Debt / Loan Fair Value Calculation Excel Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Calculation of Debt facility / loan market fair value.

DEBT EXCEL DESCRIPTION

Debt/Loan Fair Value Calculation is crucial for financial reporting and risk management. It determines the accurate market value of debt instruments, which impacts a company's balance sheet and financial statements. This calculation helps assess the true financial health and obligations of an entity, aiding investors and creditors in making informed decisions. It's essential for compliance with accounting standards and regulatory requirements. Additionally, it supports strategic planning by quantifying the cost of debt and optimizing capital structure. Overall, Debt/Loan Fair Value Calculation ensures transparency, enhances financial decision-making, and facilitates effective debt management.

PURPOSE OF TOOL

User-friendly Excel tool for determining the fair value of a debt facility or loan and other key metrics.

METHODOLOGY

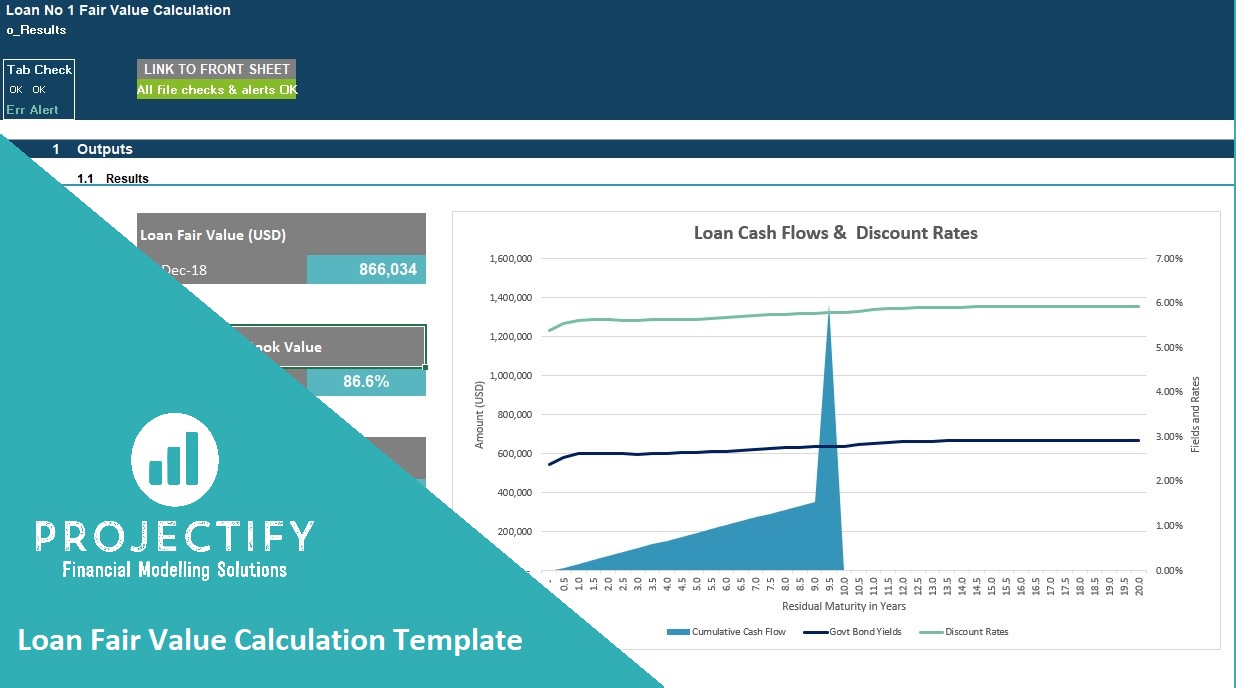

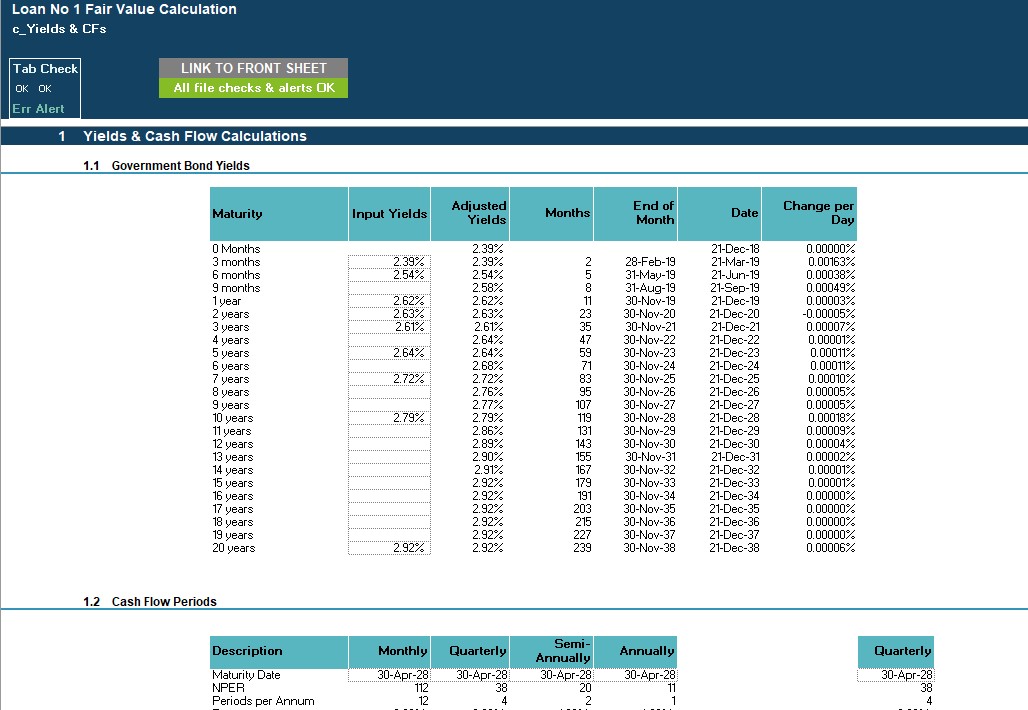

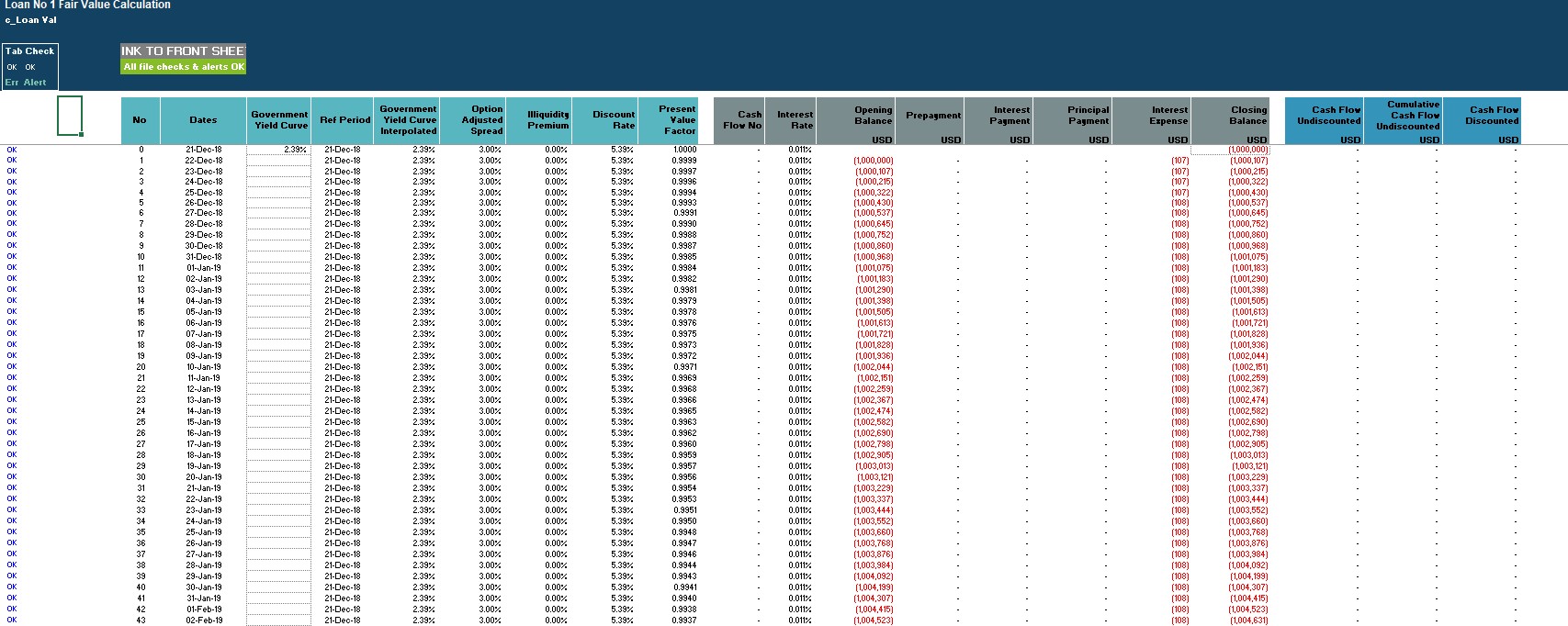

The template calculates the fair value of a debt facility / loan by extracting the remaining cash flows to maturity of the loan and discounting these cash flows at the market interest rates at the valuation date. The market rates are derived by adding the option adjusted spread (reflective of the credit risk of the loan) and any illiquidity premium to the Government bond yield curve, which is assumed to be the risk-free rate. The resulting sum of discounted cash flows is the implied fair value for the loan.

KEY OUTPUTS

The tool computes a number of key loan / debt metrics including:

• Debt facility / loan fair value;

• Debt facility / loan fair value as a percentage of book value;

• Debt facility / loan duration;

• Debt facility / loan yield to maturity;

• A chart plotting the cumulative debt facility / loan cash flows, yield curve and discounting rates.

KEY INPUTS

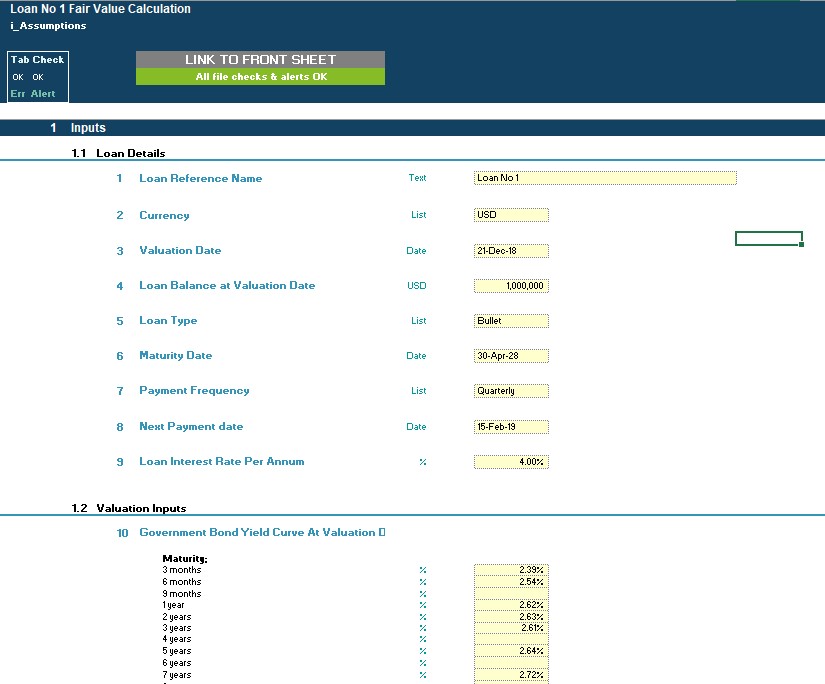

The key user-defined inputs of the tool include:

• Loan reference name

• Currency

• Valuation date

• Loan balance at valuation date

• Loan type (amortising or bullet)

• Maturity date

• Payment frequency (Monthly, Quarterly, Semi-annually, Yearly)

• Interest rate

• Government Bond Yield curve

• Option adjusted spread

• Illiquidity premium (if required)

• Prepayment rate (if required)

TOOL STRUCTURE

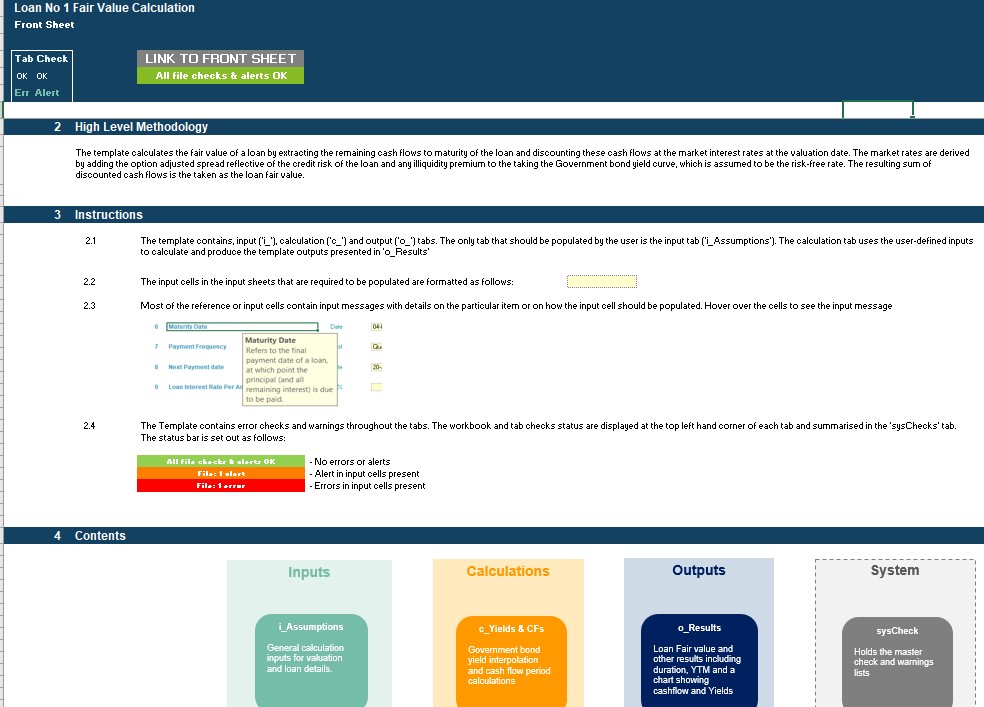

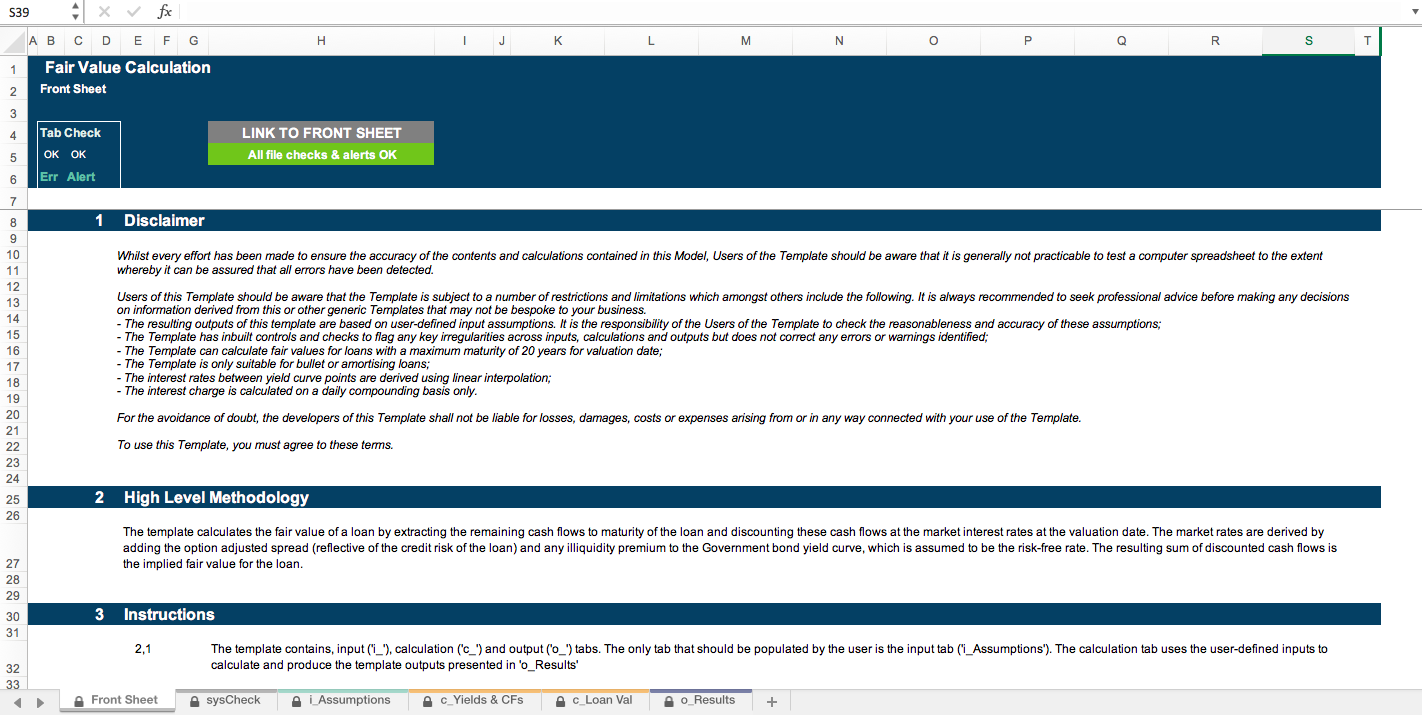

The template contains, 6 tabs split into input ('i_'), calculation ('c_'), output ('o_') and system tabs. The only tab to be populated by the user is the input tab ('i_Assumptions'). The calculation tab uses the user-defined inputs to calculate and produce the template outputs presented in 'o_Results'.

.System tabs include the following:

• 'Front Sheet' containing a disclaimer, instructions and contents;

• Checks dashboard containing a summary of checks by tab.

OTHER KEY FEATURES

Other key features of this tool include the following:

• The tool follows best practice financial modelling guidelines and includes instructions, line item explanations, checks and input validations;

• The tool can calculate fair values for debt facility / loans with a maximum maturity of 20 years from valuation date;

• The template can calculate fair value for a Bullet-type debt / loan (all principal is paid on maturity date) or an amortising debt / loan (principal is paid as part of the periodic instalments across the life of the loan);

• The template calculates interest and loan balance on a daily basis for a maximum of 20 years (+7,300 rows);

• The daily interest rates are derived from the yield curve points using linear interpolation;

• Loan/Debt name, currency, valuation date, etc. are customisable;

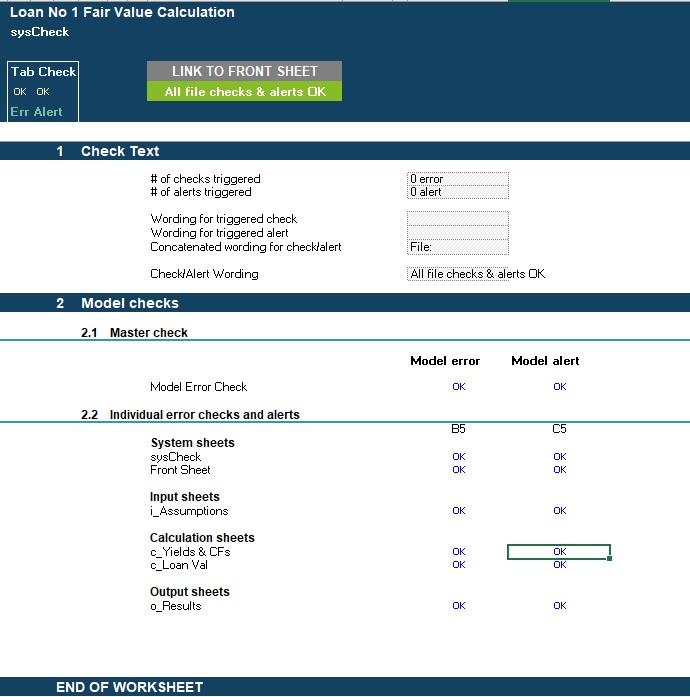

• The tool includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors;

• The tool includes checks and input validations to help ensure input fields are populated accurately.

This template includes a comprehensive checks dashboard to ensure data accuracy and integrity. Users can easily identify and rectify errors, enhancing the reliability of their financial assessments.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Debt, Loans Excel: Debt / Loan Fair Value Calculation Excel Template Excel (XLSX) Spreadsheet, Projectify