BENEFITS OF THIS EXCEL DOCUMENT

- Financial Analysis

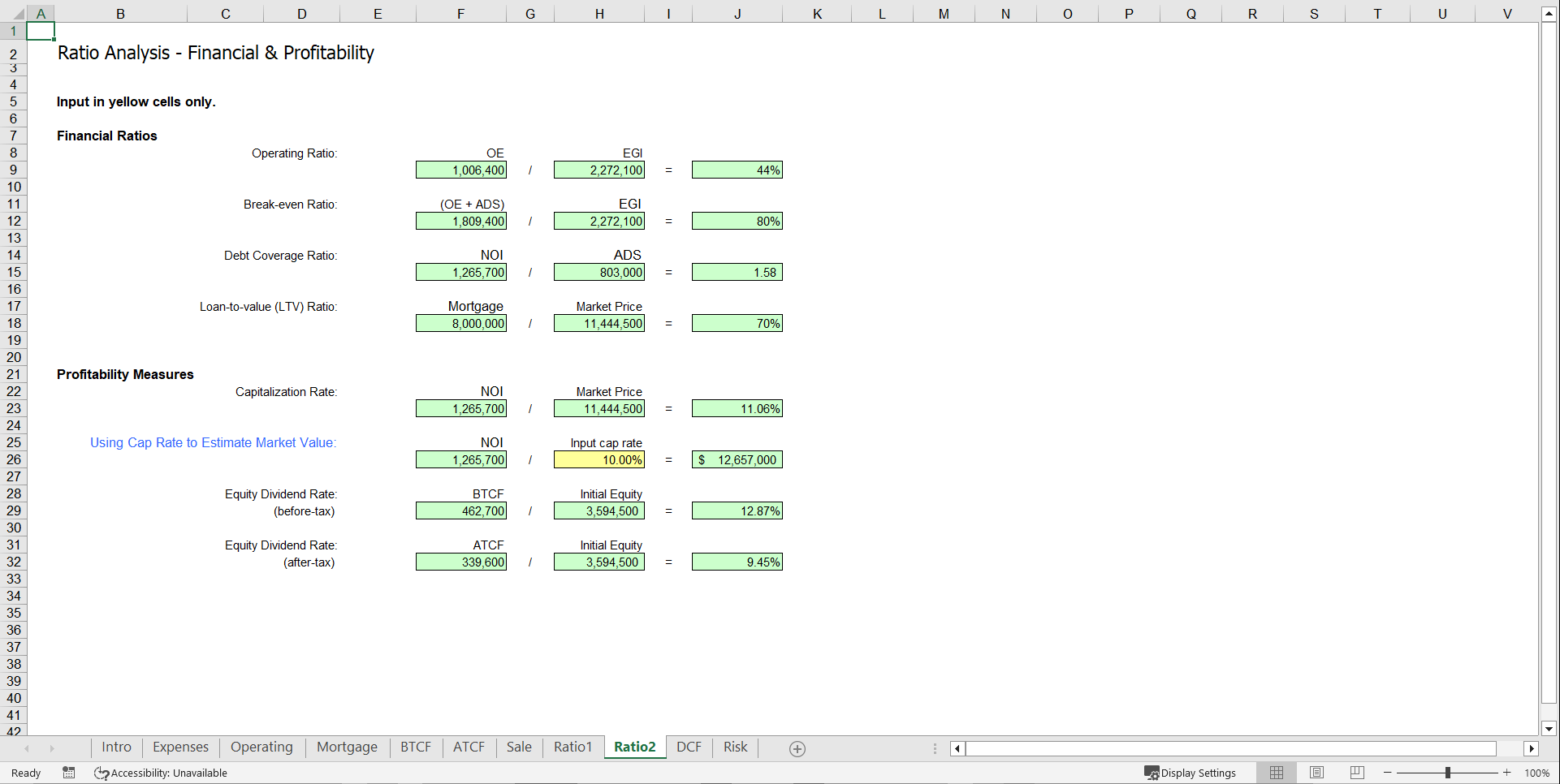

- Valuation

REAL ESTATE EXCEL DESCRIPTION

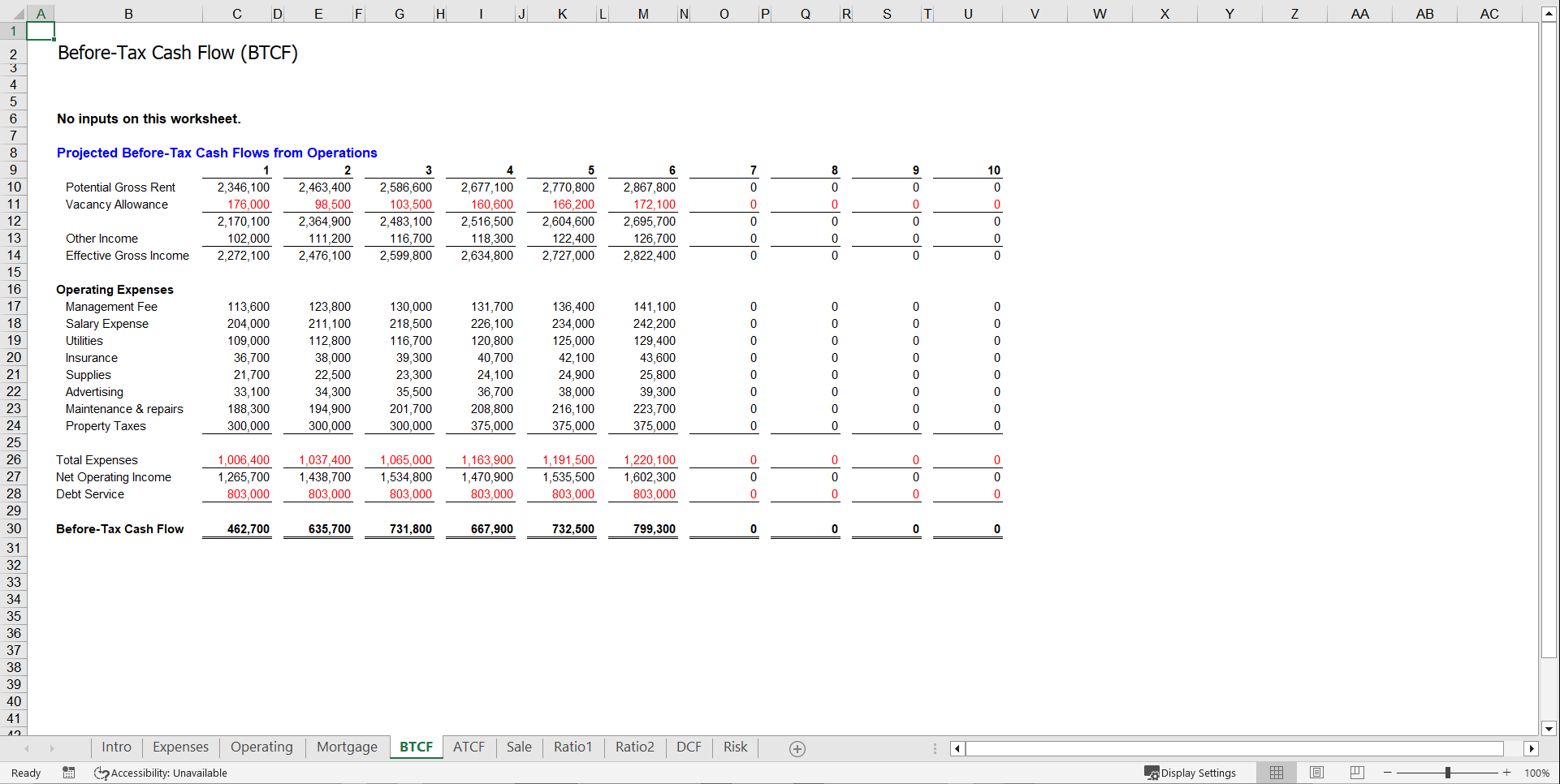

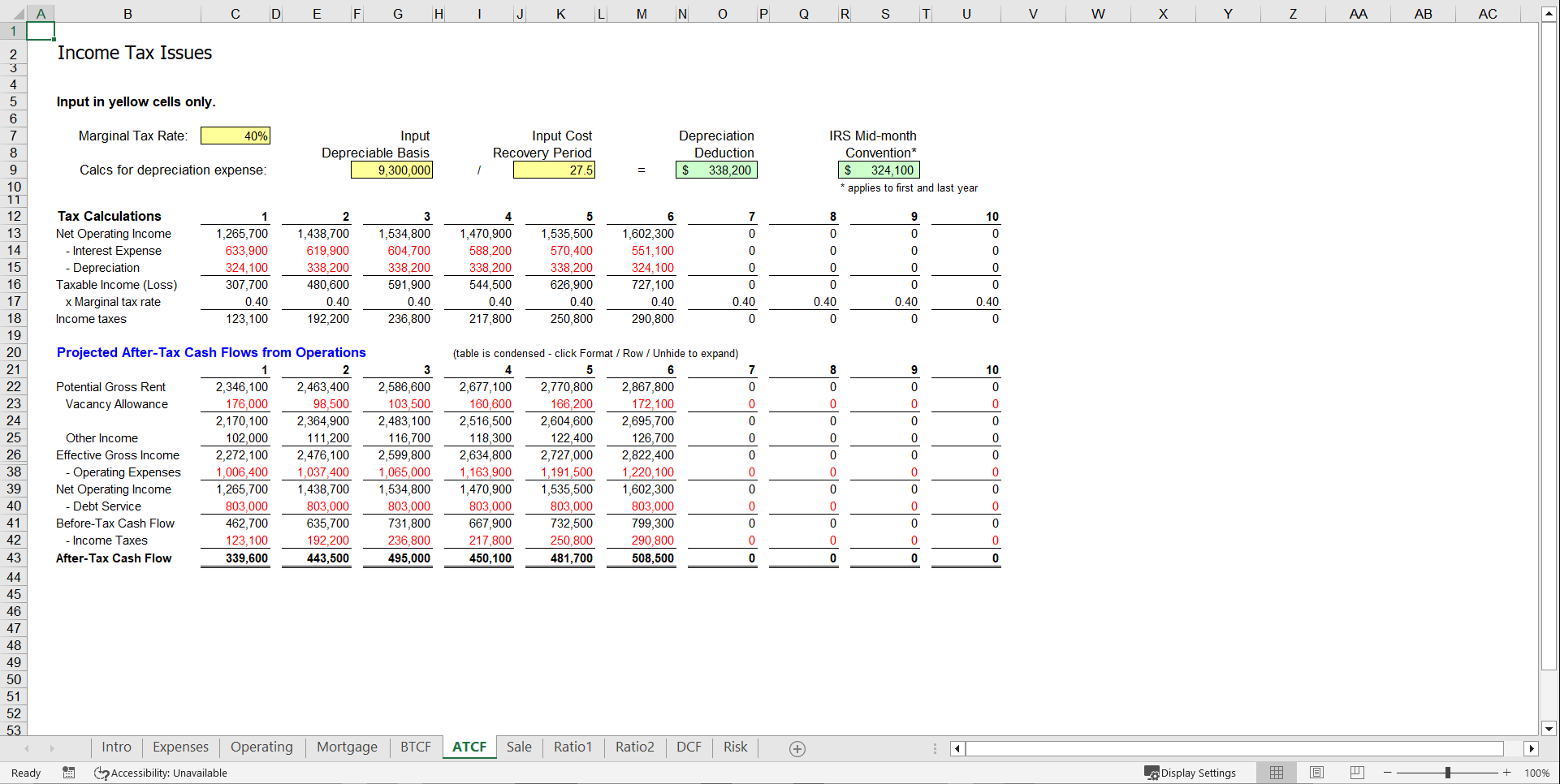

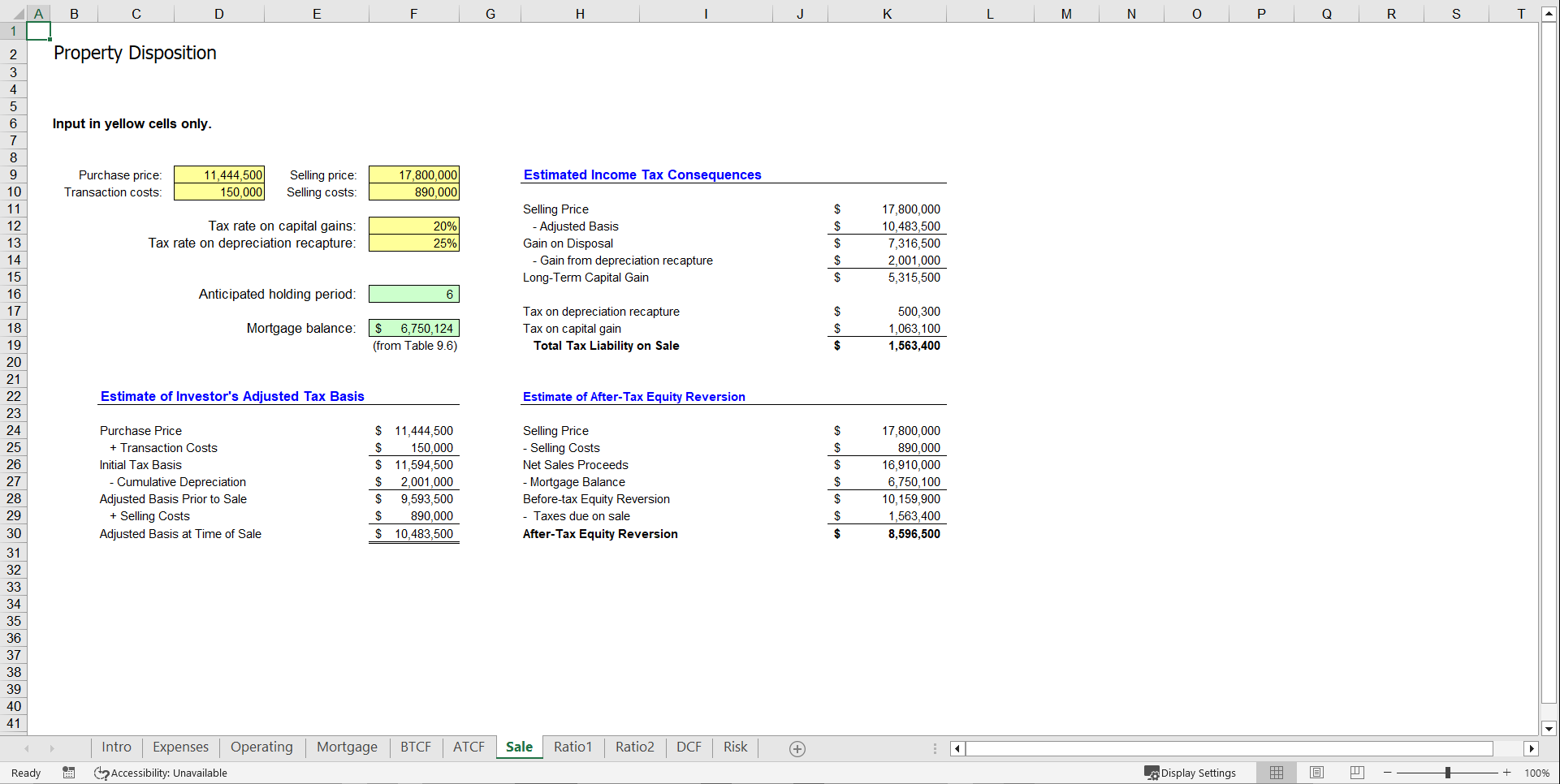

The purpose of this spreadsheet is to: 1) to estimate the valuation of commercial property and 2) to determine the financial feasibility of an investment in the subject property for a 10-year holding period. The uncertainty in this model lies in the economic factors to be input as assumptions by the user. The most important assumptions in this analysis are the Net Operating Income assumptions (Annual Gross Rent, Vacancy and Collection Loss Factor, and Operating Expenses) and the Cap Rate at Purchase.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Valuation Model Example Excel: Real Estate Valuation Model Excel (XLS) Spreadsheet, Daniel M.