Industrial Real Estate Development Model (Excel XLSM)

Excel (XLSM)

BENEFITS OF DOCUMENT

- An Excel-based analysis tool for the ground-up development, operation and ultimate disposition of a single- or multi-tenant retail property

DESCRIPTION

This product (Industrial Real Estate Development Model) is an Excel template (XLSM), which you can download immediately upon purchase.

An Excel-based analysis tool for the ground-up development, operation, and ultimate disposition of a single- or multi-tenant Industrial/retail property with or without streams.

The model is monthly in nature, and it is a 100% unlocked Excel file with fully transparent formulas that can be further tailored to suit the particulars of your transactions.

This model fits the definition of a professional tool. It is specifically built to analyze merchant-build, ground-up industrial development opportunities.

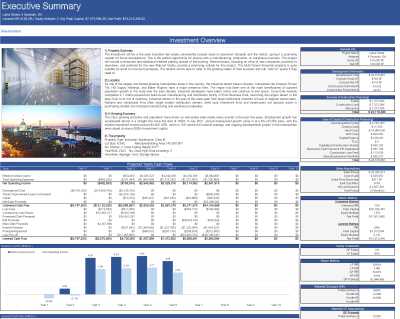

It includes an expandable budgeting and development cash flow module, robust rent roll and operating cash flow module, and the ability to model complex partnership waterfall structure. This model is meant to be used in scenarios where the user intends to evaluate development, lease-up, and sell an industrial property.

Model Options:

Dynamic Monthly & Annual Cash Flow: to calculate the key investments metrics needed to determine the feasibility of the project and the overall value of a potential selling, the cashflow is calculated on a monthly basis;

Because it is a developing project model, the lease-up forecast takes into account the fact that during the construction phase, there is no or limited revenue, and the construction loan interests are capitalized;

Dynamic construction budget: the construction expenses are modeled following an s-curve (normal distribution), meaning that construction expenses can be projected in a way that you have few expenses in the beginning, and then they quickly ramp up to your full project costs (depending on the standard deviation introduced);

In the rent roll sheet, the user can set up to 10 tenants, including options like Tennant improvement and lease commissions cost for both renewal and new contracts, Lease Type, Free Rent, Renewal Probability, and so on. The model can cope with up to 4 generations of renovations;

Dynamic financing: this model works backward to get the required amount and timing for Equity/loan funding, taking into account the capitalized interestest and any operating shortfalls that are funded with both equity and debt;

The model allows the user to set up four financing options: a construction loan, a mezzanine to Gap any additional funding during the construction period, a permanent debt, and the possibility of refinancing the permanent debt.

For the permanent and refinance debt, the user can also set those loans with the possibility to ask for additional funds to fund any Tennant Improvements and lease commissions;

Because the interest expenses are partially funded with debt, this can cause circularities issues in the model. So the template also includes a circularity breaker (toggle between on and off) to avoid it, this will "break" the circularity, and the errors will be flushed out.

Equity Waterfall Model: the template provides a 3-tier Equity waterfall model, so the user can determine how much capital the limited partner and General partner will get and their respective rates of return. The waterfall also allows setting the investor cash flow monthly, Quarterly or annual.

Capital Stack: Development debt financing is drawn and repaid as follows:

Debt funds are drawn after equity has fully funded its share of eligible costs. The Mezzanine Loan funds after all equity Loan contributions have been made and before the construction, loan draws. It is assumed that any Mezzanine Loan cash interest is paid monthly with the positive operating cash flow.

However, if the operational cash flow is insufficient, the interest cash is capitalized together with the PIK interest. The Mezz loan balance is repaid with permanent debt issuance.

The Construction Loan funds after Mezz debt and equity contributions have been exhausted. The Construction Loan interest is either capitalized or paid with operating positive cash flow after paying the Mezz loan cash interest.

In the event of conversion of the construction loan into permanent debt, the Construction and Mezzanine Loan balances are repaid in full by the permanent loan.

If the permanent loan is insufficient to pay off all outstanding debt, you will be notified with a visual alert message on the checks Sheet.

If no refinance exists, the permanent loan is repaid from net sale proceeds. If net sales proceeds are insufficient to repay the debt balance, equity must be drawn down to pay the shortfall.

Instructions:

The user only needs to input information into the cells formatted in the dark blue font in the Assumptions and Budget sheets. If the contents of a cell are colored black, it means that it is a formula.

All inputs in the model are formatted in blue type. Any input that has a suffix or Prefix such as "/month", "Year", or "SFT", and so after/before the numeric value is custom formatted to display that text suffix/prefix. You only need to enter NUMBER VALUES in those cells. Do not re-type the text suffix – it will corrupt the calculations in the model or crash the model altogether.

The template is provided with information from a hypothetical property for demonstration purposes that must be erased for a real property valuation;

The template is provided with the iterative calculation mode active and calculation as automatic except for data tables whose data are only updated after the saving of the workbook;

The investment summary sheet provides an overview of the property based on several key metrics and a printable "pitchable" report;

In the Assumptions sheet, the user can define the majority of the drivers, and along with the budget sheets are the only sheets the users need to input information;

The maximum horizon for this model is ten (10) years;

The model includes detailed assumptions for financing and construction costs, ensuring precise budgeting and forecasting. Users can customize tenant lease terms and property tax calculations to align with specific project requirements.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model, Real Estate Excel: Industrial Real Estate Development Model Excel (XLSM) Spreadsheet, Jair Almeida