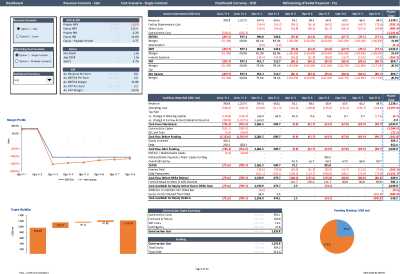

Commercial Real Estate - Lease or Sell Quarterly Model (Excel XLSM)

Excel (XLSM) + Word (DOCX)

BENEFITS OF DOCUMENT

- For Revenue calculation, Gross Developed Area is assumed to be Leased or Sold. User can switch between the scenarios from Dashboard Sheet and correspondingly see its impact on the Financials and Key KPI's.

- Project IRR & NPV

- Equity IRR & NPV

DESCRIPTION

This product (Commercial Real Estate - Lease or Sell Quarterly Model) is an Excel template (XLSM) with a supplemental Word document, which you can download immediately upon purchase.

Commercial Real Estate – Lease or Sell Quarterly Excel Model with 3 Statements, Valuation and Development & Operations Phase

Project finance is the financing of long-term infrastructure and industrial projects based upon a complex financial structure. Both project debt and equity are used to finance the project. Debt is repaid using the cash flow generated by the operation of the project, rather than other resources of the project owners.

Project Finance Model is built for a proposal to construct a commercial space in the Middle East with a Gross Leasable Area of half a million sq.f. The financial model is built with a quarterly timeline considering construction for 2 years and the operations period for 8 years.

This model includes the Following scenarios:

1. For Revenue calculation, Gross Developed Area is assumed to be Leased or Sold. User can switch between the scenarios from Dashboard Sheet and correspondingly see its impact on the Financials and Key KPI's.

2. For Cost calculation, a maintenance contract for Gross Developed Area can be assumed to be given to a single contractor with a bucket rate or specialized service providers to control cost. User can switch between the scenarios from Dashboard Sheet and correspondingly see its impact on the Financials and Key KPI's.

3. Project Output includes:

3.1 Project IRR & NPV

3.2 Equity IRR & NPV

3.3 Minimum and Average DSCR

3.4 Equity Payback Period

3.5 Cash Waterfall

3.6 Debt Service Profile

This model will help you in understanding and Modeling of:

1. Flexible capital structuring

2. Construction standby facilities

3. DSRA reserve provisions

4. Lender covenants

5. Complex cash waterfalls

6. Project finance ratios: DSCR

7. Project and Equity IRR

The model is ideal for those looking to achieve the following:

1. Refresh their financial modeling skills

2. Gain an understanding of leading approaches towards financial modeling, in order to build models that are robust and user-friendly in nature.

3. Extend their toolkit for modeling more complex areas of a project finance model in an efficient and flexible manner

4. Understand the very basics of Project Finance

Note:

This model contains Macros to break circularity which arises from the calculation of Interest During Construction, Bank Fees during the construction phase, and Overdraft drawdown (during operations phase). The objective behind macro is to run the exact calculation for loan drawdown in a project finance model as these are critical calculations and are followed closely by banks and financial institutions during negotiations. The macro can be run using the Optimization button available on the Dashboard. The Macro is stored in Module 1 of the VBA Project under VBA Basic Editor.

Important Technical Specifications:

The following are important technical specifications that you need to keep in mind before purchasing this model template:

1. Model uses Macros (VBA). To run model optimally, keep macros enabled. In case you do not like Macros, you could manually disable or remove the Macros and will have to rework the model's logic to be used without Macros but it is not recommended by the author.

2. Model is built using Microsoft Excel 2010 version.

3. We advise not to delete or insert rows and columns into the model if you are not aware of the model structure as it can distort model functioning. If you need assistance with customizing the model template, the author is more than willing to help you.

4. Model uses Cell Styles

5. File type is .xlsx

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model, Real Estate Excel: Commercial Real Estate - Lease or Sell Quarterly Model Excel (XLSM) Spreadsheet, Fin-Wiser Advisory