Comparable Companies (Peer Group) Database & Matching Tool (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Accelerates peer group building by matching your company profile to proven, curated reference cases in minutes.

- Improves defensibility and consistency through a transparent scoring logic, structured classifications, and must-match criteria.

- Enables faster, higher-quality shortlisting by providing reusable peer group case pages with clear reference context and refinement via keywords.

DUE DILIGENCE EXCEL DESCRIPTION

Purpose of the tool

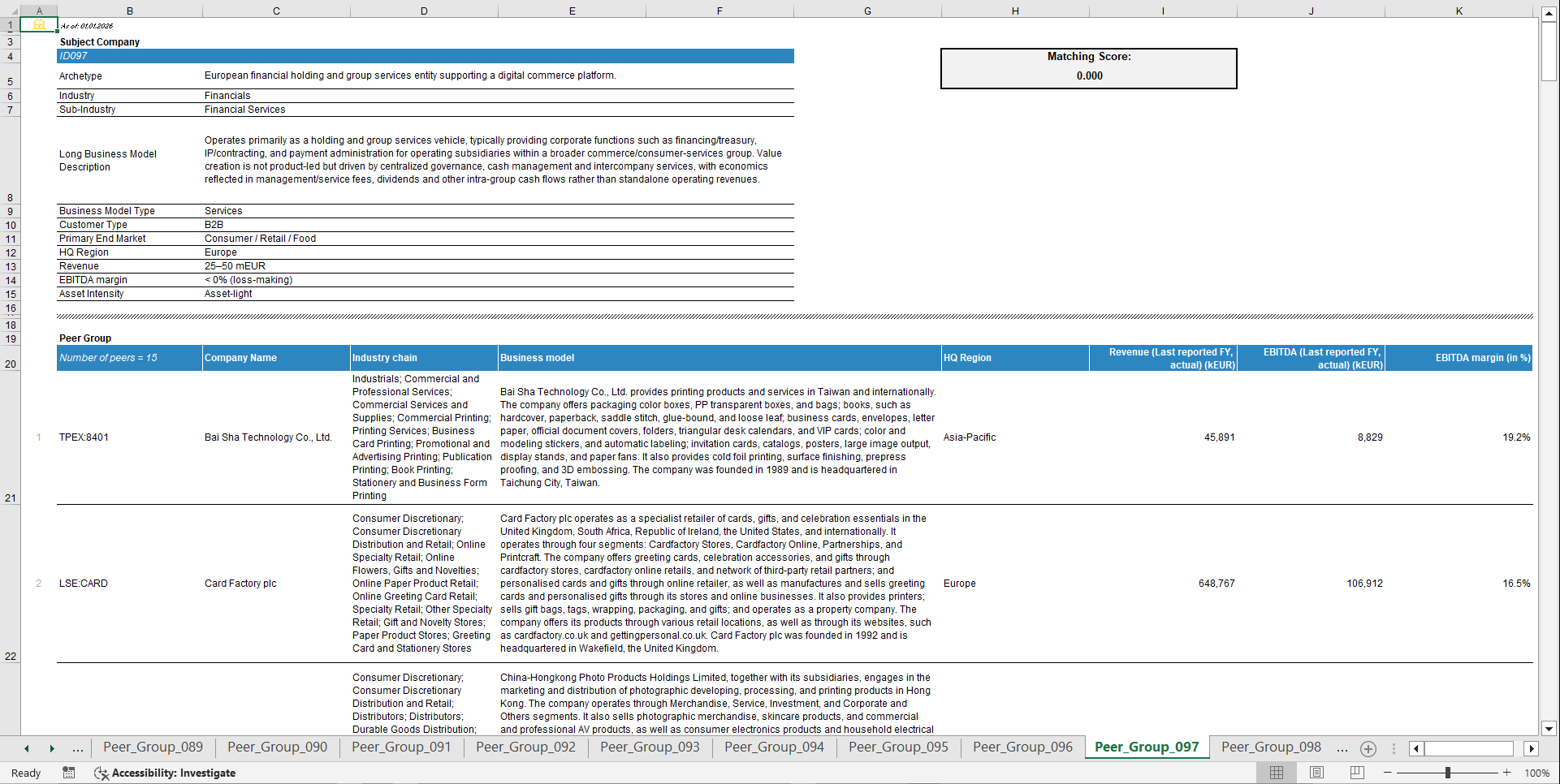

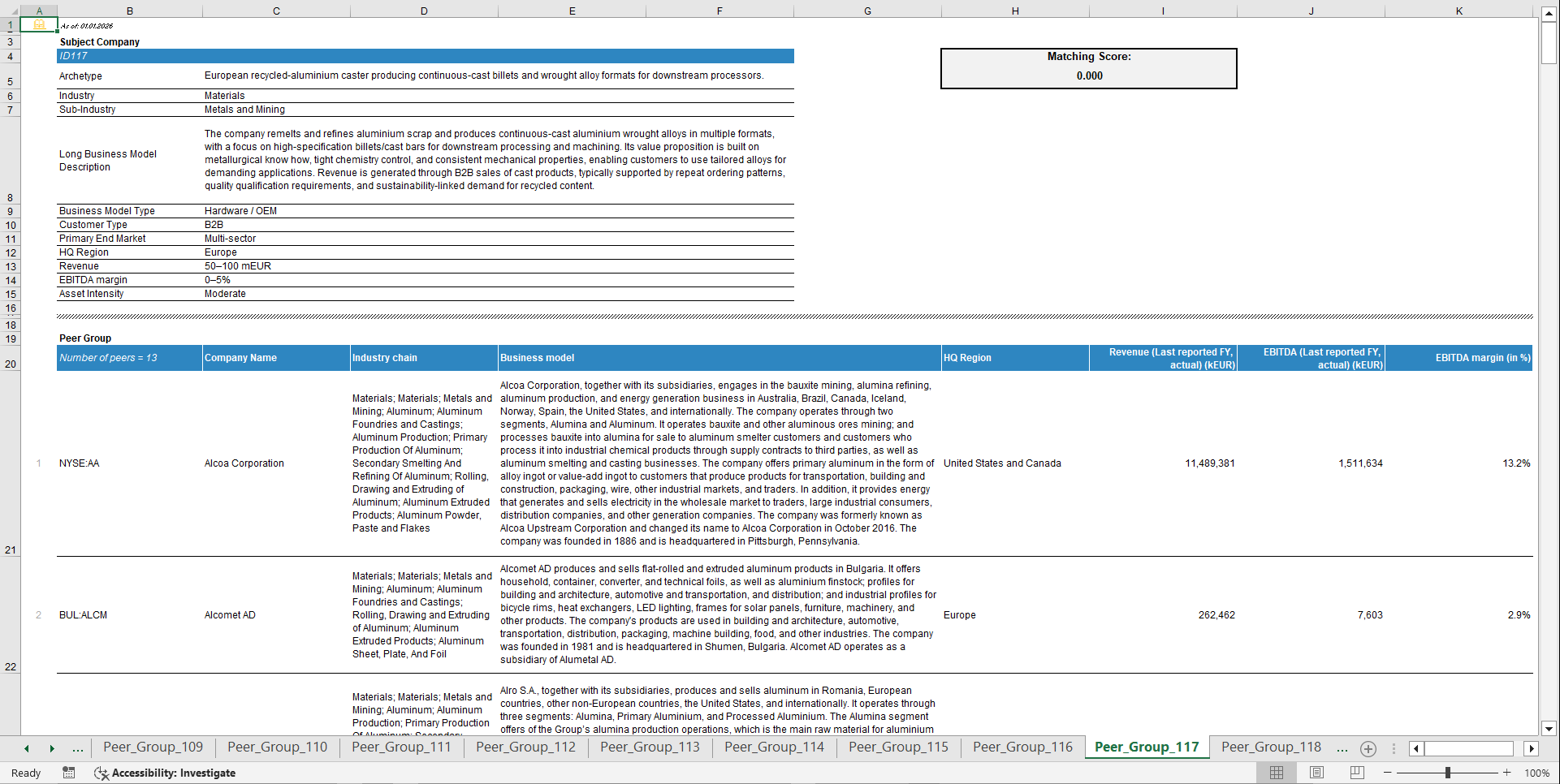

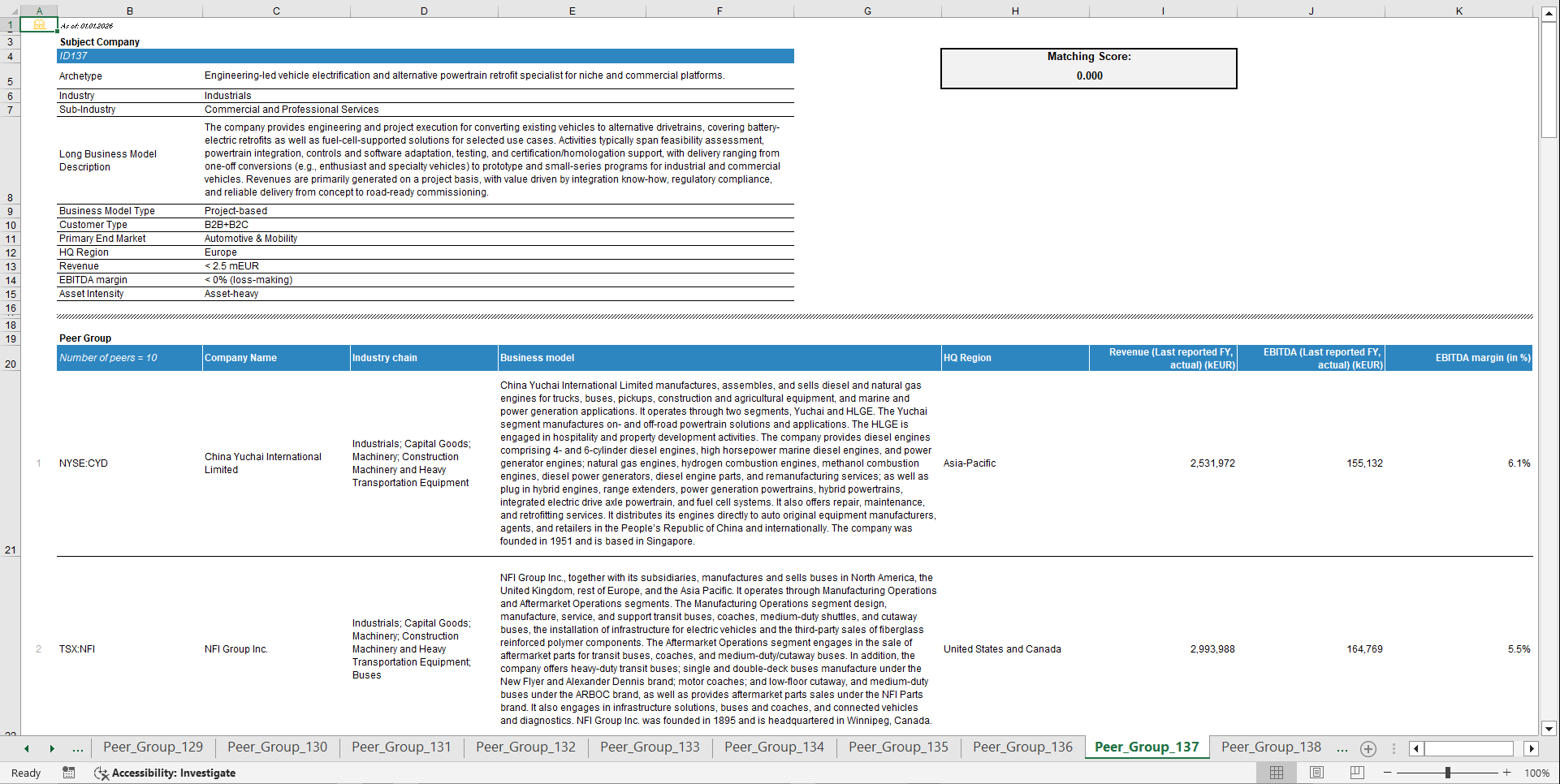

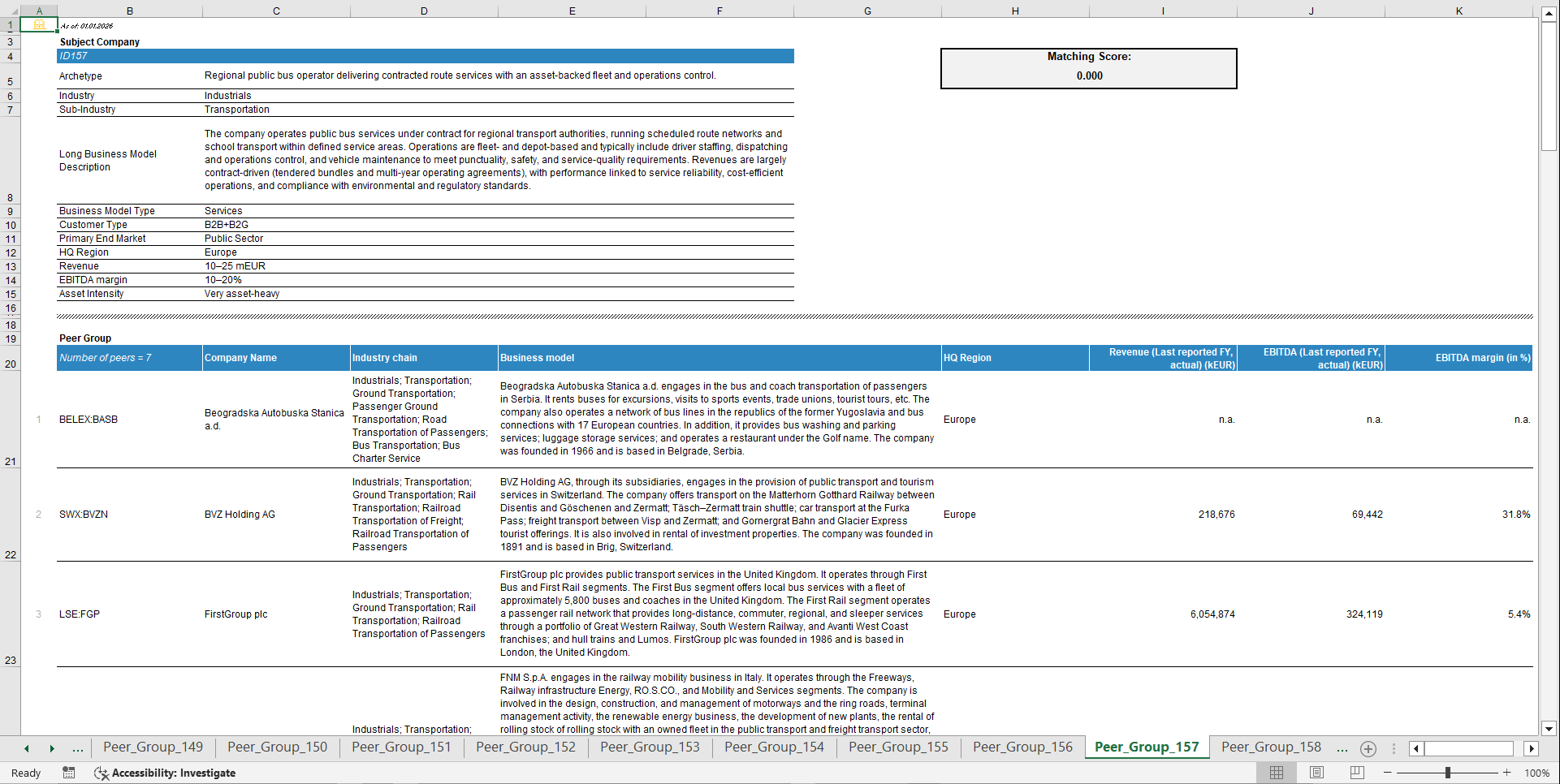

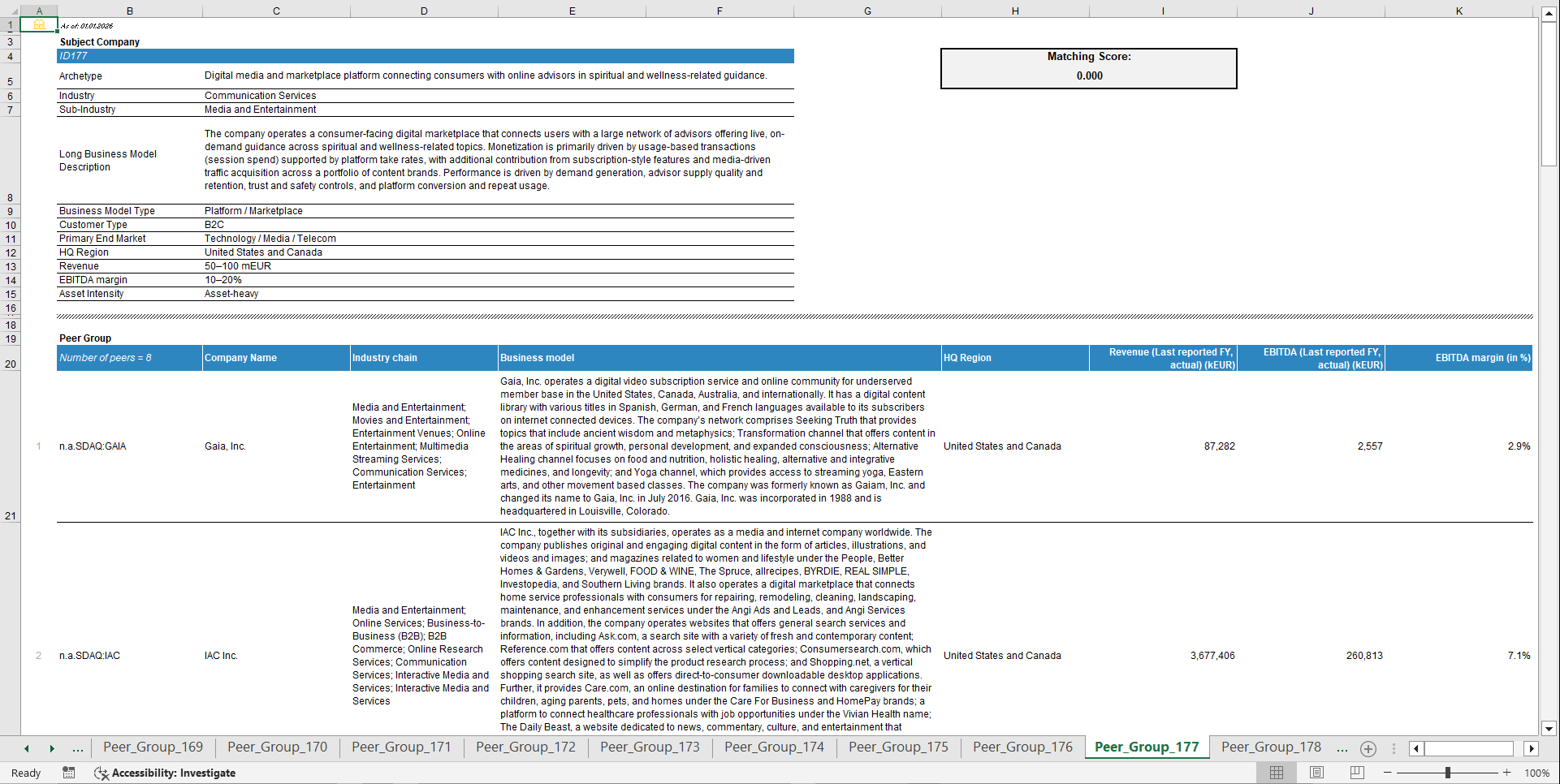

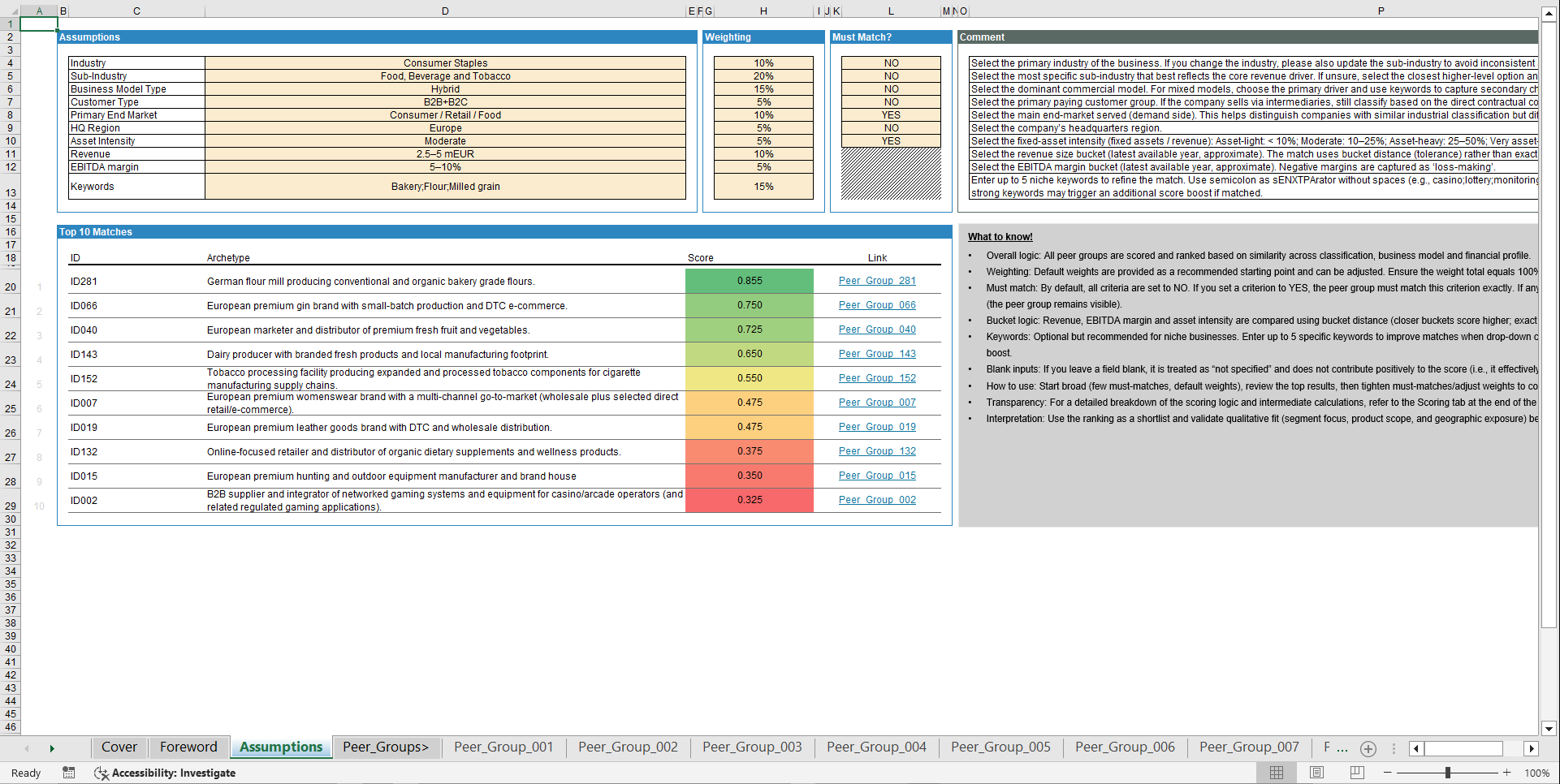

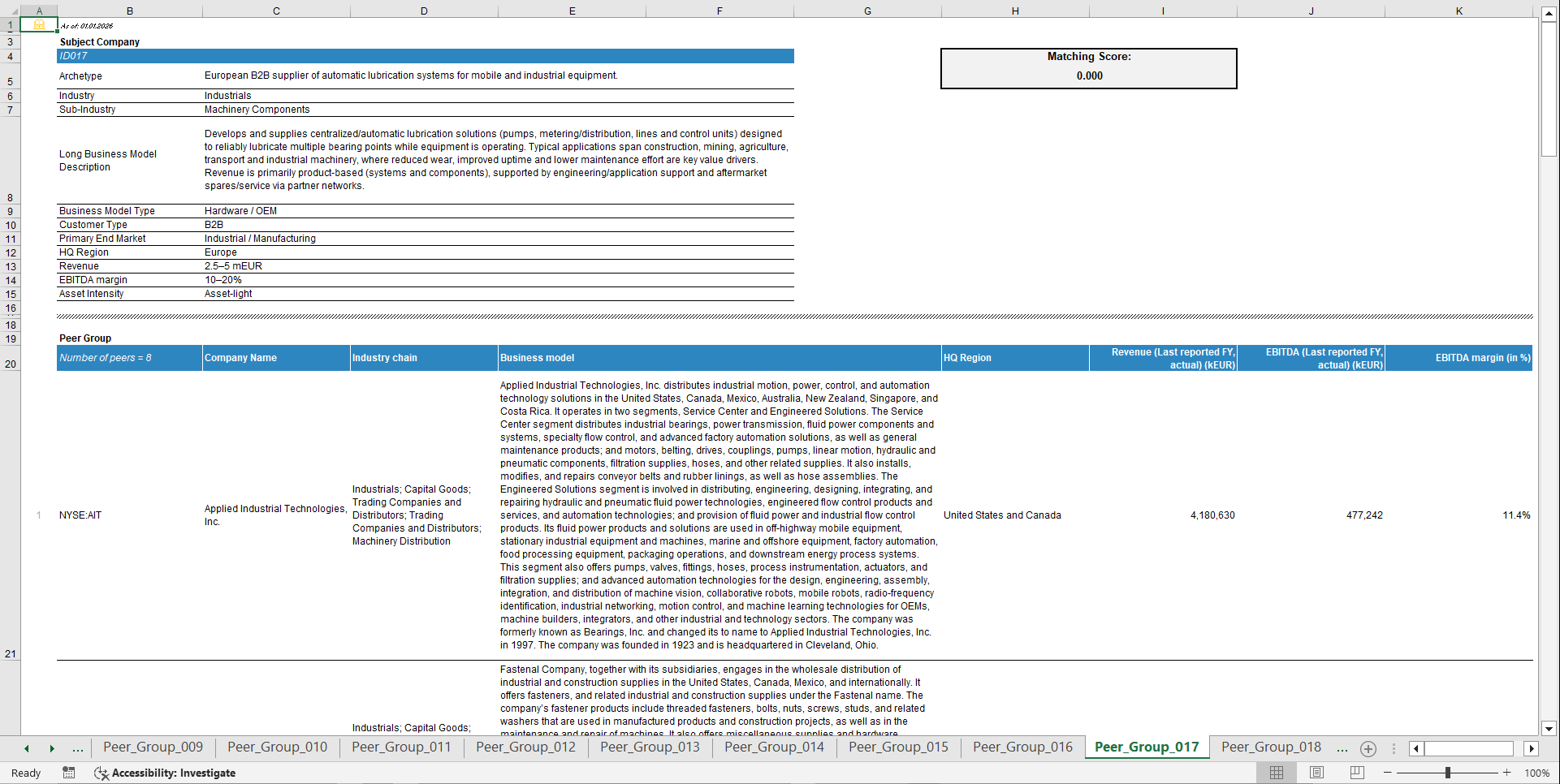

This Excel-based Comparable Companies (Peer Group) Database & Matching Tool is designed to dramatically accelerate one of the most time-consuming tasks in corporate finance and strategic analysis: building a high-quality, defensible peer set. Whether you need comparable companies for valuation, benchmarking, strategy, performance comparisons, market positioning, investor materials, or any other use case where a peer group is required, the model helps you move from "blank page" to a robust shortlist within minutes. The database is built on ~15 years of hands-on professional peer group work and is organised around historical Subject Companies. A Subject Company is the original reference business that served as the basis for a peer group build in prior analyses (e.g., valuations, PPAs, transaction-related work, benchmarking exercises, or similar contexts). For each Subject Company, a dedicated peer group was created through detailed manual research and iterative refinement—mirroring how comparable company selection is actually done in professional practice rather than relying on generic one-click screens. All Subject Companies have been anonymised, as the underlying work originates from prior professional projects. The key idea of this model is simple: you define the profile of your current company and the tool identifies the most similar Subject Companies from the library. You can then reuse and adapt the peer groups that were originally built for those reference cases—giving you a proven starting point, clear reference logic, and substantial time savings. The comparison to the Subject Company is also critical when interpreting the output: the tool does not only rank peer lists, it ranks the underlying reference cases that explain why a given peer group exists and in which context it was originally constructed. The library includes peer group cases across a broad range of industries. Coverage spans major sectors such as Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Communication Services, and Real Estate—with granular sub-industry differentiation (e.g., various industrial machinery categories, building products, chemicals, packaging, healthcare services/technology, software & services, semiconductors, media/telecom, REITs). This makes the tool suitable for a wide set of company profiles, while still allowing niche refinement via end-market and keyword matching. With 300 curated peer group cases, consistent classifications, and a transparent scoring approach, the model helps you work faster while maintaining quality and repeatability—ideal for advisors, investors, corporates, and analysts working under time pressure.

Key outputs

The tool produces a ranked shortlist of the best peer-group matches based on similarity to the underlying Subject Companies. It provides direct links to the individual peer-group case pages, including the anonymised Subject Company profile and the corresponding identified peers, so you can immediately review the context behind each match. The scoring is fully transparent and shows how weights, must-match gates, bucket-distance logic, and keyword matching drive the ranking. In addition, the model offers a reusable classification framework across industry and sub-industry, business model type, customer type, end market, region, and size/profitability buckets, while keyword-based refinement helps capture niche characteristics that are not fully reflected by drop-down selections.

Key inputs & assumptions

The matching logic is driven by a structured company profile that you define in the assumptions interface. You select the industry and sub-industry, business model type, customer type (B2B/B2C/B2G), primary end market, and HQ region. You also assign the company to buckets for revenue, EBITDA margin, and asset intensity. To refine niche matching, you can optionally add up to five keywords (separated by semicolons), which help surface Subject Companies with similar specific characteristics even when those details are not fully captured by the standard criteria.

How to use

You start in the Assumptions tab by entering your company profile through the core drop-down selections and optional keywords. If needed, you then adjust the weights (recommended defaults are provided) and activate must-match criteria when you want hard constraints to apply. Next, you review the Top Matches list, which ranks the most similar Subject Companies, and open the linked case pages to understand the reference context and the underlying peer lists. You use the output as a shortlist and starting point by either adopting a peer group directly when the fit is strong or combining and refining peers across several close matches to build the final peer set for your specific use case.

Customization

The model is designed as a professional workflow tool rather than a black box, so you can tailor it to different contexts such as valuation, operational benchmarking, or strategic peer analysis. You can adjust weights, must-match rules, and keyword usage depending on what matters most in your situation, while still keeping the process consistent and repeatable. The scoring accelerates shortlisting and improves discipline, but it does not replace professional judgement, so a qualitative reasonableness check remains essential. For full transparency, the detailed calculation logic can be reviewed in the dedicated Scoring tab at any time.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Due Diligence, Valuation Excel: Comparable Companies (Peer Group) Database & Matching Tool Excel (XLSX) Spreadsheet, Finance Model Hub