Fintech Business DCF Valuation Financial Model (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a robust framework for valuing fintech and SaaS businesses using a professional discounted cash flow methodology.

- Enables investor-ready financial projections by fully integrating income statement, balance sheet, and cash flow forecasts in Excel.

- Supports fundraising, M&A, and strategic decision-making through automated valuation outputs, key financial ratios, and visual dashboards.

FINTECH EXCEL DESCRIPTION

Curated by McKinsey-trained Executives

🚀 Fintech Business DCF Valuation Financial Model – Excel Template

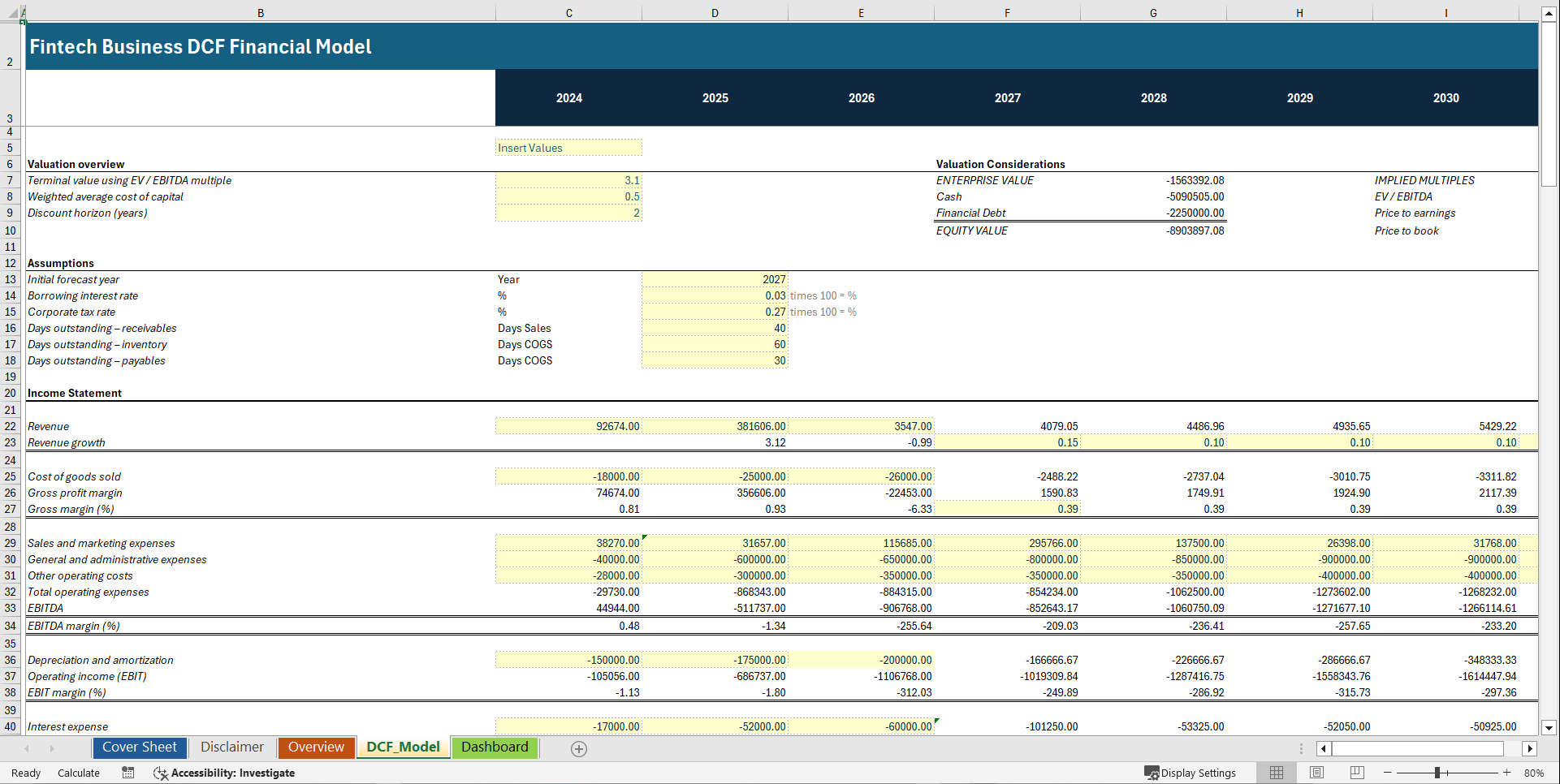

This Fintech DCF Valuation Financial Model in Excel is a comprehensive, investor-grade discounted cash flow model built specifically for fintech, SaaS, and digital financial services companies. Designed for startup founders, CFOs, financial analysts, venture capital firms, private equity investors, and M&A advisors, this template enables precise fintech business valuation based on operating performance, cash generation, and capital structure.

The model converts detailed assumptions into fully linked income statement, balance sheet, and cash flow projections, ensuring consistency across all financial outputs. It supports fintech-specific revenue streams including transaction fees, platform usage, subscriptions, and financial services income, while modeling cost of goods sold, operating expenses, EBITDA, and margin expansion with professional accuracy.

📊 Advanced Discounted Cash Flow Valuation

At its core, this model applies a robust Free Cash Flow to the Firm (FCFF) methodology, starting from after-tax EBIT and adjusting for non-cash items, working capital changes, and capital expenditures related to software development and IT infrastructure. Cash flows are discounted using a customizable Weighted Average Cost of Capital (WACC) over a flexible discount horizon, resulting in a clear calculation of net present value, enterprise value, and equity value.

A terminal value calculated using an EV / EBITDA multiple captures long-term value beyond the explicit forecast period, making this model ideal for fintech valuation, fundraising decks, acquisition analysis, and strategic planning. Built-in implied valuation multiples such as EV / EBITDA, Price to Earnings, and Price to Book provide immediate market-based validation and investor-level credibility ✔.

🧾 Complete 3-Statement Financial Forecast

The model includes a fully integrated forecast covering:

• Revenue growth and margin development

• Sales & marketing, G&A, and operating costs

• EBITDA, EBIT, EBT, and net income

• Cash, working capital, fixed assets, debt, and equity

A detailed fixed asset and depreciation schedule models software platforms, systems, and technology investments, ensuring realistic long-term projections for fintech businesses with high development spend.

💰 Fintech-Specific Cash Flow Modeling

Operating cash flow reflects real fintech economics, including timing of client payments, merchant settlements, platform costs, licenses, cloud services, and vendor payables. Investing cash flow captures capital expenditures and strategic technology investments, while financing cash flow tracks bank facilities, credit lines, equity raises, buybacks, and dividends. Opening and closing cash balances update automatically for full liquidity visibility ⚡.

📈 Automated Dashboard & Key Financial Metrics

All financial data feeds into a fully automated, investor-ready dashboard visualizing:

• Gross Profit Margin & EBITDA by year

• Margin overview and income statement trends

• Cash flows by year

• Total assets vs. total liabilities

• Debt vs. equity evolution

The model also includes a complete set of key financial ratios, covering profitability, leverage, liquidity, efficiency, and returns, including debt to EBITDA, interest coverage, current ratio, ROIC, ROE, and revenue growth rate.

🎯 Built for Investors, Founders & Advisors

Whether you are valuing a fintech startup, preparing for a venture capital or private equity raise, analyzing an acquisition, or building an internal strategic valuation, this Fintech DCF Valuation Excel Template delivers professional, scalable, and defensible results.

If you need a best-in-class fintech valuation model, optimized for SEO-driven discoverability, investor expectations, and real-world financial modeling, this template gives you everything required to analyze value, run scenarios, and present confident, data-driven insights 📌.

Key Words:

Strategy & Transformation, Growth Strategy, Strategic Planning, Strategy Frameworks, Innovation Management, Pricing Strategy, Core Competencies, Strategy Development, Business Transformation, Marketing Plan Development, Product Strategy, Breakout Strategy, Competitive Advantage, Mission, Vision, Values, Strategy Deployment & Execution, Innovation, Vision Statement, Core Competencies Analysis, Corporate Strategy, Product Launch Strategy, BMI, Blue Ocean Strategy, Breakthrough Strategy, Business Model Innovation, Business Strategy Example, Corporate Transformation, Critical Success Factors, Customer Segmentation, Customer Value Proposition, Distinctive Capabilities, Enterprise Performance Management, KPI, Key Performance Indicators, Market Analysis, Market Entry Example, Market Entry Plan, Market Intelligence, Market Research, Market Segmentation, Market Sizing, Marketing, Michael Porter's Value Chain, Organizational Transformation, Performance Management, Performance Measurement, Platform Strategy, Product Go-to-Market Strategy, Reorganization, Restructuring, SWOT, SWOT Analysis, Service 4.0, Service Strategy, Service Transformation, Strategic Analysis, Strategic Plan Example, Strategy Deployment, Strategy Execution, Strategy Frameworks Compilation, Strategy Methodologies, Strategy Report Example, Value Chain, Value Chain Analysis, Value Innovation, Value Proposition, Vision Statement, Corporate Strategy, Business Development, Busienss plan pdf, business plan, PDF, Biusiness Plan DOC, Bisiness Plan Template, PPT, Market strategy playbook, strategic market planning, competitive analysis tools, market segmentation frameworks, growth strategy templates, product positioning strategy, market execution toolkit, strategic alignment playbook, KPI and OKR frameworks, business growth strategy guide, cross-functional strategy templates, market risk management, market strategy PowerPoint dec, guide, ebook, e-book ,McKinsey Change Playbook, Organizational change management toolkit, Change management frameworks 2025, Influence model for change, Change leadership strategies, Behavioral change in organizations, Change management PowerPoint templates, Transformational leadership in change, supply chain KPIs, supply chain KPI toolkit, supply chain PowerPoint template, logistics KPIs, procurement KPIs, inventory management KPIs, supply chain performance metrics, manufacturing KPIs, supply chain dashboard, supply chain strategy KPIs, reverse logistics KPIs, sustainability KPIs in supply chain, financial supply chain KPIs, warehouse KPIs, digital supply chain KPIs, 1200 KPIs, supply chain scorecard, KPI examples, supply chain templates, Corporate Finance SOPs, Finance SOP Excel Template, CFO Toolkit, Finance Department Procedures, Financial Planning SOPs, Treasury SOPs, Accounts Payable SOPs, Accounts Receivable SOPs, General Ledger SOPs, Accounting Policies Template, Internal Controls SOPs, Finance Process Standardization, Finance Operating Procedures, Finance Department Excel Template, FP&A Process Documentation, Corporate Finance Template, Finance SOP Toolkit, CFO Process Templates, Accounting SOP Package, Tax Compliance SOPs, Financial Risk Management Procedures.

NOTE: Our digital products are sold on an "as is" basis, making returns and refunds unavailable post-download. Please preview and inquire before purchasing. Please contact us before purchasing if you have any questions! This policy aligns with the standard Flevy Terms of Usage.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Fintech Excel: Fintech Business DCF Valuation Financial Model Excel (XLSX) Spreadsheet, SB Consulting