Real Estate Development: Budget vs. Actual Investment Analysis (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

Usually real estate development happens in phases. Here you have a model that lets the user plan out the total costs / investment required by phase as well as the total units sold over time and see a final IRR and return on investment of all activities. It goes a step further by having a separate input section for the actuals and you can use this template to compare final IRR of actuals vs. budget.

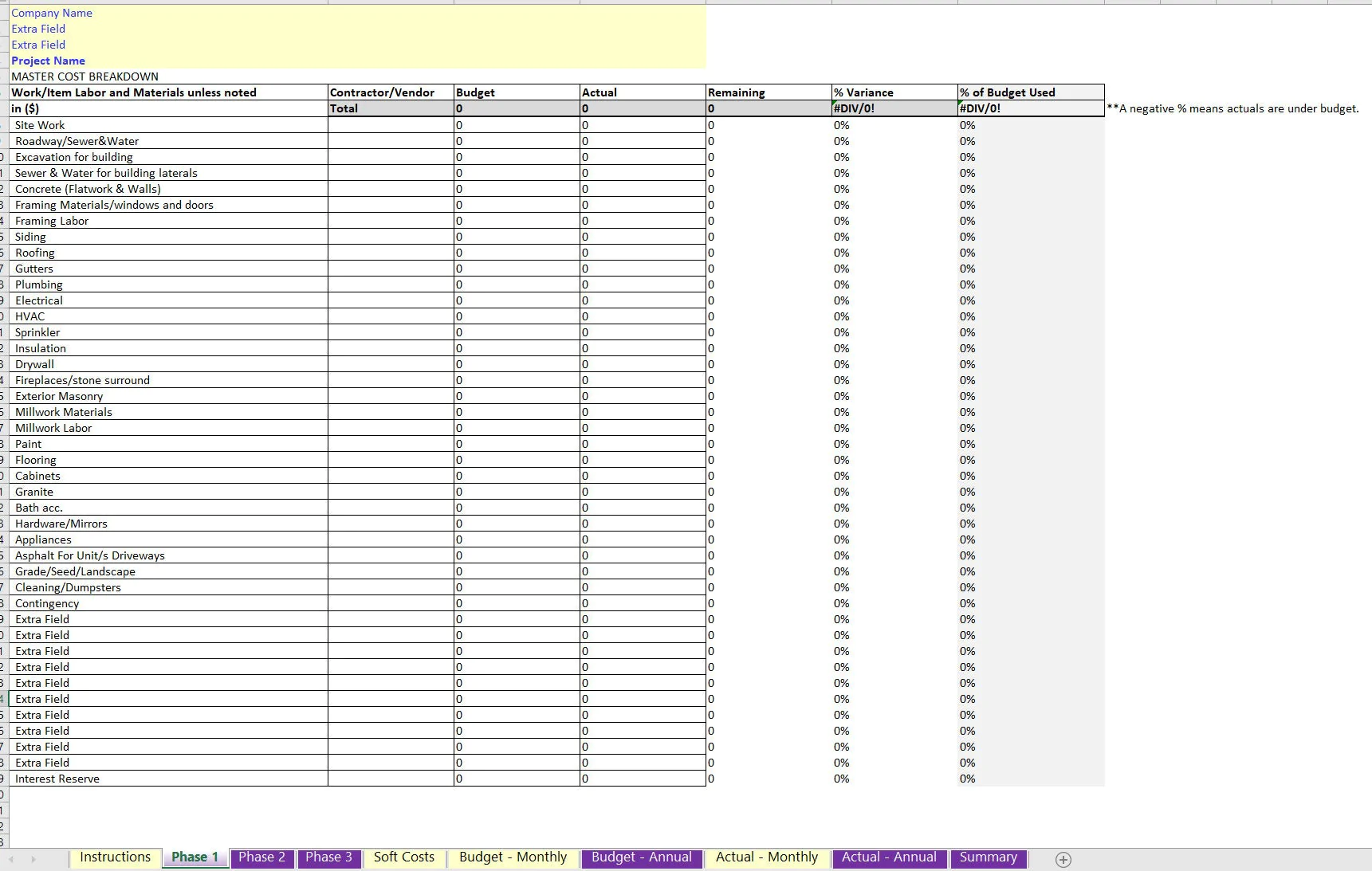

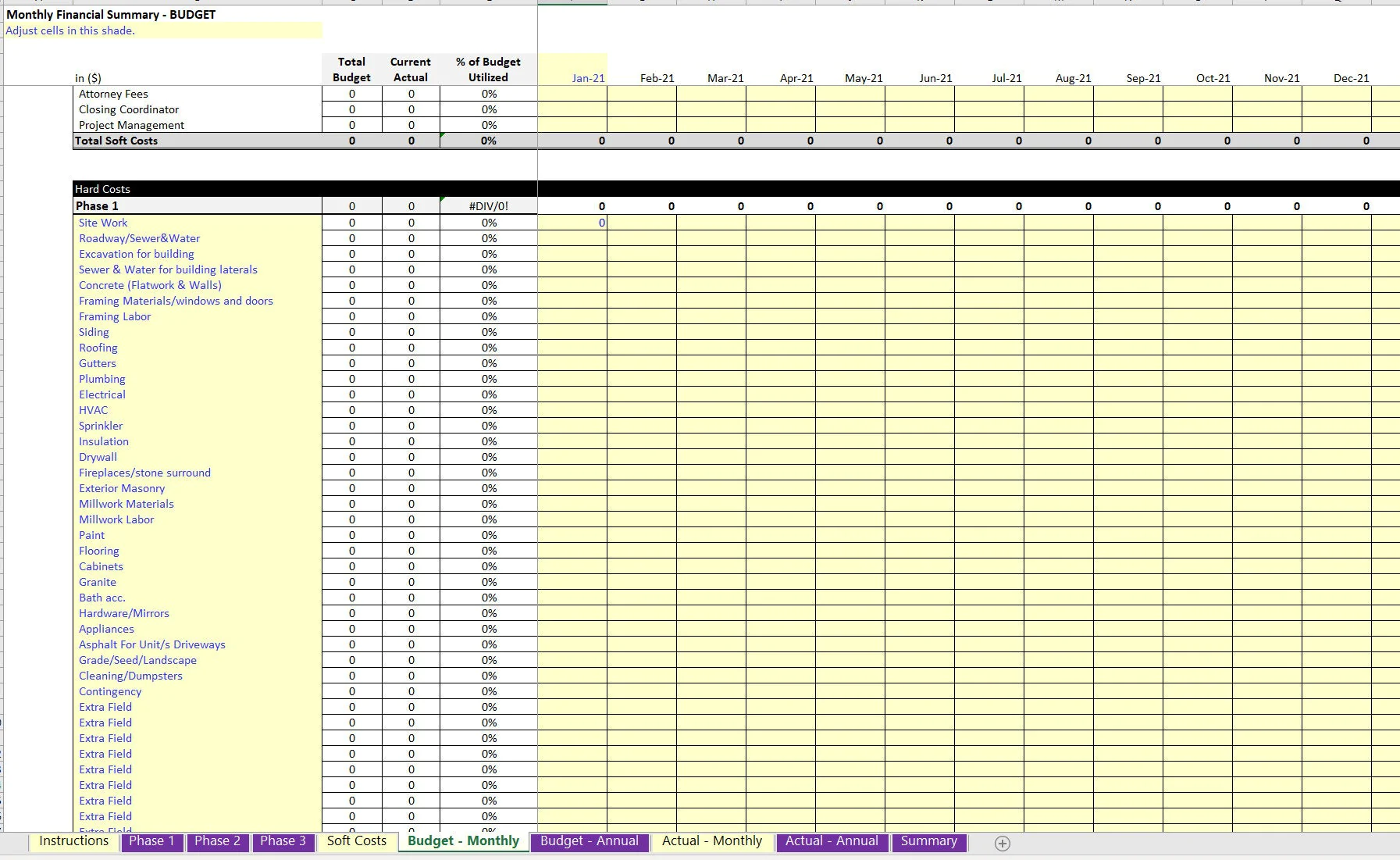

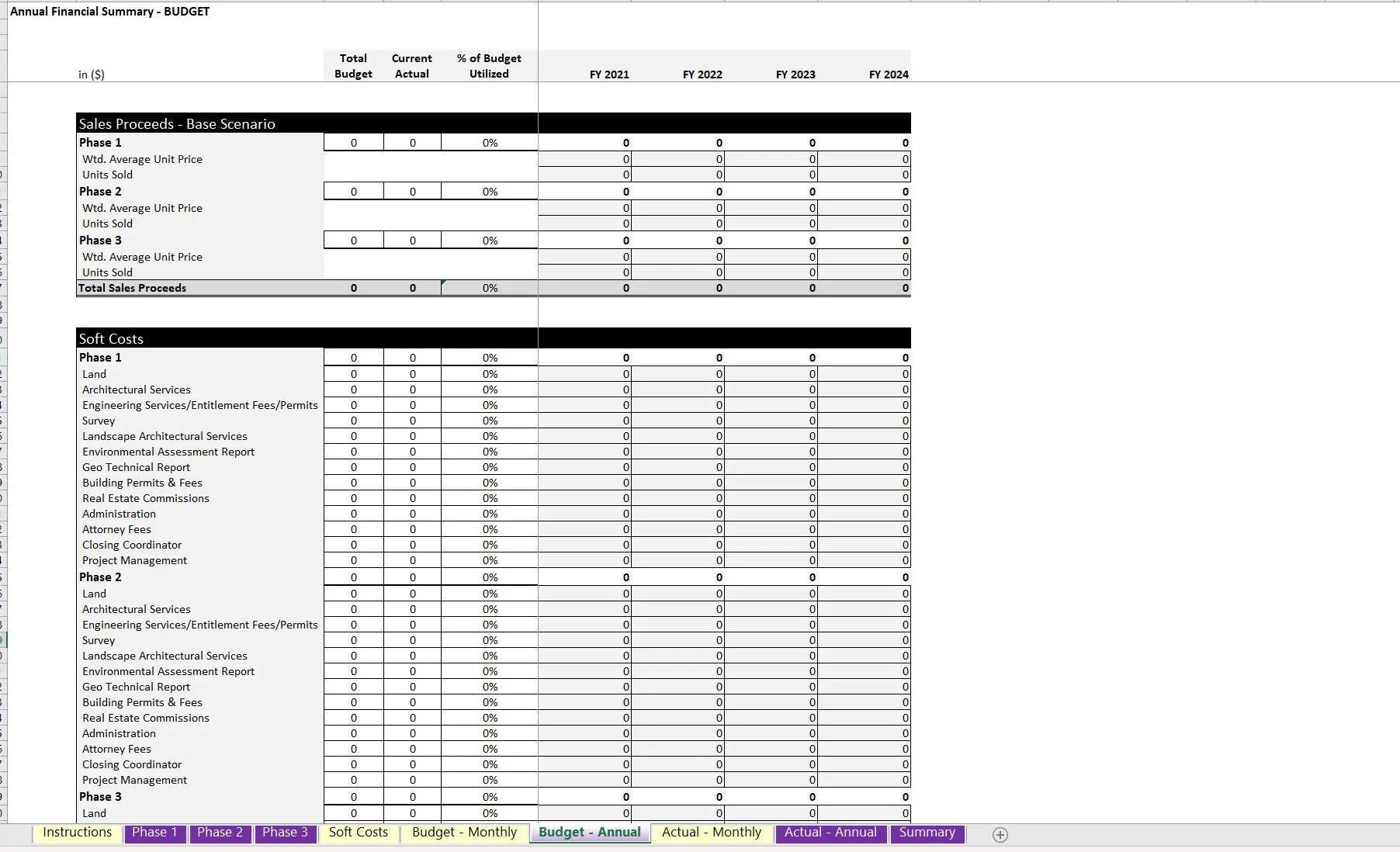

This is a real estate development budget built with logic to account for the costs (soft/hard) related to constructing / purchasing real estate (commercial or residential) and then selling it off in up to a 48 month period.

The user can account for up to 3 phases. The inputs for each phase are separated into:

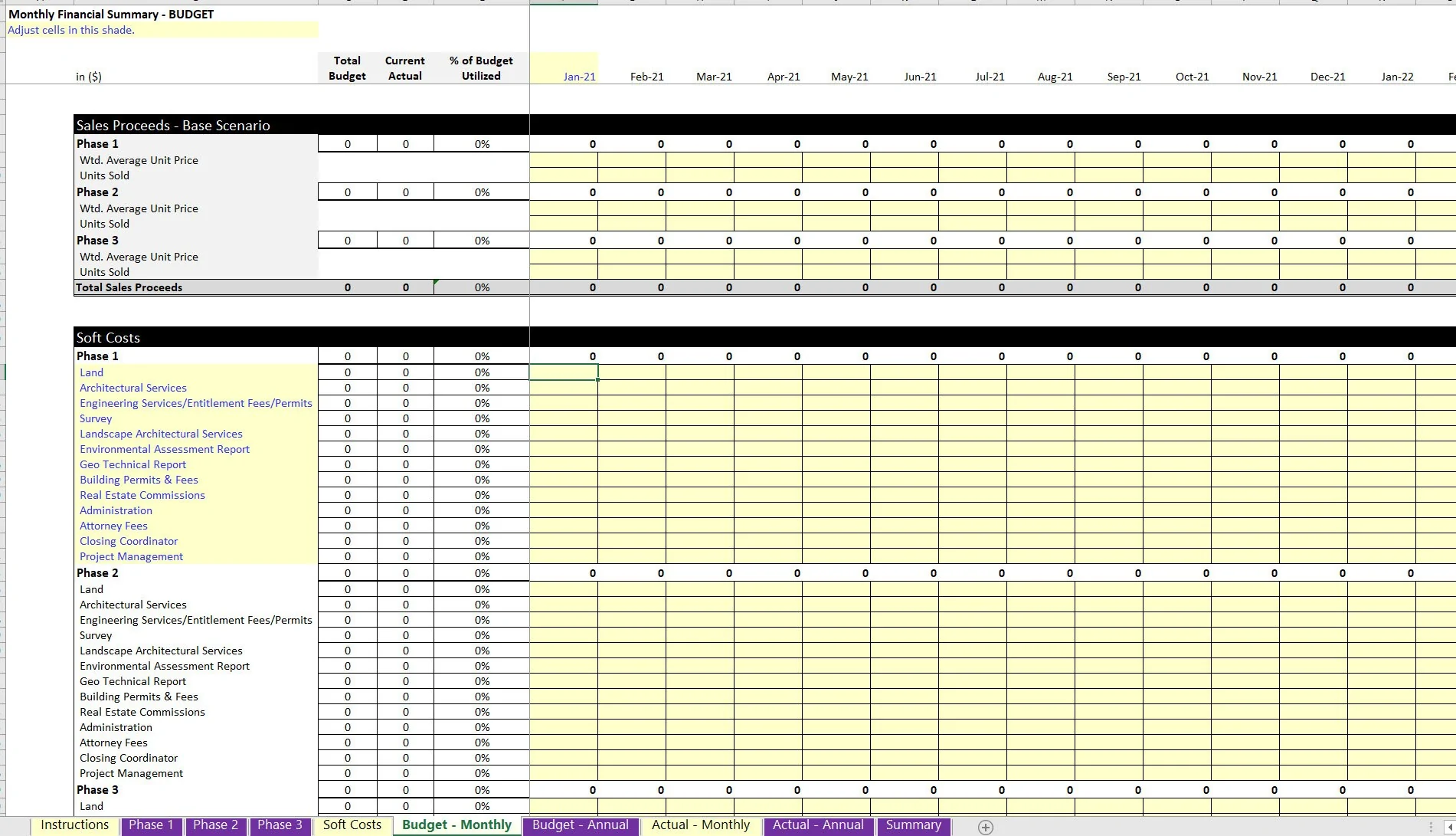

• Sales proceeds (the weighted average price per unit and total units sold can be input for each relevant month)

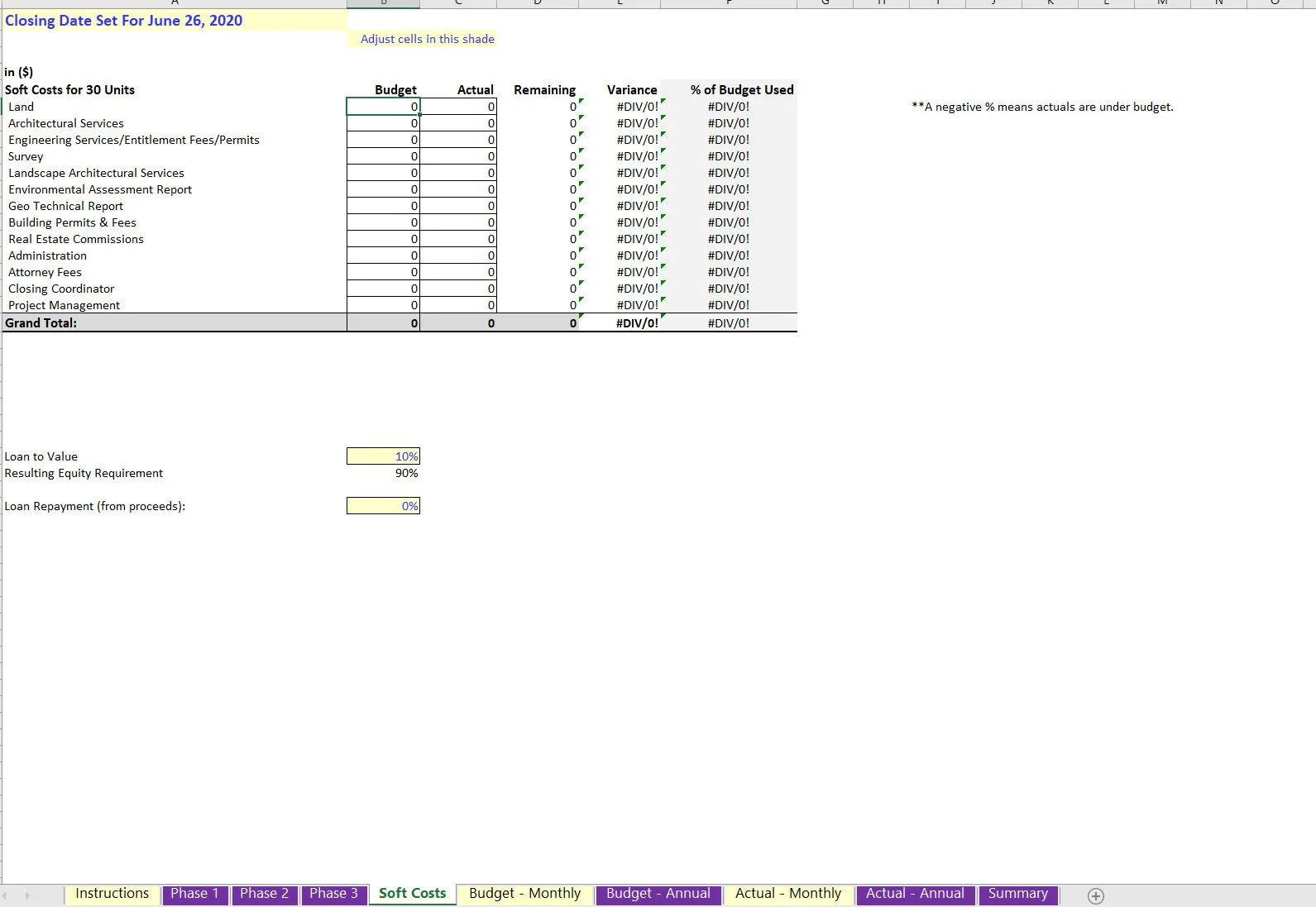

• Soft costs (defined per month)

• Hard Costs (defined per month)

A roll-up summary will be shown for hard costs per phase and total soft costs of all phases. The budget and actual are displayed across a monthly and annual summary.

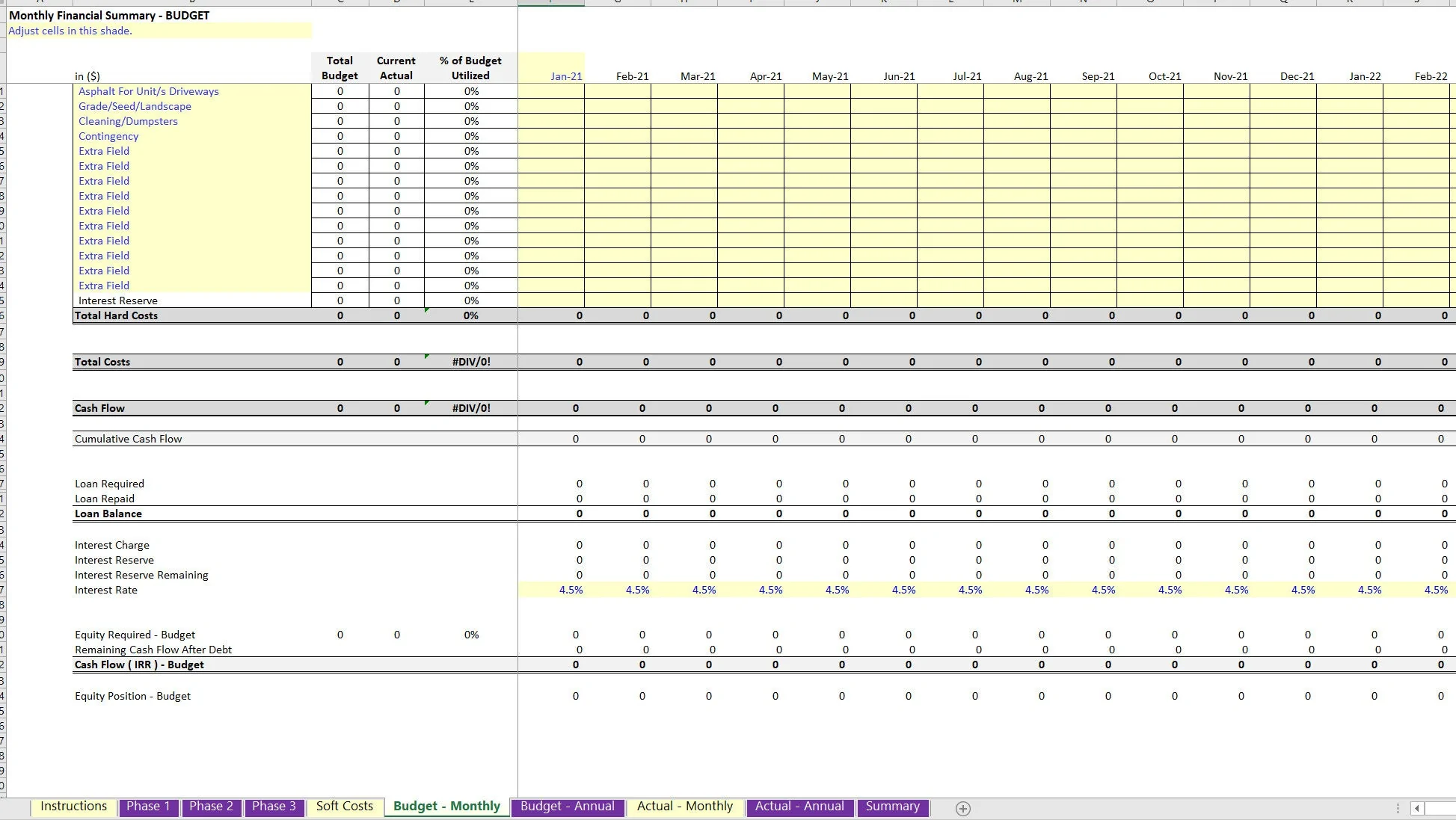

If you plan on financing the initial investment with traditional bank loans (construction loans), this model has logic to show draws based on a defined LTV and APR.

The debt service will come out of cash flow. The phases were used as the primary input structure to allow for more complex projects to be properly organized, but if you just have a single ‘phase' that everything happens in that is completely fine and in that case simply leave the other input cells blank.

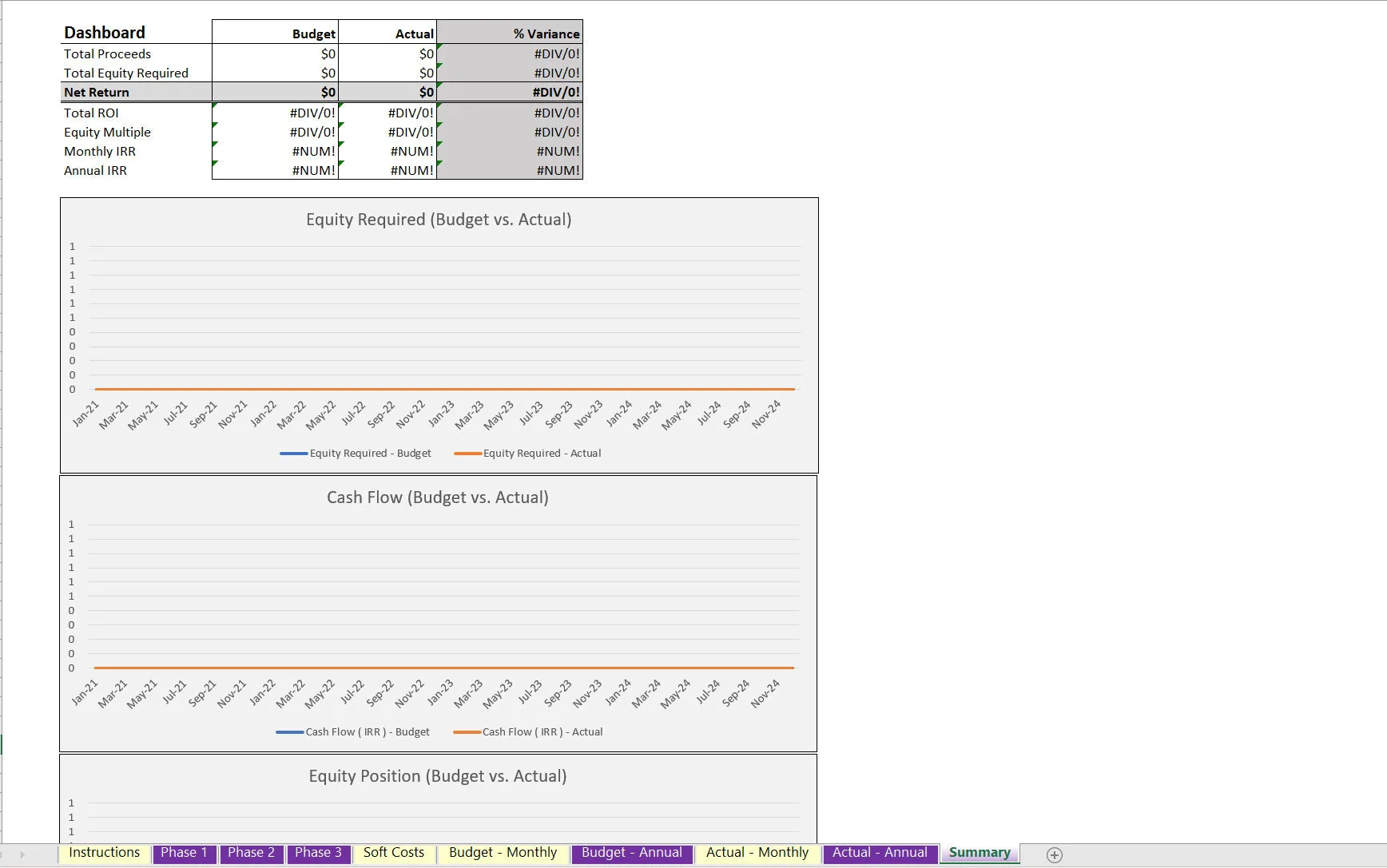

The final output is a comparison of the budget vs. the actual on each individual line item as well as the subtotal lines and final cash flow.

The following are also shown in summary for the budgeted forecast and actuals:

• Total Proceeds

• Total Equity Required

• Net Return

• Total ROI

• Equity Multiple

• Monthly IRR

• Annual IRR

There is a specific instruction tab to help with any confusion.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate Excel: Real Estate Development: Budget vs. Actual Investment Analysis Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping