Professional LBO Model (Excel): IRR/MOIC + Debt + Cash Sweep (Excel XLSX)

Excel (XLSX) + Zip archive file (ZIP)

BENEFITS OF THIS EXCEL DOCUMENT

- Save hours -- Ready-to-use LBO model linking transaction → debt paydown → returns (IRR/MOIC).

- Professional & audit-friendly -- Color-coded inputs, standard formulas, no macros, no external links.

- Scenario-ready -- Sensitivity + scenarios plus a dashboard-style summary for quick what-if analysis.

VALUATION MODEL EXAMPLE EXCEL DESCRIPTION

This Professional LBO (Leveraged Buyout) Excel model is a practical PE-style template built for deal analysis, interview case studies, and corporate finance scenario work. It's designed to be clean, audit-friendly, and fast to customize—without macros or hidden logic.

Why it's useful:

Instead of rebuilding an LBO from scratch, this workbook gives you a structured model where the core mechanics are already linked: transaction inputs → operating performance → debt paydown → returns. The layout emphasizes clarity (inputs vs formulas) so you can adapt it quickly to different companies, leverage levels, and exit assumptions.

What's included (key worksheets/features):

• START HERE / quick guidance

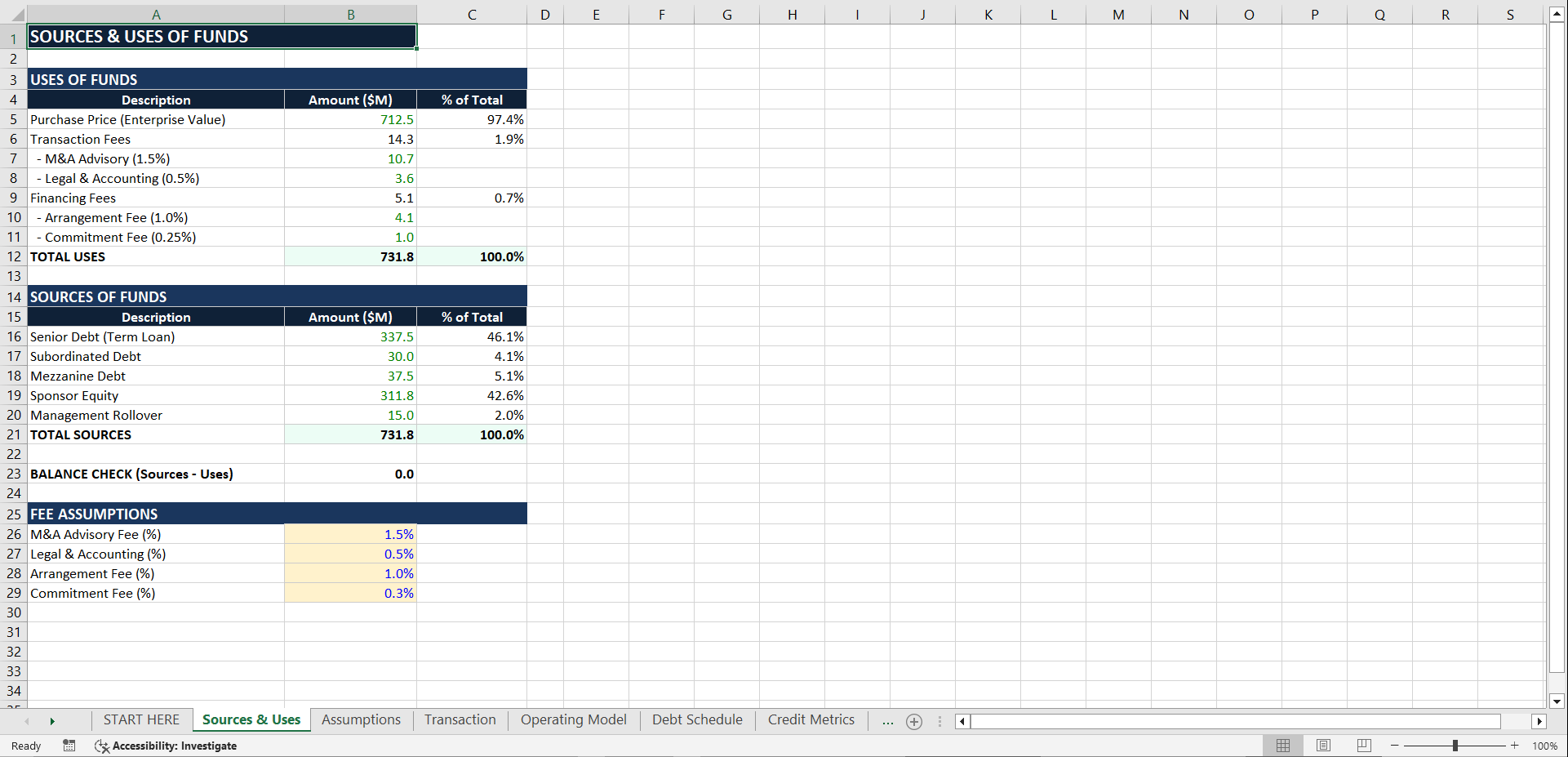

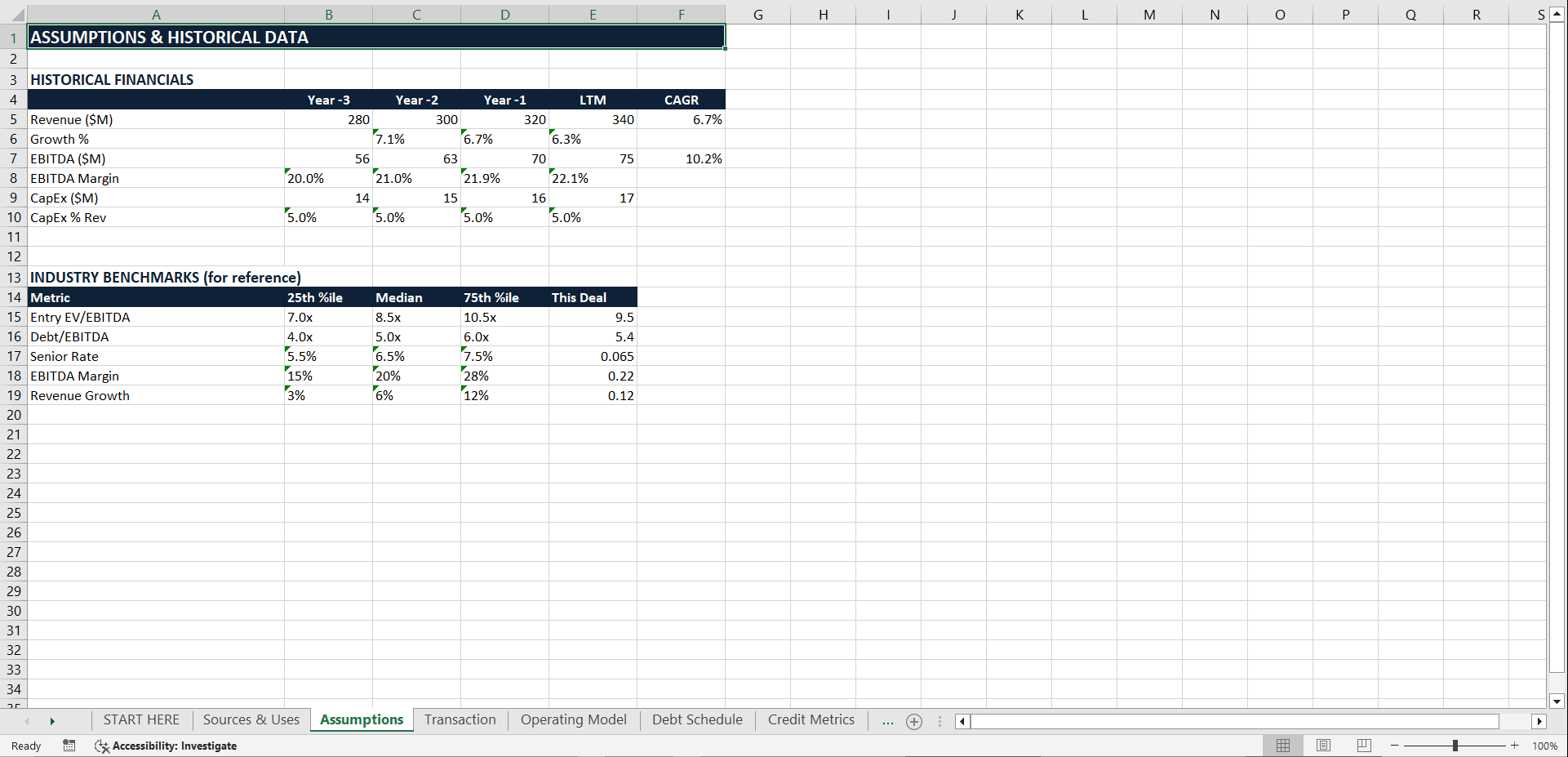

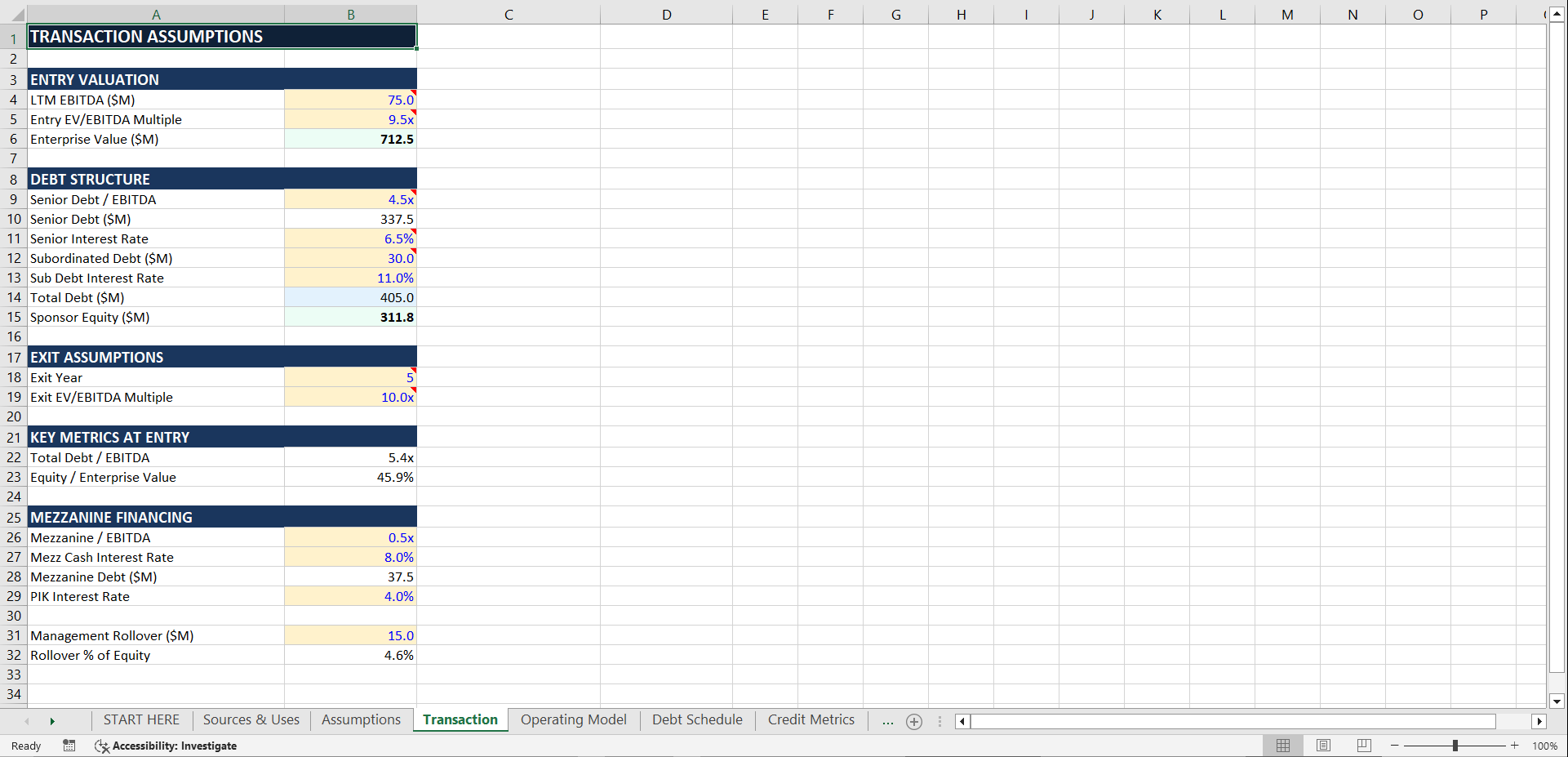

• Sources & Uses / transaction setup (entry assumptions, purchase price, leverage)

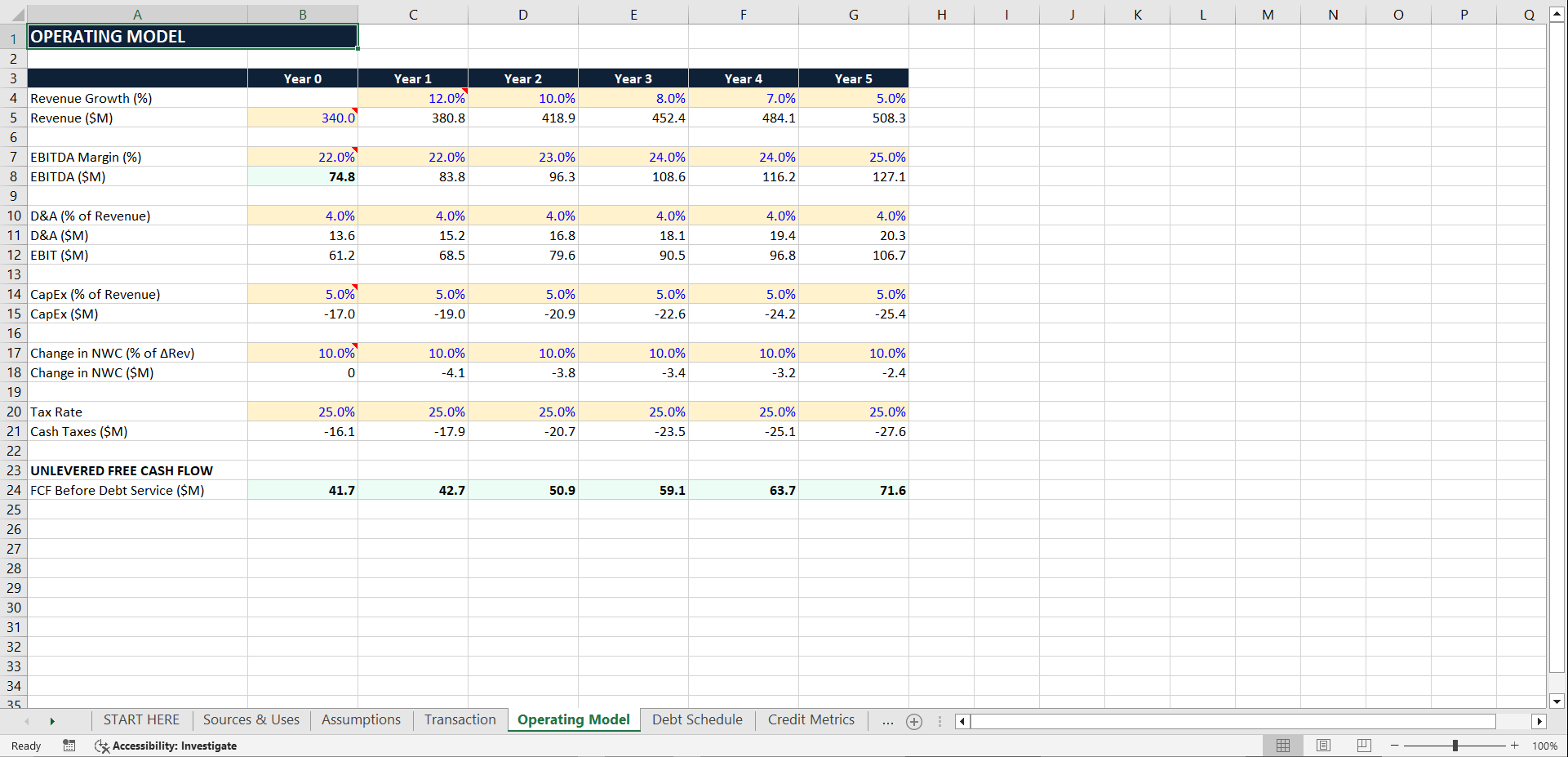

• Operating Model (multi-year projections)

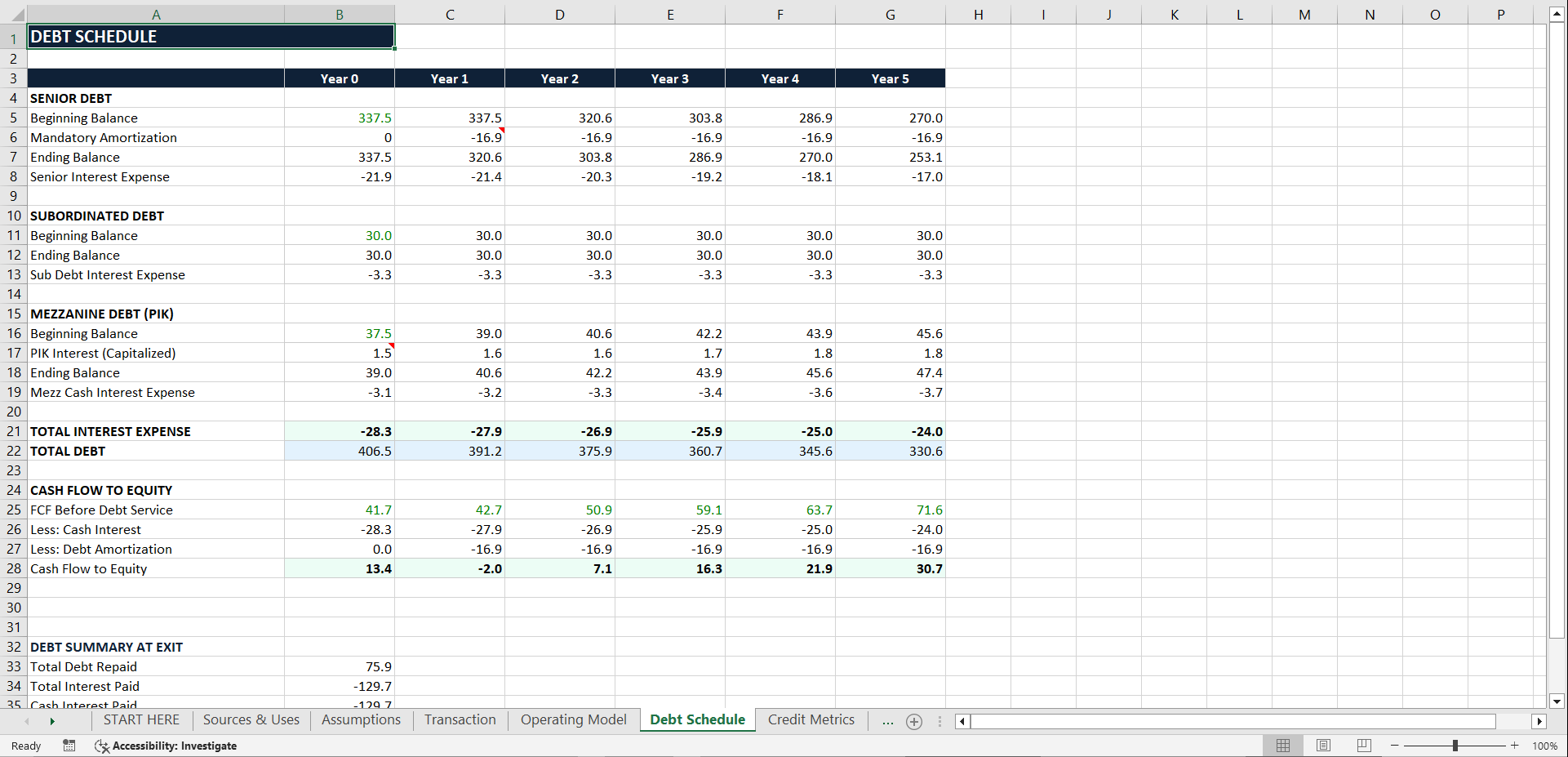

• Debt Schedule with cash sweep mechanics (repayment tied to cash generation)

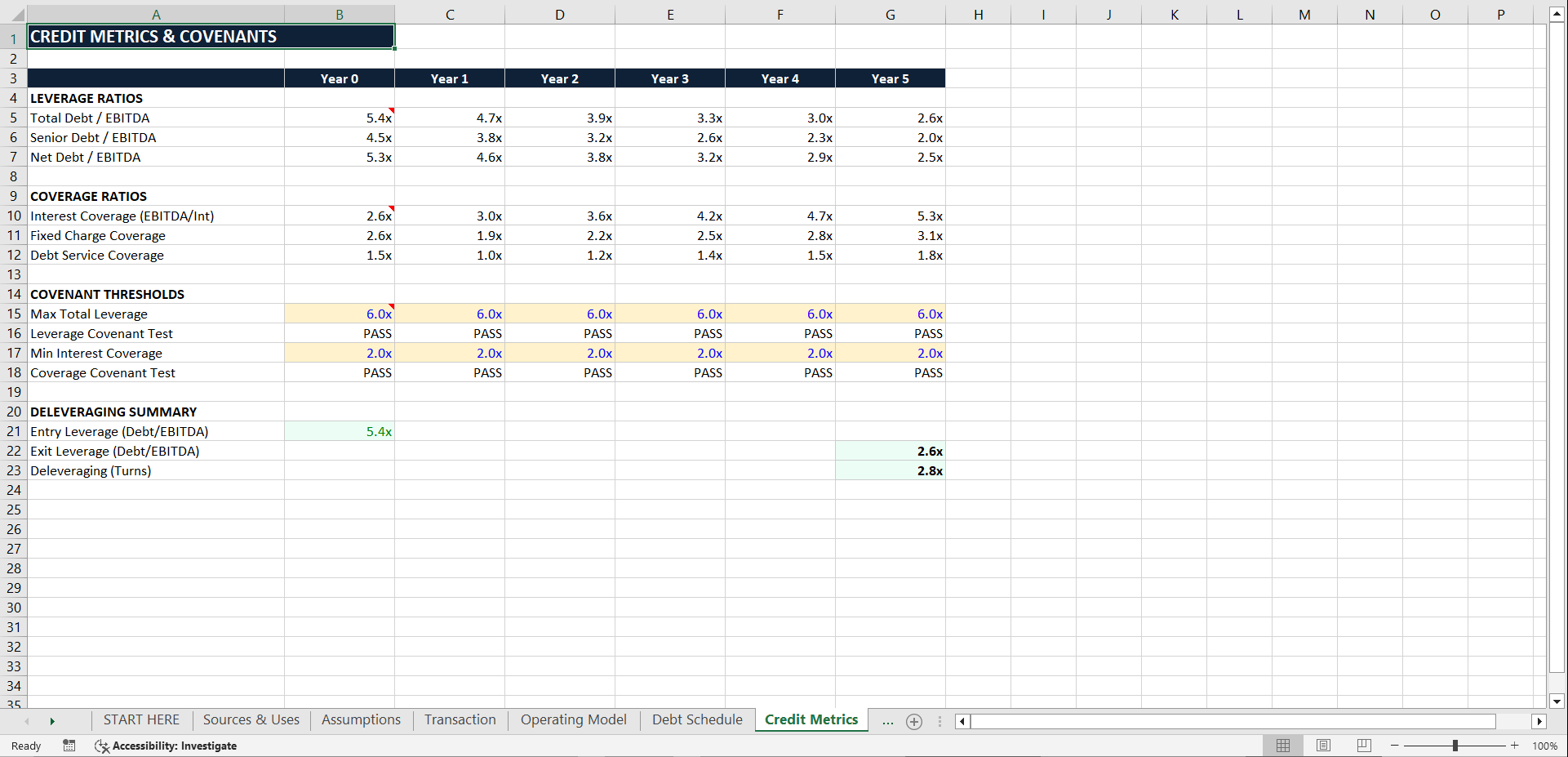

• Credit Metrics (leverage and coverage-style outputs)

• Returns Summary (IRR & MOIC outputs)

• Sensitivity + Scenarios (quick what-if views for key drivers)

• Dashboard-style summary + Documentation notes

How to use:

Edit only the color-coded input cells. Outputs update automatically. If you overwrite formulas by mistake, simply re-download the original file to restore a clean version.

Technical details:

• File format: .xlsx

• No VBA / no macros (no security warnings)

• No external links

• Lightweight workbook (opens quickly)

Compatibility:

Designed for Microsoft Excel (Windows/Mac). Files may open in Google Sheets, but some formulas/formatting can behave differently. For best results, use Excel.

Disclaimer:

For educational and analytical purposes only. Not investment advice.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Model Example Excel: Professional LBO Model (Excel): IRR/MOIC + Debt + Cash Sweep Excel (XLSX) Spreadsheet, FinModelAI