Toll Road Development – Project Finance Model (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Enables users to get a solid understanding of the financial feasibility of a Toll Road project and to evaluate the return to investors.

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

A toll road development project involves designing, financing, and constructing a roadway where users pay fees for access. The goal is to improve transportation infrastructure, reduce congestion, and support regional growth. The project typically includes traffic studies, route planning, land acquisition, and the installation of toll collection systems—either manual, electronic, or both. It may be funded through private funding or public-private partnerships, with revenues used to repay construction costs, maintain the road, and generate returns for investors.

This Finance Model provides a dynamic (up to 15 years) forecast and profitability analysis for a Toll road development and operating scenario. The main purpose of the model is to enable users to get a solid understanding of the financial feasibility of the project and to evaluate the return to investors.

The structure of the template follows Financial Modeling Best Practices principles and is fully customizable.

Model Structure

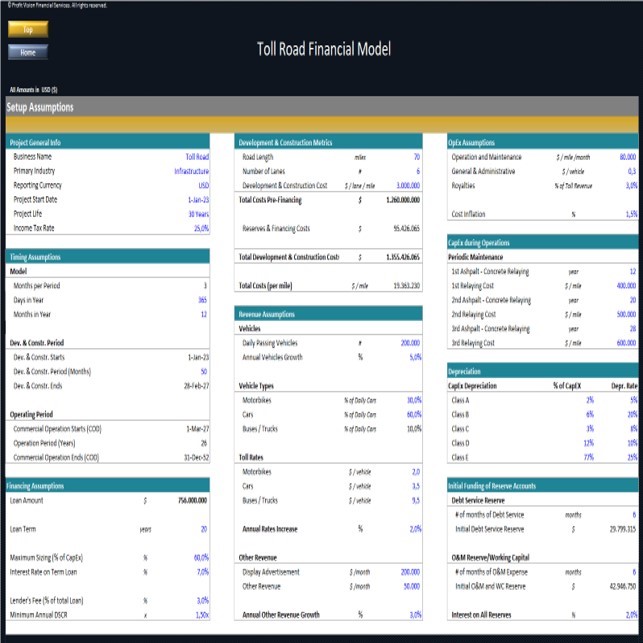

* Setup Assumptions

This section is used to input all the assumptions for the project.

It includes assumptions for Project Timing, Revenue Assumptions (Toll Collections and Ancillary sources), Direct & Indirect Operating Expenses, Capital Expenditures, Uses & Sources of Cash, and Debt Financing

* Development Budget

This section includes all assumptions for the Road development.

It includes Land Costs, Hard Costs , Soft Costs, Development Contigencies and Development timing

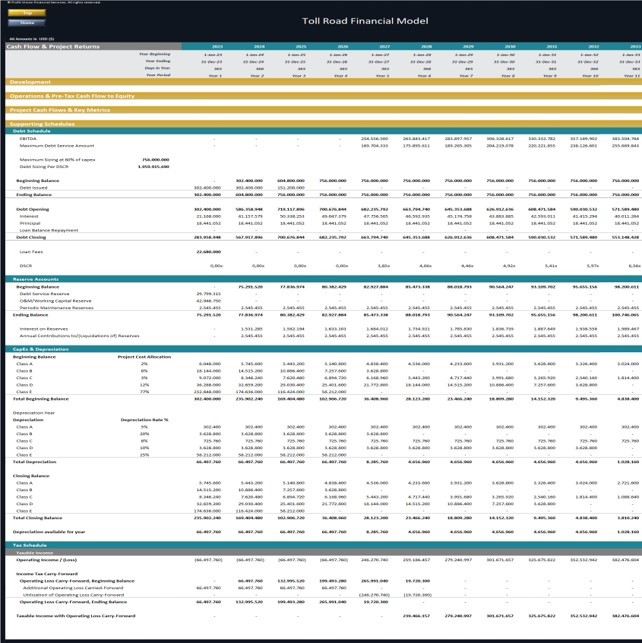

* Loan Schedule

Loan amortization Schedule of project's debt including an optional moratorium and interest-only (IO) period.

* Scenarios

Scenario Ananysis for Road Traffic, Revenue, and OpEx using 3 different approaches (Base, Upside and Downside scenario).

* Project Cash Flows and Return Metrics

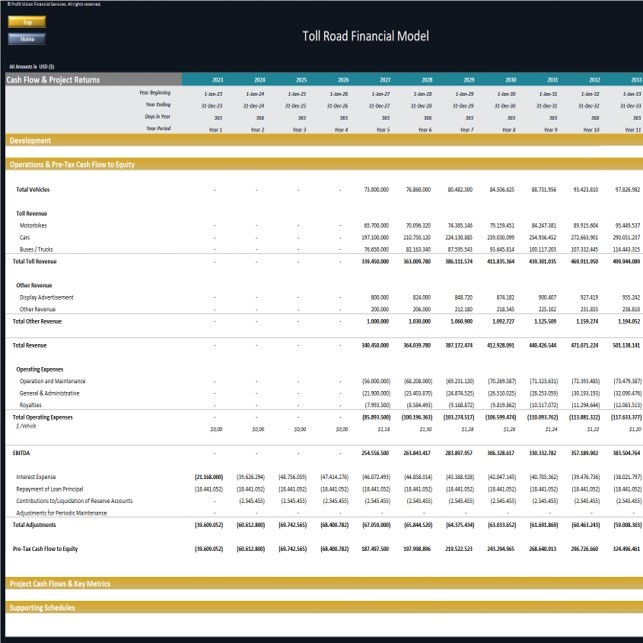

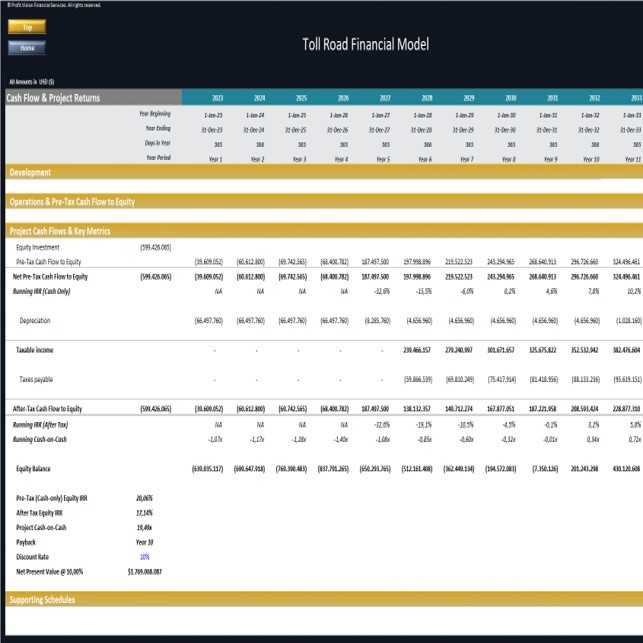

Presentation of Project's Cash Flow and Returns including the below reports:

– Monthly and Quarterly Project Cash Flow per Year

– Annual Project Cash Flow

– Financing and Tax Supporting Schedules

– Breakeven Analysis and Key Performance Indicators

– Unlevered & Levered Project Return Metrics (IRR, MOIC, Payback, NPV)

– Project Dashboard including performance metrics and charts

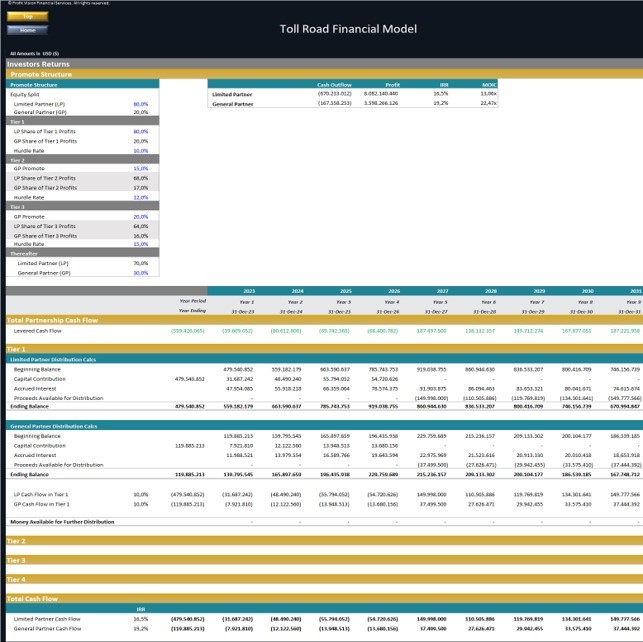

* Investors Distribution Waterfall

A Private Equity 2-Tier Investors Distribution Waterfall Model including LPs Preferred Return (Hurdle Rate)

* Project Executive Summary

Professional Executive Summary report containing all of the high-level relevant information for review and is designed to be easy to read, print, and save to pdf. The report includes Project General Info, Timing, Sources, and Uses of Cash, Operations Summary and Key Metrics, Project and Investor return metrics.

Instructions on the use of the model are included in the Excel file.

Help & Support

Committed to high quality and customer satisfaction, all our templates follow best practice financial modeling principles and are thoughtfully and carefully designed, keeping the user's needs and comfort in mind.

No matter if you have no experience or you are well versed in finance, accounting, and the use of Microsoft Excel, our professional financial models are the right tools to boost your business operations!

If you however experience any difficulty while using this template and you are not able to find the appropriate guidance in the provided instructions, please feel free to contact us for assistance.

If you need a template customized for your business requirements, please e-mail us and provide a brief explanation of your specific needs.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Toll Road Development – Project Finance Model Excel (XLSX) Spreadsheet, Profit Vision