VALUATION MODEL EXAMPLE EXCEL DESCRIPTION

Evaluate leveraged buyouts with precision and confidence using this comprehensive Advanced LBO Financial Model Template. Designed for investment analysts, private equity teams, corporate finance professionals, and founders, this template provides a structured framework to build, test, and analyze LBO scenarios. Gain insights into value creation, debt servicing, and investor returns while performing detailed financial forecasting and scenario analysis.

Key Features

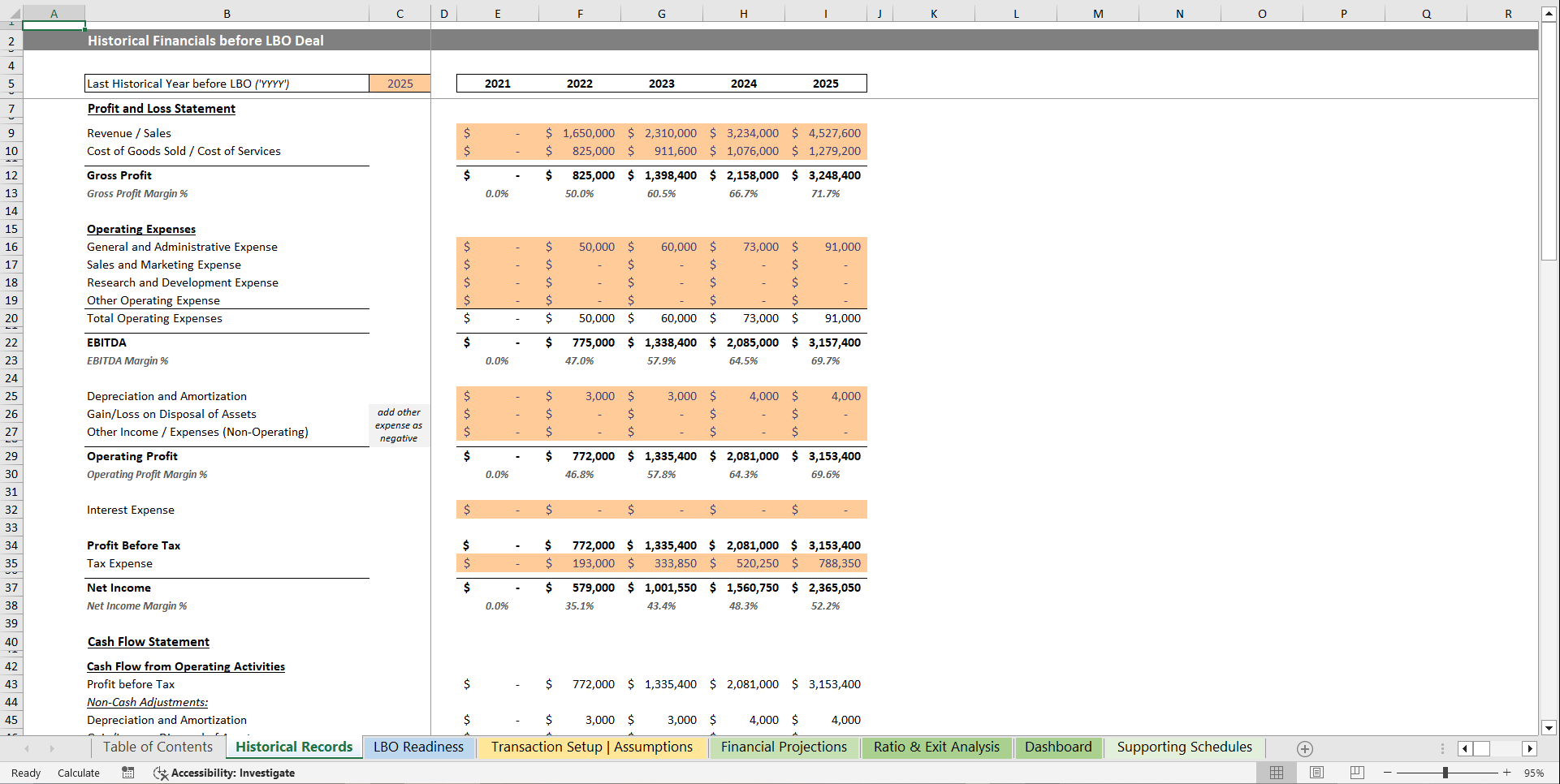

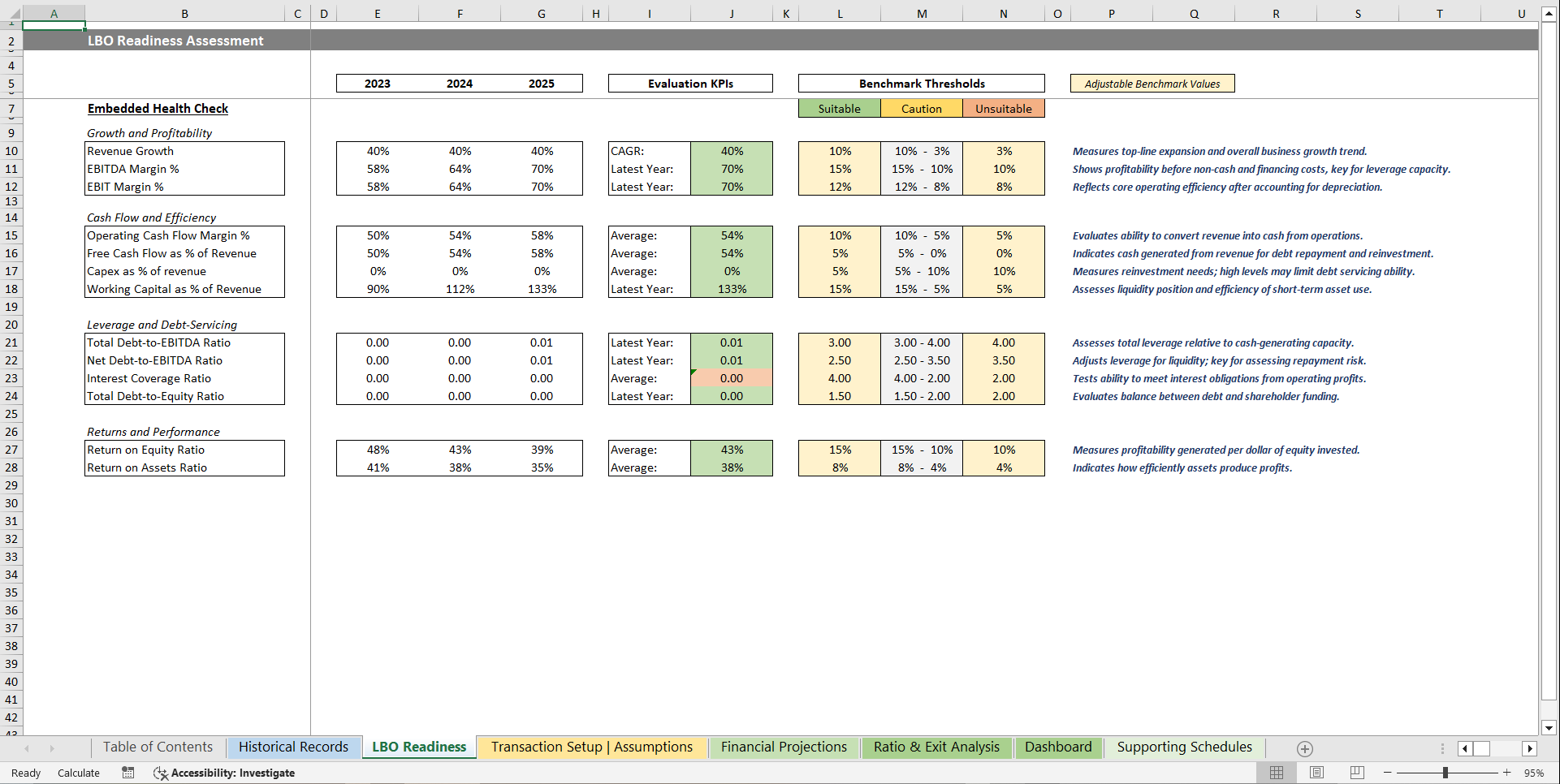

1. Historical Financials and LBO Readiness Check: Input up to five years of historical financial results, including revenue, costs, cash flow, capital expenditures, and leverage data. A minimum of two years is required to assess LBO readiness. The model evaluates growth trends, cash flow stability, debt capacity, and operational efficiency to determine the company's suitability for a leveraged buyout.

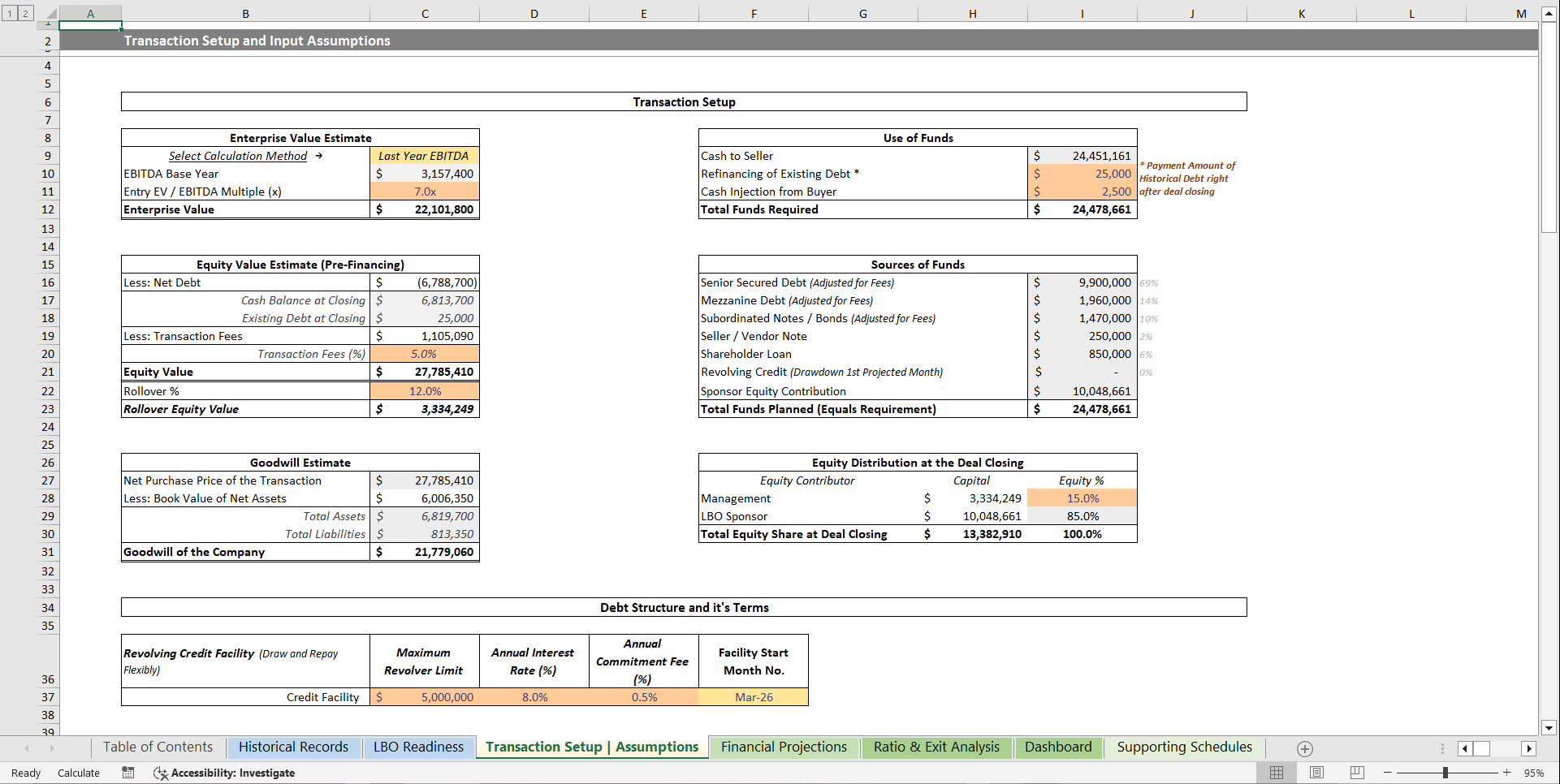

2. Transaction Setup and Capital Structure: Build the full deal structure in one place. Define purchase price, funding mix, debt tranches, interest terms, rollover equity, and investor contributions. Establish a clean capital structure to support accurate LBO modeling and scenario planning.

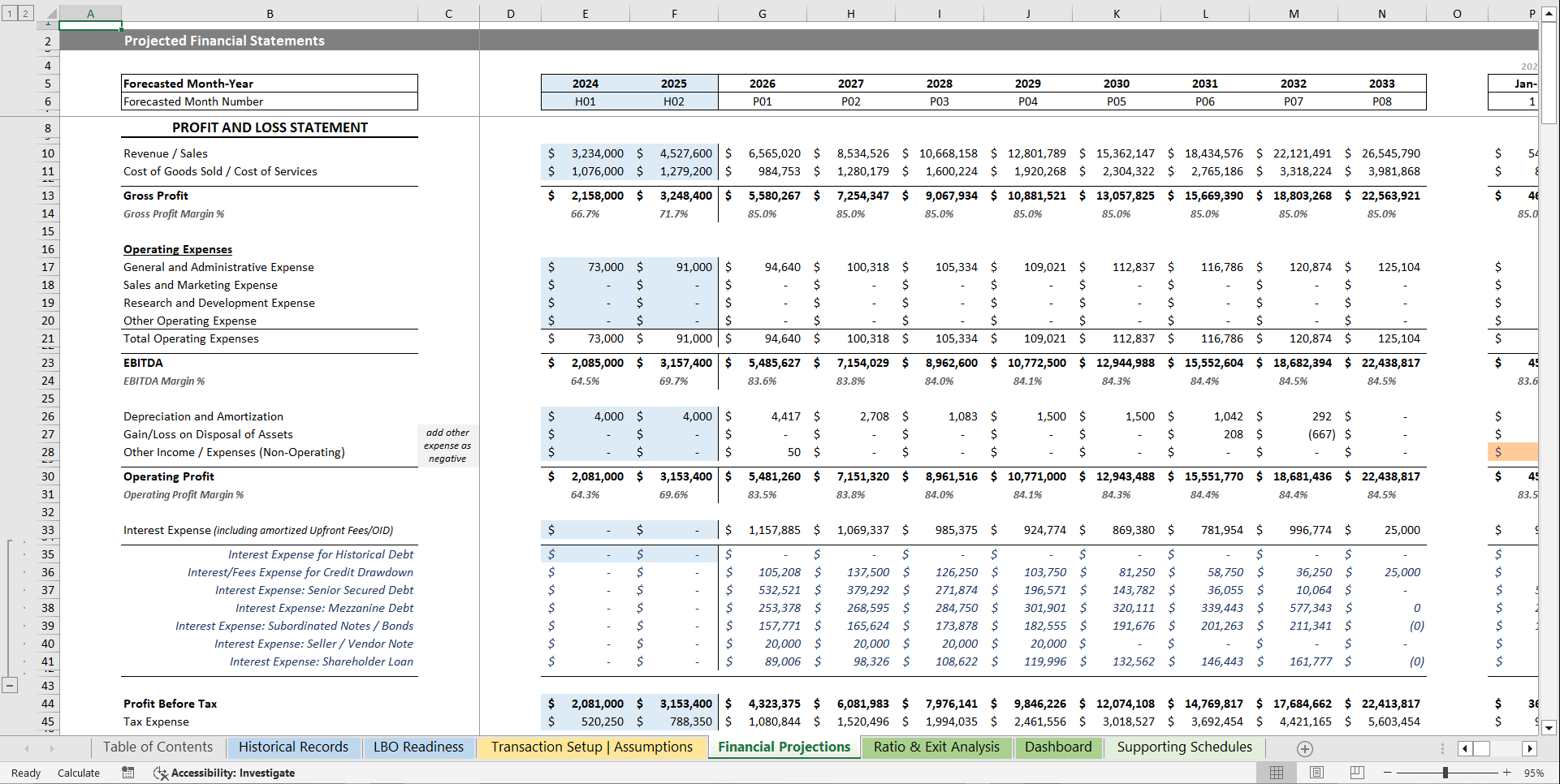

3. Operational and Financial Forecasts: Forecast revenue, operating expenses, capital expenditures, and working capital requirements using flexible input assumptions. All financial statements are linked dynamically, providing a clear view of profitability, cash flow performance, and business sustainability over the projection period.

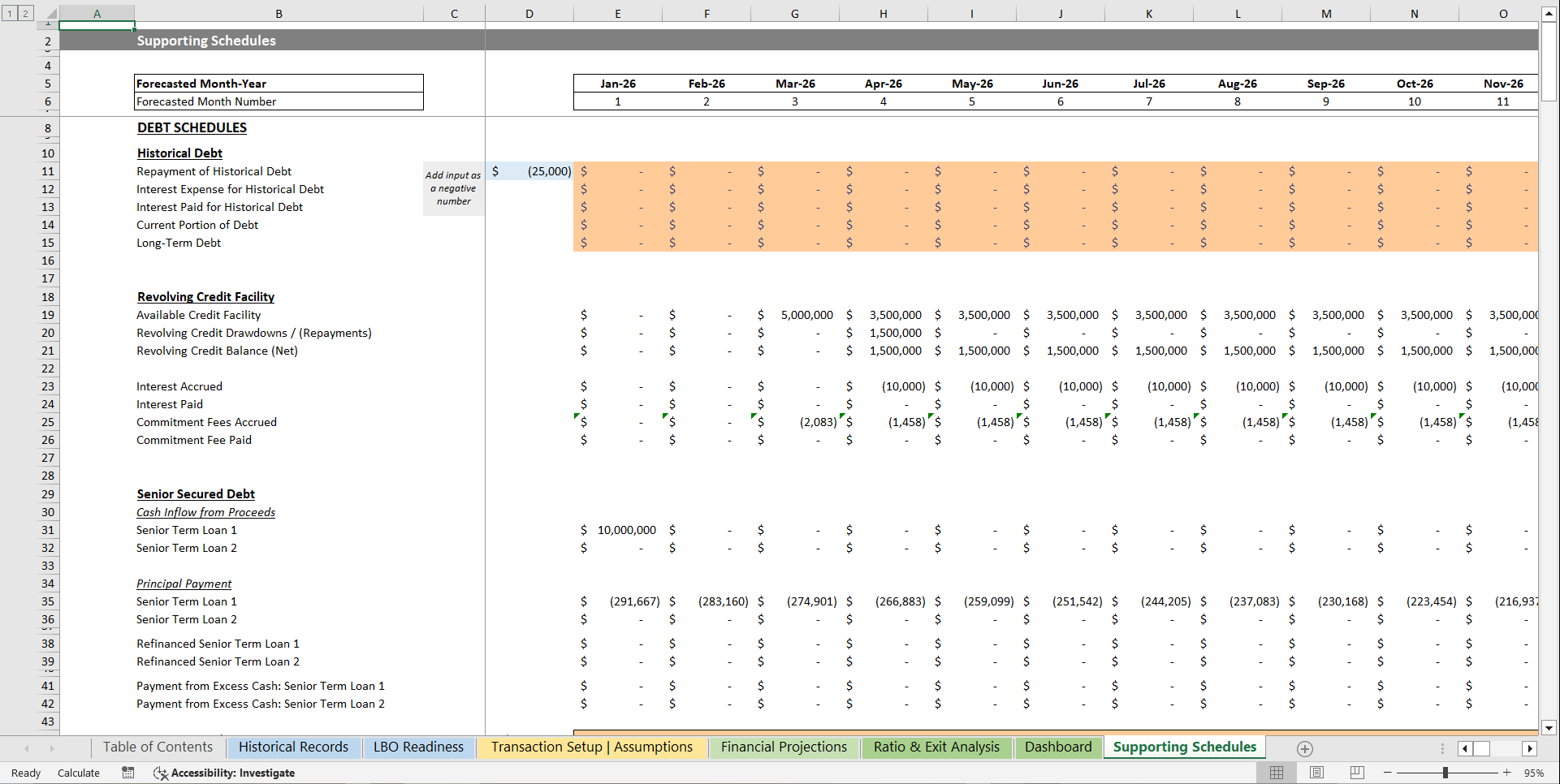

4. Detailed Debt Schedule: Track each debt facility in detail, including interest, principal payments, cash sweeps, and remaining balances. Monitor leverage and debt service coverage to evaluate the company's ability to meet obligations throughout the LBO cycle.

5. Dividend and Equity Distribution Logic: Calculate dividends and monitor equity distribution for management, sponsors, and new investors. The logic is linked to cash flow and retained earnings, allowing transparent investor-level analysis.

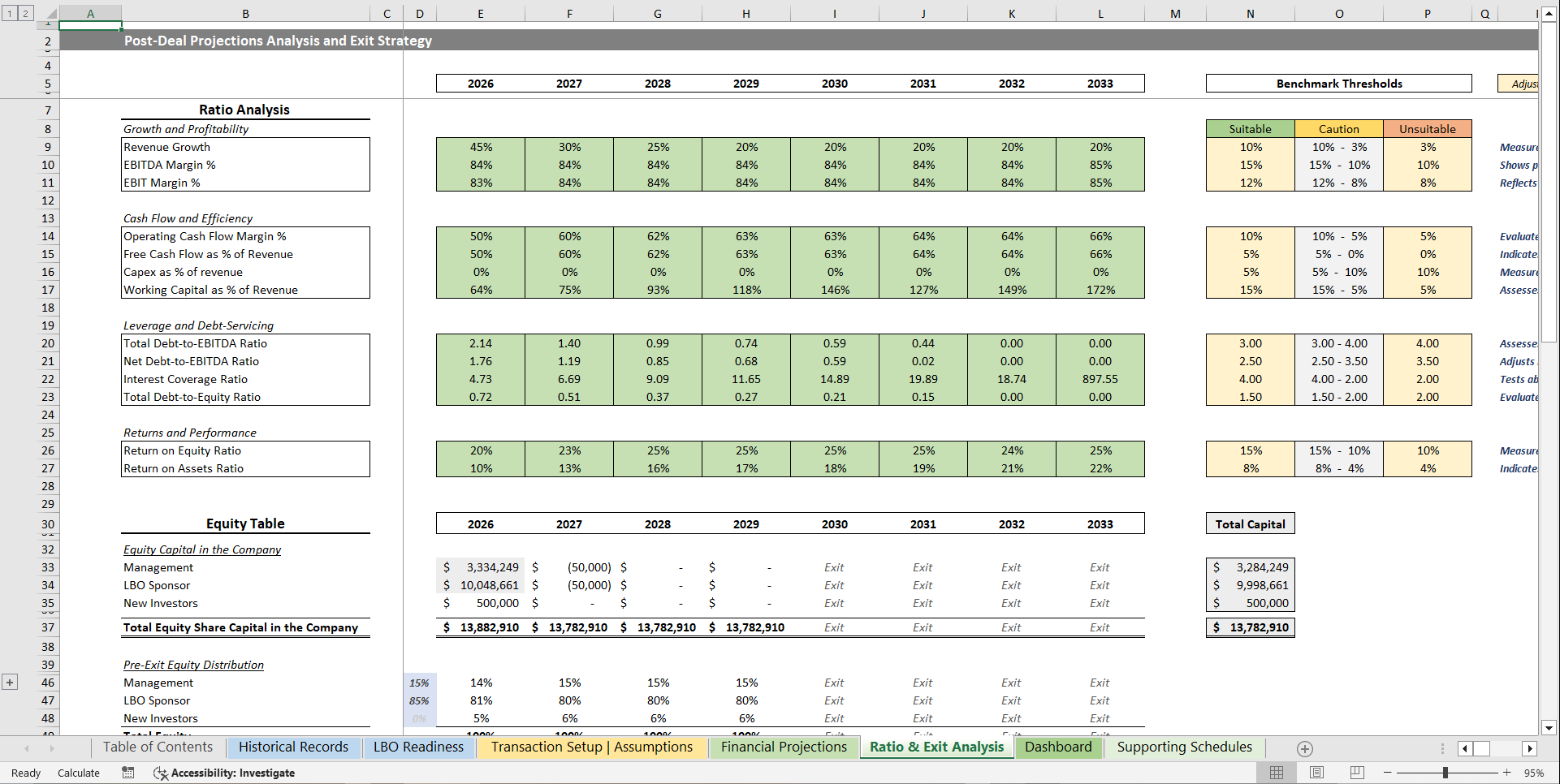

6. Exit Analysis: Value the business at exit using EBITDA multiples and projected enterprise value. Estimate net debt, equity value, rollover equity, and the cash proceeds received by each investor group.

7. Returns and Investor Performance: Measure investor returns with MOIC, IRR, total cash returned, dividends received, and retained equity value. This section provides a clear view of each equity holder's financial performance and payoff from the LBO.

8. Sensitivity Analysis: Test key assumptions and evaluate risk. Adjust exit EBITDA or other financial drivers to see how enterprise value, equity value, and MOIC change under various scenarios.

9. Dashboard and Key Ratios: Access a high-level dashboard summarizing the deal. Visualize enterprise value, equity value, debt funding, exit value, MOIC, and IRR. Review charts for debt composition, long-term debt balance trends, profitability metrics, and cash flow performance from operating, investing, and financing activities.

Who Should Use This Template

This Advanced LBO Model is ideal for private equity analysts, investment bankers, corporate finance teams, valuation consultants, and founders preparing for buyout or leveraged acquisition analysis. It supports both simple and complex LBO structures.

Frequently Asked Questions (FAQs)

1. Do I need advanced financial knowledge to use this model?

No. The model is structured with clear inputs and outputs for intuitive navigation.

2. Can I update assumptions as my analysis evolves?

Yes. Editable inputs automatically update the full model.

3. Does the template calculate investor-level returns?

Yes. It calculates MOIC, IRR, dividends, and retained equity for each investor group.

4. Can I model different deal structures?

Yes. Adjust debt types, capital mix, equity splits, and rollover percentages.

5. Does the model support long-term forecasting?

Yes. Multi-year projections capture the full lifecycle of an LBO, from acquisition through exit.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Model Example Excel: Advanced LBO Financial Model Template Excel (XLSX) Spreadsheet, Oak Business Consultant