Mixed-Use Real Estate Model (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Units or Rent per SQ. FT.

- Flexible Configuration

- Time-saving Analysis

REAL ESTATE EXCEL DESCRIPTION

The second file in the download drives all revenues and expenses off of rent per square foot and expense per square foot data entry instead of unit count and rent per unit.

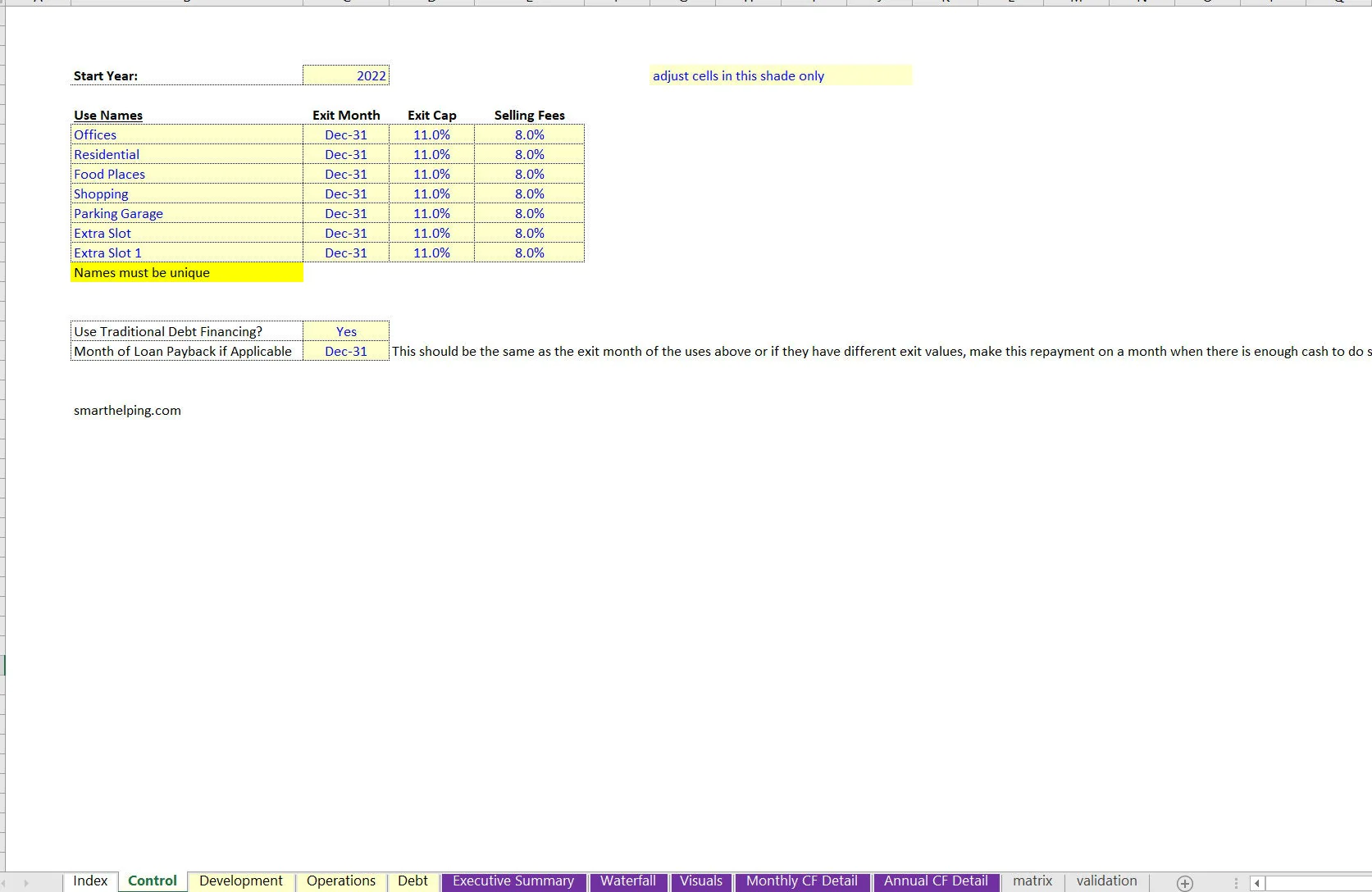

This is a well-done mixed-use real estate analysis spreadsheet. You are getting a comprehensive tool that allows developers to evaluate the feasibility and profitability of a mixed-use development project. It contains multiple tabs and sections that cover various aspects of the development process, from financial projections to market analysis. The logic is setup to account for acquisitions as well.

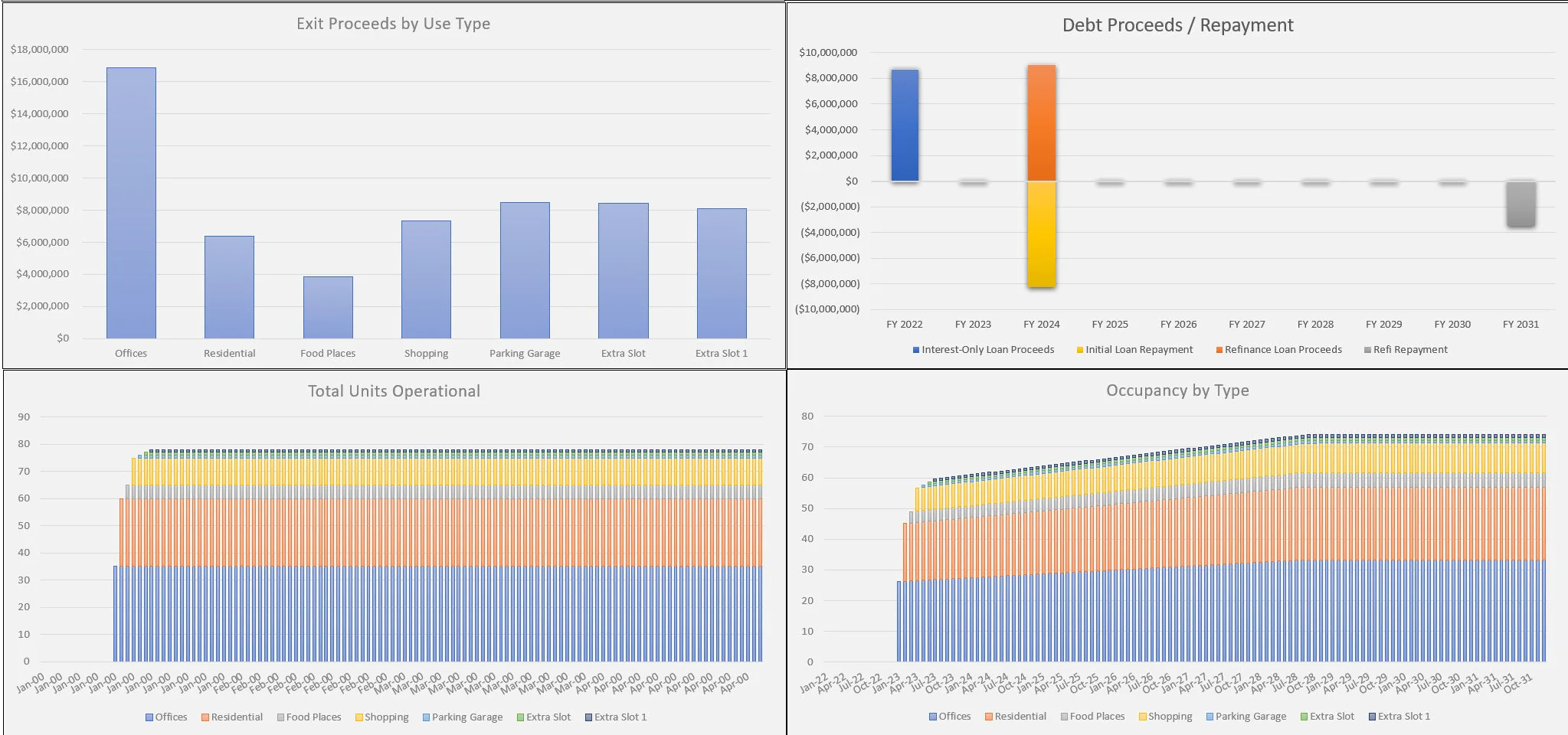

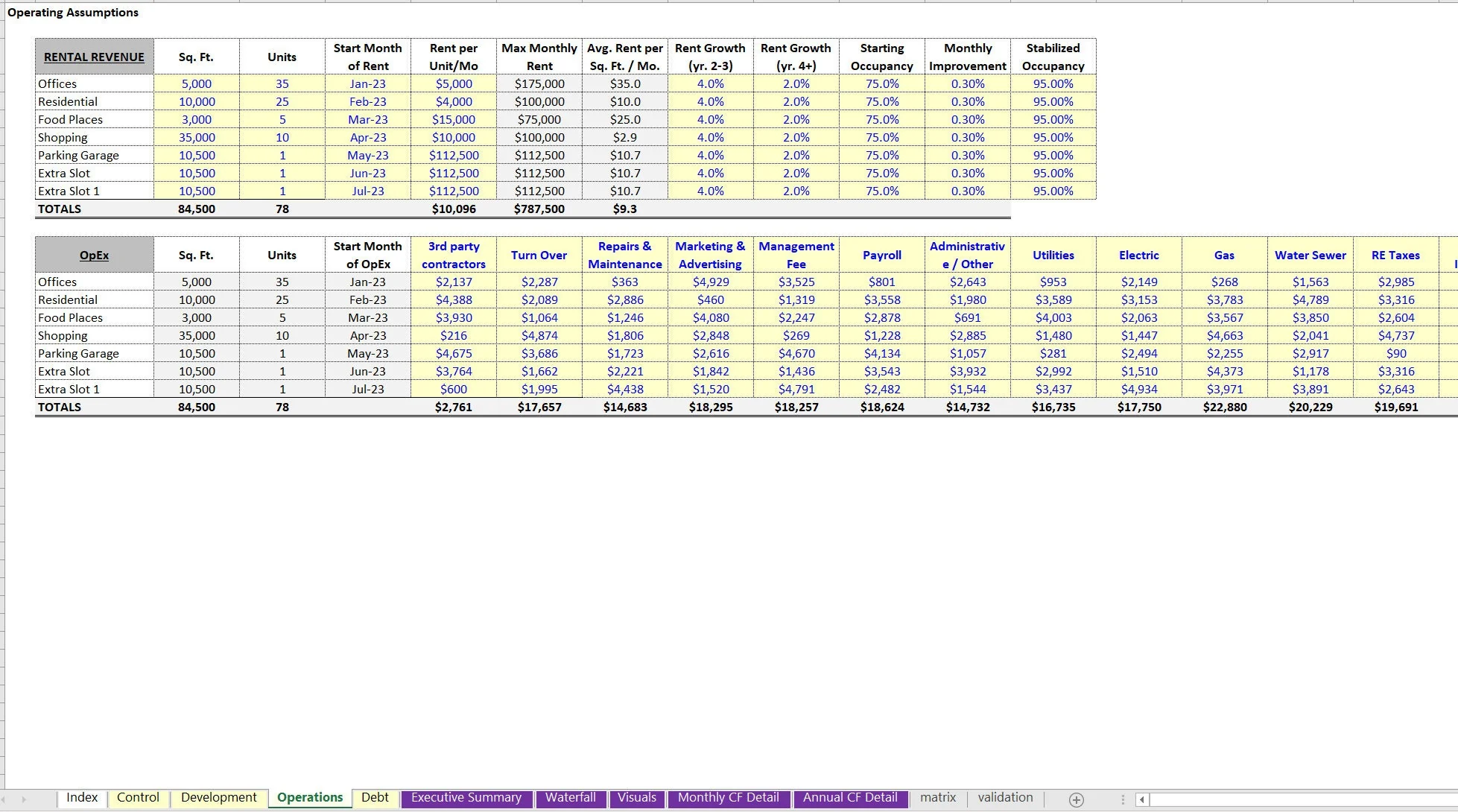

The 'Operations' section of the spreadsheet includes a summary of the project, including the location, size, and type of development. This is followed by an overview of the market conditions and trends, including expected unit counts, occupancy, expected stabilized occupancy, rent start month, and rent growth expectations.

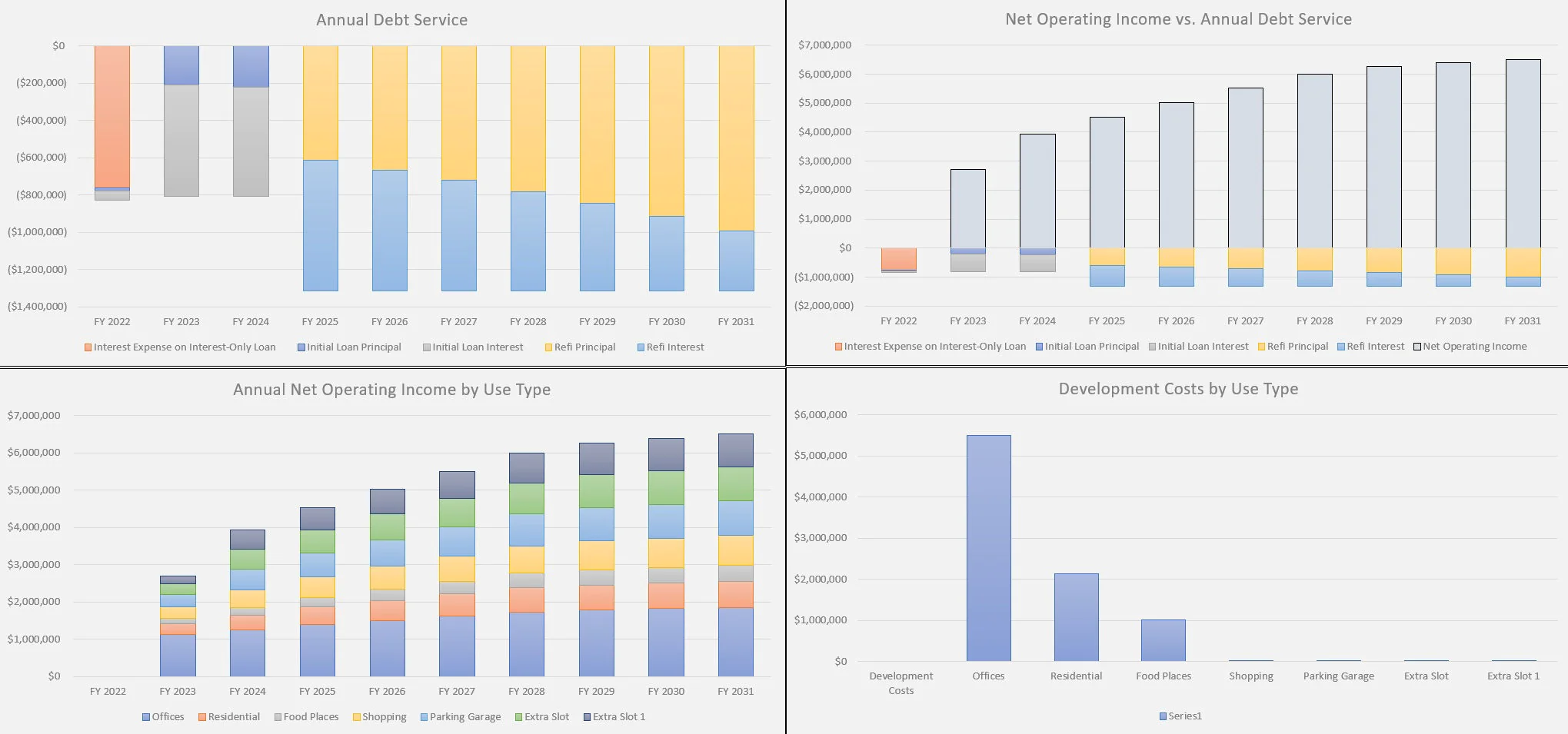

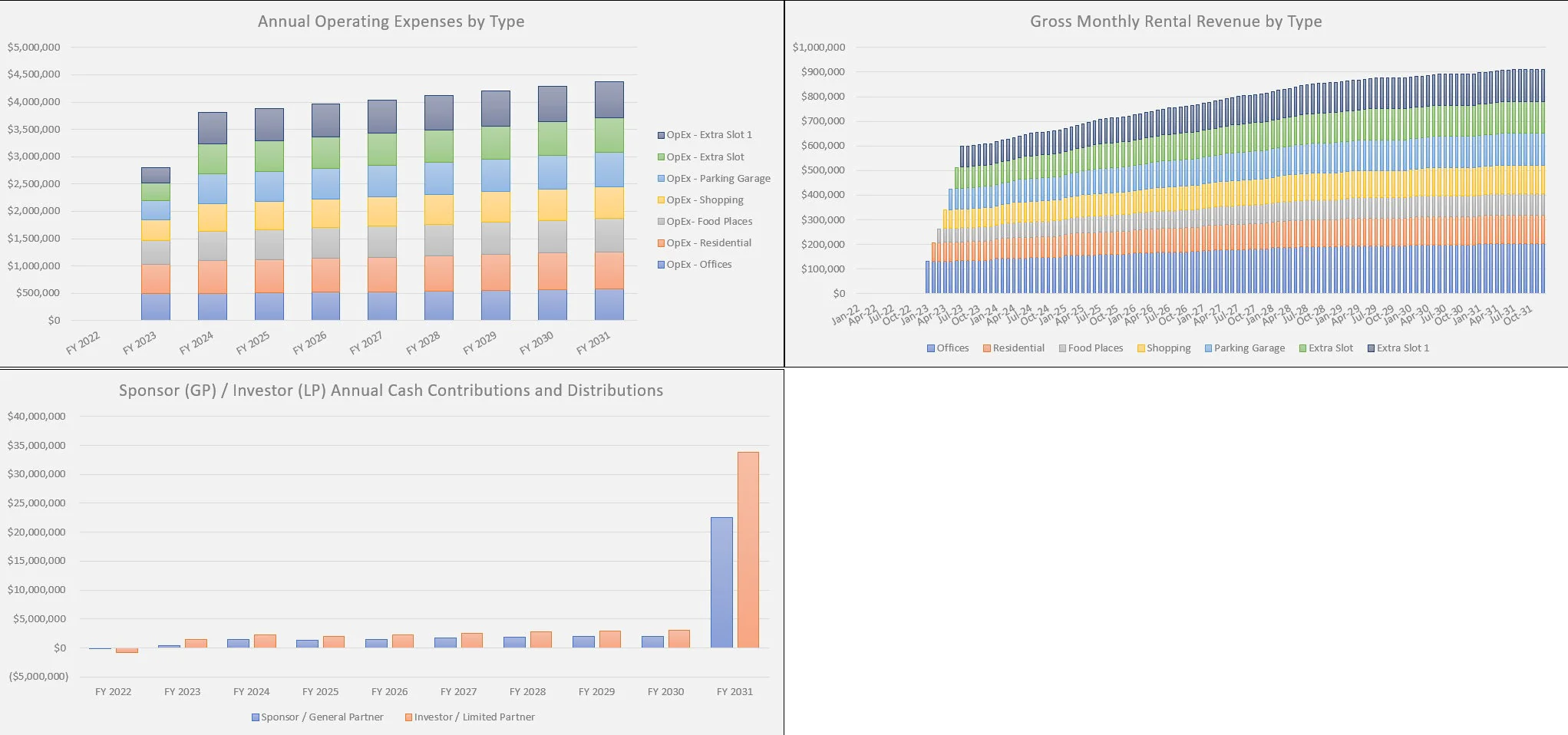

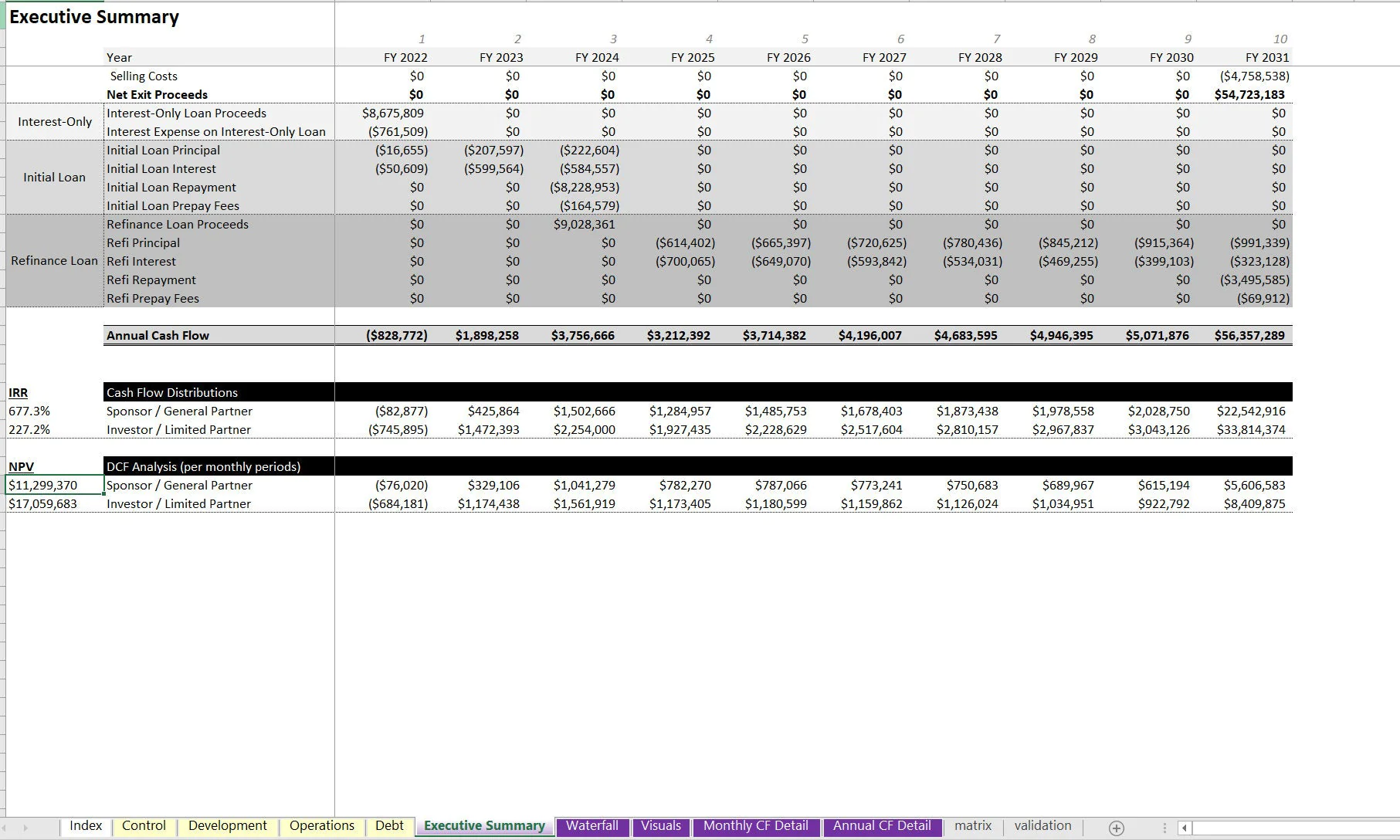

The financial summary section of the spreadsheet is the most critical aspect of the analysis. It includes detailed projections of the project's revenue, expenses, and cash flow over a period of several years (up to 10). This section includes gross rental income, vacancy loss, and operating expenses, as well as financing terms and equity contributions. The projections should be based on realistic assumptions and take into account any contingencies or risk factors.

In addition to financial projections, the spreadsheet makes it easy to conduct a sensitivity analyses, which allows developers to assess the impact of changes in key variables on the project's profitability. For example, the sensitivity analysis may show the effect of changes in rent, occupancy rates, or construction costs on the project's net present value or internal rate of return.

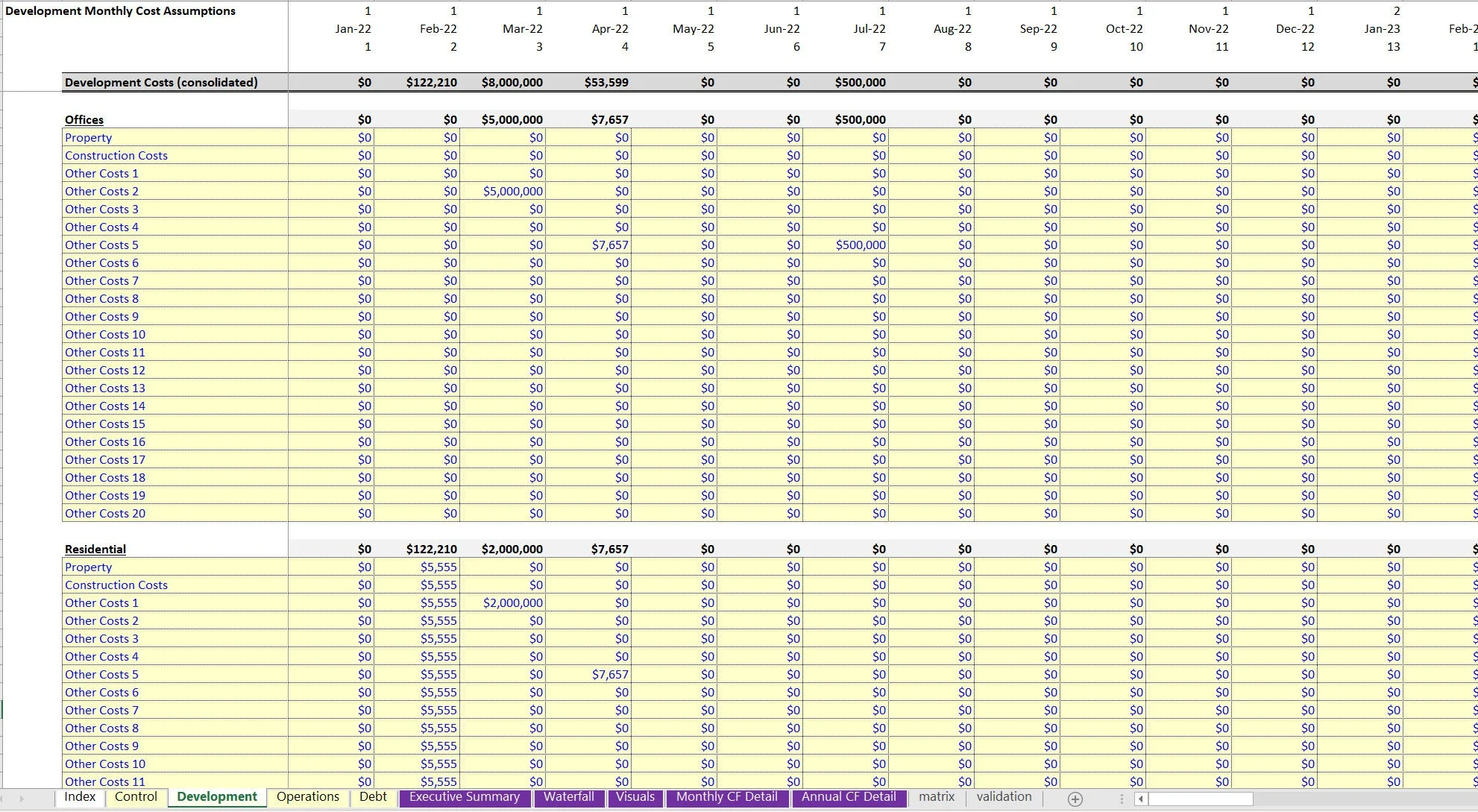

Other sections of the spreadsheet include a detailed cost estimate for the development, including construction costs, land acquisition costs, and financing costs. The spreadsheet also includes an option for joint venture waterfall distributions based on IRR hurdles for the LP.

Key metrics displayed include annual debt service coverage ratio and visualizations for rental income, cash flow, occupancy, and annual cash contributions and distributions summary. I made the model dynamic in a way where the user can plan to sell off various parts (uses) individually or all at once based on the net operating income produced by each section.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Mixed-Use Real Estate Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping