EDUCATION EXCEL DESCRIPTION

This financial model is like a navigator for your school's financial position. You just have to input the numbers, and it shows where you're headed. Whether you're forecasting revenue, analyzing operating costs, or balancing accounts payable, the model brings clarity and control. It's especially handy for business owners who want to create business plans or analyze financial statements like the balance sheet and income statement without hiring a full time corporate finance professional.

Key Features of the Model

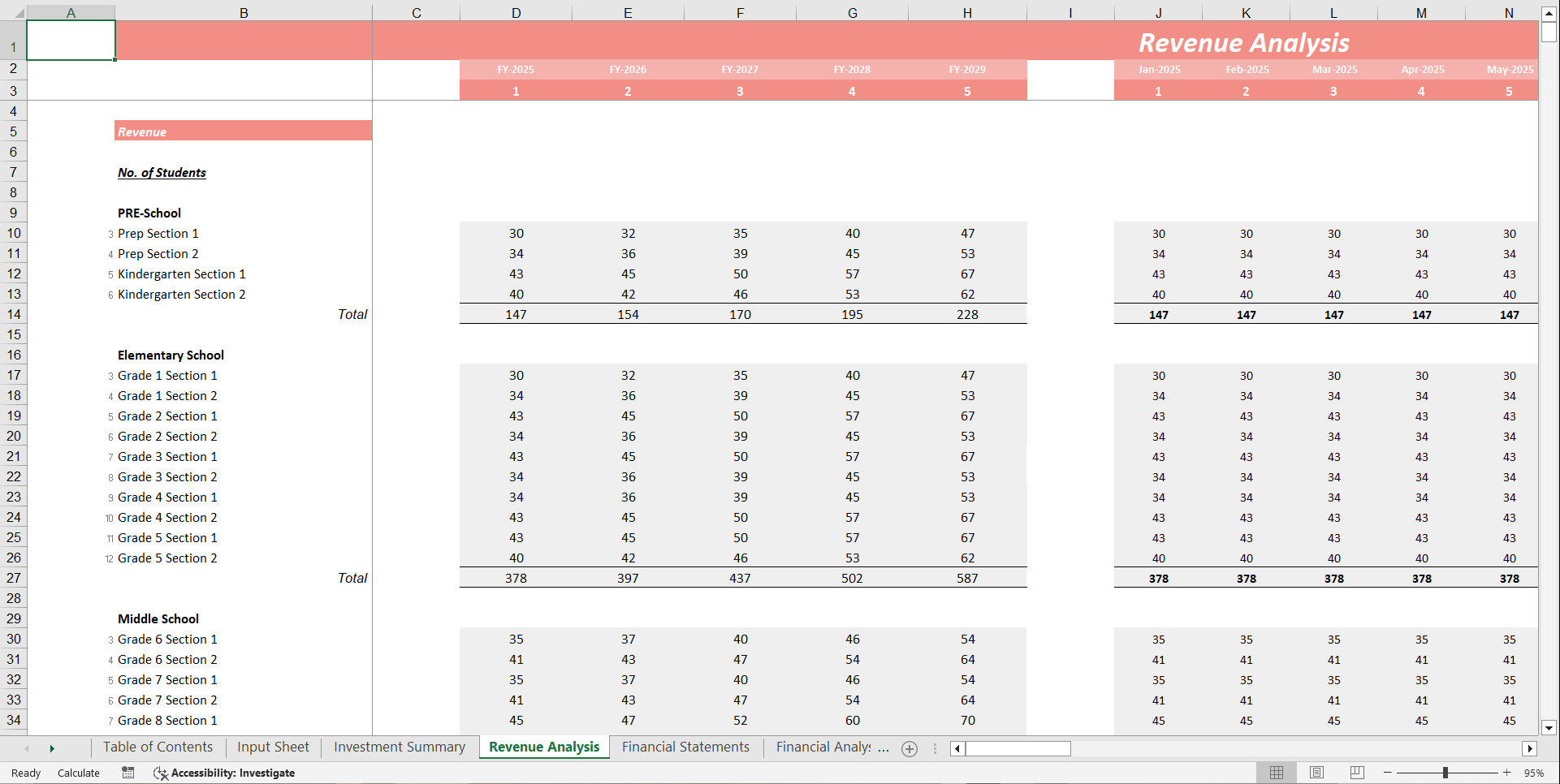

1. Revenue Projections

Sales Forecasting: Estimate future revenue based on student enrollment, grade-wise tuition fees, admission trends, and annual fee escalation.

Revenue by Category: Break down income into Tuition Fees, Admission Fees, Exam Fees, and Extra-Curricular Activities.

2. Cost Structure

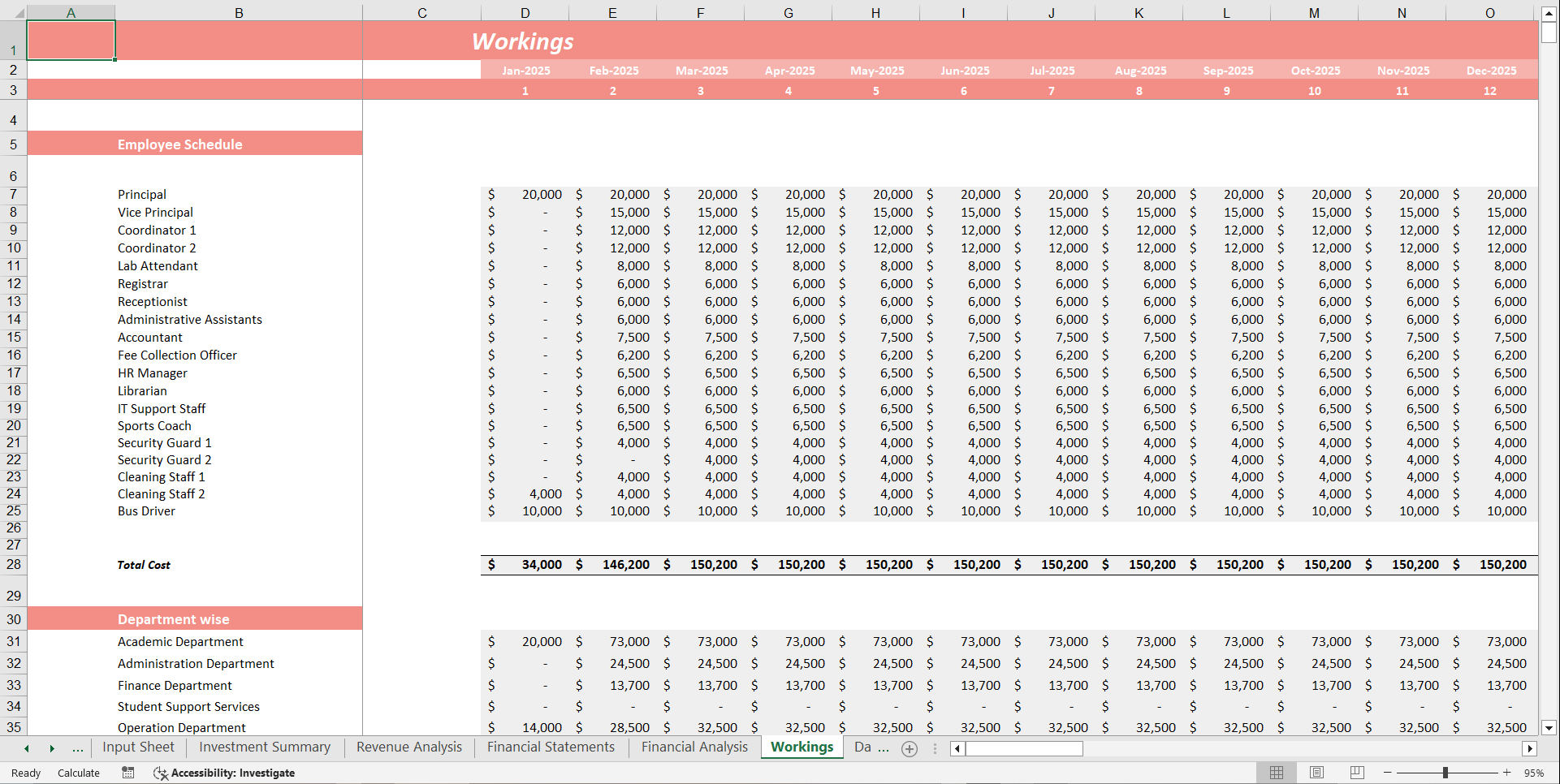

Direct Costs: Adjust direct costs like Teachers' Salaries, Academic Supplies, Transport Staff, and Classroom Utilities as a percentage of revenue to assess gross margin.

Administrative Expenses: Include fixed costs such as rent, non-teaching staff salaries, utilities, software subscriptions, and marketing.

Business Expenses: Capture additional expenses like loan repayments, equipment leasing, legal and audit fees, and insurance.

3. Profitability Analysis

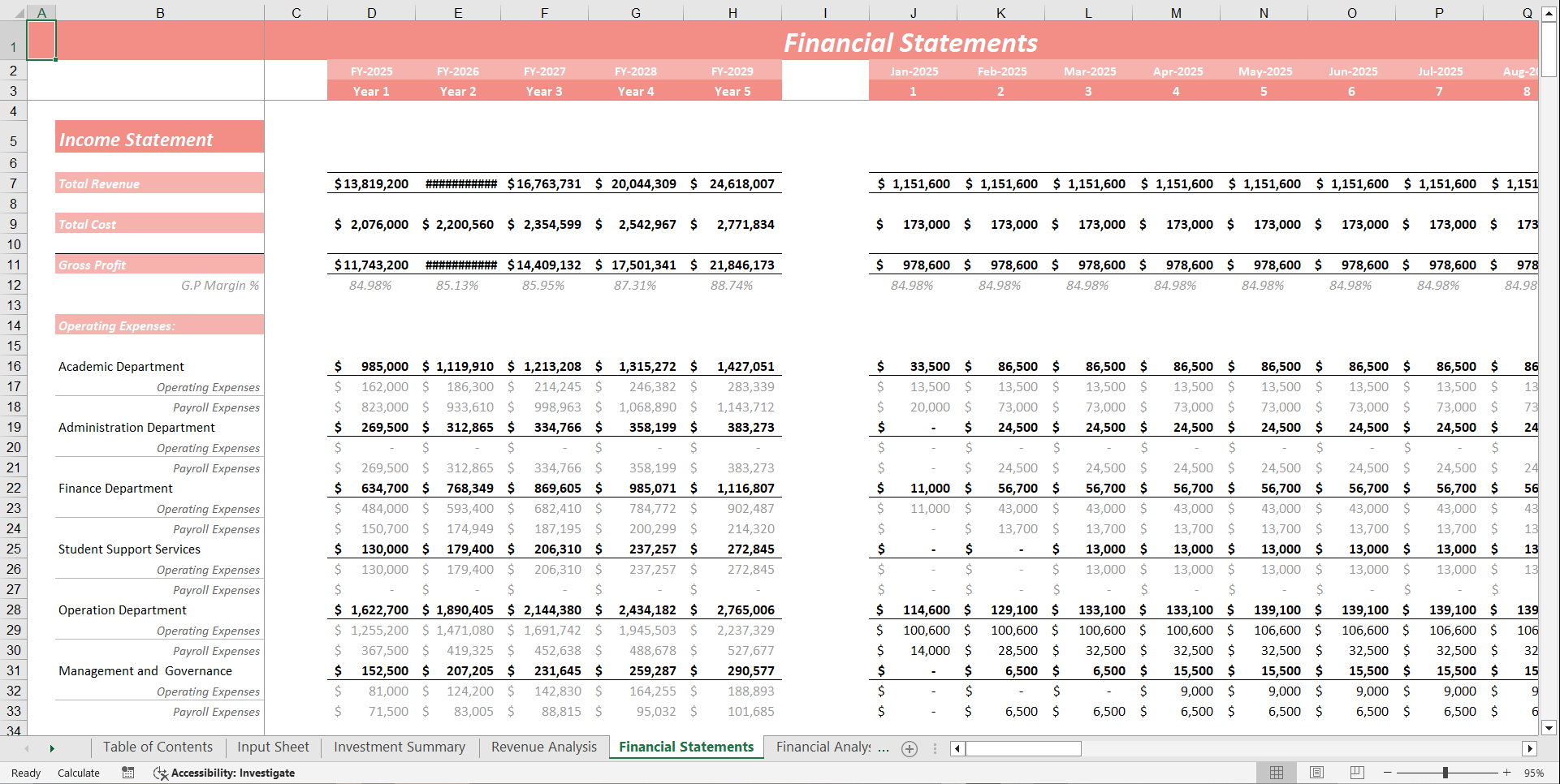

Profit and Loss Statement: Track income, expenses, and profit over 5 years.

Gross Margin & Net Profit: Get to know what is the performance of the Industrial based on gross and net profit.

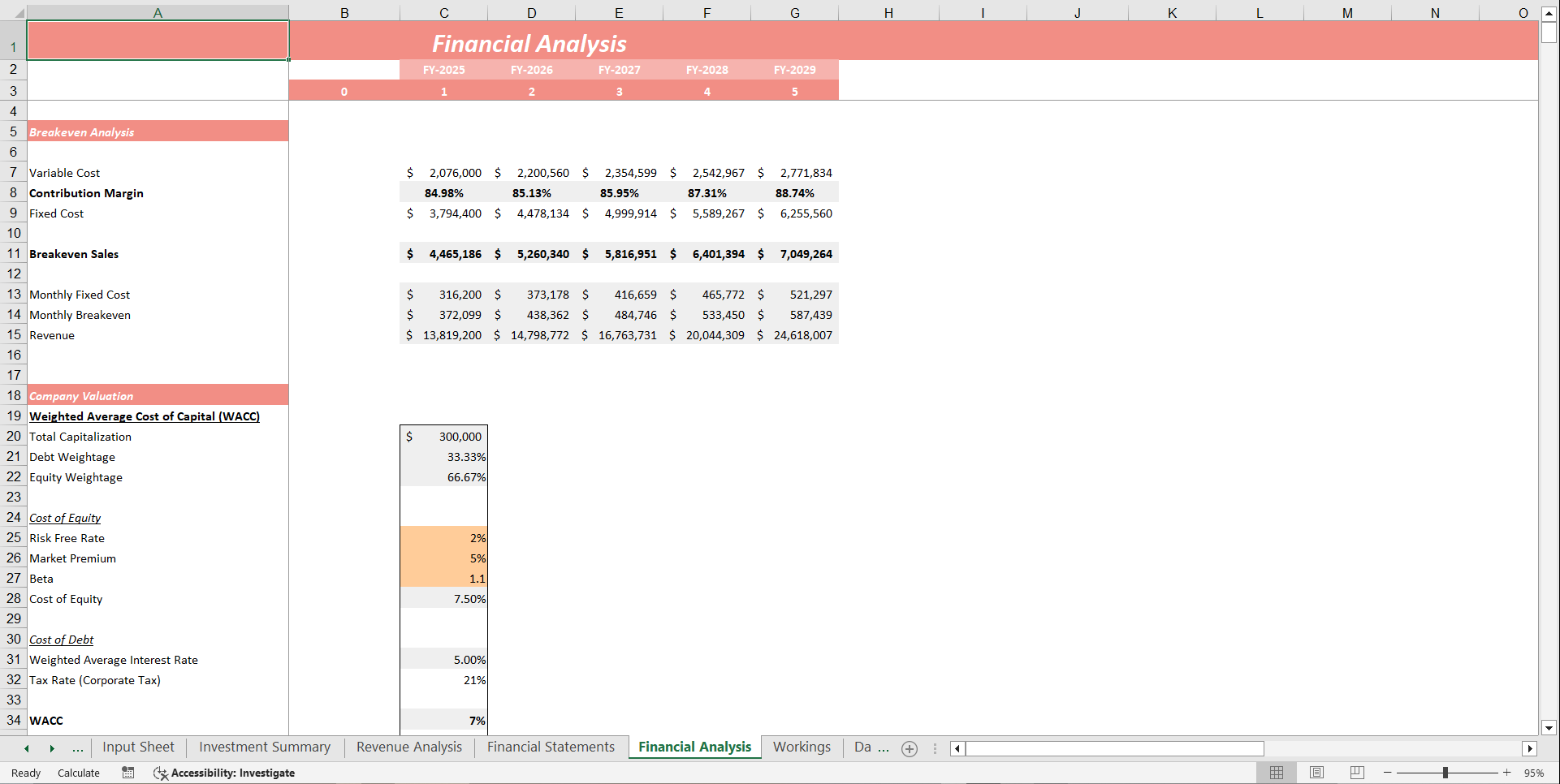

Break-Even Analysis: Determine the number of Customers needed to cover costs and achieve profitability.

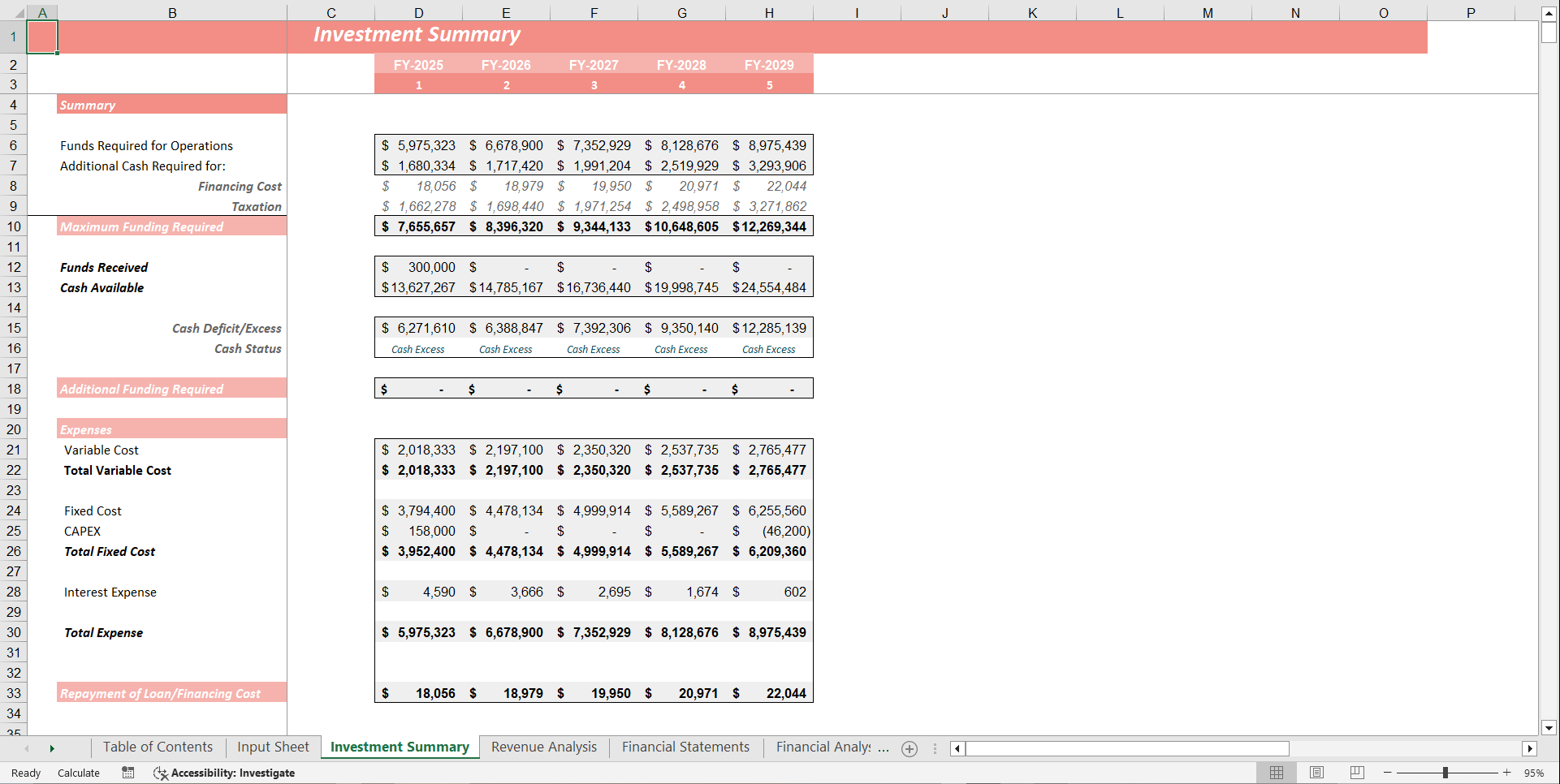

4. Cash Flow Management

Cash Flow Statement: Track money flowing in and out of your business.

Financial Position: Ensure adequate working capital for seamless operations.

Investment Scheduling: Plan accordingly the cashflow to make your investment decisions for a smoother flow of operations.

5. Financial Forecasting & Scenario Analysis

5-Year Financial Plan: Develop long term projections for revenue, expenses, and profitability.

Market Conditions & Trends: Adjust financial forecasts based on industry changes and customer behavior.

Best-Case, Base-Case, and Worst-Case Scenarios: Evaluate different financial outcomes and prepare accordingly.

6. Key Performance Indicators (KPIs)

Enrollment & Fee Segments: Track student enrollment across classes, and monitor revenue by tuition tier, scholarships, or special programs.

Retention & Growth Potential: Measure student retention, admission trends, and explore expansion opportunities such as new grades, campuses, or extracurricular offerings.

Financial Statements: Access dynamic income statements, cash flow reports, and balance sheets for deep insight into school performance and future planning.

7. Investor Readiness & Business Strategy

Attract Potential Investors: Present a professional financial plan to secure funding.

Strategic Planning: Align business objectives with financial projections for long term success.

Cost Analysis & Optimization: Better understand which costs can be minimized and which one have to most impact on profitability.

Key Benefits of Using This Model

1. Better Financial Planning: Gain a clear understanding of your business's financial feasibility.

2. Optimized Operations: Enhance cost analysis and resource allocation.

3. Risk Mitigation: Plan ahead for financial uncertainties and avoid cash shortages.

4. Customizable Tool: Adapt the model to fit different business needs.

5. Scalability: Suitable for both small startups and established agencies.

FAQ's

1. Why is a financial model important for private schools?

A financial model helps you manage operating costs, plan financial forecasts, and ensure financial stability. It's a basic need for business owners who want to make informed decisions.

2. Can this model handle complicated debt schedules?

Yes, the loan schedule is designed to manage even the most complicated debt schedules. It keeps track of repayments, interest, and how they impact cash flow of the business.

3. What is the revenue per student, and why does it matter?

Revenue per student is the average income generated from one student. It's difficult for understanding profitability and planning for revenue growth.

4. How does this model support financial planning & analysis?

The model includes tools like break-even analysis, cash flow modeling, and sensitivity analysis. These help with short-term planning and long-range financial modeling.

5. Is this model customizable?

Absolutely. You can adapt it to fit your school's unique needs, whether you're focusing on school programs, capital improvements, or administrative expenses.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Education, Integrated Financial Model Excel: Private School Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant