPs, Finance SOP Excel Template, CFO Toolkit, Finance Department Procedures, Financial Planning SOPs, Treasury SOPs, Accounts Payable SOPs, Accounts Receivable SOPs, General Ledger SOPs, Accounting Policies Template, Internal Controls SOPs, Finance Process Standardization, Finance Operating Procedures, Finance Department Excel Template, FP&A Process Documentation, Corporate Finance Template, Finance SOP Toolkit, CFO Process Templates, Accounting SOP Package, Tax Compliance SOPs, Financial Risk Management Procedures.

NOTE: Our digital products are sold on an "as is" basis, making returns and refunds unavailable post-download. Please preview and inquire before purchasing. Please contact us before purchasing if you have any questions! This policy aligns with the standard Flevy Terms of Usage.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Due Diligence Excel: 100+ Mergers & Aquisitions (M&A) Due Diligence SOPs Excel (XLSX) Spreadsheet, SB Consulting